A unique investment philosophy

Nearly four decades of bottom-up fundamental investing.

Asset Value Investors (AVI) has managed the c.£1.1* bn AVI Global Trust since 1985. Our strategy has remained consistent for this period: to buy quality companies held through unconventional structures, trading at a discount. The strategy is global in scope, and we believe that attractive risk-adjusted returns can be earned through detailed research with a long-term mind-set.

The world is filled with challenges and volatility, with a war on European soil and rising interest rates alongside high levels of inflation. Despite the challenging market conditions, we continue to find good investment opportunities.

Our proprietary research process with a focus on mispriced assets that trade at a discount to net asset value enables us to filter through the numerous companies, to distil the market down to a more manageable universe.

AVI’s well-defined, robust investment philosophy helps to guide investment decisions. An emphasis is placed on three key factors:

(1)companies with attrac-

tive assets, where there is potential for growth in value over time; (2) a sumof-the-parts discount to a fair net asset value; and (3) an identifiable catalyst for value realisation. A concentrated high conviction core portfolio of c. 30± investments allows for detailed, in-depth research which forms the cornerstone of our active approach.

Once an investment has been made, we seek to establish a good relation-

ship and actively engage with the managers, board directors and, often, other key shareholders. Our aim is to be a constructive, stable partner and to bring our expertise - garnered over almost four decades of investing in asset backed companies - for the benefit of all. The approach is benchmark-agnostic, with no preference for a particular geography or sector which allows us to seek out the best opportunities anywhere

AGT’s long-term track record bears witness to the success of this approach, with a NAV total return well in excess of its benchmark. We believe that this strategy remains as appealing as ever and continue to find plenty of exciting opportunities in which to deploy the trust’s capital.

• The UK stock market is starting to look increasingly lopsided

• Drug companies under the spotlight after breakthrough with new weight-loss treatment

• CAB Payments IPO could be the trigger to revive UK stock market flotations

• Why the market was spooked by the Bank of England’s super-sized rate hike

• Carnival shares have soared this year but it’s become a rockier ride

• Fidelity China Special Situations shares hit after China reopening stutters

New: Shell / VT Gravis UK Listed Property Fund

Ten Entertainment

The reason why Frasers wants to own stakes in so many retailers

Revealed: the companies which could join the exodus from the UK market

has made investors rich over the years: are the shares worth buying today?

an opportune moment to pounce on private equity trusts?

Editor’sView:DanielCoatsworth

Thereasonwhy Frasers wants to ownstakesinsomanyretailers

StakebuildinginAO,ASOS,Boohooand Currysmightnotbeasoddasitlooks

FTSE100retailgroupFrasers(FRAS)has upitsfingersinmorepiesthanPukkaserves OverataRotherhamUnitedfootballmatch. thepastfewweeks,ithasunveiled investmentsinyetmorelistedretailcompanies. itsBeforeyouthinkithasgonewild,thereismethodin Inmadness. imagerecentyears,Frasershastriedtoshakeoffits business.asa‘pile‘emhigh,sell‘emcheap’typeof MikeAshleyhaspassedtheCEObatonto hisson-in-law,MichaelMurray,whohasfocusedon ledexpandingthegroup’supmarketinterests.Hehas investmentsinmoreluxurystoresandfocused onpremiumproductsundertheFlannelsbrand. group,Whilethathasgivenanewleaseoflifetothe elsewhere.itisimportantnottoforgetitsrootslie Fraserscrackedtheformulaforfilling pricesstoresfromfloortoceilingwithproductsatlow pickingviaSportsDirect,andAshleyspentyears atthebonesoffailedretailerstoaddnewstrandstothegroup.

Heisanexpertatpickingupabargain,beitbuying dealsabusinessonthecheap,strikinggoodproperty orinvestinginunlovedcompaniesforstrategic cangains.Onceagain,itlooksasifAshleyhasdowneda WhileofRedBullandspottednewopportunities. henolongerrunsFrasers,heremainsthe biggestshareholderowningjustover70%ofthe business. theAshleyhaspreviouslyimpliedthathedidnotget luxurygoodssideofFrasers,leavingittoMurray topursue.Instead,hisbreadandbutteraremassmarketretailbusinesses. FraserstakingstakesinAO(AO.)andCurrys (CURY)effectivelyprovidesafootinthedoorfor thetheelectronicssector.Italreadyhadapositionin becomingcomputergamesindustrybyowningGAMEbut amajorshareholderinAOandCurrys shouldgiveFrasersabroaderunderstandingofthe challengesaroundsellingtechhardware. AOisalsoanexpertatmovinggoodsfromAto moreB–somethingincreasinglyimportanttoFrasersas machinespeopleorderbulkyproductssuchasexercise fromSportsDirectandfurnitureviaitsSofa.combusiness. TakingstakesinASOS(ASC)andBoohoo (BOO:AIM) fashionable,makessense.Athleisureisincreasingly buttheproductsinSportsDirectstores aretoosamey.Ifyoudonotlikesecond-tierbrands youincludingSlazenger,Firetrap,PumaandEverlast, areunlikelytowanttokitoutyourwardrobe inSportsDirectshops.However,thereisscopeto forbroadentherangeandmakeitmoreofadestination didAddingshoppers.brandsisthewayforward,justlikeFrasers ASOSwiththepurchaseofJackWillsin2019.Iamsure andBoohoocouldoffersuggestions. businessesDonotexpecttakeovers.Fraserspreferstobuy outofadministrationandnoneofits recentinvesteecompaniesareinseriousfinancial betrouble.Instead,beingamajorshareholdershould boardenoughtogetAshleyanaudiencewiththe valuableofdirectorswherehecanprizeoutallthe informationandfeedthatintoFrasers’ thisownbrainmachine.Itisanexpensivegambletoget worthboardroomaccess,butAshleyclearlythinksitis it. withIamsurprisedhehasnotmadeasimilarmove afootwearretailer,giventheobviouscross-overwithSportsDirect.Isthatnextonthelist?

Frasers has been busy taking stakes in AO, Currys and Boohoo – there is logic to these investments

The retailer continues to seek ways to expand its empire and taking equity stakes should give it access to the people with the best insight into their industries

Feature:UKListings

Revealed:thecompanies whichcouldjointheexodus from the UK market

Three important things in this week’s magazine 1 2 3

Theexchange’sbattletoattractnew companiesandkeepexistingonesis becomingmoreintenseT hereareanincreasingnumberoflarge theirfirmswhicharethinkingaboutchanging mainsharelistingfromtheUK totheUSorelsewhere,raisingfearsLondonislosingitsimportance. seriousThisarticleexplainswhycompaniesaregiving thoughttothisissueandwhomightbenexttopressthebutton. IrishbuildingmaterialsgiantCRH(CRH)isthe US.latestfirmtodecidetomoveitsmainlistingtothe SeptemberItisexpectedtotakeeffectaroundtheendof 2023.ItsUKlistingwillsubsequently willchangefromapremiumtoastandardlisting,andit ThenolongerqualifyforinclusioninFTSEindices. shareholdercompanyreceivedoverwhelming supportfortheplan.TheUS representsaround75%ofitsEBITDA(earnings andbeforeinterest,tax,depreciationandamortisation) operationalitbelievesthemovewillbringcommercial, andacquisitionbenefits. ChiefexecutiveAlbertManifoldsaidtheUS theisexpectedtobeakeydriverofgrowthand listingmarks‘animportantmilestonein ourdevelopmentandwillenableCRHtofully thatparticipateinthesignificantgrowthopportunities Gamblinglieahead.’firmFlutterEntertainment(FLTR)hasreceivedshareholdersupportforasecondaryUS listingwhichmanagementenvisagewillprovide strategicandcapitalmarketbenefitsasitpursues growthinthatcountry. brandFlutter’smarketleadingUSfantasysportsbetting FanDuelisexpectedtoturnaprofitin2023 andhasthescopetobecomethelargestdivision withinthegroupincomingyearsgiventhegrowth

opportunity.Fluttertoyedwiththeideaoffloating FanDuelonNasdaqin2021. primaryIntimeFluttermaydecidetomakeNewYorkits Plumbing,listingandLondonitssecondarylisting. heating,andairconditioningsolutions groupFerguson(FERG) formerlyknownas Wolseley,addedasecondaryUSlistingin2021 inbeforemakingNewYorkitsprimarylistingvenue The2022.companybeganthinkingaboutaUSlisting ain2019afteractivistinvestorNelsonPeltztook Northstakeandpushedforthegrouptofocusonits Americanbusiness.

Timesthatmovingtheprimarylistingvenue hadachievedmostofitsgoalsandfacilitated managementtospeakwitha‘verylargepoolof capital’forlittleextracost.

ChiefexecutiveKevinMurphytoldtheFinancial

WHYDOCOMPANIESMOVETHEIRLISTING? theThereareseveralgoodreasonscompaniesmake move,buttopofthelist,andwhatconnects allthemovesseensofar,isthesheeramountof businessthesefirmsalreadydointheUS.

