Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The British electorate has spoken and the UK has decided to “Leave” the European Union. The Prime Minister is going, the Leader of the Opposition is under the cosh from his own party and the fate of the Chancellor of the Exchequer is uncertain. Meanwhile, there is no clarity on when (or even whether) the UK will invoke Article 50 of the Treaty of Lisbon, an act which would leave it with two years to negotiate its withdrawal before its membership of the economic bloc ends come what may.

Those are the cards investors have been dealt. The question is what do they do now? In some ways it is difficult to know where to start but in this column’s view there are four issues in particular which require careful thought, although investors should resist the urge to tinker with their portfolios for the sake of it. This incurs stamp duty, dealing costs and potentially tax, all charges which eat into portfolio returns over time.

Investing is a long-term business and second-guessing short-term market movements is the devil’s work, so investors should really only act if they feel there is a strong valuation case for doing so, if they are aware of the costs they are incurring and if any portfolio changes fit with their overall strategy, time horizon, target return and appetite for risk.

Up or down

The first question to address is will there be a UK recession?

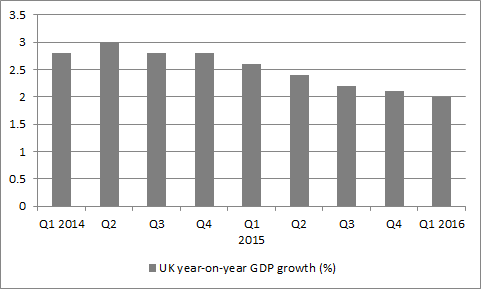

The UK had been losing economic momentum before the EU referendum, as evidenced by GDP numbers ....

Source: ONS, Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

... and the latest purchasing managers’ (PMIs) surveys

Source: CIPS/Markit

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

None of us can say although the economy had been losing steam ahead of the vote anyway, judging by the charts above.

If investors think a downturn is coming – and they also believe the pound will remain weak for some time as a result – then owning some overseas assets via well-run active or passive funds is one potential hedge against short-term lumps bumps in the UK’s financial markets.

Meanwhile, value-oriented funds with a domestic focus will hope to demonstrate that they can offer downside protection, as they specialise in buying stocks which already trade at depressed valuations.

Examples which may merit further research include the Lowland investment trust run by James Henderson at Hendersons; Tom Dobell and the M&G Recovery fund; Investec’s Alastair Mundy, who runs the Investec Special Situations fund and also the Temple Bar investment trust; and also Richard Penny, whose Legal & General UK Special Situations fund features a concentrated portfolio of picks which he considered undervalued or mispriced.

Value funds will be seeking to sift through the market melee for opportunities

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

... as will investment trusts which also look to the value end of the market

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

As he seeks out potential catalysts which may trigger improved stock performance, Penny seeks out refinancings, merger and acquisition activity, secular growth and also stock-specific events such as placings.

Performance has been helped by underweight positions in banks, oils, miners and retailers and Penny is now starting the process of picking through the market for downtrodden stocks to buy, with housebuilders and financial services providers an early area of focus.

For the moment the market still seems to be preferring quality, safe and low-volatility stocks as a place to shelter but it will be interesting to see what happens when panic is replaced by a more calculating look at what valuation opportunities have been thrown up by the post-vote volatility.

The market is currently leaning toward defensives, reliable cash-generators, low volatility stocks and dollar earners

| 7-day performance | 3-month performance | 1-year performance | ||||

| 1 | Randgold Resources | 24.5% | Fresnillo | 62.8% | Fresnillo | 112.9% |

| 2 | Fresnillo | 22.5% | Anglo American | 40.9% | Randgold Resources | 81.3% |

| 3 | Mediclinic | 13.2% | Randgold Resources | 26.8% | Admiral | 37.6% |

| 4 | AstraZeneca | 11.4% | Standard Chartered | 24.5% | Intertek | 33.1% |

| 5 | Hikma | 9.3% | Hikma | 24.3% | BAT | 32.7% |

| 6 | GlaxoSmithKline | 8.7% | Ashtead | 21.0% | SAB Miller | 30.6% |

| 7 | Royal Dutch Shell | 8.6% | BHP Billiton | 20.6% | Compass | 29.7% |

| 8 | BAT | 8.5% | Mediclinic | 20.1% | Hikma | 28.8% |

| 9 | BP | 8.1% | BP | 19.7% | Reckitt Benckiser | 27.1% |

| 10 | Shire | 8.0% | Royal Dutch Shell | 19.2% | RELX | 26.7% |

| 91 | Legal & General | -21.8% | Legal & General | -21.6% | Next | -35.0% |

| 92 | Travis Perkins | -23.6% | Marks & Spencer | -22.9% | Barratt Developments | -35.7% |

