ARTIFICIAL INTELLIGENCE:

THE STOCKS USING IT TO THEIR ADVANTAGE

Everything you need to know to invest in the sector GOLD MINERS

VOL 25 / ISSUE 20 / 25 MAY 2023 / £4.49

• Germany’s flagship DAX index surges to new all-time high

• Stealth rally in construction stocks suggests economy is on a firm footing

• Initial surge as Zoom beats expectations and lifts forecasts fails to last

• ATOME shares boosted by Baker Hughes investment and its fertiliser plan

• Sage seizes its chance to impress investors

• The owner of Boots loses a quarter of its value in six months

/

25 May 2023 | SHARES | 03 Contents 06 NEWS

12 GREAT IDEAS New:

Updates: Hunting 18 FEATURE The fast-food stocks making investors rich: the secrets of their success 23 EDITOR’S VIEW Proof that boring companies can make the best investments 24 FEATURE Artificial intelligence: The stocks using it to their advantage 30 DANNI HEWSON How robotics and AI might shake up the labour market 32 SECTOR REPORT Investing in gold miners: the stocks and funds that matter 36 EMERGING MARKETS Are emerging markets less reliant on commodities than you think? 38 FEATURE Should I worry if my investments aren’t making money? 42 FEATURE How these two technical indicators can make you money and two shares to buy now 48 ASK TOM Help: can I choose which pension scheme my employer pays into? 50 PERSONAL FINANCE Which ISA is best for you? Read our guide to the different types 52 INDEX Shares, funds, ETFs and investment trusts in this issue 53 SPOTLIGHT Bonus report on smaller companies 18 06 MAY 2019 THIS WEEK: 10 PAGES OF BONUS CONTENT INCLUDES COMPANY PROFILES, COMMENT AND ANALYSIS 2632-5748 MAY 2023 Frenkel Topping Good Energy 50 30 24

SSP

VT Cantab Sustainable Global Equity

Feature:Fast-foodcompanies

The fast-food stocksmakinginvestors rich:thesecretsof theirsuccess

Three important things in this week’s magazine 1 2 3

SectorReport:Goldminers

and funds that matter goldWelookatthekeydriversforthe priceandthevariouswaystogetexposure

Investingingoldminers:thestocks

IARTIFICIAL TheNTELLIGENCE: theirstocksusingitto advantage

investorshavebeenracingtofindwinnersfromthis scramblingCorporateleaders,meanwhile,havebeen toprovetoinvestorsthattheyare harnessingthetechnologytodriverevenue growth,improveoperationalefficiency,andmore. reportsInfirst-quarter2023earningsintheUS,company mentionedAIandrelatedtermsmore studythantwiceasoftenastheydidayearago,arecent showed. companiesConsultancyMcKinseybelieves70%of willbeusingatleastonetypeof AIby2030,andinvestmentbankMorgan StanleyforecaststheAIindustrywillgenerate$1 trillioninannualrevenueby2050.

S&P

andSabuhiGard

Popularbrandsaredemonstrating strongpricingpoweranddelivering growth Dstateespitegloomycommentaryonthe interestoftheeconomycausedbyrising ratesandacost-of-livingcrisis, onecornerofthestockmarketappearstobeinrudehealth. restaurantsBigplayersinfastfoodorquickservicelooktobeatthetopoftheirgame withmanysharesinthisspacetradingatnew all-timehighs. Forexample,McDonald’s(MCD:NYSE)isup 27%overthepast12months,whileYum!Brands (YUM:NASDAQ),ownerofKFCandTacoBell,isup25%andBurgerKing’sparentRestaurantBrands International(QSR:NYSE)

RALLY FUELLED BY AI GAINS

AIfervourthisyearhasbeenresponsibleforallof

theS&P500’sgains,accordingtonewanalysisby showsSociétéGénérale.Theinvestmentbank’sresearch thatwithoutthegainsof‘AIboomstocks’ theS&P500wouldactuallybedown2%thisyear, ratherthanup8%(whentheresearchwasreleased earlierinMay). considerThatisnotentirelysurprisingwhenyou stocksofcompaniesperceivedasAIwinners–Nvidia(NVDA:NASDAQ) Microsoft (MSFT:NASDAQ) Alphabet(GOOG:NASDAQ)and others–havebeenonanabsolutetear. yearNvidia’ssharepricehasmorethandoubledthis (+121%),whileMicrosofthasrallied33%since itinvested$10billioninOpenAIbackinJanuary. excitementMorganStanleyanalystsbelievethecurrentAI couldbemorethanjusthype.‘When weconsidertechdiffusionwithrealmarketimpact potential,generativeAIisaseriouscontender,’says EdwardStanley,MorganStanley’sheadofthematic researchinEurope.

Many companies are now detailing how they already use, or to play to use, artificial intelligence

In this week’s main feature, we explore various names embracing this technology and the impact AI could have around the world

monthsEasilythebiggestwinneroverthepast12 ischickenwing-focusedWingstop (WING:NASDAQ)whosesharepriceisup180%.WINGSTOP’SRECIPEFORSUCCESS wasTheideafortheBuffalo-stylechickenwingoperator hatchedin1994andthefirmnowoperatesfromover1,500storesacrosstheUS,South America,Asia,FranceandtheUK.

USItsshareslistedontheNasdaqexchangeinthe returnin2015andhavedeliveredasix-foldshareprice annualtoinvestors,equivalenttoacompound However,growthrateofaround27%ayear.beforerushingouttobuytheshares, anditshouldbepointedouttheydon’tcomecheap tradeonaone-yearforwardpricetoearnings ratioof90.8.Thatcompareswith17.6-timesfor theS&P500index. Thehighratingreflectsafast-growingbusiness ofwhichhasdeliveredearningspersharegrowth expected24%ayearoverthelastdecade.Earningsare togrowatamoremodestclipofaround 15%ayearoverthenextcoupleofyears,according toRefinitivdata. seemProspectsofmaintaininghighgrowthmay likeatallorderbutthecompanyhasplentyofroomtogrownifitwantstocatchupwith McDonald’swhichhasafootprintof40,000 storesacross100countries.

Investors are feasting on fast-food companies as many stocks hit new share price highs

Chipotle Mexican Grill, Wingstop and Greggs have delivered the strongest returns over the past five years

Visit our website for more articles

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

Iandnanenvironmentofpolitical,economic withinmarketturmoil,thegoldpriceis touchingdistanceofrecordhighsandUSpreciousmetalsminerNewmont (NEM:NYSE)recentlysealedablockbuster$19billiontakeoverofAustralianrivalNewcrestMining (NCM:ASX),bringingextrapizzazztothesector. andGoldanditsminersareclearlyinthespotlight haveencouraginglyforinvestorswhofeartheymay medium-sizedmissedtheboat,valuationsamongsmalland goldminingstockshavenotkeptpacewiththesurgingpriceofthemetal. banksAlotofdemandforgoldhascomefromcentral ratherthaninstitutionalandretailinvestors. trackIfthatchangesandmoneypilesintofundsthat strongthepriceofmetalthenthiscouldactasa catalystforgoldminingstocks.

FORTHESHORTANDMEDIUM-TERMDRIVERS GOLD talksAkeydriverforgoldintheshorttermhasbeen overtheUSdebtceiling.Goldhasretreated alittlefromthe$2,000markasinvestorshave thisbecomeslightlymorehopefulaboutaresolutionto crisiswhichdoesn’tinvolvetheUSdefaultingonitsdebt.

Dechra

drop 10% after full year profit guidance downgrade

Whenisgoldindemand? Gold,whichhaslimitedapplicationsin industry,tendstobeindemandduring whenperiodsofeconomicorgeopoliticalstrife, inflationthreatenspapercurrencies ortherearesignificantfallsinbondand equitymarkets. onItsstatusasa‘safehaven’assetisbased theitshistoricroleasastoreofvalueand cannotfactthat,unlikecurrencies,itsvaluebemanipulatedthroughadjustmentstointerestrates.