Quite a few UK-listed companies are looking to the US market to boost their valuation, but there is no guarantee that value uplift will happen

We look at the likely candidates to focus on the US market and what investors need to do if the listings change

Visit our website for more articles

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

whileGainsareconcentratedinafewsectors lossesarewidelyspread

UKofinvestorswillbewellaware thelopsidedperformancerecentoftheUSstockmarketin months,witha handfulofstocksaccountingforalmostthe entireindexgainssofarthisyear. However,asimilarphenomenonis ofoccurringrightunderournoseswithmost thegainsintheFTSE100andFTSE250 downtotheoutperformanceofsomeof theirlargerstocks. obscureThisconcentrationonaselectfewtendstowhatisgoingonfurtherdowntheindices,

toTheUKstockmarketisstarting lookincreasinglylopsided

ExamplesofUKstockstrading around12-monthshare-pricelows

Table:Sharesmagazine•Source:Stockopedia,26June2023

anditwaswithsomesurprisethatwerecently counted90stockstradingatorwithin3%oftheir 12-monthlows. upJustoverhalfofthestocksintheFTSE100are marketthisyear,withgainsbeingledbythosewith capsover£10billionlikeAssociatedBritish Foods(ABF)up24%,Flutter(FLTR)up36%, HSBC(HSBA)up22%,Rolls-Royce(RR.)up 67%and3i(III)up41%. IntheFTSE250,lessthan100stocks withorathirdoftheindexareintheblack gainsmostnotableinAstonMartin Lagonda(AML)up135%,Carnival(CCL)up

75%,Marks&Spencer(MKS)up52%,EasyJet

Large-capstockssuchas

(EZJ)up47%andMitchells&Butler(MAB),also up47%. outperformanceInthemiddleofacost-of-livingcrisis,theofagroupofstockswhichdependifonconsumerspendingseemscounter-intuitive notdownrightbizarre.Atthesametime,the market’sdislikeofothersectorsseemstobejustasTakeextreme. infrastructurerealestateinvestmenttrustsandtrusts,whicharebeingputthroughthethewringerasUKbaseratesrise,whichhas theirmechanicaleffectofloweringthevalueof risingassetseventhoughmostarereporting Outearnings.of90stockstradingatorneartheiryear-lows thereare20REITsandadozeninfrastructuretrusts, including3iInfrastructure(3IN)whichisaholding forbigbrother3i,oneoftheFTSE’sbestperformers. outRenewableenergyinfrastructureisparticularly offavour,yetsoarehalfadozensmalleroiland gasproducers,butthelistisn’trestrictedtothe bottomendofthemarket.

AngloAmerican(AAL) Diageo(DGE) Mondi(MNDI)andVodafone(VOD)Angloarealltradingatorcloseto12-monthlows,with AmericanandMondiofferingmid-singledigityieldsandVodafoneapproachinga10%yield. quoteAsBenGrahamputit,MrMarketwillhappily pricesalldaylongwithoutmakinganysense thehalfofthetimesoit’suptoinvestorstoworkout realvalueofthesecompanies.[IC]

There is an alarming number of UK stocks trading near to 12-month lows, showing the market to be as lopsided as the US

While names like Aston Martin might have doubled this year, the UK market has plenty of well-known stocks struggling to make headway

fall back: analysts question why Amazon would make a bid

Ocado

To be ahead in Asia, be on the ground.

abrdn Asian Investment Trusts

In Asia, life and business move fast. To invest here successfully, you need local knowledge. abrdn has had investment teams in Asia for almost 40 years. So we get to know markets, companies, trends and innovations first hand. And you get to select from investment trusts featuring the most compelling Asia opportunities we can find.

To harness the full potential of Asia, explore our Asian investment trusts on our website. Please remember, the value of shares and the income from them can go down as well as up and you may get back less than the amount invested. Asian funds invest in emerging markets which may carry more risk than developed markets.

Request a brochure: 0808 500 4000 invtrusts.co.uk/asia

Issued by abrdn Investments Limited, registered in Scotland (SC108419) at 10 Queen’s Terrace, Aberdeen, AB10 1XL, authorised and regulated in the UK by the Financial Conduct Authority. Please quote Q231.

The UK stock market is starting to look increasingly lopsided

and it was with some surprise that we recently counted 90 stocks trading at or within 3% of their 12-month lows.

UKinvestors will be well aware of the lopsided performance of the US stock market in recent months, with a handful of stocks accounting for almost the entire index gains so far this year.

However, a similar phenomenon is occurring right under our noses with most of the gains in the FTSE 100 and FTSE 250 down to the outperformance of some of their larger stocks.

This concentration on a select few tends to obscure what is going on further down the indices,

Examples of UK stocks trading around 12-month share-price lows

Just over half of the stocks in the FTSE 100 are up this year, with gains being led by those with market caps over £10 billion like Associated British Foods (ABF) up 24%, Flutter (FLTR) up 36%, HSBC (HSBA) up 22%, Rolls-Royce (RR.) up 67% and 3i (III) up 41%.

In the FTSE 250, less than 100 stocks or a third of the index are in the black with gains most notable in Aston Martin Lagonda (AML) up 135%, Carnival (CCL) up 75%, Marks & Spencer (MKS) up 52%, EasyJet (EZJ) up 47% and Mitchells & Butler (MAB), also up 47%.

In the middle of a cost-of-living crisis, the outperformance of a group of stocks which depend on consumer spending seems counter-intuitive if not downright bizarre. At the same time, the market’s dislike of other sectors seems to be just as extreme.

Take real estate investment trusts and infrastructure trusts, which are being put through the wringer as UK base rates rise, which has the mechanical effect of lowering the value of their assets even though most are reporting rising earnings.

Out of 90 stocks trading at or near their year-lows there are 20 REITs and a dozen infrastructure trusts, including 3i Infrastructure (3IN) which is a holding for big brother 3i, one of the FTSE’s best performers.

Renewable energy infrastructure is particularly out of favour, yet so are half a dozen smaller oil and gas producers, but the list isn’t restricted to the bottom end of the market.

Large-cap stocks such as Anglo American (AAL), Diageo (DGE), Mondi (MNDI) and Vodafone (VOD) are all trading at or close to 12-month lows, with Anglo American and Mondi offering mid-singledigit yields and Vodafone approaching a 10% yield.

As Ben Graham put it, Mr Market will happily quote prices all day long without making any sense half of the time so it’s up to investors to work out the real value of these companies. [IC]

Gains are concentrated in a few sectors while losses are widely spread

Drug companies under the spotlight after breakthrough with new weight-loss treatment

awaiting regulatory approval for obesity, induced an average 22.5% body weight loss in clinical trials.

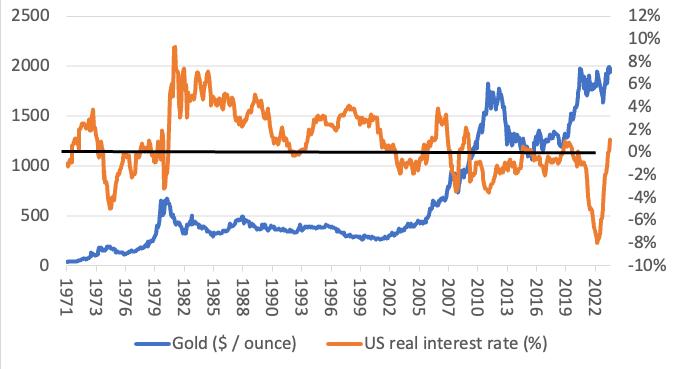

The obesity drugs market could be worth over $100 billion annually by the end of the decade according to industry experts as pharmaceutical companies race to find treatments for one of the fastest growing world health problems.

On 23 June, family-owned German company Boehringer Ingelheim said participants in a second phase study of one of its treatments, developed with Danish biotech group Zealand Pharma (ZEAL:CPH), lost an average 19% of their body weight.

Although not directly comparable, it is higher than the weight loss achieved in prior studies of market-leading obesity drug Wegovy where participants lost around 15% of their body weight.

Wegovy is made by Danish diabetes specialist Novo Nordisk (NVI:NYSE). Its success in developing an obesity drug has catapulted its shares 3.6 times higher over the last five years as investors eye the huge market potential.

Eli Lilly’s (ELI:NASDAQ) Mounjaro, which is approved for treating type-two diabetes and

High expectations for the company’s obesity and Alzheimer’s drug portfolio have seen the company become the world’s largest pharmaceutical company by market value at $430 billion.

On 26 June, Pfizer (PFE:NYSE) said it was scrapping its once-a-day obesity candidate on concerns of liver safety, causing the shares to fall over 3%. However, chief executive Albert Bourla said the company will continue developing its twice-daily obesity drug Danuglipron which showed similar weight-loss benefits to Wegovy in mid-stage trial results in May.

Demand for obesity drugs has skyrocketed after celebrities advocated using them as well as off-label diabetes drugs to shed weight. Former prime minister Boris Johnson wrote in The Daily Mail he was taking Wegovy but stopped after suffering adverse side effects.

The World Health Organisation estimates obesity rates have tripled since the mid-1970s and a study from Harvard predicts nearly half of Americans will be obese by the end of the decade.

Boehringer Ingelheim’s experimental drug Survodutide mimics glucagon which speeds up a patient’s metabolic rate, increasing how much energy is burned. A quarter of patients pulled out of the trial after experiencing side effects but the company hopes this can be avoided in later trials if the dose is increased more slowly.

