Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“A deal in Congress to approve a $1.7 trillion budget for US federal spending in the fiscal year to September 2024 should avoid the risk of a government shutdown, but legislative approval is still needed by early next month and the issue of how America’s debt and interest bills keep galloping higher is not going away,” says AJ Bell investment director Russ Mould.

“Although financial markets believe cooler inflation will permit the US Federal Reserve to cut interest rates as early as March, America’s federal debt may be influencing the central bank’s thinking when it comes to both headline borrowing costs and also Quantitative Tightening (QT).

“The Biden administration may have kicked the can down the road with June’s suspension of the debt ceiling at $31.4 trillion until January 2025, but the total federal deficit is already $33.9 trillion (and rising).

Source: US Government Publishing Office. US Treasury, FRED - St. Louis Federal Reserve database

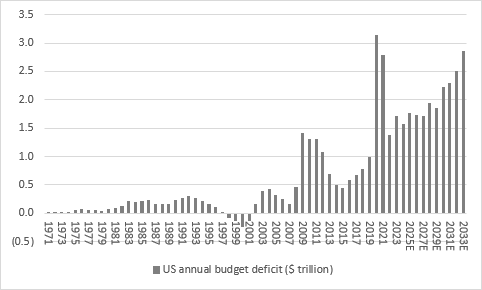

“The Biden administration is staking a lot of economic – and political – capital in the CHIPS Act and the Inflation Reduction Act, and the considerable upfront investment is driving up the annual deficit. In the year to September 2023, America’s government generated $4.4 trillion in tax income but spent $6.1 trillion. The resulting $1.7 trillion deficit was the third worst on record and came at a time when the economy was healthy.

“It does make you wonder what would happen to the annual (and thus aggregate) deficit if an unexpected recession were to hit, tax income were to fall and welfare spending were to rise. As it is, the Congressional Budget Office expects similar levels of overspending in 2024 through to 2027.

Source: FRED - St. Louis Federal Reserve database, Congressional Budget Office, LSEG Datastream data

“One reason for the increased deficit in 2023 was the surge in the federal interest bill, as aggregate debt, interest rates and the yields on US Treasuries all rose. Soaring debt did not matter when interest rates were zero, but it has started to matter now that the Fed has decided money should have a real cost once more.

Source: FRED - St. Louis Federal Reserve database

“On an annualised basis, the interest bill is now $1 trillion, a big sum when set aside the $4.4 trillion in tax income. The drop in Treasury yields in the final quarter of 2023 is therefore helpful and the US federal debt is surely an additional complication when it comes to the Federal Reserve’s policy decisions, as it juggles growth, inflation, financial market stability, the dollar and the government’s interest bill (and all in an election year for good measure).

Source: LSEG Datastream data

“The Fed is independent and apolitical, but it will presumably not wish to be blamed for causing a recession, or at least a steep one, and the rising US interest bill could well begin to weigh on growth at some stage (from January 2025 at the latest, if a new debt ceiling obliges the US government is to rein in its currently generous levels of fiscal stimulus).

“This may therefore be a bigger influence upon policymakers’ thinking than markets appreciate, as they currently focus on their hoped-for scenario of a cooling in inflation, a soft economic landing and interest rate cuts for these (positive) reasons. In this context, it is interesting to hear the Dallas Federal Reserve’s president, Lorie Logan, talk publicly about the Fed ending its programme of QT, whereby it ceases to buy Treasuries to cap yields and lets them mature, without reinvesting the proceeds, at a rate of $80 billion to $95 billion a month.

“The Fed’s balance sheet has shrunk by $1.2 trillion, or 15%, to $7.7 trillion from its early 2022 peak. If the Fed thinks this is as far as it can go, then markets may welcome the prospect of an end to any further withdrawal of liquidity from the financial system, as they look forward to both rate cuts and an end to QT, which is a potential source of upward pressure on bond yields and thus the federal interest bill. If the Fed were a seller – or at least a non-buyer – at a time when rising debt could force greater issuance of Treasuries, it would be logical to expect yields to rise so that America could tempt investors to buy those bonds and thus lend it the cash that it needs.

Source: FRED - St. Louis Federal Reserve database

“Any sign of rebellion from the bond market – and a fresh surge in US Treasury yields in the view that the Fed is cutting rates too early and thus playing fast and loose with inflation – could signal trouble ahead for equities that are pricing in a soft landing rather than a recession or a crack-up boom, as well as for the US government’s spending plans and thus America’s wider economic outlook.

“Such a rebellion could also catch the attention of gold bugs. Gold is on a roll and if the Fed has to cut interest rates to keep the federal interest bill manageable, support government spending plans (wittingly or otherwise) and take a risk with inflation, then fans of the precious metal may become even more voluble.”

Source: FRED - St. Louis Federal Reserve database, Congressional Budget Office, LSEG Datastream

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 22/05/2024 - 09:19

- Wed, 15/05/2024 - 16:51

- Wed, 08/05/2024 - 11:46

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37