Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

According to data from independent consultant ETFGI, global fund flows into exchange-traded funds (ETFs) came to $197 billion in the first quarter of 2017. That compares to inflows of $70 billion in the same period in 2016 and is enough to take total assets under management to $3.9 trillion.

It is easy to see why this trend is developing so strongly and why so-called passive funds are proving popular with investors:

- They are low cost, with ongoing charge figures (OCFs) for products which track some of the best-known global stock market indices reaching 0.05% or less. Keeping costs low is one of the best ways of boosting total returns over time.

- Markets are generally going up, so investors may be happy to seek broad exposure and simply let the favourable trend be their friend.

- Actively-managed funds’ majority ownership of the financial markets means they cannot all outperform at once – it is mathematically impossible. This may lead some investors to question why they should pay the premium fees charged by an active fund manager, when at any given time the outperformance required to justify the higher charges may not be delivered.

Yet the torrent of fund flows into ETFs is raising disquiet in some corners (and not just among active fund managers). Product proliferation, soaring markets and plunging volatility are all leading some to question whether ETFs are stoking new bubbles, or are even a bubble in themselves.

Now may therefore be a good time for this column to revisit ETFs. After all, they are tool for building portfolios like building any other and like any tool they must be researched and properly understood before they are used, to ensure their potential is maximised and possible injury avoided – and as Warren Buffett once argued injury in an investment context is best defined as permanent loss of capital.

This week we will look at the case for ETFs, relative to other options, such as open-ended active funds (unit trusts or OEICs) and closed-ended active funds (investment trusts).

Exchange-traded funds

An exchange-traded fund (ETF) is known as a passive (or sometimes tracker) fund because it is designed to track, or mirror, the performance of the underlying assets and deliver that performance, minus any running costs. In most cases, if the underlying assets rise in value by 1%, then so will the ETF (minus its running costs), and if they all 1%, so will the ETF (with the running costs on top).

The underlying is usually a market index of some kind, or in some cases a specially-created basket of equity or fixed-income securities or commodities. No effort is made to choose between the relative merits of the index constituents (which is what an active fund run by a manager will seek to do) and no effort is made to outperform the benchmark, just match it (again minus costs).

ETFs are traded like a share – on exchange, with a bid-offer spread, in real-time pricing. They are run by an algorithm developed by the product provider and the absence of the money manager and his or her research efforts means they tend to be a lot cheaper than actively-managed funds.

The case for their use in a portfolio is four-fold.

1. Low-cost portfolio diversification

The first argument for ETFs rests on low-cost portfolio diversification.

For a relatively small capital outlay, a single ETF can provide access to dozens, hundreds or in some cases thousands of securities, be they stocks, bonds or even commodities.

In addition, ETFs can be used to glean broad-brush exposure to markets, by using them to track the performance of mainstream indices, or take a more granular approach, to track a specific geography, country, investment style, market theme or even duration of bonds, for example.

Finally, they appeal to many for their low cost, with ongoing charge figures (OCFs) for ETFs which track some of the best-known global stock market indices going as low as 0.05%.

An example of an ETF which tracks a very broad index is the iShares Core MSCI World ETF, which covers 1,644 individual, globally-listed stocks.

How the performance of the iShares Core MSCI World ETF compares to the underlying index

Source: Thomson Reuters Datastream

2. Simplicity

The second point in favour of ETFs is their simplicity.

Again, advocates of ETFs cite single-trade diversification, speed of trading and the ability to target either broad indices or specific themes.

ETFs can also permit access to areas which may otherwise be difficult to trade cheaply or quickly without institutional status, such as Brazil or India, or commodities, where issues such as storage and insurance would become expensive nuisances.

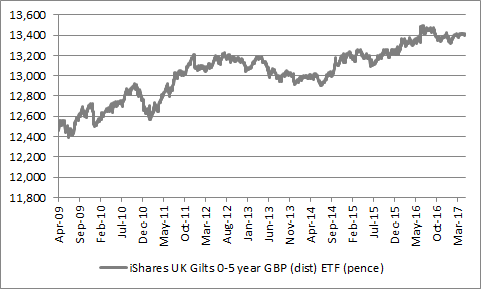

A more granular option would be the iShares UK Gilts 0-5 years ETF.