Ifadealisbrokeredthenapullbackingoldprices term,ispossibleintheshort-term,butinthemediumasinterestratespeak,economiespotentially headintorecessionandthedollarweakens(theUS gold)currencytendstohaveaninverserelationshipwith Segunthengoldpricescouldshine. Lawson,theCEOofThorExplorations (THX:AIM),whichrecentlycompleteditsfirstfull tellsyearofproductionfromitsSegilolamineinNigeria, Shares ‘I’malwaysbullishongold.’ theHeadds:‘Whenitcomestothegoldprice, globalinflationaryenvironmentwearein andaslowingdownofinterestratehikesmeans somewherearoundthe$2,000markwillhopefully persistthroughthisyear.’ CrayfourdOfferingamoredispassionateview,Robert managesCQSNaturalResourcesGrowth&Income(CYN) aninvestmenttrust whichinvestsacrosstheminingandoilandgas space.Heexplainsthetrust’sexposuretogold minershasbeensteadilyincreasingandrecently reachedthe20%mark.

There are plenty of options to invest in gold miners as the precious metal price shines

We look at the stocks and funds related to the gold theme and pick three names to buy

UK equity investment trusts: Fidelity Special Values leads the pack while Henderson Opportunities Trust is the laggard

Cranswick shares sizzle as better-than-expected profits and Pets

04 | SHARES | 25 May 2023 Contents

18 | SHARES 25May2023

30 SHARES 25May2023

Gold ($/oz) 20192020202120222023 1,200 1,400 1,600 1,800 2,000 Chart:Sharesmagazine Source:Refinitiv

24 | SHARES |25May2023

Pharmaceuticals shares

Investors remain sceptical despite 75% rally in Fevertree Drinks shares

at Home partnership please

BAILLIE GIFFORD POSITIVE CHANGE FUND

Constructive

capitalism. With your help it can power positive change.

A bold statement, but we truly believe that capital thoughtfully and responsibly deployed can be a powerful mechanism for change. Our Positive Change Fund seeks to identify high quality growth businesses who are providing solutions to global challenges. We think those businesses will prosper and flourish, at the same time delivering attractive returns to your portfolio. Want to help us power positive change?

Please remember that changing stock market conditions and currency exchange rates will affect the value of the investment in the fund and any income from it. Investors may not get back the amount invested.

Find out more at bailliegifford.com/positivechange

Baillie

& Co Limited is the Authorised Corporate

of

&

Limited is wholly owned by

& Co. Both companies are authorised and regulated by the Financial Conduct Authority.

Gifford

Director

the Baillie Gifford ICVCs. Baillie Gifford

Co

Baillie Gifford

Actual Investors

Germany’s flagship DAX index surges to new all-time high

Germany’s blue-chip DAX index comprising the country’s 40 largest quoted companies made a new intraday all-time high of 16,333 points on 19 May after it breached the prior high of 16,290 points set in November 2021.

That makes the DAX the second-best European performer in 2023 with total gains of 17.2%, slightly behind the French CAC index which is up 18% but way ahead of the FTSE 100 which is up a paltry 6%.

The comparison isn’t quite apples-to-apples though because the DAX is one of a few total return indices which means it is calculated to include dividend payments.

The number of DAX constituents was increased to 40 from 30 in September 2021. The maximum individual company weighting is capped at 10%.

WHAT’S BEEN LEADING THE DAX HIGHER?

Engineering and technology stalwart Siemens (SIE:ETR) is up 22% so far in 2023 and 37% over the past 12 months. Last week (17 May) the company increased sales and profit guidance for the year to 30 September having already raised its outlook in February.

Sales growth was increased to 9% to 11% from 7% to 10% while earnings per share was increased

Top DAX performers over 1 year

by 6.5% to €9.75 in the middle of the range.

Airline Deutsche Lufthansa (LHA:ETR) is up 25% in 2023 and 42% over the last 12 months. Analysts have increased their earnings estimates by 80% since December 2022 on pent-up demand in air travel.

In early May rival Ryanair (RYAAY:NASDAQ) won its legal challenge against Lufthansa’s 2020 state bailout.

STELLAR EUROPEAN EARNINGS

Few people would have predicted European stock markets to be so buoyant a year after the invasion of Ukraine, skyrocketing energy prices and the ECB (European Central Bank) aggressively raising interest rates.

But with energy prices now well below their peak and China reopening following the abandonment of its zero-Covid policy, the future looks a fair bit brighter.

Positive investor sentiment seems to have been driven in part by an impressive first quarter reporting season. Morgan Stanley’s equity strategist Graham Secker calculates it is the fourth best European earnings beat over the last 15 years.

A net 36% of companies have beaten consensus expectations by a weighted average of 13.4% at the index level with large cap names leading the charge.

Despite the strong showing Secker warns the ‘stellar’ season is unlikely to be replicated as the broader macro data seems to be fading. He says said the macro weakness points to weaker earnings ahead.

Another worrying omen came out in the same week as the DAX made a new high. May’s ZEW index which measures investor sentiment unexpectedly fell into negative territory for the first time in five months. [MG]

News 06 | SHARES | 25 May 2023

Despite an impressive first quarter earnings beat there is some cause for concern

Munich Re 50.7 Siemens Energy 42.2 Deutsche Lufthansa 41.6 Siemens 37.2 Heidelberg Cement 36.5 Company % Table: Shares magazine • Source: Share Pad

Stealth rally in construction stocks suggests economy is on a firm footing

The FTSE 350 construction and materials index is up 20% this year despite recession fears and a weak housing market

While there is much handwringing over the outlook for the new-build housing sector, it seems the rest of the UK construction industry is in rude health. That has helped construction to be one of the best performing sectors in the FTSE 350 index year-to-date, up 20%.

The latest S&P Global/CIPS UK Construction PMI survey – which tracks changes in the total volume of construction activity in the UK by taking responses from 150 firms – posted a third consecutive monthly rise in output in April.

Although the housing sector recorded the fastest fall in activity since May 2020, this was more than offset by rising volumes of commercial and civil engineering work.

At the same time, supply conditions improved to the greatest extent since September 2009 due to better availability of materials, fewer transport delays and an easing of price pressures.

Commercial building was the fastest-growing area of the construction sector in April, with improving economic conditions helping to boost clients’ willingness to spend.

Civil engineering activity also picked up in April, supported by resilient pipelines of work on infrastructure projects.

Encouragingly, new orders increased for the third consecutive month in April and are growing faster than they were on average in the second half of 2022 due to ‘resilient client demand’ especially for commercial building.

‘The growth in the construction of commercial properties is welcome news, with the avoidance of a recession in the last quarter leading to clients being more willing to spend,’ commented John Glen, chief economist at the Chartered Institute of Procurement & Supply.

Leading the charge on the stock market has been

Performance of FTSE 350 Construction stocks year-to-date

Data correct as of 22 May 2023

Table: Shares magazine • Source: Sharepad, Shares. Total return.

construction and urban regeneration firm Morgan Sindall (MGNS) with a total return of 26% and FTSE 100 global building materials group CRH (CRH), returning 24%.

In its April update, CRH said it had seen ‘a positive start to the year in a seasonally quiet trading period’ driven by good activity levels in the Northeast US in its essential materials, road solutions and infrastructure divisions.

Meanwhile, Morgan Sindall reported healthy demand in UK construction and infrastructure and strong trading in its fitout business with its order book and new enquiries providing ‘confidence for the rest of the year’.

Other notable performers this year include Genuit (GEN), formerly known as Polypipe, and infrastructure firm Balfour Beatty (BBY), which added two major road projects to its order book in the first quarter along with a contract to build US data centres. [IC]

News 25 May 2023 | SHARES | 07

Morgan Sindall 26.0% CRH 24.0% Volution 23.0% Genuit 20.0% Balfour Beatty 17.0% Ibstock 13.0% Marshalls 12.0% Keller −12.0% FTSE 350 Construction & Materials Index 20.0%

rising volumes of commercial and civil engineering work”

Initial surge as Zoom beats expectations and lifts forecasts fails to last

Growth is slowing and the company faces an increasing competitive threat from Microsoft

An early share price advance in after-hours trading for Zoom Video Communications (ZM:NASDAQ) off the back of its latest earnings update (22 May) evaporated fast.

