Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The markets continue to digest the implications of last week's decision by the Swiss National Bank (SNB) to stop interfering in currency markets and let the Swiss franc find its own level against the euro. That move, more than three years in the coming, is still roiling the forex industry, at a time when commodity markets are still in flux, bond prices are rising and equity prices are finding it hard to make ground with any great conviction.

At least two currency brokerages and one hedge fund have gone under in the wake of the Swiss franc's surge, sparking concerns about who else has taken a hit on leveraged forex positions. Once markets get over immediate worries over whether there is another LTCM or Amaranth out there, hedge funds best known for their 1998 and 2006 collapses after a Russian debt default and natural gas price plunge respectively, then they will start to think about the long-term implications of the SNB's admission that Mr Market is best left to his own devices when it comes to price discovery.

In this column's view, there are five conclusions to be drawn and all have potential implications for investors' portfolios.

- Central banks might like to think they can buck the markets, but Swiss experience proves they cannot do so for ever. The Bank of Japan in particular should take note.

- Oil's plunge, broad commodity weakness, a bond market rally and bumpy equity markets are all confronting clients just three months after the US Federal Reserve stopped adding to its Quantitative Easing (QE) scheme. This may not be a coincidence as the drug of cheap central bank liquidity wears off, even if the Japanese and European central banks are doing their best to jolly along the party. The FTSE 100 is showing more volatility now than at any stage since late 2011, when, perhaps coincidentally, the Fed's QE-II scheme had ended and then chairman Ben Bernanke followed up with two rounds of Operation Twist as stock markets and economic data alike began to sag.

- Even if foreign exchange is not technically part of any top-down asset allocation process, it probably should be. Movements in currencies can make a huge difference to portfolio returns, as evidenced by the dollar's rise and declines in the euro and emerging market currencies, relative to sterling.

- The Bloomberg Commodities index may stand at a six-year low, and the woes of oil, copper and the whole energy complex are well known, but gold could be quietly building a floor.

- Gold is seen a store of value, or a haven, during times of deflation or inflation, as shown by how well it did in the 1920s, 1930s, 1970s and the first decade of this century (it performed appallingly in the 1980s and 1990s as inflation was squeezed out of the system and growth was good). Its rise may hint at risk aversion, a view potentially borne out by the ongoing march higher in bond prices, as sovereign yields in particular grind lower. This could, in time, prompt renewed interest in equities which offer a dependable yield, should markets' faith in the economic growth outlook remain weak.

Currency carnage

In September 2011, the SNB effectively devalued the franc by some 8% saying it would not allow the currency to rise above CHF 1.20. Chairman Thomas Jordan said the SNB would buy unlimited quantities of foreign currency to drive the franc lower, which it did until 17 January of this year, when the SNB abandoned the peg, presumably in the view any move toward money printing and Quantitative Easing by the European Central Bank would overwhelm it.

The SNB's intervention achieved nothing in the end

Source: Thomson Reuters Datastream

The franc is now stronger than when the SNB began its intervention over three years ago, to highlight both how fruitless such programmes are and how clients should not rely upon central banks as a crutch when it comes to asset valuations or portfolio performance. The fundamentals will win out in the end, as supporters of sterling found out in 1992 and proponents of the mantra “Don't Fight the Fed” discovered in 2000 to 2003 and 2007 to 2008 when US and global stocks fell even as the central bank frantically cut interest rates.

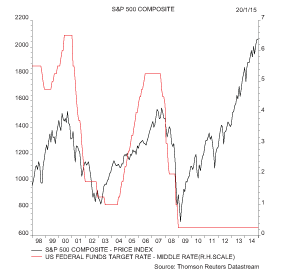

Bears have successfully fought the Fed twice since 2000

Source: Thomson Reuters Datastream

Despite interest rates of -0.75%, some market participants are clearly still happy to pay this charge to keep their money in Swiss francs, which tells you what they think of the other options out there. AAA-rated Denmark is already trying to stop Copenhagen being the next port of call for money that is seeking a sound sovereign base, with its own move to negative headline interest rates. We shall see whether that works but Switzerland's experiences suggest the odds may be against it.

Heavily indebted developed nations such as the UK, US, Japan and most of the eurozone do not want a strong currency. They would like a weak one, so they can try and export their way out of trouble and inflate away their liabilities to foreign creditors.