In separate news, Boehringer Ingelheim lost an arbitration case where it was seeking to be indemnified by French pharmaceutical company Sanofi (SAN:EPA) in relation to selling heartburn drug Zantac.

GSK (GSK) invented Zantac and is being pursued by claims the drug causes cancer. It settled a class action lawsuit on 23 June comprising around 3,000 cases to avoid distraction related to protracted litigation on the case, giving the shares a 5% boost on the day. [MG]

Several pharmaceutical groups are trying to muscle in on a potentially lucrative market

Harvard predicts nearly half of Americans will be obese by the end of the decade

CAB Payments IPO could be the trigger to revive UK stock market flotations

Business-to-business cross-border payments and foreign exchange fintech sets scene for £851 million London listing

Fintech business CAB Payments has set the price for its upcoming IPO (initial public offering) at 335p per share, implying a market value of £851 million when conditional trading starts on 6 July 2023. It should join the FTSE 250 index later this year based on that valuation.

IPOs in London have slowed to a crawl this year with companies scared off from selling shares to investors amid a catalogue of challenges that have elevated volatility. Earlier in June, Turkey-based industrial WE Soda scrapped its $7.5 billion IPO, blaming ‘extreme investor caution’ in the UK.

According to consultancy EY, just five companies listed shares on the UK stock market in the first

three months of 2023, raising just £81 million from investors.

‘The London IPO market continues to experience the extremely challenging conditions witnessed in 2022,’ said Scott McCubbin of EY in its first quarter report. ‘There remain strong headwinds including the war in Ukraine, high energy and commodity prices, and wider inflationary pressures.’

CAB Payments offers business-to-business crossborder payments and foreign exchange. ‘CAB Payments has a differentiated business model with an attractive economic profile marked by profitability, cash generation and strong margins, and it benefits from structural growth drivers,’ said chief executive Bhairav Trivedi, who used to run Network International (NETW) which recently agreed a £2.2 billion takeover by Canadian investment group Brookfield Asset Management. [SF]

Why the market was spooked by the Bank of England’s super-sized rate hike

UK central bank delivers hawkish surprise in response to sticky inflation

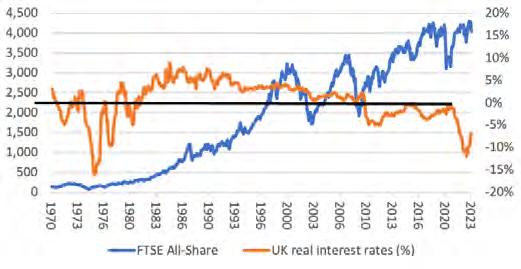

London’s FTSE 100 and FTSE 250 indices both fell on 22 June when the Bank of England raised interest rates by half a percentage point in response to inflation holding firm at 8.7%, as investors worried about the impact of further rate hikes on the UK economy.

The central bank’s decision to raise rates from 4.5% to 5% marked its thirteenth consecutive hike since December 2021 and could exert downward pressure on

house prices at a time when many mortgage holders are already struggling to pay the bills due to the cost-of-living crisis.

Interest rate-sensitive stocks

including banks and housebuilders dipped, the latter cohort on concerns higher rates will cause mortgage market chaos and crimp demand for homes, while sterling and gilt yields seesawed as traders priced in a peak to UK rates of as much as 6% and its implications for recession risk.

Rising mortgage rates, coupled with continuing price rises in goods and services, could act as a sharp brake on the UK economy.

The latest rate hike doesn’t bode particularly well for consumer confidence in the second half of the year, at which point retailers may really start to feel the squeeze. [JC]

Carnival shares have soared this year but it’s become a rockier ride

Demand remains strong but cost pressures are getting worse

Shares in cruise operator Carnival (CCL) are trading 75% higher versus the start of 2023 thanks to strong customer demand for its voyages. Despite the strong rally, the shares have become more volatile in recent sessions after the company guided for lower than expected profit in the current quarter.

The cruise industry has seen a surge in bookings this year from seasoned cruise travellers as well as those who have never tried it before.

Carnival’s secondquarter results on 26 June beat market

forecasts with smaller net losses than expected at $407 million versus guidance of $425 million to $525 million. It generated record second quarter revenue of $4.9 billion and said bookings made during the period reached a new alltime high for all future sailings. Despite this good news, investors focused more on guidance for third quarter profit to come in below previous estimates thanks to rising costs, sending its shares down nearly 14% on the day. The following day saw the stock rebound 9% on the London market. [SG]

Fidelity China Special Situations shares hit after China reopening stutters

Last October, shares in Fidelity China Special Situations (FCSS) started to rally on hopes that a relaxation of Covid restrictions in China would help to lift the economy and benefit the companies in its portfolio. The shares went from circa 178p to 302p over the space of four months.

Since then, nearly all those gains have faded away amid fears the China reopening story was weaker than previously expected. Those fears proved correct, with recent

data showing disappointing tourist spending and weak exports. Add in geopolitical issues such as the country’s fragile relationship with the US and the status of Taiwan, and it is clear why shares in the Fidelity trust are languishing on 10.9% discount to net asset value.

‘The biggest change post-Covid is the outlook for the consumer,’ said portfolio manager Dale Nicholls earlier this month in the trust’s fullyear results. ‘While the recovery is bumpy and varies somewhat by sector,

the path to recovery is clearly there.’ Nicholls said that while growth rates have tempered in the second quarter, he believes the government’s GDP target of 5% for the year looks achievable. ‘This will make China one of the few large economies that will see accelerating economic growth in 2023.’ [JC]

UK UPDATES OVER THE NEXT 7 DAYS

FULL-YEAR RESULTS

July 3: Duke Royalty, Mercia Asset Management.

July 5: Supreme, Redde Northgate, AO World.

July 6: PayPoint, Currys, Jet2, Naked Wines

TRADING ANNOUNCEMENTS

July 3: Sainsbury’s

July 6: Persimmon, Robert Walters

HALF-YEAR RESULTS

June 30: Audioboom, Faron Pharmaceuticals

July 3: Porvair, Kitwave

Investors hope Jet2 results on 6 July will trigger a new share price rally

It will need to show that demand has stayed healthy and cost pressures are easing

Airline and package holidays provider Jet2 (JET2:AIM) is expected to report between £387 million and £395 million pre-tax profit before foreign exchange adjustments on 6 July when it publishes full-year results to 31 March 2023.

The company last updated on trading on 20 April when it came across as upbeat despite flagging cost pressures from fuel, carbon taxes, a higher US dollar and wages. It said pricing for flights and package holidays remained ‘strong’ and margins were ‘encouraging’.

Like many of its rivals, Jet2 has been increasing capacity versus prepandemic levels in a bid to capitalise on more people wanting to get away for a week of sea and sun. It makes higher profit margins when someone books a package holiday and the percentage of departing passengers in this category hit 65.9% at the halfyear stage versus 52.8% in the 2019 comparative period.

Shares in Jet2 started the year well, rising from circa 940p in January to

£13.80 in March, but they have since drifted sideways in a small trading range despite positive messages from the company and the airline industry in general.

Investors appear to be concerned that the ongoing rise in interest rates could deter some people from booking holidays this year. That means a key focus in Jet2’s forthcoming results will be on summer bookings, to see if the rebound in travel demand is sustainable. [SG]

What to expect from Jet2

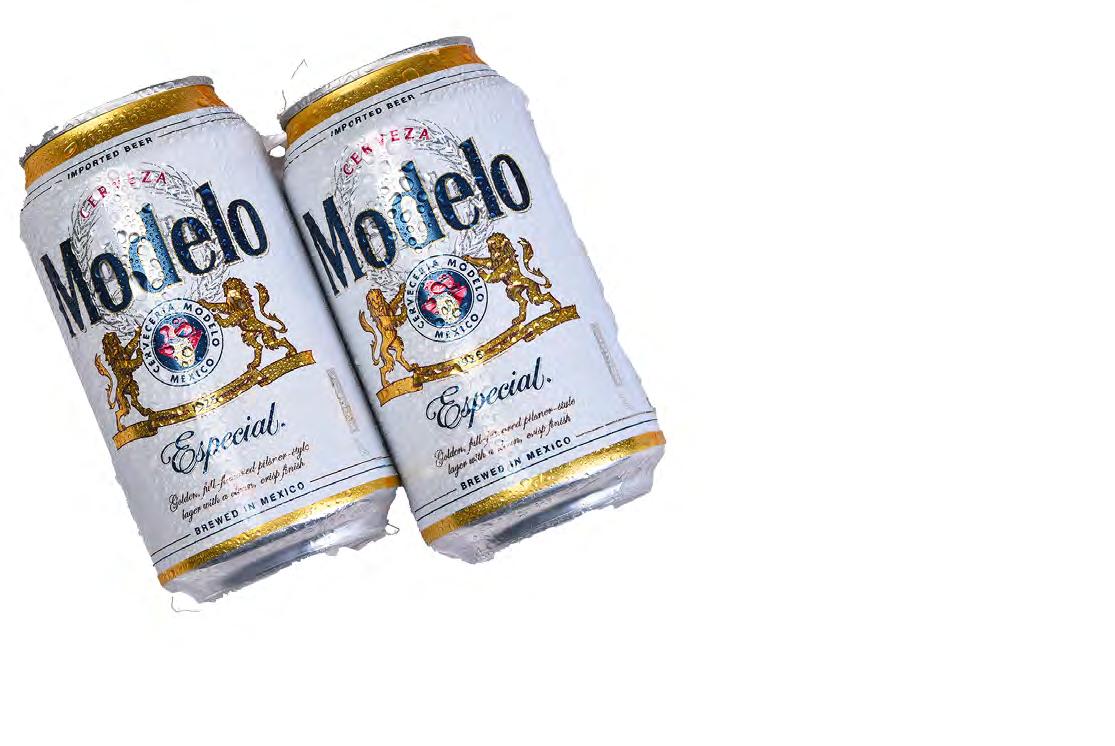

A consumer boycott of AnheuserBusch Inbev’s (BUD:NYSE) Bud Light brand following a backlash over its social media promotion with transgender influencer Dylan Mulvaney appears to have benefited smaller rival Constellation Brands (STZ:NYSE)

Constellation’s Modelo Especial Mexican lager brand has reaped the rewards from the fallout, having leapfrogged Bud Light to become the top-selling US beer brand for the first time.