The video conferencing platform raised its annual revenue forecast to between $4.47 billion and $4.49 billion, representing year-on-year growth of 2%. Previously it had forecast $4.44 billion to $4.46 billion.

First-quarter revenue was ahead of forecasts but also represented the slowest quarterly growth on record of 3%. Its enterprise business, which encompasses larger customers, saw quarterly growth of 13% but the company’s guidance implied a slowdown in the remainder of the year. These factors saw the stock give back all its initial gains.

During the pandemic Zoom shares surged to highs above $550 as the platform entered the public consciousness and demand soared but it now trades at a little over $71.

Growth has slowed significantly and the competitive threat from rivals with deeper pockets, most notably Microsoft (MSFT:NASDAQ), has put Zoom on the back foot.

As Microsoft introduces AI functions into its Teams video conferencing system it could further increase its grip on a market which could have a winner-takes-all element to it.

After all, if Microsoft becomes the platform of choice for businesses and individuals then increasingly it may become the only service people feel they need to subscribe to, thereby squeezing Zoom out of the picture. [TS]

ATOME shares boosted by Baker Hughes investment and its fertiliser plan

Micro-cap hydrogen play gets endorsement from a major player

ATOME Energy (ATOM:AIM) is generating excitement after it attracted US energy services heavyweight Baker Hughes (BKR:NASDAQ) as a strategic investor.

On 22 May it was revealed Baker Hughes is investing £2.4 million to take a 6.6% holding in the company at a 3.2% premium to the previous market close. The company also has the right of first offer to supply equipment to ATOME, although it

has no exclusivity and must offer a competitive rate.

ATOME CEO Olivier Muscat tells Shares it is possible the agreement could be the precursor to a deeper partnership involving other projects.

Longspur Research analyst Adam Forsyth says: ‘As with all such strategic stakes the information content of the investment is key, signalling a positive appraisal of the company from an industry insider.’

ATOME was formed for the purpose of producing, marketing and distributing green hydrogen and ammonia (for fertiliser). Green

hydrogen and ammonia (made through renewable energy) is expected to be a fast-growing market. The company has projects in Paraguay, Iceland and Costa Rica of which Villeta in Paraguay is the most advanced.

Alongside the Baker Hughes news, the company has announced plans to develop its ammonia into a finished product before sale which Muscat says should generate higher returns. A final investment decision is expected on Villeta later this year with production following around two years later. [TS]

News 08 | SHARES | 25 May 2023

Sage seizes its chance to impress investors

There is talk of a new era of growth for the UK’s largest listed technology company

Having missed the January tech rally, accounting tools software supplier Sage (SGE) has been making up for lost time. The share price has stormed higher since reporting first-half results on 17 May, with analysts getting excited about the prospect of cloud adoption triggering a new era of growth.

That’s important for what is now the UK’s biggest technology company by market value. Sage’s cloud revenues rose 29% in the six months to 31 March 2023, pushing annual recurring revenues up 12%, providing the sort of cash flow

security that catches the eye of investors.

Peel Hunt believes execution in the accountant practices space has been particularly sharp, claiming that about a quarter of the UK’s 20,000 accountants are now onboard with Sage.

This is an important channel into the company’s core small and mid-sized enterprise segment. With operating profit margins now moving up to 20.8%, there is renewed hope that Sage could yet get back to the 27% to 28% levels of years past. [SF]

The owner of Boots loses a quarter of its value in six months

Abandoned disposal and $6.8 billion pre-tax charge for opioid-related claims had a knock-on effect

Shares in Walgreens Boots Alliance (WBA:NASDAQ), the owner of Walgreens and Boots, have lost over a quarter of their value in the past six months.

This fall to around the $31 mark is surprising considering the retail pharmacy giant raised its full-year sales outlook. Or is it?

Last year, the retail pharmacy giant abandoned plans to sell Boots, citing inability to find a buyer in difficult market conditions. This turned out to be a bit of good luck for the company as the UK division reported sales growth of 16% for the second quarter of 2023.

However, what wasn’t good for

Walgreens is the prospect of paying out billions of dollars to settle thousands of lawsuits accusing the chain of mishandling opioid painkillers.

This had a knock-on effect for Walgreens’ earnings. During the first six months of its 2023 financial year, the pharmacy giant swung from a profit of $2.5 billion to an operating loss of nearly $6 billion.

With a sharp drop in income from Covid-related products and services, Walgreens is looking to its VillageMD primary care arm to help accelerate earnings growth.

News 25 May 2023 | SHARES | 09

Walgreens

($) Jul 2022 OctJan 2023 Apr 35 40 Chart: Shares magazine • Source: Refinitiv Sage (p) Jul 2022 OctJan 2023 Apr 600 650 700 750 800 850 Chart: Shares magazine • Source: Refinitiv

Boots Alliance

HIGHER Moving DOWN in the dumps

UK UPDATES OVER THE NEXT 7 DAYS

Bloomsbury set to report

£30 million profit and outline digital growth plans

The publisher is seeing strong demand from both consumer and academic markets

Bloomsbury Forecasts

FULL-YEAR RESULTS

May 26: Volvere

May 30: Silver Bullet Data Services

May 31: Bloomsbury

Publishing

June 1: Pennon, NextEnergy Solar, Auto Trader, Dr. Martens

Life has gone particularly well for publishing company Bloomsbury (BMY). The reading boom during the pandemic has not faded away. Demand from consumers and students for books has remained strong despite the cost-of-living crisis. Bloomsbury’s recent hits include Samantha Shannon’s novel, A Day of Fallen Night – the prequel to The Priory of the Orange Tree.

On 15 March, Bloomsbury said its results for the 12 months to 28 February 2023 would be ahead of previous expectations with revenue above £260 million and pre-tax profit in the region of £30 million.

HALF-YEAR RESULTS

May 26: IntegraFin

May 30: Hollywood

Bowl, Oxford Biodynamics, Greencore

May 31: Impact Asset Management

The exact figures will be reported on 31 May, to be followed on 21 June by a capital markets day which will provide more information on its

digital offering.

In December 2021 Bloomsbury bought a business called ABC-CLIO for £17.3 million to strengthen its position in digital academic resources, including a big presence in the US high school library market.

Investors will want to know how it plans to replicate ABC-CLIO’s US success in other geographic territories and the initial response to the launch of its academic streaming content platform, Bloomsbury Video Library, which has more than 2,000 films covering a large range of subjects.

News: Week Ahead 10 | SHARES | 25 May 2023

Revenue (m) 260.8272.1278.9 Pre-tax profit (m)30.232.234.2 EPS (adjusted) (p)28.329.030.7 2023 2024 2025 February year-end Table: Shares magazine Source: Refinitiv

[SG]

US UPDATES OVER THE NEXT 7 DAYS

Salesforce faces the challenge of geographical expansion versus protecting profits

Software giant faces tricky prospect of trying to please everyone

The Salesforce (CRM:NASDAQ) share price has surged 56% in 2023, but there are concerns that growth will slow this year.

The $206 billion technology giant has been in the news a lot lately, trouncing earnings and revenue forecasts in January, upping guidance, and catching the eye of activist investors Elliott Management, Third Point and others.