The instrument is designed to track the performance of 14 UK Government-issued bonds that will mature within five years.

Their short duration helps to protect investors from any interest rate rises (as bond prices fall as interest rates and yields rise). In return for this relative safety the yield is modest at 0.74% although that still beats cash in many cases so the ETF could have a role as an alternative to cash.

How the performance of the iShares UK Gilts 0-5 years ETF has performed since inception

Source: Thomson Reuters Datastream

3. Transparency

When it comes to transparency, ETFs have two potential selling points.

The first is the availability of real-time pricing for an instrument that is traded intra-day on exchange. This contrasts markedly with the manner in which funds are bought or sold, which are priced daily.

The second is that the underlying holdings are disclosed in their entirety every day on the website of the ETF provider. This differs from both funds and investment trusts (with a few notable exceptions), where a monthly factsheet discloses the top 10 holdings and the key sector or geographic exposures.

A good example of this is the Source S&P 500 ETF.

This ETF uses so-called synthetic or indirect replication to generate performance. In plain English this means it does not own the underlying securities but instead uses a derivatives transaction between the provider and a counterparty (usually an investment bank).

What the ETF does then own under these circumstances is collateral and even these holdings are published every day, so even the nosiest and most risk-averse investor can peek under the bonnet, just in case.

The top 10 holdings of Source S&P 500 ETF

| Holding | Country of origin | Sector | Portfolio weighting | |

| 1 | Bayer | Germany | Chemicals | 6.1% |

| 2 | Nestle | Germany | Food Producers | 5.7% |

| 3 | Unilever | Netherlands | Food Producers | 4.1% |

| 4 | Vertex Pharmaceuticals | USA | Pharmaceuticals | 4.1% |

| 5 | Dow Chemical | USA | Chemicals | 3.9% |

| 6 | ING | Netherlands | Insurance | 3.8% |

| 7 | Allianz | Germany | Insurance | 3.5% |

| 8 | Merck | USA | Pharmaceuticals | 2.9% |

| 9 | Deutsche Telekom | Germany | Telecoms | 2.4% |

| 10 | Daimler | Germany | Autos & Parts | 2.3% |

Source: Source factsheet, as of 16 May 2017.

4. Liquidity

Liquidity rounds off the quartet of arguments in favour of using ETFs.

We have already touched upon the advantages of exchange-listing, real-time pricing and intra-day trading. Some ETF providers even argue that the intra-day process of creating and redeeming units in the instruments when investors buy or sell actually helps to create, or at least boost, liquidity in the underlying markets, especially in fixed-income.

This ebb and flow in the underlying assets, which ETFs using physical or direct replication to provide performance will actually buy, sell and own, can be further augmented by specific types of instrument known as ‘short’ (or ‘inverse’) and ‘leveraged’.

‘Short’ ETFs rise in value as the underlying falls (enabling advisers and clients to profit, or protect) themselves from market drops while ‘leveraged‘ ETFs do not move on a one-to-one basis with the underlying, but rise or fall by two, three or even four times as much.

Fixed-income ETFs such as iShares GBP Corporate Bond ETF provide liquid access (in theory) to an underlying market which is not always easy to trade

Source: Thomson Reuters Datastream

That deals with the four arguments in favour of using ETFs to help construct a properly balanced portfolio.

Next week’s column will look at the wrinkles to research and the traps to avoid, to ensure that ETFs help to manage risk and optimise returns rather than unwittingly engage risk and endanger wealth.

Russ Mould, AJ Bell Investment Director

Related content

- Thu, 09/05/2024 - 16:12

- Thu, 18/04/2024 - 11:00

- Thu, 28/03/2024 - 14:28

- Tue, 12/03/2024 - 15:33

- Thu, 18/01/2024 - 09:00