Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Last week's (31 Oct) monetary policy announcement from the Bank of Japan electrified the Tokyo stock market, pushed yields on ten-year government bonds ever low and at the same time drove a stake through the heart of the yen - perhaps appropriately enough given it was Halloween, after all.

The Japanese counter has since slipped further to around the ¥114 mark against the greenback, a seven-year low, as a corollary of the dollar strength frequently referenced in this column of late. Tokyo's Prime Minister, Shinzō Abe, and his willing assistant, Bank of Japan Governor Haruhiko Kuroda, must be pleased with their work, as yen weakness looks to be a tacit part of “Abenomics” and the plan to generate 2% inflation on a trend basis.

Kuroda justified his expansion of Japan's Quantitative Easing (QE) scheme as necessary by citing the uncertain outlook, the need to ensure inflation is ingrained in what has been a deflation-riddled economy and the potential impact of a proposed impact in consumption tax from 8% to 10% next autumn. His move comes as the pressure on the European Central Bank to launch its own QE scheme continues to build in the face of its own slide toward deflation, despite the implacable opposition of Germany and the Bundesbank.

Eurozone is fighting to avoid deflation ...

Source: Eurostat

… as Japan fights to stoke inflation

Source: Thomson Reuters Datastream

This leaves investors with a difficult balancing act.

- The autumn deflation scare points to the haven value of bonds and even cash while more QE will drive bond yields down and prices up. Yet logic suggests central bank money printing should, one day, lead to inflation, an environment which usually favours stocks, commodities and property and does no favours to holders of fixed-income assets.

- October's jump in volatility suggests the equity markets are not as healthy as they look on the surface, yet QE worldwide means equities offer a better yield than bonds and cash, at a time when savers are looking for dependable income.

Such dilemmas speak in favour of a balanced portfolio, with exposure to a range of assets as the range of possible end-games is huge and their timelines uncertain. Being too dogmatic one way or the other is unlikely to bring immediate rewards, as frustrated equity bears will testify in the wake of the Bank of Japan's coup. Just as they were waiting to see what the markets would do without the prop of liquidity from the Federal Reserve, Governor Kuroda has stepped into the gap left by Chair Janet Yellen.

Meanwhile those who doubt the power of Abenomics are also left to fume, as Japanese stocks are carried higher by a tidal wave of central bank cash, timed to coincide with Government pension scheme reform for maximum effect.

The good news is a value case can be made for Japanese stocks, based on the number of firms with net cash, or whose shares trade below book value and even some with offer both features. The bad is the yen looks set to go lower and those who believe in the power of central banks and Abenomics could consider buying actively-managed funds and exchange-traded funds which hedge the currency and offer sterling-priced units or shares. These are easy to find via the research centre on the AJ Bell Youinvest website. The data below show the top performing OIECs and ETFs which provide Japanese exposure in a sterling-priced format.

Best performing currency hedged Japanese large cap funds over the past year

| ISIN | Fund size £ million | One-year performance | Dividend yield |

Ongoing charge |

Morningstar rating |

|---|---|---|---|---|---|

| Schroder Tokyo Fund GBP Hedged Z (Inc) | |||||

| GB00B8V8R746 | 1,343.4 | 17.3% | 0.3% | 0.92% | n/a |

| GLG Japan CoreAlpha Equity I H GBP | |||||

| IE00B64XDT64 | 2,675.3 | 15.9% | n/a | 1.13% | n/a |

| Jupiter Japan Income I-H (Inc) | |||||

| GB00B6496D90 | 524.2 | 15.3% | 2.0% | 1.14% | n/a |

| JOHCM Japan GBP A Hdg | |||||

| IE00B5LD7P60 | 666.1 | 13.9% | 0.4% | 0.85% | n/a |

| Capital Group Japan Equity Fund (Lux) Zgdh GBP | |||||

| LU0939056361 | 140.6 | 12.8% | 1.5% | 1.00% | n/a |

Source: Morningstar, for Japan Equity - currency hedged category. Clean funds only. Sterling denominated funds only. Where more than one class of fund features only the best performer is listed.

Best performing currency-hedged Japanese ETFs over the last year

| EPIC | Market cap £ million | One-year performance |

Dividend yield |

Total expenseratio |

Morningstar rating |

|---|---|---|---|---|---|

| iShares MSCI Japan GBP Hedged UCITS ETF | |||||

| IJPH | 397.7 | 16.0% | n/a | 0.64% | n/a |

| db X-trackers MSCI Japan Index UCITS ETF 6C GBP Hedged (GBP) | |||||

| XMJG | 818.4 | 15.9% | n/a | 0.60% | n/a |

Source: Morningstar, for Japan Equity - currency hedged category. Clean funds only. Sterling denominated funds only. Where more than one class of fund features only the best performer is listed.