Caught in the crossfire of a debate about sales expansion versus margin protection, the customer

relationship management software firm faces a challenge to extend its international expansion without sacrificing some short-term profit. How it deals with this conundrum will certainly grab investors’ attention when it reports the February to April results on 31 May. Pre-announced plans to cut its workforce by 10% will help, as will plans to reduce its office space footprint, but probably not this quarter. More job cuts could be coming, some analysts speculate. Consensus, according to Investing. com data, is for $1.61 of earnings per share on $8.18 billion sales. [SF]

QUARTERLY RESULTS

May 26: AIA Group, Meituan, Marvell, Cathay Financial, Booz Allen Hamilton, Buckle, Sumo Logic, Hibbett Sports

May 30: Elbit Systems, Box Inc, Golar, Victoria’s Secret, Hello Group, Canopy Growth

May 31: Salesforce, National Bank of Canada, Hewlett Packard, Julius Baer June 1: Broadcom, Dollar General, Hormel Foods, GameStop, Macy’s, Lululemon Athletica, Uipath

News: Week Ahead 25 May 2023 | SHARES | 11

Salesforce ($) Jul 2022 OctJan 2023 Apr 140 160 180 200 Chart: Shares magazine • Source: Refinitiv What's expected from Salesforce Quarterly forecasts EPS $1.61 Revenue $8.18 billion Same quarter a year ago EPS $0.98 Revenue $7.41 billion EPS = earnings per share Table: Shares magazine • Source: Yahoo Finance, Salesforce

SSP is a great way to play the recovery in global travel

One of the most notable trends of the last year has been the rebound in travel, both in the UK and across the globe, as workers have gone back to their offices and holidaymakers have gone on what the media likes to refer to as ‘revenge travel’, making up for trips which were put off due to the pandemic.

Yet strangely, shares in food travel expert SSP (SSPG) are still only half their value at the start of 2020, which suggests investors have overlooked the business and its potential for recovery.

The group, which operates over 2,800 outlets ranging from food on-the-go kiosks to fine dining venues at railway stations and airports in 35 countries worldwide, under such brands as Upper Crust, Ritazza and Le Grand Comptoir, is rapidly making up lost ground.

In the six months to March 2023, sales were up 64% to £1.32 billion, taking them above 2019 levels for the first time, while operating profits reached £34 million against a prior-year loss of £36 million.

While we appreciate London isn’t representative of the whole of the UK, recent Transport for London data suggests office attendance in the

capital is back to around 70% of pre-pandemic levels and the situation is likely to be similar in other big cities.

Also, research by the Centre for Cities and Imperial College estimates around half of those workers who are back in the office spend a minimum of three days at their desk, with this proportion higher for workers under 30.

In Europe, air travel has soared in the past year with low-cost airline Ryanair saying it carried 169 million passengers in the 12 months to March, 74% more than in the previous period, while it also noted a sharp increase in Asian and US visitors to Europe thanks to the strength of the dollar.

The pick-up in people using trains and planes has helped SSP grow its European revenues to 116% of 2019 levels, while in North America revenues are 124% of 2019 levels thanks to a surge in spending on travel and leisure as customers look to make the most of their free time.

Earlier this month, SSP announced it had increased its North American footprint with the acquisition of the concessions business of Midfield, giving it a presence in 30 of the largest US airports and bringing in an extra $100 million of annual revenue.

Thanks to this sharp recovery in activity, the group now sees sales and operating profit at the top end of previous expectations driven by its North American and Rest of the World operations. [IC]

Great Ideas: Investments to make today 12 | SHARES | 25 May 2023

Shares in the multi-national foodservice

SSP (p) 20192020202120222023 100 200 300 400 500 600 Chart: Shares magazine • Source: Refinitiv

Price:

Market cap:

firm are still way below their pre-pandemic levels

SSP (SSPG)

274p

£2.2 billion

VT Cantab Sustainable Global Equity offers exposure to well-financed, quality companies with positive ESG credentials

Top quartile in terms of performance over the past 12 months, under-the-radar fund VT Cantab Sustainable Global Equity (BK5XL00) deserves a closer look. It was one of the few growth funds to deliver a positive return in 2022, a year where US stock markets experienced a miserable showing and growth investing as a style was out of favour.

Having maintained its top quartile position for the past three and six months, it’s clearly doing something right. Don’t be put off the mere £41 million assets under management, there is a lot to like about this fund.

Shares believes this carefully constructed portfolio of 35 quality names, operating in a diverse batch of sectors and bought at attractive valuations, should allow risk-averse investors to sleep at night by holding up better than its sector during market selloffs while participating in market upswings. It has a 0.91% ongoing charge.

VT CANTAB SUSTAINABLE GLOBAL EQUITY (BK5XL00)

Fund size: £41 million

Yes, the outlook for the global economy is somewhat clouded. However, quality companies with sustainable franchises and fortress balance sheets should continue to flourish in what could prove to be uncertain times ahead.

DISCIPLINE AND PATIENCE

Managed by Cantab Asset Management’s Mark Wynne-Jones, a seasoned equity analyst and fund manager, the fund seeks to generate superior riskadjusted returns through a disciplined and patient investment process. Warren Buffett-fan WynneJones’ process focuses on investing in responsible companies with sustainable franchises at attractive valuations and holding them for the long term.

Since its late 2019 launch, a few months before the onset of the pandemic, VT Cantab Sustainable Global Equity has produced a robust performance, generating a three-year cumulative return of 37.4%, ahead of the 32.4% delivered by the IA Global sector.

Wynne-Jones’ philosophy posits that quality companies, which typically trade at premium valuations, generate superior risk-adjusted returns to investors, as long as they are purchased at attractive valuations with a margin of safety, and held for the long term.

The fund manager adopts a glass half-empty approach to analysis, focusing at least as much on downside risk as upside potential.

He says investors should think of the approach as being Warren Buffett and Charlie Munger with an ESG (environmental, social and governance) overlay, since the fund’s investable universe excludes companies involved in the production

Great Ideas: Investments to make today 25 May 2023 | SHARES | 13

This global equities fund may not stay under the radar for long

of fossil fuels and armaments as well as alcohol, tobacco and gambling stocks.

Quantitative and qualitative analysis is also used to assess whether companies are paying due attention and consideration to ESG concerns and are demonstrating this through their policies and practices.

Wynne-Jones insists that if investors can manage risk in the short term, they are far more likely to deliver superior returns in the long run. Given the recent failures of Silicon Valley Bank, Signature Bank and Credit Suisse, investors may be reassured that the fund owns no banks, though it does hold a pair of insurers in MetLife (MET:NYSE) and Aviva (AV.).

Wynne-Jones’ preference for strong balance sheets is demonstrated by the fact that seven of the portfolio’s non-financial stocks have net cash positions, while a further 13 have estimated 2023 net debt to earnings before interest, tax, depreciation and amortisation (EBITDA) ratios of less than one times.

WHAT’S IN THE PORTFOLIO?

The fund’s top 10 includes Google-parent and AI play Alphabet (GOOG:NASDAQ), Danish drug maker Novo Nordisk (NOVO-B:CPH) which is benefiting from growing excitement over its Wegovy obesity offering, and Spanish travel industry software concern Amadeus IT (AMS:BME).

It has a stake in consumer staple General Mills (GIS:NYSE), the food multi-national that makes and markets breakfast cereals Cheerios and Lucky Charms in a partnership with another of the fund’s holdings, Nestle (NESN:SWX)

Investors putting money into the fund will get exposure to Akamai Technologies (AKAM:NASDAQ), a leading player in internet content delivery and security expanding its cloud computing offering, as well as Swatch (UHR:SWX), the pure-play collection of luxury watch brands which Wynne-Jones believes is too lowly valued for such a unique asset.

Shares in the world’s largest watchmaking group behind brands including the namesake Swatch as well as Omega, Harry Winston, Tissot and Longines, ticked higher in the first quarter of 2023 thanks to the reopening of China as well as the successful launch of the ‘MoonSwatch’.

Top 10 Holdings

Of late, VT Cantab Sustainable Global Equity has added to its position in Trend Micro (4704:TYO), Japan’s largest specialist software security company which is tapping into opportunities created by the rise in cyberattacks globally.

Wynne-Jones has also bought shares in PayPal (PYPL:NASDAQ), the digital payments firm he believes has longevity despite transaction margin pressures and competition from the likes of Apple (AAPL:NASDAQ) whose own payments system is growing fast. [JC]

VT Cantab Sustainable Global Equity

Great Ideas: Investments to make today 14 | SHARES | 25 May 2023

(p) 2020 2021 2022 2023 80 100 120 140 Chart: Shares magazine • Source: Refinitiv

Novo Nordisk 5.4% Omnicom 4.2% Oracle 3.4% General Mills 3.3% Swatch 3.2% Alphabet 3.1% Schneider Electric 3.1% Amadeus IT 3.1% Trend Micro 3.0% Akamai Technologies 3.0%

Table: Shares magazine • Source: Cantab Asset Management, as of 30 April 2023

Discover the power of Collective Wisdom.