Logically, the currencies of those countries with the lowest debt-to-GDP ratios and healthiest balance sheets should come out best in the long run – just ask the Swiss or the Danes, down at 35% to 40%, compared to the 80% to 100%-plus numbers which characterise the UK, US and most of Europe – let alone poor old Japan at some 240%. In the long run, emerging markets are in relatively good financial shape, too as the chart of aggregate government and consumer debts to GDP show, even if their dollar borrowings need to be watched.

Switzerland and emerging markets still have lower debt-to-GDP ratios than most developed nations

Source: Geneva World Economic Report, October 2014

Metal movement

The SNB's failure to bend the forex markets to its will may prompt some clients to ask whether other central banks can keep bond and equity arenas supine. The Bank of Japan dominates the market for Japanese Government Bonds (JGBs) the Bank of England and US Federal Reserve are huge owners of their respective governments debts. Low yields may continue to drive a quest for higher returns elsewhere – equities, sub-investment grade debt, alternative asset classes such as hedge funds, private equity or even wine – and force clients to scramble for income as best they can, whether they like it or not.

The market's apparent renewed interest in gold, as highlighted by a rise in its price whilst nearly everything else bar the dollar and Swiss franc fall or tread water, is interesting in this context. The Fed and Bank of England have stopped adding to their QE schemes but any talk of unwinding them has stopped, while Japan and Europe are pressing ahead with their programmes. After last week's adventures in Zurich, perhaps forex traders are again looking at gold as a currency, and one where supply only rises very slowly relative to electronically-created 'fiat' counters, since only the Swiss franc can point to gains against the precious metal over the last 12 months. In dollar, sterling and euro terms gold is up and up nicely.

Gold is up in all major currencies bar the Swiss franc over the last 12 months

| Change in gold price (over one year) | |

| Ruble | 124.1% |

| Euro | 21.4% |

| Yen | 15.8% |

| Real | 13.7% |

| Canadian Dollar | 12.5% |

| Pound | 11.0% |

| Aussie Dollar | 10.2% |

| NZ Dollar | 10.0% |

| Singapore Dollar | 7.0% |

| Yuan | 5.2% |

| Rupee | 3.4% |

| US Dollar | 2.6% |

| Swiss Franc | -3.4% |

Source: Thomson Reuters Datastream, AJ Bell Research

Data runs from 16 January 2014 to 16 January 2015

The Bloomberg Commodities index may be soft but gold is not

Source: Thomson Reuters Datastream

Up, down and around

The SNB's decision to let the franc rise caught many traders on the hop and reintroduced them to a world of volatility. Anyone who invests in commodities and equities will already be used to turbulence, but they may have to ready themselves for more.

Since 1995, the FTSE 100 has moved by more than 2% in a day from open to close on 415 occasions, or once every 13 days.

Since the Fed stopped adding to QE in the USA in October, the FTSE has moved by that much eight times already, or once very 6.6 days. In the absence of central bank-supplied monetary anaesthetic, markets seem a little less sure of themselves, a view again backed up by rising sovereign debt and gold prices.

Markets have become more volatile in the past three months

| Daily movement in the FTSE 100 | Average number of trading days between moves | |||||

| Between 1% and 2% | Between 2% and 5% | More than 5% | Between 1% and 2% | Between 2% and 5% | More than 5% | |

| Since 1995 | 1,070 | 390 | 25 | 4.9 | 13.4 | 208.9 |

| 1995 to Nov 2008 * | 731 | 270 | 20 | 5.0 | 13.4 | 181.4 |

| Oct 2008 to Oct 2014 ** | 329 | 112 | 5 | 4.9 | 14.3 | 320.2 |

| Since Oct 2014 *** | 10 | 8 | 0 | 5.3 | 6.6 | n/a |

Source: Thomson Reuters Datastream, AJ Bell Research

* Before launch of QE-I by US Federal Reserve

** Period of QE programmes run by US Federal Reserve

*** Since US Federal Reserve stopped adding to QE

Increased volatility is not a bad thing on its own, as price movement and inefficiencies it would be nigh on impossible to make a profit. Nevertheless investors can only take advantage of any wild swings in asset prices if their portfolios are sound and well diversified enough to get them through the rough patches in the first place.

Russ Mould, AJ Bell Investment Director

Note: The writer owns shares in GoldCorp, Newmont Mining and New Gold, Yamana Gold and City Natural Resources High Yield Trust. The positions were acquired in August 2012.

Related content

- Thu, 09/05/2024 - 08:44

- Mon, 29/04/2024 - 09:30

- Wed, 17/04/2024 - 09:52

- Tue, 30/01/2024 - 15:38