Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

At its core, stock-picking can be pretty simple stuff.

The key is to identify firms which are going to show the best profit and dividend growth. (The hard part is doing the research into companies’ business models, competitive position, financial strength and management acumen so you have a good grasp of the firms’ potential to consistently deliver).

All of this is neatly shown by the reception given by investors to a pair of contrasting trading statements from grocer Morrisons and fashion retailer Next.

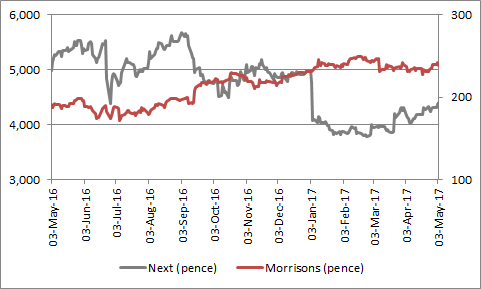

Over the past 12 months Morrisons' shares are up by 26% and Next’s are down by 20% and the companies’ respective trading updates released on Thursday 5 May show why.

Morrisons shares have done much better than Next’s over the past year

Source: Thomson Reuters Datastream

Momentum

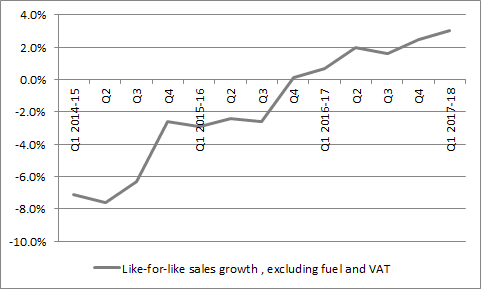

Morrison’s reported like-for-like-sales growth of 3% in its first quarter, the sixth consecutive period of growth and accelerating growth at that.

Morrisons continues to show improved sales momentum

Source: Company accounts

By contrast, Next was once more been obliged to shave down its sales growth and profits forecasts for the year.

After reporting a 3% year-on-year drop in full-priced sales for its first quarter, chief executive Lord Wolfson steered expectations lower, as he cut the mid-point of his full-year sales forecast to -1.5% from -0.5% and full-year profit guidance to £710 million from £730 million.

That is barely a 3% cut in profit estimates but the shares swiftly fell by nearly 6%, whereas Morrisons’ shares were flat, holding on to the strong gains of the past year, having initially opened some 2% higher.

Analysts are now expecting Morrisons to show earnings growth in 2017 and 2018, now it has finally stopped a long string of profit declines in 2016, while Next’s profits are expected to decline in the next two years after 2016 ended a long run of consecutive increases:

Morrisons is expected to show further profits growth, Next further profit declines

Source: Company accounts, Digital Look, analysts’ consensus estimates

Income

That all explains why Morrisons has done so much better than Next – anyone spotting the grocer’s improvement in profit momentum and the fashion retailer’s loss of it would have potentially done well.

The question investors, especially contrarian ones, may now wish to address now is whether Next is sufficiently cheap as to merit portfolio inclusion.

Valuation comparison of Morrisons and Next

| 2017E | |||||

| Price/earnings ratio | Dividend yield | Earnings growth | Dividend growth | Dividend cover | |

| Morrisons | 19.5 x | 2.5% | 12% | 10% | 2.05 x |

| Next | 10.5 x | 8.0% | -9% | 114% | 1.19 x |

| 2018E | |||||

| Price/earnings ratio | Dividend yield | Earnings growth | Dividend growth | Dividend cover | |

| Morrisons | 18.3 x | 2.7% | 7% | 10% | 2.00 x |

| Next | 10.6 x | 3.7% | -1% | -53% | 2.52 x |

Source: Digital Look, analysts’ consensus estimates

At its peak of £80 less than 18 months ago, investors were paying 18 to 19 time forward earnings for a stock where profits were expected to grow consistently in 2016, 2017 and 2018, even from what were already record levels.

Now the stock trades on barely 10 times earnings which are expected to drop for at least three years in a row – so sentiment has turned. Instead of paying high multiples for peak earnings, the market is now paying low multiples of potentially depressed profits.

This could be an over-reaction, and an opportunity for value investors.

But that will be the case only if the drop in Next’s profits proves transitory and the result of stock management issues, a short-term spike in UK inflation and broader economic uncertainty over Brexit.

Value hunters will also point to Next’s ordinary dividend of 158p a share, which equates to a 3.8% yield and is covered by earnings by more than 2.5 times (way above the FTSE 100 average of 1.7 times cover).

They will also eye up Next’s announcement of a second special dividend for 2017 of 45p a share, to be paid on 1 August. Two more such payments are planned, potentially taking the total dividend to 338p a share for a dividend yield of 8%.

Next offers a yield which may tempt income hunters to do further research

Source: Company accounts, Digital Look, consensus analysts’ forecasts

Value – or value trap?

What income seekers will then have to weigh up is whether Next’s woes are short-term and cyclical or long-term and structural.

If short-term, there must still be a catalyst to persuade other investors that the shares are oversold. One possibility here is a rebound in the pound.

Next has previously warned of the raw material cost inflation that has resulted from the pound’s post-referendum decline and how it would need to raise prices to compensate. Increasing prices in a very competitive fashion market may not be proving easy so any renewed strength in sterling may help, as it would take pressure off costs and consumers wallets, in the form of lower inflation.

While history is no guarantee for the future, the FTSE All Share General Retailers sector does look to do better when the pound is strong and less well when it is weak.

Retail stocks have historically done better when the pound has been strengthening

Source: Thomson Reuters Datastream

Buying a stock on the back of the foreign exchange markets alone is a risky plan, given just how unpredictable currencies are, and that still leaves the potential long-term challenges facing Next.

These include competition from purely web-based rivals and the battle between ‘bricks and clicks’; record-levels of consumer debt in the UK; and the concept of ‘peak stuff.’

The last-named idea suggests that millennials who share houses, because they cannot get on the property ladder, share jobs or work in the gig economy, may simply buy less material goods as they have no space or spare cash for them, preferring to spend on experiences instead.

Anyone fearing this trio of tests may still fight shy of Next in the view it could be a classic value trap, where the risk of capital loss can outweigh the potential benefits of the dividend.

It must be said there is no room for complacency at Morrisons’ shareholders, either, given how fearsomely competitive the supermarket business remains. The latest numbers from consultants Kantar Worldpanel show how the Big Three of Tesco, Sainsbury and Morrisons are still losing market share to the discounters Aldi and Lidl.

All three are having to work hard to stand still, let alone grow profits, and any sign that the Morrisons’ profit recovery is running out of steam could see a resurrection of fears that the supermarkets remain structurally challenged, as well, to the potential detriment of their share prices.

Russ Mould, AJ Bell Investment Director

Related content

- Thu, 09/05/2024 - 08:44

- Mon, 29/04/2024 - 09:30

- Wed, 17/04/2024 - 09:52

- Tue, 30/01/2024 - 15:38