Surrendering the top spot must be particularly galling for Budweiser-toStella Artois owner Anheuser-Busch Inbev, since it was forced to divest its Modelo US business to Constellation by the competition authorities following its purchase of a majority holding in Grupo Modelo back in 2013.

Investors will be looking for more colour on Modelo’s market share

gains when Constellation serves up its results for the first quarter ended 31 May before the US markets open on 30 June.

Whereas Anheuser-Busch Inbev’s shares are down year-to-date, Constellation Brands’ shares are in positive territory. To keep things that way, CEO Bill Newlands will need to assure investors that consumers are swallowing beer price hikes, enabling Constellation to offset pressures from higher raw material, packing and logistics costs. [JC]

UPDATES OVER THE NEXT 7 DAYS

QUARTERLY RESULTS

June 30: Constellation Brands, Sodexo, Virtus, Accolade, Pimco

July 6: WD-40, Tilray, Kura Sushi

What to expect from Constellation Brands

What to expect from Constellation Brands

Buy shares in Shell: it has a big plan to catch up with US rivals

Energy giant Shell (SHEL) is on a mission to play catch-up with its higher-valued US peers and investors should hop on for the ride.

New chief executive Wael Sawan pledged laserlike focus on cash and returns at an investor day on 14 June and if he can deliver on his promises, shareholders stand to see a real benefit in the next two or three years.

Sawan is adopting a more pragmatic approach to the company’s transition away from fossil fuels. He has abandoned plans to cut oil output by 1% to 2% a year out to 2030.

Based on consensus forecasts for 2024 Shell trades on a price to earnings ratio of 6.8 and offers a dividend yield in the region of 5%. By comparison, its US counterpart ExxonMobil (XOM:NYSE), which has not made the same commitments to shifting out of hydrocarbons, is on a PE of 11.4 and yields 3.7%.

Shell is scaling back its capital expenditure, cutting its budget for 2024 and 2025 to between $22 billion to $25 billion from a previous range of $23 billion to $27 billion, and is aiming to reduce its operating costs by $2 billion to $3 billion per year by 2025.

The emphasis placed on returns means it will move away from more speculative investments in clean technologies like hydrogen and carbon capture.

All these initiatives should help underpin a 10% increase a year in underlying free cash flow per share. Investment bank Berenberg estimates Shell could generate a free cash flow yield of 12.5% at a conservative oil price of around $65 per barrel – most of which can be returned to shareholders through dividends and share buybacks.

What provides some confidence in these targets is that Shell is not in a bad shape. It has a strong

Price: £23.36

Market cap: £158.4 billion

balance sheet with net debt having nearly halved since the end of 2019 to its lowest level in more than a decade. It also has a leading global LNG (liquefied natural gas) business which could have a crucial role to play as the world seeks to gradually move to less polluting fuels.

Shell faces both structural and cyclical risks. Energy prices are likely to remain volatile and a global recession could hit demand. This is mitigated somewhat by geopolitical tensions which are constraining supply as well as Saudi Arabia’s recent efforts to prop up prices.

The other risk is that by seemingly backsliding on its commitment to the energy transition Shell faces an increase in political and regulatory pressure. Investors may have their own ethical concerns about this too. [TS]

How to get exposure to the best UK property assets in one go

A

If you could buy a selection of the bestquality UK real estate investment trusts all under one roof rather than individually, it would save a lot of time and effort. You can, thanks to the open-ended VT Gravis UK Listed Property Fund (BK8VW75)

While property has been out of favour recently, weaker valuations means you can get exposure at a cheaper price.

The fund is owned and run by Gravis Capital Management, a specialist in property and infrastructure, and managed by Matthew Norris, who brings over two decades of experience in managing real estate stocks.

Norris’s strategy is to buy and hold REITs with exposure to four social and economic megatrends: an ageing UK population (which currently accounts for 16% of the portfolio), ‘digitalisation’ (46% of the portfolio), urbanisation (10%) and what Norris calls ‘generation rent’ (25%), while avoiding the retail sector.

Within each megatrend the manager seeks out stocks with the best combination of growth, income, value and sustainability, which has resulted in several of its holdings being taken over at a premium already this year.

The average loan-to-value is conservative at 30%, and over 80% of the debt held by investee companies is fixed with an average cost of 3.2% compared with base rates of 5% today.

Across the portfolio, around a third of rents are inflation-linked or include fixed uplifts, while two thirds are open-market, which in the current environment means there is significant upward reversion potential, and higher rents mean higher earnings and dividends.

The fund trades on a 12-month trailing yield of 4.7% and pays a quarterly dividend, which it has raised every quarter since inception in late 2019, in

VT GRAVIS UK LISTED PROPERTY FUND (BK8VW75)

Price: 86p

Fund size: £88 million

line with many of its top holdings which have lifted their annual payouts for a decade or more.

As of the end of May the top two holdings were student accommodation firm Unite (UTG) and professional landlord Grainger (GRI), both of which are part of Norris’s ‘generation rent’ theme.

These are followed by industrial warehouse firms Segro (SGRO) and Tritax Big Box REIT (BBOX) which form part of the ‘digitalisation’ theme.

Norris is also keen to future-proof the fund from a sustainability viewpoint, and to that end over 80% of the underlying property assets have an EPC rating of between A and C compared with a national average for non-domestic property of just 40%.

With the government having set a minimum standard of a C rating by 2027, the majority of the fund’s assets already meet the criteria meaning their owners will have to invest less to meet the new standards. [IC]

VT Gravis UK Listed Property Fund

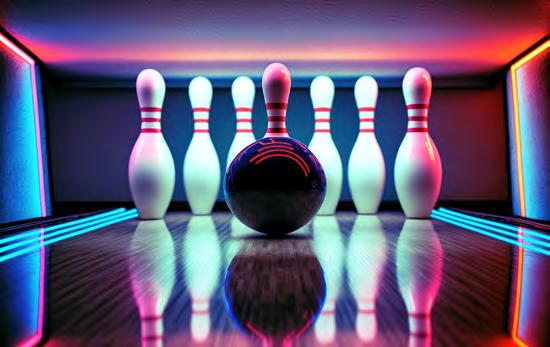

Despite strong gains Ten Entertainment shares remain too cheap

The company’s value for money proposition represents an affordable family treat

Ten Entertainment (T EG:AIM) 290.45p

Gain to date: 35%

We highlighted tenpin bowling and family entertainment operator Ten Entertainment (TEG:AIM) as a great company trading at a great price on 29 September 2022.

The return so far has been very pleasing with the shares up around a third compared with approximately 7% gains for the FTSE All-Share and FTSE 100 indices.

WHAT HAS HAPPENED SINCE WE SAID TO BUY?

The company has continued to deliver strong financial performance with full-year sales to 3 January rising 51% to £126.7 million, higher than analysts’ expectations and adjusted pre-tax profit up 84% to £26.1 million, a new record.

Footfall increased 42%, driven by a greater number of new customers and existing customers visiting more frequently. The company attracted over eight million customers in 2022 which is a third more than in 2019, testament to the attraction of its format.

Business in the new financial year has got off to a good start despite tough year-onyear comparatives for the first 10 weeks to 12 March, with like-for-like sales up 2.7%, leaving management ‘cautiously optimistic’ for the rest of the year.

No formal guidance was provided but management said it expects like-for-like growth to moderate to low single digits going forward, augmented by growth from new openings.

Chief executive Graham Blackwell told Shares the company has a strong pipeline of acquisition

opportunities it is assessing to complement organic growth.

Historically, the company has opened between two and four new sites a year. A new site in Crewe opened in February while outlets in Milton Keynes and Dundee will open in July and August respectively.

The company ended the past financial year with net cash of £10.3 million after generating £27.2 million of free cash flow.

WHAT SHOULD INVESTORS DO NOW?

With sustainable organic growth of around 8% a year and a dividend yield of 3.5% plus the prospect of increased dividends and acquired growth, the one year forward price to earnings multiple of 9.4 times looks too cheap. Keep buying the shares. [MG]

Scottish Mortgage is a global portfolio investing in companies driving progress. To find them our managers work with entrepreneurs and academics who help us imagine what’s next. Because we believe that transformative change delivers transformative returns. If you want to discover what possibilities the future holds, invest with us today.