Trick or treat

The Bank of Japan certainly caught the markets on the hop last week. Governor Kuroda announced an increase in its monthly QE scheme from ¥60 trillion to ¥70 trillion a month to ¥80 trillion. That equates to ¥960 trillion ($842 billion) a year, or a programme 80% of the size of America's $85 billion-a-month QE4 scheme that was designed for an economy that is three times the size. Japan will now more than double its monetary base in less than two years from the starting point of its QE foray, 4 April 2013 and the additional QE cash will be used to:

- increase the purchases of Japanese Government Bonds (JGBs)

- increase the duration of JGBs purchased, toward the 7 to 10 year range

- triple purchases of Tokyo-listed Real Estate Investment Trusts

- triple purchases of Tokyo-listed Exchange-Traded Funds (ETFs), including for the first time those which track the new JPX-Nikkei 400 benchmark index

The turbo-charge the impact of these measures, the Abe administration's call for reforms in the Government Pension Investment Fund (GPIF) took another step forward on the same day.

- The GPIF will cut its allocation to domestic bonds from 60% to 35%

- The GPIF will double its equity weighting from 24% to 50%.

- Within the equity portion, holdings of overseas stocks will rise from 23% to 40%, forcing the GPIF to sell yen and buy overseas currencies so it can strike these trades.

Under normal circumstances, this would mean disaster for holdings of JGBs. The 10-year yields 0.46%, yet the Government wants 2% inflation and there is a huge seller of paper. Yields would usually rocket to levels Japan could ill-afford given its mountainous debts, which already siphon off more than a quarter of tax revenues in interest payments. This is where the BoJ's increased QE scheme changes the rules. The central bank's buying will soak up the supply of JGBs and let the GPIF buy stocks in the sort of arrangement which might just make Charles Ponzi blush.

QE is depressing Japanese bond yields even as the Government targets 2% inflation

Source: Thomson Reuters Datastream

Currency clash

Japan's QE efforts already dwarf those of the USA, at least in terms of how central bank assets stack up as a percentage of GDP, as the chart below shows. The latest phase will simply take Japan off the scale but whether the plan will work or not remains to be seen.

New QE plan means Japanese policy looks more expansive than ever

Source: OECD. Chart shows central bank assets as a percentage of GDP.

It is certainly weighing on the yen, which has slumped from ¥96.4 to ¥114 against the dollar since April 2013. This does not have to be the end of the slide either, as the yen traded as high as ¥160 in the late 1980s and south of ¥300 in the 1970s, but the problem is everyone wants a weak currency - not just Japan. The Swiss are still pegging their currency to the Euro and selling the franc hand over fist against overseas currencies to defend the CHF 1.20 level laid down as a floor in September 2011. The central banks of Australia and New Zealand are bewailing the strength of their counters, while it seems unlikely the Federal Reserve, European Central Bank or Bank of England will be too pleased to see the buck, euro or pound go too far, given the risk this poses to their exports (not to say their own cherished 2% inflation targets). Only Russia is currently really trying to prop up its currency and the rouble has already collapsed.

The Yen has slumped since Japan's resumption of QE in April 2013

Source: Thomson Reuters Datastream

The Swiss are still printing to depress the franc

Source: Thomson Reuters Datastream

Quite why 2% is the preferred level remains a mystery to me, although the need for inflation is easier to understand. It erodes the value of Governments' monstrous sovereign debts and the worth of the coupons they must pay bondholders, in real terms. Yes, savers suffer as paltry nominal returns on cash and bond yields but they will simply become collateral damage if the money printing continues at an ever-increasing pace – as Japan's policy shift suggests it could.

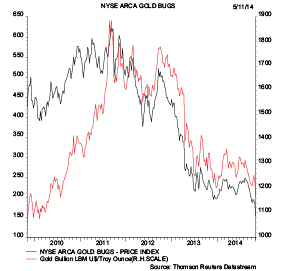

It is hard to see who can emerge the winner from this race to the bottom as various Governments and central banks seek to both stoke inflation and drive currencies lower to try and generate export-led economic growth. They cannot all go down at the same time relative to each other, although in theory they can do so against the value of 'real' assets, such as equities, property and potentially commodities such as (dare I say it?) gold, which remains firmly in clients' doghouse. Gold mining stocks continue to head lower, using NYSE ARCA Gold Bug index (or HUI) as a guide, while the precious metal itself slumped to $1,146 on Wednesday (5 Nov) after huge selling in the futures market. This seems counter-intuitive given Japan's latest efforts to weaken the value of its paper currency, but markets can be perverse when they want to be.

Gold miners and the metal's price are still in freefall despite further central bank QE

Source: Thomson Reuters Datastream

As John Maynard Keynes put it, “The markets can stay irrational a lot longer than you and I can stay solvent.” Gold would be a logical beneficiary of any loss of faith in 'fiat' currency, central bank money printing and inflation or any broader loss of faith in 'fiat' currency and the prevailing policy orthodoxy. In the absence of inflation, at least according to the official numbers, and in markets' desire to let central banks get on with it, the metal's price is melting. It is unlikely that last week's events in Tokyo will change gold bugs' minds and if anything their resolve will be strengthened.

Russ Mould, AJ Bell Investment Director.

As part of his portfolio, Russ Mould owns shares in Goldcorp, Golden Prospect Precious Metals, New Gold, Newmont Mining and Yamana Gold.