Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“If 2021 was the year that inflation made an unwelcome reappearance and 2022 was when fears of recession stalked financial markets, then 2023 saw share prices (in developed markets, at least) start to discount a much rosier scenario – in the form of a peak in both inflation and interest rates, alongside a soft landing – as the much-discussed downturn failed to materialise,” says AJ Bell investment director Russ Mould.

“As a result, technology stocks roared higher (buoyed by AI-oriented narratives), equities had a good year (except in the UK, Hong Kong and China), bonds rallied hard as yields sank in the second half of the year, gold surged, and Bitcoin went bananas.

Capital return in 2023 (%)* |

||||

|---|---|---|---|---|

| Asset classes | Major stock indices | |||

| Bitcoin | 156.9% | NASDAQÊ | 42.4% | |

| Global equities | 18.2% | Nikkei 225 | 25.5% | |

| Gold | 11.4% | S&P 500 | 25.5% | |

| Global high-yield bonds | 4.7% | CAC 40 | 20.5% | |

| Emerging equities | 4.3% | DAX | 20.0% | |

| Global corporate bonds | 4.2% | S&P BSE 100 | 19.8% | |

| Global sovereign bonds | 1.2% | Bovespa | 18.6% | |

| Oil | (7.3%) | Euronext 100 | 13.6% | |

| Commodities | (10.8%) | SSMI | 7.4% | |

| Natural Gas | (43.5%) | TSX 60 | 6.5% | |

| FTSE 100 | 6.5% | |||

| Shanghai Comp. | (5.1%) | |||

| Hang Seng | (16.6%) | |||

Source: LSEG Datastream data. *From 30 Dec 2022 to 18 Dec 2023, in local currency

“Investors may be tempted to argue that 2021-22 was a post-Covid-19 aberration, and that the long-term trend of cheap energy, food, goods and labour that began in the early 1980s has reasserted itself. It is therefore worth thinking about what happened in 2023 and why, and whether five key trends that helped to shape financial markets this year can continue to exert an influence in 2024 and beyond.”

1. Oil and gas prices fall

“A surge in oil, and especially natural gas, prices in 2022 in the wake of Russia’s invasion of Ukraine had markets on alert. Rising energy prices were seen as bad for inflation (and even food prices, given how diesel and fertilisers are two major cost components of any farm), bad for growth (as they function as a tax on consumers’ pockets and pressure corporate profit margins) and bad for governments’ stretched finances, given the many fuel and energy subsidies that were rolled out.

Source: LSEG Datastream data

“Had investors then told everyone there would be a war in the Middle East in 2023, the result could well have been panic, given how similar events stoked major oil price spikes in the 1970s. However, even OPEC+ production cuts have not supported hydrocarbon prices as US shale output has surged this year. The issue now is whether oil price weakness is just about increased American supply or wider weakness in demand. If it is the former, then all well and good. If the latter, then the economic picture may not be so clear after all.”

2. Inflation cools

“Lower oil and gas prices have helped to take the sting out of inflation and boost markets’ confidence the worst is behind us. The test now is whether we do get a repeat of the 1970s, when inflation struck in three major waves as wage and price spirals set in, with 1973’s oil price spike after the Yom Kippur war followed by another in 1979 when the Shah of Iran fell from power.”

Source: Office for National Statistics, US Bureau of Labor Statistics, European Central Bank. US and UK based on consumer price index, EU on Harmonised Index of Consumer Prices

3. Interest rate hike momentum slows

“Lower energy prices and cooling inflation mean Western central banks appear to be bringing a sharp cycle of interest rate hikes to a halt, while some emerging market monetary authorities are starting to cut headline borrowing costs.

Source: www.cbrates.com

“This is sparking hopes that the longed-for pivot to lower rates and cheaper money is near. In the US, markets are now discounting five one-quarter point interest rate cuts in 2024, and in the UK investors are pricing in four, with the result that borrowing costs will be 4.25% by next Christmas. The Fed and Bank of England continue to protest that such talk is premature but two-year Treasury and gilt yields are going lower (and they tend to pre-empt central banks by six to nine months).

“Lower interest rates mean lower returns on cash and (usually) lower bond yields, which helps to increase the relative attractiveness of other asset classes, such as equities. But central banks must now deliver in 2024 to keep stock and bond markets happy.”

4. USA supports global growth

“A global recession did not materialise in 2023, despite a disappointing post-Covid recovery from the world’s second biggest economy, China. The world’s largest economy, America, seemed to take up the slack, despite spring’s banking crisis, as it was buoyed by a still-confident consumer and Bidenomics, as the government spent heavily on the CHIPS and Inflation Reduction Acts.

Source: US Bureau of Economic Analysis

“America’s latest debt ceiling breach did not stop such spending and President Biden is unlikely to turn off the taps ahead of November’s election, but the consumer saving rate is ebbing and America’s deficit is soaring. At some stage, there remains a risk both trends provide headwinds not tailwinds, which should slow their spending.”

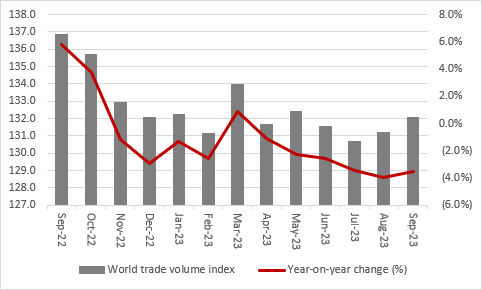

5. Global trade flows stay weak

“American onshoring of key technologies, to buttress supply chains and reduce reliance on China, is a major geopolitical and economic trend that will surely run (and run). The US economy is feeling the benefit and China’s is taking the pain.

Source: CPB World Trade Monitor, www.cpb.nl

“Tensions remain elevated and global trade flows are still subdued, which is not normally a good sign for global economic growth. Any further trade and tariff tiffs in 2024 may not be helpful as the global outlook may be more delicate than stock markets currently think.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 15/05/2024 - 16:51

- Wed, 08/05/2024 - 11:46

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13