As with any investment, your capital is at risk. A Key Information Document is available on our website. Discover what’s next. Explore the future at scottishmortgage.com Connect with us:

The reason why Frasers wants to own stakes in so many retailers

Stakebuilding in AO, ASOS, Boohoo and Currys might not be as odd as it looks

FTSE 100 retail group Frasers (FRAS) has its fingers in more pies than Pukka serves up at a Rotherham United football match. Over the past few weeks, it has unveiled investments in yet more listed retail companies. Before you think it has gone wild, there is method in its madness.

In recent years, Frasers has tried to shake off its image as a ‘pile ‘em high, sell ‘em cheap’ type of business. Mike Ashley has passed the CEO baton to his son-in-law, Michael Murray, who has focused on expanding the group’s upmarket interests. He has led investments in more luxury stores and focused on premium products under the Flannels brand. While that has given a new lease of life to the group, it is important not to forget its roots lie elsewhere. Frasers cracked the formula for filling stores from floor to ceiling with products at low prices via Sports Direct, and Ashley spent years picking at the bones of failed retailers to add new strands to the group.

Frasers' equity holdings

He is an expert at picking up a bargain, be it buying a business on the cheap, striking good property deals or investing in unloved companies for strategic gains. Once again, it looks as if Ashley has downed a can of Red Bull and spotted new opportunities.

While he no longer runs Frasers, he remains the biggest shareholder owning just over 70% of the business.

Ashley has previously implied that he did not get the luxury goods side of Frasers, leaving it to Murray to pursue. Instead, his bread and butter are massmarket retail businesses.

Frasers taking stakes in AO (AO.) and Currys (CURY) effectively provides a foot in the door for the electronics sector. It already had a position in the computer games industry by owning GAME but becoming a major shareholder in AO and Currys should give Frasers a broader understanding of the challenges around selling tech hardware.

AO is also an expert at moving goods from A to B – something increasingly important to Frasers as more people order bulky products such as exercise machines from Sports Direct and furniture via its Sofa.com business.

Taking stakes in ASOS (ASC) and Boohoo (BOO:AIM) makes sense. Athleisure is increasingly fashionable, but the products in Sports Direct stores are too samey. If you do not like second-tier brands including Slazenger, Firetrap, Puma and Everlast, you are unlikely to want to kit out your wardrobe in Sports Direct shops. However, there is scope to broaden the range and make it more of a destination for shoppers.

Adding brands is the way forward, just like Frasers did with the purchase of Jack Wills in 2019. I am sure ASOS and Boohoo could offer suggestions.

Do not expect takeovers. Frasers prefers to buy businesses out of administration and none of its recent investee companies are in serious financial trouble. Instead, being a major shareholder should be enough to get Ashley an audience with the board of directors where he can prize out all the valuable information and feed that into Frasers’ own brain machine. It is an expensive gamble to get this boardroom access, but Ashley clearly thinks it is worth it.

I am surprised he has not made a similar move with a footwear retailer, given the obvious cross-over with Sports Direct. Is that next on the list?

Cutthrough withconviction

FIDELITYINVESTMENTTRUSTS

Trulyglobalandaward-winning,therangeissupported byexpertportfoliomanagers,regionalresearchteamsand on-the-groundprofessionalswithlocalconnections.

With400investmentprofessionalsacrosstheglobe,webelieve thisgivesusstrongerinsightsacrossthemarketsinwhichweinvest. Thisiskeyinhelpingeachtrustidentifylocaltrendsandinvestwith theconvictionneededtogeneratelong-termoutperformance.

Fidelity’srangeofinvestmenttrusts:

•FidelityAsianValuesPLC

•FidelityChinaSpecialSituationsPLC

•FidelityEmergingMarketsLimited

•FidelityEuropeanTrustPLC

•FidelityJapanTrustPLC

•FidelitySpecialValuesPLC

Thevalueofinvestmentscangodownaswellasupandyoumay notgetbacktheamountyouinvested.Overseasinvestmentsare subjecttocurrencyfluctuations.Thesharesintheinvestmenttrusts arelistedontheLondonStockExchangeandtheirpriceisaffected bysupplyanddemand.

Theinvestmenttrustscangainadditionalexposuretothemarket, knownasgearing,potentiallyincreasingvolatility.Investmentsin emergingmarketscanmorevolatilethatothermoredeveloped markets.Taxtreatmentdependsonindividualcircumstancesandall taxrulesmaychangeinthefuture.

Tofindoutmore,scantheQRcode,goto fidelity.co.uk/itsorspeaktoyouradviser.

Thelatestannualreports,keyinformationdocument(KID)andfactsheetscanbeobtainedfromourwebsiteat www.fidelity.co.uk/its orbycalling0800414110.Thefullprospectusmayalsobeobtained fromFidelity.TheAlternativeInvestmentFundManager(AIFM)ofFidelityInvestmentTrustsisFILInvestmentServices(UK)Limited.IssuedbyFinancialAdministrationServicesLimited,authorisedand regulatedbytheFinancialConductAuthority.Fidelity,FidelityInternational,theFidelityInternationallogoandFsymbolaretrademarksofFILLimited.Investmentprofessionalsincludebothanalystsand associates.Source:FidelityInternational,30September2022.Dataisunaudited.UKM1222/380938/SSO/1223

Investing for children

How to give them a head start in life

There are important things to consider if you want to invest for your child. For example, what age to start investing, what investment strategy to adopt and whether you should get your children involved in picking stocks and funds. We will now go through the key points.

The average cost of raising a child in the UK from birth to 18 is £69,621 for a couple and £113,102 for a lone parent, according to data from the Child Poverty Action Group. This rises to £157,562 and £208,735 respectively if housing and childcare costs are factored in.

By Sabuhi Gard Investment Writer

Your child may rely on you for money well into their adult lives, so the more you can do now to prepare for this, the better.

WHY SHOULD YOU INVEST FOR YOUR CHILD?

The most common question you should begin asking yourself as parents is why should you start investing for your child?

One simple answer is to help them pay for life events once they are an adult, such as university fees, buying their first home or getting married. Even before your child turns 18, they may need money for driving lessons or a vocational course.

WHY START INVESTING AS EARLY AS POSSIBLE?

There are many benefits of starting investing for your children early. The main one is you can invest for a longer timeframe. For example, investing at birth means you have 18 years before they become an adult to build up wealth.

You might want to invest in riskier assets which may generate greater returns as you will have plenty of time to ride out the ups and downs of the stock market.

‘A parent and/or guardian must think first why they are saving for their children and what is the purpose of it. Is it to buy something in the shortterm or the longer term?’ says James Norton, head of financial planning at Vanguard.

THE COST OF GOING TO UNIVERSITY

Tuition costs

Universities in England, Northern Ireland and Scotland can charge students from England up to £9,250 a year for undergraduate tuition. For accelerated degrees (which are completed in less time) English universities can charge up to £11,100. The most Welsh universities can charge is £9,000 a year. To pay these fees, you can apply for a loan of up to £9,250 (or up to £11,100 for an accelerated degree) from Student Finance England. This will cover your university’s tuition fees in most cases. Otherwise, you will have to find the cash elsewhere – hence why saving for your child’s education can be a good use of your spare money.

Student accommodation costs

WHERE SHOULD YOU HOLD YOUR CHILDREN’S INVESTMENTS?

A Junior ISA is a great starting point as any capital gains or income from investments inside this account are tax-free. You can pay up to £9,000 a year into a Junior ISA. The child can take control of the account when they are 16 years old and they can withdraw money from age 18.

Just remember the money inside the Junior ISA belongs to the child so there is an element of trust that the funds will be used for the original investment goal.

The average amount students pay for rent in the UK is £535 per month. A student studying at a London university may pay the most rent. With an average bill of £865 per month, UCL turned out to be the most expensive university for accommodation – 1.6 times more than the national average.

CASE STUDY 1: INVESTING FOR Alistair

Parents Suzy and Jim have chosen to put away £100 a month into their Junior ISA for their newborn son Alistair. Assuming 4% annual return, by the time Alistair is 18 he could have more than £31,000 to go towards a deposit for a home or to pay for accommodation costs at university.

CASE STUDY 2: INVESTING FOR Felicity

Penelope and Brian are able to use the full £9,000 annual allowance for the Junior ISA which they have opened for their new-born daughter, Felicity. By the time Felicity is aged 18 she will have much more than Alistair at £250,000, based on 4% annual gains.

WHICH IS MORE POPULAR: CASH OR INVESTMENTS FOR JUNIOR ISAS?

Parents are increasingly choosing to invest for their children through Junior ISAs than just sticking it in cash, according to Laura Suter, head of personal finance at AJ Bell: ‘Cash Junior ISAs have continually been more popular, as parents either don’t want to take risk with their child’s savings or lack the confidence or time to invest. However, that finally is changing,’ she says.

‘Parents are still more likely to open a cash Junior ISA account, with 60% of those paying into a Junior ISA putting money in a cash account in 2021-22, but that’s a significant fall from the 70% seen the previous year.’