We live in an uncertain world. For investors this can mean new levels of volatility. But at Witan we have consistently grown our dividend for 48 years. Our multi-manager approach offers a combination of collective wisdom, variety and expertise to our shareholders.

This financial promotion was approved by Witan Investment Services Ltd FRN: 446227 on 13 February 2023. Please note that past performance is not a guide to future performance. Witan Investment Trust is an equity investment. The value of an investment and the income from it can fall as well as rise as a result of currency and market fluctuation and you may not get back the amount originally invested.

*Source: Morningstar/Witan. Total return includes the national investment of dividends.

** The Net Asset Value figures value debt at fair value. # Witan’s benchmark is a composite of 85% Global (MSCI All Country World Index) and 15% UK (MSCI UK IMI Index). From 01.01.2017 to 31.12.2019 the benchmark was 30% UK, 25% North America, 20% Asia Pacific, 20% Europe (ex UK), 5% Emerging Markets.

Discover the Witan approach to global equity investment. witan.com Discrete Performance* Share price Net Asset Value** Q4 2017 Q4 2018 Q4 2018 Q4 2019 Q4 2019 Q4 2020 Q4 2020 Q4 2021 Q4 2021 Q4 2022 -8.1% 22.1% 2.7% 11.9% -9.8% -8.4% 21.3% 4.2% 15.8% -10.2% Benchmark# -6.6% 20.1% 9.5% 19.9% -6.2%

Time to cut losses after Hunting’s swift reversal of fortunes

The energy services firm has seen its shares come under pressure in the wake of its annual results

Hunting (HTG) 208p

Loss to date: 26.6%

We flagged the appeal of energy services firm Hunting (HTG) at 283.5p in September 2022 as a means of playing a rebound in spending by the sector off the back of strong oil and gas prices. Hunting is particularly exposed to rig activity in North America.

WHAT HAS HAPPENED SINCE WE SAID TO BUY?

At first, our hypothesis proved on the money as in both operational and share price terms the company continued to demonstrate real momentum. In February, the shares hit a high above 350p, implying a gain on paper of around 25%.

However, the company’s full year results and accompanying strategy update on 2 March were poorly received and put the stock firmly on the back foot. In hindsight we should have reacted quicker to the shift in the company’s fortunes.

The numbers themselves were decent with revenue up 39% to $725.8 million and the order book increasing from $211.5 million to $473 million year-on-year. The dividend was up 13%.

However, Berenberg analyst Richard Dawson observed at the time that ‘the US rig count has

declined year-to-date and faces headwinds to further growth, including labour shortages, supply chain constraints, lower gas prices and continued capital discipline’, prompting a 3% and 4% cut to his revenue forecasts for 2023 and 2024 respectively.

Falling commodity prices amid concerns about recession have also contributed to weaker sentiment.

Alex Brooks from Canaccord Genuity is worried that Hunting will make expensive acquisitions over the next two years to diversify away from oil and gas.

WHAT SHOULD INVESTORS DO NOW?

We’re cutting our losses rather than persevere. The outlook for energy prices is heavily tied to the current dampened global growth picture and without an uptick in the oil and gas markets it may be tricky for Hunting shares to rebound. [TS]

Great Ideas Updates 16 | SHARES | 25 May 2023

Hunting (p) Jul 2022 OctJan 2023 Apr 150 200 250 300 350 Chart: Shares magazine • Source: Refinitiv Hunting (p) Jul 2022 OctJan 2023 Apr 150 200 250 300 350 Chart: Shares magazine • Source: Refinitiv

Cutthrough withconviction

FIDELITYINVESTMENTTRUSTS

Trulyglobalandaward-winning,therangeissupported byexpertportfoliomanagers,regionalresearchteamsand on-the-groundprofessionalswithlocalconnections.

With400investmentprofessionalsacrosstheglobe,webelieve thisgivesusstrongerinsightsacrossthemarketsinwhichweinvest. Thisiskeyinhelpingeachtrustidentifylocaltrendsandinvestwith theconvictionneededtogeneratelong-termoutperformance.

Fidelity’srangeofinvestmenttrusts:

•FidelityAsianValuesPLC

•FidelityChinaSpecialSituationsPLC

•FidelityEmergingMarketsLimited

•FidelityEuropeanTrustPLC

•FidelityJapanTrustPLC

•FidelitySpecialValuesPLC

Thevalueofinvestmentscangodownaswellasupandyoumay notgetbacktheamountyouinvested.Overseasinvestmentsare subjecttocurrencyfluctuations.Thesharesintheinvestmenttrusts arelistedontheLondonStockExchangeandtheirpriceisaffected bysupplyanddemand.

Theinvestmenttrustscangainadditionalexposuretothemarket, knownasgearing,potentiallyincreasingvolatility.Investmentsin emergingmarketscanmorevolatilethatothermoredeveloped markets.Taxtreatmentdependsonindividualcircumstancesandall taxrulesmaychangeinthefuture.

Tofindoutmore,scantheQRcode,goto fidelity.co.uk/itsorspeaktoyouradviser.

Thelatestannualreports,keyinformationdocument(KID)andfactsheetscanbeobtainedfromourwebsiteat www.fidelity.co.uk/its orbycalling0800414110.Thefullprospectusmayalsobeobtained fromFidelity.TheAlternativeInvestmentFundManager(AIFM)ofFidelityInvestmentTrustsisFILInvestmentServices(UK)Limited.IssuedbyFinancialAdministrationServicesLimited,authorisedand regulatedbytheFinancialConductAuthority.Fidelity,FidelityInternational,theFidelityInternationallogoandFsymbolaretrademarksofFILLimited.Investmentprofessionalsincludebothanalystsand associates.Source:FidelityInternational,30September2022.Dataisunaudited.UKM1222/380938/SSO/1223

AvailableinanISA

The fast-food stocks making investors rich: the secrets of their success

Popular brands are demonstrating strong pricing power and delivering growth

Despite gloomy commentary on the state of the economy caused by rising interest rates and a cost-of-living crisis, one corner of the stock market appears to be in rude health.

Big players in fast food or quick service restaurants look to be at the top of their game with many shares in this space trading at new all-time highs.

For example, McDonald’s (MCD:NYSE) is up 27% over the past 12 months, while Yum! Brands (YUM:NASDAQ), owner of KFC and Taco Bell, is up 25% and Burger King’s parent Restaurant Brands International (QSR:NYSE) is up 44%.

Its shares listed on the Nasdaq exchange in the US in 2015 and have delivered a six-fold share price return to investors, equivalent to a compound annual growth rate of around 27% a year.

However, before rushing out to buy the shares, it should be pointed out they don’t come cheap and trade on a one-year forward price to earnings ratio of 90.8. That compares with 17.6-times for the S&P 500 index.

The high rating reflects a fast-growing business which has delivered earnings per share growth of 24% a year over the last decade. Earnings are expected to grow at a more modest clip of around 15% a year over the next couple of years, according to Refinitiv data.

Prospects of maintaining high growth may seem like a tall order but the company has plenty of room to grown if it wants to catch up with McDonald’s which has a footprint of 40,000 stores across 100 countries.

Easily the biggest winner over the past 12 months is chicken wing-focused Wingstop (WING:NASDAQ) whose share price is up 180%.

WINGSTOP’S RECIPE FOR SUCCESS

The idea for the Buffalo-style chicken wing operator was hatched in 1994 and the firm now operates from over 1,500 stores across the US, South America, Asia, France and the UK.

Feature: Fast-food companies 18 | SHARES | 25 May 2023

Fast-food stocks: ranked by fiveyear total return

Mexican-themed Chipotle Mexican Grill (CMG:NYSE) is another fast-growing business. It operates from around 3,200 restaurants, making it double the size of Wingstop in terms of outlets.

The business is expected to generate revenue of $9.9 billion and a net profit of $1.2 billion in 2023, according to Refinitiv data. Analysts expect earnings per share to increase 35% in 2023 and 21% in 2024. Over the last five years earnings have grown at a rapid clip of 38% per year. The shares trade on a one year forward PE of 42, less than half the rating of Wingstop.

