Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Share prices have so far responded negatively to the abandonment of a vote on President Donald Trump’s healthcare plan (24 March).

The first real political setback for the Trump reform programme offers a timely reminder that long-term investors in stocks are better served by focusing on company cash flows and valuation than second-guessing what politicians are going to try and do.

Our analysis of historic US stock market performance under Democratic and Republican Presidents since 1948 and the background to the Reagan reforms and bull stock market of the 1980s suggests investors should not blindly back the Trump reflation trade, either via their own direct stock picks or the funds they choose.

This is not to say Trump cannot make a difference or that the US stock market run that began in 2008 is over.

But it is to say the consensus view is currently that Trump will make big changes, that the US economy will benefit and that corporate profits will soar, taking stocks higher.

And the consensus is rarely right for too long, not least as it is quickly factored into valuations. So either Trump needs to deliver something else, and fast, to soothe frayed nerves, or markets could get bumpier in the near term.

Meanwhile April’s first-quarter reporting season will provide American companies’ perspective on the world.

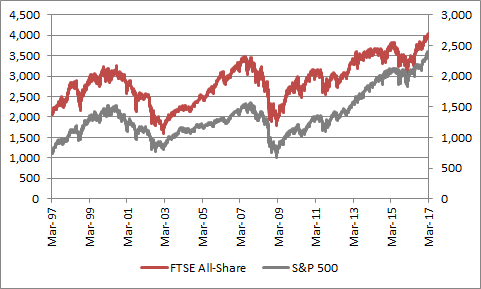

Investors with US exposure will be particularly interested in how American corporations’ profits develop from here but even those who are focused just on the UK need to pay attention. This is because in stock market terms the UK tends to follow where the US goes, as this first chart suggests:

The FTSE All-Share has historically tended to take its lead from the US stock market

Source: Thomson Reuters Datastream

Three historical pointers

Stocks and the dollar have welcomed Trump’s tax cutting, infrastructure spending and deregulating programme, prompting favourable comparisons with Ronald Reagan’s reforms of the early 1980s.

Reagan did help to galvanise the US economy and start a multi-year bull run in stocks.

But to say Trump will be able to do the same could be too simplistic for three reasons – even assuming he can get the House of Representatives and the Senate to bend to his will and pass the reforms he wishes to introduce:

- First, it is too glib to assume that Trump will be good for stock markets because he is seen as being pro-business.

George W. Bush was seen as being ‘good for business’ but the Dow Jones Industrial Average fell by 18% during his term in office (because he took over just as a slowdown hit the economy and US equity valuations were horribly stretched after the tech bubble).

Bill Clinton and Barack Obama were seen as being of the left and ‘anti-business,’ yet the Dow Jones Industrials soared during each of their Presidencies (as both took over after a recession and stocks had suffered bear markets, meaning valuations were much more attractive).

Trump is taking over after an eight-year economic expansion, albeit a feeble one, and a multi-year bull run in stocks that leaves US equities trading near to their all-time high valuations levels using metrics such as market cap to GDP.

The US stock market does not seem to care whether a Democrat or Republican is in the White House

| Election | President | Party | Change in the Dow Jones Industrials during term in office |

| 1948 | Harry S. Truman | Democrat | 65% |

| 1952 | Dwight D. Eisenhower | Republican | 111% |

| 1960 | John F. Kennedy / Lyndon B. Johnson * | Democrat | 53% |

| 1968 | Richard M. Nixon / Gerald R. Ford ** | Republican | 6% |

| 1976 | Jimmy Carter | Democrat | -4% |

| 1980 | Ronald Reagan | Republican | 125% |

| 1988 | George H. W. Bush | Republican | 52% |

| 1992 | Bill Clinton | Democrat | 227% |

| 2000 | George W. Bush | Republican | -18% |

| 2008 | Barack Obama | Democrat | 123% |

| 2016 | Donald J. Trump | Republican | ? |

Source: Thomson Reuters Datastream. * John F. Kennedy assassinated in November 1963 and replaced by Lyndon B. Johnson. ** Richard M. Nixon resigned August 1974 and replaced by Gerald R. Ford

- Second, while the Reagan comparison is beguiling, Trump has inherited a very different set of circumstances: inflation.

Interest rates may be trending higher now, while under Reagan they dropped like a rock.

In addition, equity valuations were much lower, as Reagan took over after a recession and bear market, while Trump again is assuming office after a multi-year upturn and bull run in stocks:

Trump is inheriting a very different (and potentially less favourable) set of circumstances than Reagan did

| Reagan | Trump | ||||

| 1981 | Trend | 2017 | Trend (?) | ||

| Fed Funds rate | 18.0% | Down | 1.00% | Up | |

| US 10-Year Treasury yield | 15.0% | Down | 2.4% | Up | |

| US 30-year mortgage rate | 16.0% | Down | 4.2% | Up | |

| Total US debt to GDP* | 96% | Up | 215% | Up | |

| US inflation | 8.0% | Down | 2.7% | Up | |

| Shiller CAPE | 9.0 x | 29.0 x |

Source: FRED, St. Louis Federal Reserve database, Federal Reserve Bank of New York, www.econ.yale.edu/shiller/data/ie_data.xls. *Excludes pension obligations

- Third, the Reagan era actually got off to a sticky start.

Even ‘The Gipper,’ Reagan’s sometime-nickname after a role he played in a 1940 film about American football, needed time to outline and implement his reforms. The Dow Jones initially rallied after his November 1980 victory but then sagged 19% from peak to trough in summer 1981 before it found its footing once more:

Reagan’s bull stock market took time to gather momentum

Source: Thomson Reuters Datastream

Reporting season

While Trump’s plans may bring long-term benefits, assuming he can get them approved and implemented, it could take time and there remains the risk markets have got a little ahead of themselves.

This makes the imminent first-quarter US reporting season all-the-more important.

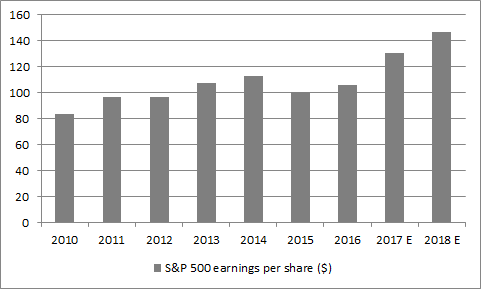

The 2015-16 corporate earnings recession looks to have ended, at least using the numbers reported by Standard & Poor’s for the S&P 500 index, which show aggregate earnings per share (EPS) for the benchmark rose by 21% year-on-year in Q4 2016.

That was the second straight year-on-year increase, after a dreadful run of seven consecutive declines.

Consensus expectations are looking for 23% EPS growth in 2017 and 13% in 2018 as a whole.

US earnings forecasts already assume strong increases for 2017 and 2018

Source: Standard & Poor’s

If those forecasts are met or beaten, then key headline stock market indices in the US, such as the Dow Jones Industrials, S&P 500, small-cap Russell 2000 and tech-laden NASDAQ Composite, could keep going higher (and potentially drag the FTSE 100 and other UK benchmarks along for the ride).

If corporates undershoot those forecasts then stocks could become a lot choppier, especially after a period of unusual calm, at least by historic standards – the 1% drop in the S&P 500 index on Tuesday 21 March was the first such move for 110 days, compared to a post-1970 average of one such decline every 11 days.

Russ Mould, AJ Bell Investment Director

Related content

- Thu, 09/05/2024 - 08:44

- Mon, 29/04/2024 - 09:30

- Wed, 17/04/2024 - 09:52

- Tue, 30/01/2024 - 15:38