According to the latest data from HMRC, there was £859 million held in Junior ISAs in the 2021-

22 tax year and £631 million in cash. However, more cash accounts were being actively used than stocks and shares ones. In the tax year, money was put into 737,000 Junior ISA cash accounts versus 475,000 stocks and shares Junior ISAs.

SHOULD YOU INVOLVE YOUR CHILDREN IN INVESTMENT DECISIONS?

If you’re putting money away for your child, getting them involved in the decision-making process can help them to forge a good saving and investing habit at a young age, which should hopefully continue for the rest of their life.

According to a study by the London Institute of Banking & Finance, when young people were asked about where they get their financial understanding from, two thirds (68%) said that most of their financial understanding and knowledge came from their parents, up from 56% last year. Only 8% cite school as their main source of financial education, which is a significant drop from 15% last year.

When asked at what age they’d like to start learning about money: 52% said between the ages of 11 and 14, 27% said between the ages of 15 and 18, and 16% said 10 and under.

One of the positives of getting your children involved with investment decision making is the fact that you are giving them a financial education ‘by stealth’. But it depends on your child’s age. There is no point discussing the benefits of Junior ISAs with pre-school children as they might struggle to grasp the concept.

Another positive is that it encourages children to be financially responsible and more financially aware of companies they use on a daily basis,

Examples of companies on the stock market whose products and services are widely used by children

Alphabet

Amazon Apple

Mattel

McDonald's Microsoft

Netflix

Walt

HOW MUCH DO I NEED FOR A HOUSE DEPOSIT?

The average deposit for first-time buyers is £62,470 according to Halifax, almost double the UK’s average annual salary, with people typically putting down around 20% of the purchase price of their property. A typical UK property costs £286,532 as of May 2023 (compared to £286,662 in April).

Source: Halifax

for example Netflix (NFLX: NASDAQ) or Google-owner Alphabet (GOOG:NASDAQ).

James Norton, head of financial planning at Vanguard, says: ‘There aren’t personal finance courses in most schools and therefore if a parent or guardian does open a Junior ISA for their child then it is a good opportunity to start educating them about money.

‘If you are in a broadly diversified index fund, you can own most of the largest companies in the world. Telling children they own a tiny piece of Tesla, for example, is a way of engaging them in the topic.’

One of the negatives of getting your children involved with investment decision making is that they might not fully understand the concept of long-term investing. They might become frustrated that they are not instantly seeing a return or have access to the money.

They might also disagree with your investment choices, and it could cause strain in the family.

Whatever you choose to do as a parent it is important to make your children aware of investing, saving and other money matters which will affect their future.

WHY DOES THE INVESTMENT TIME FRAME MATTER?

It’s a fact of life that raising a child can be expensive and many parents find they cannot afford to put aside any money until their son or daughter is a teenager. After all, many parents work and need to pay for a childminder or nursery when their child is young.

Fortunately, it’s never too late to start saving for your child. You just need to think about when the money will be needed. For example, your child might be 16 years old and an adult in two years’ time. Is it worth bothering saving for them now?

Yes, it is.

The plan might be to give them some money to help buy a flat when they’ve finished university and are in full-time employment.

Realistically, you’re probably looking at a point when they are in their second or third job before their salary is sufficient to be able to pay monthly mortgage payments and to pay for all the other bits that come with owning a property. That might be when they are in their late 20s at least, which means a potential investment time horizon of 10 years or more if they are 16 now.

In this situation, investing in a selection of equities (stocks and shares) would be one route to consider – you might find it easier to put money into funds containing a portfolio of equities rather than pick individual companies.

WHERE TO INVEST ON A SHORT TIME HORIZON

What if the investment timeframe was much shorter, such as two years? In this situation, putting money into shares is risky. Just imagine if the stock market went through a bad patch a year before your child needs the money – it might take more than 12 months for the market to recover. For a two-year horizon, cash might be a better option, certainly in the current market where you can get a decent return on your money in the bank.

Investing in a mix of bonds and equities might be more suitable for a three to five-year investment time horizon. Consider a multi-asset fund or an income fund that invests in high quality companies, reinvesting any dividends along the way.

WHERE TO INVEST ON A LONGER TIME HORIZON

If you have five years or more, you should focus on equities as history suggest they provide the biggest return versus bonds and cash. At the simplest level, a global tracker fund might suffice. For example, iShares MSCI World ETF GBP Hedged (IWDG) looks ideal for someone looking to invest their money for their child over at least a five-year period. It has a 0.3% annual charge.

This tracker fund will provide you with exposure to large and medium-sized companies across 23 developed market countries. It would mean your child owns a slice of Apple (AAPL:NASDAQ), Microsoft (MSFT:NASDAQ), Amazon (AMZN:NASDASQ), Nvidia (NVDA:NASDAQ) and much more.

Put another way – your child might use an iPhone, they like playing on an Xbox, they watch films on Amazon Prime, and they’re fascinated by the rise of artificial intelligence. By owning this fund, they should benefit from the success of companies behind these products and services.

Investors happy to pay a small fee to a fund manager to try and beat the market might want to spread their money across a few funds or investment trusts as well as the iShares tracker fund. Smaller companies have historically delivered strong returns over time – while this part of the market has been out of favour for the past few years, now might be a good point at which to get exposure while prices are lower.

T Rowe Price US Smaller Companies Equity Fund (B82YBL3) has achieved 13.8% compound annual returns over the past 10 years, according to FE Fundinfo. That is ahead of the 11.6% annualised returns from the MSCI World index, which is the backbone for the iShares tracker fund.

While there is no guarantee it will continue to deliver such strong returns, the T Rowe Price fund looks a good choice for someone with at least a five-year investment horizon.

It provides exposure to both growth and valuestyle stocks, and its portfolio currently includes Waste Connections (WC:NYSE) which helps to keep America’s streets clean, Ingersoll Rand (IR:NYSE) which supplies air compressors for various industries including body shops and food production, and Vulcan Materials (VMC:NYSE) which produces the materials used to pave roads across the US.

DISCLAIMER: AJ Bell is the owner of Shares magazine. Daniel Coatsworth, who edited this article, owns shares in AJ Bell.

HOW MUCH DOES IT COST TO LEARN TO DRIVE?

STOCK SPOTLIGHT: BROADCOM –INVESTING FOR A CHATBOT WORLD

It is the stuff of science fiction – from 2001: A Space Odyssey to Star Trek, Star Wars, Red Dwarf and beyond. The recent launch of ChatGPT, an artificial intelligence (AI) chatbot that can answer questions like a human, brings us closer to a world where computers become interchangeable with people in many roles.

Schools and universities are having to revise how they examine students, who can now ask ChatGPT to write their essays – and receive an answer in seconds. It will even write love poems for them – move over, Cyrano de Bergerac!

This is just the start. Google has introduced its own AI chatbot, Bard; Microsoft is incorporating similar technology into its Bing search engine; and Baidu, China’s main search engine, has its own chatbot, Ernie.

It may seem scary, but it is also exciting. AI chatbots allow us to interact with technology in smarter ways. The benefits will extend far beyond homework and courting. Experience has probably

taught you to be quite limited in the way you phrase questions for search engines today. That will change. Looking for a Cornish cottage that has three bedrooms, is no further than two miles from a beach and accepts pets? Now you should be able to find the answer much more quickly. The search engine should do the refining, not you.

There is, though, a price to this. First, there are the billions that will be invested in the software. And then there is the hardware. AI will demand ever-greater processing power.

A research paper from Stanford University, Nvidia and Microsoft Research1 highlighted the challenges a couple of years ago. Machinelearning algorithms can require billions of computing operations. If you cannot wait several hundred years for your answer you will need multiple processors running in parallel.

One company involved in the AI revolution is California-headquartered Broadcom. You may

not have heard of Broadcom, but the company estimates that 99.9% of all internet data traffic passes through its technology at some point on its journey.

One of Broadcom’s specialisms is chips for networking – it generated $200m in revenue from these in 2022 and expects that number to quadruple this year2.

It also makes components for smartphones, set-top boxes, wi-fi routers, DSL gateways to the internet, technology used in cars for vehicle connectivity, cameras and sensors. It has a business geared to providing infrastructure for data centres, which we will need more of in an AI world, and it is involved in cyber security as well. The switch to 5G also benefits Broadcom.

There are risks, of course. The semiconductor industry is highly sensitive to the state of the economy while rapid technological change leaves the business at risk of being overtaken by disruptors. But Broadcom has demonstrated an ability to invest well in Research & Development

1https://arxiv.org/pdf/2104.04473.pdf

2New Street Research March 2023

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

The use of borrowings may increase the volatility of the NAV and may reduce returns when asset values fall.

The Invesco Select Trust plc uses derivatives for efficient portfolio management which may result in increased volatility in the NAV. In addition, some companies are suspending, lowering or postponing their dividend payments, which may affect the income received by the product during this period and in the future.

The Invesco Select Trust plc – Global Equity Income Share Portfolio invests in emerging and developing markets, where difficulties in relation to market liquidity, dealing, settlement and custody problems could arise.

Important information

Data as at 5 June 2023 unless otherwise stated. This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that

and make smart acquisitions. It is significantly expanding its AI capacity and building new data centres specifically equipped to support next-gen AI hardware.

