Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

UK mortgage approvals

June’s mortgage approvals figure was 63,726 according to the Bank of England. That undershot economists’ forecasts, representing the seventh time in twelve that approvals had fallen month-on-month and the eleventh consecutive year-on-year decline.

- Perhaps most tellingly, that figure also undershot the 12-month average that prevailed in the lead up to the pandemic, as the shot in the arm provided to the market by the Government’s stamp duty land tax break during the viral outbreak wears off. Monthly approvals are no higher now than they were in summer 2013, shortly after the launch of Help to Buy by then-Chancellor of the Exchequer George Osborne.

- There are several possible explanations for this slide in mortgage applications (although the quoted housebuilders continue to assert that demand for new dwellings remains strong). One is the loss of the stamp duty land tax exemption, and another is the imminent closure of Help to Buy (unless the Government grants a further exemption and provides yet another example of former US President Ronald Reagan’s maxim, ‘nothing lasts longer than a temporary Government programme.’)

- Help to Buy’s ten-year history already looks like confirmation of Reagan’s views anyway and it can hardly be said that the scheme has helped in its core goal of making housing more affordable. Since April 2013, when Help to Buy first came into effect:

- The average UK house price has advanced by 75%, according to the Halifax’s index for all UK housing

- The average UK weekly wage, including bonuses, has increased by 33% to £611 per week, according to the Office for National Statistics

- According to Halifax, the average UK house now costs £293,211, more than nine times the average UK salary, including bonuses

- It is hard to describe boosting demand without boosting supply as ‘helping.’ Would-be UK house buyers are obliged to take on ever more debt in their quest to get on the housing ladder, and to do so as interest rates rise. Equally, other factors may be at work beyond the end of Government subsidies, notably the effect of inflation, which is eroding wages in real terms and is another factor when it comes to affordability.

- That loss of real purchasing power thanks to inflation means the UK GfK consumer confidence survey stands at a record low of minus 44 and the major purchase sub-segment of that analysis is also depressed. The last reading was minus 38, although that was at least not as bad as the prior lows of minus 52 in April 2020 (as covid-19 ran riot) and minus 43 in October 2008 (just after Lehman Brothers went bust and threatened to take the global banking system with it).

Source: Bank of England, GfK, Refinitiv data

US jobs

- As is often the case with the first week of any given month, the main macroeconomic item is going to be the latest American jobs and wage growth figures. And, as usual, they will come on three different days, in three different formats:

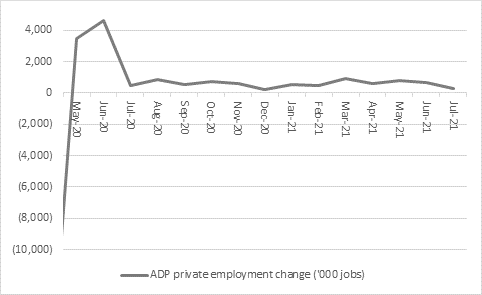

- The ADP National Employment survey is due on Wednesday 31 August, and it looks at how many jobs America created last month. This is a bit of an odd one, as ADP suspended its survey in June while it (and I quote) “retooled” the report to make it more robust. This came after regular criticism that the ADP findings bore little, if any, relation to the Government survey which comes two days later (more on that in a second). Anyway, for May, the last reading data showed 128,000 new jobs added, the smallest gain since the covid-19 outbreak in early 2020.

Source: ADP. April 2020 saw 19.1 million job losses, May 2020 3.5 million gains and June 2020 4.6 million gains

- The Challenger, Gray & Christmas job losses survey is due on Thursday 1 September. The last reading here was 25,810 for July, which was the second-highest reading so far in 2022 and represented a 36% increase from the year before. Though the figures are still low by historic standards, and it’s too early to say that the Challenger survey is definitively pointing toward a recession.

Source: Challenger, Gray & Christmas. April 2020 saw 671,129 job losses and May 2020 a further 397,016 losses

- Finally, we get the big one on Friday 2 September. That is the non-farm payrolls survey from the US Bureau of Labor Statistics, as the American government gives its verdict on job creation last month, relative to the privately-backed survey by ADP. The non-farm payrolls figure for July was strong, as it showed the addition of 528,000 jobs, the second-highest reading in 2022. The official U3 unemployment rate is just 3.5% and the U6 rate is 6.7% so the labour market is tight, especially in the context of a job vacancies figure that still exceeds one million, according to the Job Openings and Labor Turnover survey, or JOLTS.

Source: US Bureau of Labor Statistics

- The result could be wage growth. Economists, central bankers, investors and politicians will therefore also keep an eye on the average hourly pay number. Last month it was $32.27, 5.2% higher than the year before, lower than inflation but probably enough to have central bankers on edge as they continue to fret about a pay-price-pay-price spiral which entrenches inflation, at least if the 1970s is any guide.

Source: US Bureau of Labor Statistics, FRED – St. Louis Federal Reserve database

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Mon, 29/04/2024 - 09:30

- Wed, 17/04/2024 - 09:52

- Tue, 30/01/2024 - 15:38

- Thu, 11/01/2024 - 14:26