| 93 | Berkeley | -25.3% | Assoc. British Foods | -23.5% | ITV | -36.0% |

| 94 | Barclays | -25.4% | Berkeley | -25.8% | Standard Life | -38.4% |

| 95 | Royal Bank of Scotland | -27.7% | ITV | -29.3% | Antofagasta | -39.7% |

| 96 | easyJet | -29.6% | easyJet | -30.1% | Marks & Spencer | -43.4% |

| 97 | Barratt Developments | -30.7% | Barratt Developments | -30.4% | Standard Chartered | 43.9% |

| 98 | Intl. Consol. Airlines | -31.9% | Persimmon | -32.7% | Glencore | -46.0% |

| 99 | Persimmon | -32.4% | Taylor Wimpey | -33.4% | Barclays | -48.8% |

| 100 | Taylor Wimpey | -32.8% | Intl. Consol. Airlines | -37.0% | Royal Bank of Scotland | -50.2% |

Source: Thomson Reuters Datastream, as of 10:00 on Wednesday 29 June

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Cash flow needs

The second question to address is what to do for equity income?

Some investors may be happy to bank regular coupons or dividends from bonds, stocks or funds and plan their cash needs accordingly. Others may be unhappy to have to face the risk of capital losses as they seek out reliable income.

With regards to the UK, it is unlikely investors will change strategy, as this is a long-term strategy and the dependable yield-generating stocks have held up relatively well, at least so far.

Risk-tolerant portfolio-builders could even look to European equity income funds – as there is a deep pool of European dividend payers to investigate - or to Asia and Japan, where more companies are focussing on shareholder returns much more intently, even if the UK still offers a premium dividend yield.

The UK equity market offers a relatively fat dividend yield

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Also remember that Emerging Markets have underperformed Developed ones for four years now and the West seems to bring just as much political risk at the moment, which is most unusual.

Emerging markets have underperformed Developed ones for the last four years, in dollar terms

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Bond market blitz

The third issue to address is what to do about other forms of income as Government bond yields grind ever lower?

UK Gilt yields are setting new record lows

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Some investors may view bonds as return-free risk now, but interest rates are unlikely to rise in a hurry anywhere in the West and inflation seems subdued for now. The Bank of England seems more likely to cut rather than hike, Japan may be edging towards lower rates and more QE and the European Central Bank seems in no rush to tighten policy. Meanwhile the US Federal Reserve continues to push back the timing of its second rate rise.

Central banks seem disinclined to increase interest rates even after many years of record-low headline borrowing costs

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Corporate spreads have widened so corporate bond funds will be looking for value here, especially at the long end, with rates unlikely to rise. A good flexible or strategic bond fund will also be looking to pick out the value, protect capital as well as grow it and pick up yield across Government, corporate and high-yield paper across all maturities and geographies.

Corporate bond yields have risen, relative to Government paper

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Shiny stuff

The final question is what to do about gold and silver?

Precious metal prices are soaring

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Gold and silver are soaring and taking miners along for the ride. Some investors will never touch these so-called barbarous relics. Others will warm to them.

There are plenty of actively-managed and passive funds which offer access to miners or the actual metals, which have haven but also inflation-proofing appeal, should investors decide that exposure here fits with their overall strategy, time horizon, target returns and appetite for risk.

Inflation is not an issue at the moment, but the referendum vote reflected discontent with the dominant economic narrative of austerity.

Exchange-traded funds which track gold mining shares are doing well at the moment

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

A new British Prime Minister and Government may just change that tune, as the political debate begins to swing that way in several other countries, including Canada, Italy and Japan to name but three. If fiscal stimulus joins monetary stimulus maybe bonds do finally hit the buffers, with the exception of index-linkers, and the precious metals continue to thrive.

This may be the political impact which needs closest scrutiny and we will continue to do our best to keep you informed via our regular written and video updates.

Russ Mould

AJ Bell Investment Director