STAR PERFORMERS

The table shows the total returns (share price gains/losses and dividends) from popular fastfood companies around the world. Note that you can buy shares in most of the best-known chains either on the US or UK stock market. One notable exception is Subway which is privately-owned.

Chipotle Mexican Grill is the best performer over the past five years, generating a 364% total return. Close behind is Wingstop with a 355% total return. In third place is Greggs (GRG) with a 197% return.

Feature: Fast-food companies 25 May 2023 | SHARES | 19

Chipotle Mexican Grill 364% Wingstop 355% Greggs 197% Starbucks 105% McDonald's 103% Yum! Brands 79% Restaurant Brands 61% Wendy's 59% Papa Johns 48% Domino's Pizza (US) 29% Jack in the Box 15% Shake Shack 15% Table: Shares magazine • Source:

18

2023 ChipotleMexicanGrillis

Refinitiv, data as of

May

expectedtogeneraterevenue of$9.9billionandanetprofit of$1.2billionin2023

The laggards are Shake Shack (SHAK:NYSE) which has nearly 460 locations – approximately two thirds in the US and Colombia and the rest overseas – and Jack in the Box (JACK:NASDAQ) which has more than 2,000 sites mainly on the West Coast of the US. Both have generated a 15% total return over five years.

WHAT ARE THE WINNERS’ KEY QUALITIES?

The strong returns achieved for most of the selected shares may at first appear counterintuitive to a generally held view that the fast-food sector is highly competitive with few barriers to entry and limited brand loyalty.

The best positioned fast-food operators have managed to build strong brand value which has allowed them to flourish over decades.

McDonald’s is a good example. According to Statista, McDonald’s brand value was $196.5 billion in 2022, making it one of the top 10 most valuable global brands.

Brand value isn’t visible in a firm’s report and accounts. It represents intangible value. Tangible assets like plant and machinery can be touched and measured unlike intangibles.

Fundsmith founder Terry Smith is a big fan of intangible value and says: ‘We seek to invest in businesses whose assets are intangible and difficult to replicate.’

Another advantage of intangible assets according to Smith is that it is hard for competitors to replicate intangible assets with borrowed funds because banks tend to favour the comfort of tangible collateral. Importantly, concludes Smith, this means the business does not suffer from ‘economically irrational’ competitors.

You know you’ve made it into the big leagues when The Economist creates an index from your product as an informal way of measuring consumer purchasing power in different countries.

The Big Mac index started in 1986 and can be used to estimate the theoretical value of currencies. For example, a Big Mac in the UK costs £3.79 while in the US it is $5.36, according to The Economist.

This implies an exchange rate of £1.41 to the US dollar. Given the current exchange rate is £1.25, it means the pound is 11% undervalued, based on the Big Mac index.

McDonald’s has been no slouch in returns either, delivering roughly 13% a year over the last 40 years, giving investors a 115-fold return.

On top of that, the company has a long history of increasing its dividend which stretches back to 1976. Over the past decade the dividend has increased by around 7% a year. In addition, the company has purchased and cancelled around 25% of its shares in the past decade.

Size can create further barriers which serve to protect the business. McDonald’s spends around $400 million a year on advertising which is difficult for smaller competitors to match.

A further distinguishing feature of several companies in the table is that they operate franchised businesses which have the advantage of being able to expand quickly in a capital-light way.

WHY ARE FAST-FOOD COMPANIES DOING SO WELL?

The big players can offer great value for money which is a key advantage when times are tough. In addition, they have been able to pass on higher costs through menu increases without losing customers.

Feature: Fast-food companies 20 | SHARES | 25 May 2023

Starbucksbeat quarterlyearnings estimatesassame storesalesjumped 12%boostedbya6% increaseintraffic

Chipotle Mexican Grill has increased menu prices by a tenth from a year ago, helping it top first quarter sales and earnings estimates as same-store sales grew 10.9%. Traffic rose 4% as both lower and higher income diners visited more frequently.

Higher menu prices and lower avocado costs pushed up margins as net income jumped 81% to $291.6 million. CEO Brian Niccol said the chain has demonstrated pricing power, adding: ‘We don’t want to be in front of the inflationary environment, but we also don’t want to fall behind.’

Constant innovation is another differentiating factor working in favour of the best operators. Chipotle generates nearly 40% of its total sales from digital orders. It works hard to improve speed of service and accuracy to efficiently manage demand from in-person diners and digital orders. The company plans to open 255 to 285 new restaurants in 2023.

Burger chain Wendy’s (WEN:NASDAQ) reported an upbeat first quarter ahead of analysts’ estimates after delivering 8% growth in same restaurant sales. The company reiterated 2023 global systemwide sales growth of between 6% and 8%, with earnings per share expected to grow between 14% and 20%. Digital sales accelerated to represent 12% of overall sales while management committed to delivering ‘meaningful’ global growth.

Higher margins led to a big jump in free cash

flow to $40.7 million which allowed the company to continue buying back shares and double the quarterly dividend to $0.25 per share.

The company is planning to launch an artificial intelligence chatbot to automate its restaurants’ drive-throughs. Called FreshAI, the bot will hold limited conversations with customers and answer frequently asked questions.

‘Wendy’s introduced the first modern pick-up window more than 50 years ago and we’re thrilled to work with Google Cloud to bring a new wave of innovation,’ said CEO Todd Penegor.

Starbucks (SBUX:NASDAQ) also recently beat quarterly earnings estimates as same store sales jumped 12% boosted by a 6% increase in traffic. The company’s second largest market, China, registered its first same-store sales growth since the third quarter of 2021 as the country emerges from its prior zero-Covid policy.

Belinda Wong, the boss of Starbuck’s Chinese mainland operations, said her part of the business registered 30% same-store sales growth in March which continued into the firm’s third quarter.

Feature: Fast-food companies 25 May 2023 | SHARES | 21

YUM! BRANDS BUY AT $137.22

Yum! Brands (YUM:NASDAQ) owns iconic restaurant brands KFC, Pizza Hut and Taco Bell as well as The Habit Burger Grill. Its subsidiaries franchise or operate more than 55,000 restaurants spanning 155 countries.

YUM! Brands consensus forecasts

attracted diners in their droves and helped to drive 6% growth in same-store sales across the group in 2022.

China is KFC’s largest market. In the first quarter of 2023 the company said system sales in that country jumped 17%. China is the second largest market for Pizza Hut and system sales went up by 24% in the quarter. The brand also performed well in the US with same-store sales up 8%.

Meanwhile, Mexican-themed Taco Bell reported first quarter same-store sales growth of 8%. Taco Bell is Yum! Brands’ fastest growing international brand with 746 new locations opened in the first three months of 2023.

We like the firm’s exposure to a reopening Chinese market which is its second largest behind the US. We also favour its high proportion of digital sales which make up 45% of total sales and strong brands which focus on value for money meals.

Deals such as Taco Bell’s ‘$2 and under’ menu, KFC’s ‘two for $5’ and Pizza Hut’s $6.99 ‘melts’ have

Yum! Brands' dividend history

As well as providing double digit annualised gains in the share price, Yum! Brands has delivered 20% annualised growth in dividends per share over the last two decades.

Analysts forecast 15% to 16% earnings growth over the next two years which is up with the fastest growing fast-food businesses while the PE ratio of 26.7 times is towards the bottom end of the pack.

Feature: Fast-food companies 22 | SHARES | 25 May 2023

($) 1.00 2.00 2004200620082010201220142016201820202022 0.07 0.15 0.19 0.38 0.49 0.56 0.63 0.74 0.86 0.99 1.09 1.22 1.36 1.20 1.44 1.68 1.88 2.00 2.28

Chart: Shares magazine • Source: Yum! Brands. Dividend per share

SHARES’ TOP PICK

Sales ($bn) 7.3 7.9 EPS ($) 5.1 5.9 2023 2024 Table: Shares magazine • Source: Refinitiv, Stockopedia

Proof that boring companies can make the best investments

Think a stock is dull as dishwater? Dig deeper and you might want to put it at the top of your shopping list

Imagine you’ve been given the choice of investing in three companies. You can choose one of two batches with the intention of holding them for at least five years.