With a wide array of revenue flows in sectors that are critical to society, as well as strong cash flow and opportunities for growth, it is a company I consider worthy of inclusion in our portfolio.

Want to find out more?

Stephen Anness is Head of the Henley-based Global Equities team. Click to find out more about the investment trust he manages:

Invesco Select Trust PLC (LSE:IVPG)Share price | AJ Bell

Invesco Select Trust plc Global Equity Income Share Portfolio

require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Views and opinions are based on current market conditions and are subject to change.

For more information on our products, please refer to the relevant Key Information Document (KID), Alternative Investment Fund Managers Directive document (AIFMD), and the latest Annual or Half-Yearly Financial Reports. This information is available using the contact details shown.

Further details of the Company’s Investment Policy and Risk and Investment Limits can be found in the Report of the Directors contained within the Company’s Annual Financial Report.

If investors are unsure if this product is suitable for them, they should seek advice from a financial adviser.

Issued by Invesco Fund Managers Limited, Perpetual Park, Perpetual Park Drive, Henley-onThames, Oxfordshire RG9 1HH, UK. Authorised and regulated by the Financial Conduct Authority.

©2023 Invesco Ltd. All rights reserved

Revealed: the companies which could join the exodus from the UK market

The exchange’s battle to attract new companies and keep existing ones is becoming more intense

There are an increasing number of large firms which are thinking about changing their main share listing from the UK to the US or elsewhere, raising fears London is losing its importance.

This article explains why companies are giving serious thought to this issue and who might be next to press the button.

Irish building materials giant CRH (CRH) is the latest firm to decide to move its main listing to the US. It is expected to take effect around the end of September 2023. Its UK listing will subsequently change from a premium to a standard listing, and it will no longer qualify for inclusion in FTSE indices.

The company received overwhelming shareholder support for the plan. The US represents around 75% of its EBITDA (earnings before interest, tax, depreciation and amortisation) and it believes the move will bring commercial, operational and acquisition benefits.

Chief executive Albert Manifold said the US is expected to be a key driver of growth and the listing marks ‘an important milestone in our development and will enable CRH to fully participate in the significant growth opportunities that lie ahead.’

Gambling firm Flutter Entertainment (FLTR) has received shareholder support for a secondary US listing which management envisage will provide strategic and capital market benefits as it pursues growth in that country.

Flutter’s market leading US fantasy sports betting brand FanDuel is expected to turn a profit in 2023 and has the scope to become the largest division within the group in coming years given the growth

opportunity. Flutter toyed with the idea of floating FanDuel on Nasdaq in 2021.

In time Flutter may decide to make New York its primary listing and London its secondary listing.

Plumbing, heating, and air conditioning solutions group Ferguson (FERG), formerly known as Wolseley, added a secondary US listing in 2021 before making New York its primary listing venue in 2022.

The company began thinking about a US listing in 2019 after activist investor Nelson Peltz took a stake and pushed for the group to focus on its North American business.

Chief executive Kevin Murphy told the Financial Times that moving the primary listing venue had achieved most of its goals and facilitated management to speak with a ‘very large pool of capital’ for little extra cost.

WHY DO COMPANIES MOVE THEIR LISTING?

There are several good reasons companies make the move, but top of the list, and what connects all the moves seen so far, is the sheer amount of business these firms already do in the US.

Moving a listing to the region where a company does most of its business makes commercial sense, especially if its peers are already listed on the local stock exchange.

Ferguson believes it meets the criteria to be included in the S&P 500 index which is one of the most tracked indices in the world and a major attraction of having a US listing.

Increased trading volumes usually result in tighter trading spreads (the difference between the buying and selling price) which reduces costs to investors.

Deeper capital markets attract wider analyst coverage which in theory means more information is disseminated to a wider audience. This can make it easier to raise capital because the investment narrative is widely known, especially if a firm’s peers are also listed on the same exchange.

Many firms highlight the potential to achieve a higher valuation as another advantage of listing in the US.

Citigroup strategists argue UK-listed shares trade at a record valuation discount to their US peers, heaping pressure on companies to consider relisting abroad.

However, the jury is still out on whether a move increases a company’s valuation in practice.

Life science tools and antibody maker Abcam (ABCM:NASDAQ) moved its listing entirely to the US in 2022 and cancelled its London listing.

Abcam was one of the largest firms on London’s junior AIM market and a popular name with retail shareholders due to its strong share price performance since listing and inheritance tax benefits that came with being a certain type of company on AIM.

The company raised more than $150 million for a listing on the technology-focused Nasdaq index in October 2020 which it argued would have been hard to achieve on AIM.

Yet the shares trade at roughly the same listing price around $20, despite the Nasdaq Composite index rising 22% over the same period.

Another example is equipment hire group Ashtead (AHT) which generates 84% of its sales and 90% of profit in the US which makes it one of the most US-focused groups on the London market. Its shares trade at a premium to US peer United Rentals (URI:NYSE) which trade on 10.3 times

earnings per share compared with Ashtead’s 18-times according to Refinitiv data.

Ashtead told Bloomberg it reviews its listing periodically but remains committed to London.

Having a US-listed share can be helpful when structuring acquisitions because the US dollar is more valuable to US companies than offering UK shares.

Both Ferguson and Ashtead continue to be acquisitive in the US as they consolidate fragmented markets.

WHO COULD BE NEXT?

The yawning valuation gap between oil major Shell (SHEL) and US peers ExxonMobile (EXON:NYSE) and Chevron (CVX:NYSE) is prompting its top executives to explore the advantages of a US listing according to a Financial Times report.

Shell trades on a price to earnings ratio discount to ExxonMobile and Chevron of 22% and 33% respectively. Losing another big resource stock after miner BHP (BHP) moved its primary listing to Australia would be a blow for London, but it would also make the FTSE 100 less resource heavy.

Companies which generate most of their sales and profits from the US could potentially up sticks but in practice there are several factors which go into the decision.

Ashtead is clearly the front-runner given its predominately US business but as discussed, its shares already trade a premium to its main US peer, removing a big incentive.

There are a handful of FTSE 100 firms which generate more than half of their business in the US,

FTSE 100 firms which generate 50% or more of revenues from the US

We see little reason for Standard Chartered (STAN) to retain a UK stock market listing as its focus is Asia and the company trades at a significant discount to peers in that region. Moving its listing to Singapore, for example, could see it command a much higher valuation.

WHAT TO EXPECT WHEN A LISTING MOVES

Shareholders have certain rights which mean their economic interests remain in place regardless of where the shares are listed. It is more a question of electing to swap existing shares into overseas shares or selling the shares if the UK listing is cancelled.

When Abcam delisted, shareholders were given plenty of notice to decide to either exchange their UK shares into US ADRs (American depository receipts) or keep their UK shares. The downside to keeping the UK shares is they are no longer tradeable.

but they also do business across the globe and are therefore more diversified.

For example, food services giant Compass (CPG) has a global business operating in over 40 countries but generates two thirds of its sales from North America. It seems unlikely the company will move its listing stateside.

However, education company Pearson (PSON) which generates 60% of its revenues from the US market has indicated it is open to a US move if it was deemed in the best interest of shareholders.

Around four years ago the management of medical products company Smith & Nephew (SN.) mulled a shift in its primary listing.

But according to some reports this was partly motivated by the-then CEO Namal Nawana looking to increase his pay. He denied this, saying a move would be a strategic question for the board.

In the case of building materials group CRH, it is changing to a standard listing on the London Stock Exchange and, investors do not need to do anything to maintain their exposure to the company.

The London shares may become relatively less liquid, but everything else will remain the same. Institutional investors may decide it is beneficial to hold the most liquid version of the shares which may reduce the liquidity in London.

The shares will not be eligible for inclusion in the FTSE indices which means UK tracker funds no longer need to hold the shares which again may reduce liquidity.

When mining company BHP moved its primary listing to Australia in 2022 and its London shares converted to a standard listing, the UK shares were removed from the FTSE 100 index.

Arguably this was beneficial to the remaining listed UK mining shares because investors looking to maintain exposure to the sector might look to buy those names instead.

To give an idea of relative liquidity following a listing change, BHP’s UK shares trade an average daily value of £37 million while in Australia it is around £300 million.

By Martin Gamble Education EditorCC Japan Income & Growth Trust plc An AJ Bell Select List Investment Trust

Uncovering income & growth opportunities in Japan

Portfolio manager Richard Aston’s valuation-disciplined; total return approach is designed for investing in the Japanese stock market of today. With the strategy’s core focus on consistent and improving shareholder returns, Richard looks to provide a stable income via dividends and share buybacks from Japanese companies of all sizes. Richard’s high conviction and index agnostic portfolio aims to capture the key beneficiaries of Japan’s improving corporate governance and ongoing structural economic reforms.

THE INCREASING IMPORTANCE OF DIVIDENDS IN JAPAN

Dividends, as well as share buybacks, continue to rise in Japan thus improving shareholder returns for investors. With a focus on companies that can provide both a stable dividend AND can demonstrate the ability to grow, CC Japan Income & Growth Trust aims to capture the best ideas that corporate Japan has to offer across sectors, the full market cap spectrum and even geographical reach (domestic, regional & global leaders).