The first batch features a rat catcher, a provider of emergency telephones for lifts and a trucking company carrying small loads across the US. Sounds boring, right?

The second batch features an American cruise line operator. You also get the owner of brands loved by young and old including Yankee Candle and Sharpie pens, and a fashion seller which generated $6.2 billion revenue in 2022.

I would wager that more people would choose the second trio of stocks over the first batch. They all sound exciting – many are likely to have used their products and services, and that familiarity means investors might feel more comfortable owning a slice of these businesses.

Unfortunately, if you had picked batch two a decade ago, you would be holding a trio of duds. Each one of these three companies has lost money for investors over that period.

The leisure group is Norwegian Cruise Line (NCLH:NYSE), which has delivered a 7.5% negative annualised total return (share price gains/losses and dividends) on a 10-year basis, according to SharePad data. The Sharpie owner is Newell Brands (NWL:NASDAQ) which would have lost you 4.7% a year over that decade-long period and the fashion group is Ralph Lauren (RL:NYSE) with 3.3% negative annualised return.

In contrast, batch one features the winners. On a 10-year view, the trucking company is Old Dominion Freight Line (ODFL:NASDAQ) which has achieved 27.4% annualised total return. The rat catcher is Rentokil (RTO) with a 22% annual gain and the emergency phone group is Halma (HLMA), which boasts a 17.5% annual gain.

This is the perfect illustration that boring is beautiful when it comes to investing. While the three ‘winners’ all trade on premium valuations, that is a recognition of the strong returns they’ve generated over the years.

Think of some of the other boring names to have made investors rich over the years, such as Bunzl (BNZL) which supplies things that companies need to do business but do not actually sell to customers – think takeaway cups for coffee shops or clean door mats for hotels and offices.

Too many investors automatically flock to companies with a good narrative, thinking that is the ticket to easy returns. Space as an investing theme is a good example. We’re all fascinated by the opportunities with space, but how many of the relevant companies make any money? As a bellwether for the sector, note that Seraphim Space Investment Trust (SSIT) is down 60% in value since it joined the stock market in 2021.

Often it can pay to put your money into something more mundane, whether that’s companies which fix blocked drains or make widgets to keep factories running.

Exchange-traded fund providers have been scrambling over themselves to launch thematic ETFs which track hot themes. But they’re missing a trick.

I’d be the first in line to buy a ‘boring companies’ ETF, yet such a product still doesn’t exist. Sadly, the ETF industry would no doubt argue it would be too hard to market. What a shame.

Editor’s View: Daniel Coatsworth 25 May 2023 | SHARES | 23

Boring is beautiful when it comes to investing”

ARTIFICIAL INTELLIGENCE: The stocks using it to their advantage

There is no hotter area to invest in today than artificial intelligence, or AI as it is commonly known. Ever since OpenAI’s ChatGPT took the world by storm, investors have been racing to find winners from this explosive trend.

Corporate leaders, meanwhile, have been scrambling to prove to investors that they are harnessing the technology to drive revenue growth, improve operational efficiency, and more.

In first-quarter 2023 earnings in the US, company reports mentioned AI and related terms more than twice as often as they did a year ago, a recent study showed.

Consultancy McKinsey believes 70% of companies will be using at least one type of AI by 2030, and investment bank Morgan Stanley forecasts the AI industry will generate $1 trillion in annual revenue by 2050.

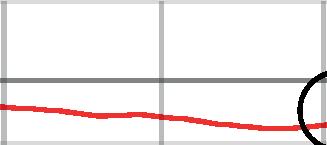

S&P RALLY FUELLED BY AI GAINS

AI fervour this year has been responsible for all of

By Steven Frazer and Sabuhi Gard

the S&P 500’s gains, according to new analysis by Société Générale. The investment bank’s research shows that without the gains of ‘AI boom stocks’ the S&P 500 would actually be down 2% this year, rather than up 8% (when the research was released earlier in May).

That is not entirely surprising when you consider stocks of companies perceived as AI winners – Nvidia (NVDA:NASDAQ), Microsoft (MSFT:NASDAQ), Alphabet (GOOG:NASDAQ) and others – have been on an absolute tear.

Nvidia’s share price has more than doubled this year (+121%), while Microsoft has rallied 33% since it invested $10 billion in OpenAI back in January.

Morgan Stanley analysts believe the current AI excitement could be more than just hype. ‘When we consider tech diffusion with real market impact potential, generative AI is a serious contender,’ says Edward Stanley, Morgan Stanley’s head of thematic research in Europe.

24 | SHARES | 25 May 2023

JPMorgan named AI as one of its hot themes for 2023, saying that with the emergence of ChatGPT, and other generative AI-powered chatbots, the future of work is set to be disrupted.

‘We believe we are on a secular trajectory towards the workforce, particularly the younger Generation Z, entering what we call the “multiearner era” – one where workers pursue multiple earning streams rather than a single job.’

Shares investigated the opportunities available to retail investors in February, and as we said then, ‘despite all the hype, AI is still in its infancy and faces years of further development, and investors have time on their side.’

We concluded at that point that an investment fund with a focus on the wider AI world was the best way to invest, and that view still stands.

However, there are investors who prefer individual shares over funds and this article provides examples of companies embracing AI.

IMPACT OF AI

The scope for AI to drive corporate profitability and free cash flow by lowering labour costs and/ or making its workforce more efficient, could have profound implications for company market valuations and share prices, both winners and losers.

‘We are already seeing businesses across our portfolio leverage AI tools to streamline the work delivered by their teams,’ says Stuart Veale from Beringea, manager of ProVen VCT (PVN).

Education is just one sector where analysts and fund managers see potential for an AI-driven

What is generative AI?

It is a type of artificial intelligence technology that produce types of content, including text, images and audio.

The expert’s view: Trevor Green, head of UK equities,

Aviva Investors

‘I believe we are at a similar stage as to when the internet came on the scene. The difference to when the internet arrived was that we didn’t have mega cap technology companies boasting unlimited budgets to invest in it, which we obviously have now.

‘But I caution that just because Apple, Google, etc have the head start and the big budgets does not automatically mean they will be the winners in this space in 10 years’ time when we look back. I believe there will be other less well-known companies at this stage who are winners.

‘There is a divide between companies that have been investing in AI for years and those that are playing catch-up and it is key as an investor to identify which camp companies are in. Take Sage (SGE) which reported last week and hardly mentioned AI in its results statement because the company has been using it for years and didn’t feel a need for sensational announcements.

‘Investors should not underestimate ChatGPT4 which is ground-breaking and is likely to result in a big reduction in call centre staff, for example. However, I would argue that in some/a lot of instances AI is not leading to job losses but freeing up those employees for other more productive roles, lowering the need for recruitment drives in organisations.

‘Remember the key launch was version 4 of ChatGPT and that was only 14 March 2023. We are still in the early days in all of this.’

25 May 2023 | SHARES | 25

?

Morgan

Stanley analysts

believe the current AI excitementcould be more than just hype

seismic shift. ‘Currently there aren’t enough teachers, classes are too large, textbooks are expensive, private education is prohibitively expensive, and exams can be too blunt and stressful an instrument for assessing diverse students with differing abilities,’ says Steven Tredget, partner at Oakley Capital. ‘AI removes all these constraints to the benefit of students.’

Tredget says the launch of AI-driven teaching assistant Syntea has received overwhelmingly positive feedback from developer IU Group and 120,000-plus higher education students.

These sorts of active examples prompted three researchers from NBER (National Bureau of Economic Research) to conduct a study to quantify the impact of AI on corporate valuations. Their work also identified companies set to benefit the most and least from ChatGPT, which was used as an illustration.

DOUBLE-EDGED SWORD

The NBER thesis was that generative AI tools could lead to an increase in some companies’ market values. That is because these technologies can boost free cash flow by affecting the workforce in two major ways.