The income focus warrants a disciplined approach to valuation and detailed fundamental research prevents the

Trust from overpaying for high-growth companies that are often priced for perfection, whilst also avoiding cheap unloved stocks that are in-fact value traps.

The Trust’s consistent and disciplined approach has demonstrated that it can perform throughout the cycle having meaningfully outperformed the TOPIX Total Return (in GBP) since launch in December 2015.

To find out more visit:

www.ccjapanincomeandgrowthtrust.com

Source: Independent NAVs are calculated daily by Apex Listed Companies Services (UK) Limited (by Northern Trust Global Services Limited pre 01.10.17.) From January 2021 Total Return performance details shown are net NAV to NAV returns (including current financial year revenue items) with gross dividends re-invested. Prior to January 2021 Total Return performance details shown were net NAV to NAV returns (excluding current financial year revenue items) with gross dividends re-invested. Ordinary Share Price period returns displayed are calculated as Total Return on a Last price to Last price basis. Past performance may not be a reliable guide to future performance. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. All figures are in GBP or Sterling adjusted based on a midday FX rate consistent with the valuation point. Inception date 15.12.15. Investments denominated in foreign currencies expose investors to the risk of loss from currency movements as well as movements in the value, price or income derived from the investments themselves and some of the investments referred to herein may be derivatives or other products which may involve different and more complex risks as compared to listed securities. CC Japan Income & Growth Trust plc (the Company) does not currently intend to hedge the currency risk.

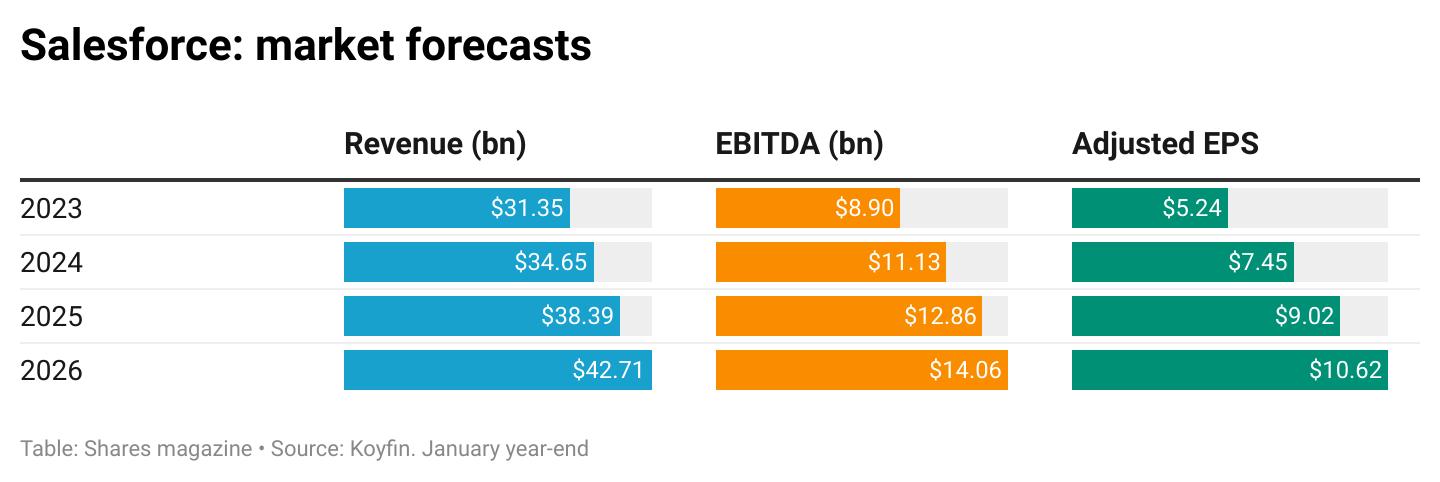

In less than 25 years Salesforce (CRM:NYSE) has become a giant of the global software industry and an iconic in Silicon Valley.

Valued at $206 billion, it is the thirty-second largest company on the S&P 500, and according to Fortune’s latest surveys, ranks eighth in the world’s 100 best companies to work for, and eleventh on the most admired companies in the world.

All well and good, but what sort of value has the San Francisco-based company’s stock created for investors? In short, an enormous amount –the shares have achieved a 6,324% total return since listing in 2004. Morningstar data shows that over the past decade the shares have averaged a compound annual return of 18.9% thanks to the company beating analyst forecasts in every quarter for a decade.

Put that into perspective… a $1,000 investment when it first joined the market would today be worth in the region of $64,000 assuming all dividends reinvested. It’s the sort of returns from which millionaires are created and can turn a modest pension pot into a very comfortable one, even for ordinary investors.

But we all know that past returns offer no guarantee for the future, especially when that future looks very different to what has gone before. The era of cheap money is over and most experts believe we will be living with higher interest rates even once the inflation monster has been tamed.

This poses investors with a fundamental question; can Salesforce shares continue to deliver

above-average returns in a reshaped economic order, and even if you believe the answer is yes, are the shares priced attractively enough?

WHAT’S THE OPPORTUNITY?

Founded in 1999 by Marc Benioff and Parker Harris, Salesforce is the global leader in customer relationship management software, and it essentially created the Software-as-aService model.

Salesforce calls itself the ‘customer company’, providing more than 150,000 clients both large and small with the tools and applications for sales, service, marketing and more.

An estimated 17 million people are thought to be trained on Salesforce products that help teams work better together, create greater understanding of what customers want and need using customer

What is Software-as-a-Service?

Software-as-a-Service or SaaS is a cloud-based software delivery model that allows endusers to access software applications over the internet. With a SaaS model, the software is hosted on remote servers, maintained and updated by the service provider, and made available to customers via web browsers, mobile apps and APIs (application programming interfaces). Key benefits include lower upfront costs, scalability, flexibility and accessibility.

further boost Salesforce’s own revenue growth. Overall, the investment bank sees Salesforce’s future cash flow growth as underappreciated, and when its analysts crunch the numbers, they get a 12-month share price target of $325, more than 50% higher than the current $212 level.

GROWTH SPEND NEEDS TWEAKING

At the start of June, Salesforce reported first quarter earnings and revenue that beat expectations and full-year earnings guidance was lifted despite larger project installation dates being pushed back. Yet the shares fell as much as 7% in response, mainly because of rampant costs.

data to provide solutions to real-world problems. Customer 360 is its full-service platform, although various toolkits can be subscribed to separately.

Source: Salesforce Q1

You could call it a niche market, but it’s a very large one – investment bank Goldman Sachs thinks Salesforce’s total market opportunity is around $280 billion. It is also a critical one, particularly for bigger businesses, driving productivity and thus client revenue, and becomes so embedded in operations that it is almost impossible to do without, even in a recession.

As one analyst noted: ‘Salesforce is ingrained in the fabric of so many companies and has become so important in the way they operate and conduct business.’ This is borne out by the fact that its net revenue retention has remained stable at roughly 90% over the past two decades.

Market intelligence firm IDC forecasts that by 2026, the Salesforce ecosystem will create 9.3 million new jobs and create $1.6 trillion in new business revenue worldwide.

Goldman Sachs says infusing artificial intelligence into Salesforce’s core software will bring new opportunities for the firm’s clients, which should

Source: Investing.com

Capital expenditures in the quarter totalled $243 million, up about 36% and above the $205 million analyst consensus, overshadowing a 1% and 5% beat on revenue and earnings per share respectively.

There is work to do on how much Salesforce invests in its future growth, which is why it has caught the eye of activist investors Elliott Management, Third Point and others, who are demanding that the company takes the scalpel

to costs.

Plans to cut its workforce by 10% will help, as will action to reduce its office footprint. More job cuts could be coming, some analysts speculate.

It achieved better-than-predicted operating margins of 28% in the first quarter. Goldman Sachs believes these are set to climb to 30% and beyond over the next few years, thanks to cost-saving initiatives, which have intensified because of the tech spending slowdown and a trending wave of belt-tightening.

This does appear to have impressed some investors, with Elliott no longer demanding its own board representation.

Caught in the crossfire of a debate about growth versus margin protection, challenges await Salesforce. Clients are still looking carefully at deals, which are taking longer to close than they were in the past. Now, the company is looking at how to automate the selling process on the low end of the market and make its salespeople more productive, including the launch of Einstein GPT, Salesforce’s own generative chatbot.

ARE THE SHARES WORTH BUYING?

Looking at earnings estimates over the next three years, the stock is on price to earnings multiples of 28.4, 23.5 and 20 for each respective 12-month

period. That implies an average PE ratio of 24 for a company growing earnings at an average 27% over the same time frame. The rating looks fair for that kind of growth.

Free cash flow was $4.25 billion in the first quarter, comfortably covering the $1.11 billion interest on borrowings. Salesforce also returned $2.1 billion in the period via share buybacks, although it does not pay a dividend.

‘Salesforce continues to impress, with another strong quarter with revenue and profitability ahead of our expectations,’ said Morningstar analysts following the latest quarterly update. They finetuned their model with profitability expectations moving up a bit, offset by slightly lower growth, resulting in an unchanged stock fair value estimate of $245, below Goldman’s estimate but still 16% up from current levels.