First, workers might be replaced with less expensive AI technologies, which would boost free cash flow by lowering operating costs. Second, companies may find their employees become

HOW AI IS CHANGING THE ADVERTISING INDUSTRY

AI is transforming the advertising industry at pace with the use of personalised adverts and chatbots, which can help consumers make buying decisions. Nick Waters, CEO of media marketing consultancy Ebiquity (EBQAIM), says the success is seen in the paid search market where AI is used to generate keywords and text that achieve stronger results than human input.

‘There have been tentative steps taken to apply AI to the development of longer form copy but this is yet to prove itself,’ he says. ‘We are still in the learning stage and testing possibilities

more efficient by using AI to get things done better and faster. This improved efficiency can lead to higher profits and more free cash flow.

The study involved giving impact scores to sample companies, rating each on how exposed its workforce is to generative AI. They studied upwards of 20,000 tasks done by humans and used ChatGPT to figure out whether AI could achieve these tasks instead. They then grouped these tasks by occupation.

Next, they linked job roles to specific companies on the stock market, then crossreferenced their findings with recent earnings call transcripts. These companies were compared by share price performance and sorted into quintiles.

In short, they found that when ChatGPT arrived on the scene, it had a sizeable positive impact on the value of firms whose labour forces were more exposed to generative AI. Put differently, firms whose workforces can benefit the most from the use of ChatGPT saw their stock prices perform significantly better than those of firms that stand to benefit the least.

This outperformance amounted to 0.4% in daily excess returns during the two weeks following ChatGPT’s release. That is huge when you consider that a daily 0.4% excess return translates into more than 100% on an annualised basis, the research says.

Technology companies have a huge swath

at Ebiquity with useful progress in data cleansing and processing. We feel the application of AI to large data sets will enhance our ability to produce predicted outcomes at speed which will be an exciting development for our clients and ourselves.’

Daily Mirror newspaper owner Reach (RCH) has been using AI to publish articles on its local news and information sites. Last July, Reach launched an AI-powered audience engagement tool called Neptune Recommender. Page views through this tool now account for 40% of Reach’s page-view growth since the start of 2022.

Using machine learning and increased data points, Reach believes it can now suggest more relevant content to readers, keeping them on its platforms for longer and targeting them with more relevant advertisements.

26 | SHARES | 25 May 2023

Companies with high and low AI

3M Costco

Adobe CSX

Advanced Micro Devices Dollar General

Broadcom Home Depot

Fiserv Lowe's IBM McDonald's Intuit Mondelez

Microsoft Northrop Grumman

Nvidia Starbucks

PayPal Target Qualcomm Tesla

S&P Global TJX ServiceNow Union Pacific

Thermo Fisher Scientific United Parcel Service Verizon Communications Walmart

of employees whose jobs could potentially be replaced by ChatGPT. The NBER researchers also found industries with higher exposure tend to pay bigger wages, suggesting more workers in well-paid positions could see their careers transformed by the technology.

Industries with higher relevance also tend to have more employees compared to their capital, spend more on research and development, and have fewer physical assets.

On the other side, firms with employees doing manual, physical tasks stand to benefit the least from ChatGPT. That includes food and drink providers Starbucks (SBUX:NASDAQ) and McDonald’s (MCD:NYSE), retailers Target (TGT:NYSE) and Walmart (WMT:NYSE) and transport companies, such as United Parcel Service (UPS:NYSE).

This list gives investors a starting point for stocks to research. The goal should be to narrow the options to a handful of companies that seem like good bets to ride the ChatGPT and AI trend.

On top of the usual analysis of a stock’s fundamentals and valuation, it is worth investigating whether each company has plans to leverage generative AI to enhance workforce productivity and/or shrink its workforce costs. This may be part of the thinking behind recent announcements from Vodafone (VOD) and BT (BT.A), which plan to cut 11,000 and 55,000 jobs respectively over the coming years.

Also keep in mind that NBER’s study focuses on

Sizing the prize: who will benefit the most from AI?

$7,000 billion

21.6% Total impact (% of GDP)

14.5% Total impact (% of GDP)

9.9% Total impact (% of GDP)

billion

11.5% Total impact (% of GDP)

5.4% Total impact (% of GDP)

billion

10.4% Total impact (% of GDP)

$1,200 billion

5.6% Total impact (% of GDP)

25 May 2023 | SHARES | 27

exposure

HIGH LOW Table: Shares magazine • Source: NBER

Map: Shares magazine • Source: PwC

CHINA

NORTH AMERICA

$3,700 billion

LATIN AMERICA

$500 billion

REST OF THE WORLD

NORTHERN EUROPE

$1,800 billion

SOUTHERN EUROPE

$700

DEVELOPED ASIA

$900

firms’ workforces but does not get into the product side of things. Generative AI has the potential not only to reduce labour costs and enhance employee productivity, but also to drive revenue growth by being integrated into existing or new products, and some companies have exposure to both, creating a potential double-whammy of value creation.

For example, creative design software firm Adobe (ADBE:NASDAQ) is one of the biggest potential beneficiaries should it choose to adopt generative AI internally and externally.

SIX STOCKS RELEVANT TO THE AI THEME

Founded in 2012, Upstart is an AI lending platform that partners with banks and credit unions to provide consumer loans using non-traditional variables, such as education and employment, to predict creditworthiness.

Upstart’s revenues have come under substantial pressure this year with the US banking sector thrown into crisis by Silicon Valley Bank’s collapse and sale. Revenue for the three months to 31 March fell 30% quarter-on-quarter to $103 million, a third the size of its $310 million the year before, but the growth trajectory could recover sharply once financial stability returns.

BAIDU (BIDU:NASDAQ)

C3.ai is a software company focused on developing enterprise-scale AI solutions, with products used in industries as diverse as healthcare, industrial automation and finance. C3.ai offers clients a range of AI products, allowing users to either develop their own code or take off-the-shelf solutions.

The suite of services is ideal for firms looking to get up to speed with the opportunities AI offers in their respective sectors. Firms should realise AI is an arms race and failure to adapt could put their very existence under threat. This makes C3.ai’s off-the-shelf software packages an option for operational functions that do not require recruiting legions of IT experts to use them.

The business remains loss-making for now but investors have been chasing the stock hard this year, fuelling a 141% rally since January.

Analysts think the Chinese company is a great play on rampant AI growth, with multiple catalysts looming for the company.

Baidu started out as China’s answer to Google, and it remains a significant player in internet

28 | SHARES | 25 May 2023 UPSTART (UPST:NASDAQ)

C3.ai (AI:NYSE)

C3.ai ($) 2021 2022 2023 0 50 100 150 Chart: Shares magazine • Source: Refinitiv Upstart ($) 2021 2022 2023 0 100 200 300 Chart: Shares magazine • Source: Refinitiv Baidu ($) 2019 2020 2021 2022 2023 0 100 200 300 Chart: Shares magazine • Source: Refinitiv

search, but its focus has broadened to cloud services are more recently, AI.

It has developed a rival to ChatGPT called Ernie with a plan to incorporate generative AI into its search engine and other products. It currently waiting for Chinese government approval to launch Ernie.

PEARSON (PSON)

process, allowing lawyers to do ‘billable’ work faster. Lawyers can then spend more time doing other duties like advising clients or performing other work.

Its Lexis+ AI system can provide legal summaries in seconds and it can also generate briefs and contract clauses.

The education publishing group is to use generative AI enhancements across key products. Pearson is hoping its AI strategy will attract a new student audience (and more subscriptions) who might ordinarily be tempted by chatbot learning through ChatGPT.

For example, in Pearson+, users will have access to a generative tool that automatically summarises the content of videos in simple bullet points and auto-generates quizzes.

It has developed proprietary predictive algorithms which assess trends in demand for skills and occupations globally, and recommend career and learning pathways for consumers, enterprises and governments.

RELX (REL)

RELX says the first AI-linked tools have been around in the legal world for more than a decade. However, the industry is now exploring the capabilities more seriously.

RELX’s recent financial results highlighted further diversification into higher growth analytics and decision tools.

For example, it is using AI to speed up the complex and time-consuming legal research

Regular users of Instagram and Facebook might wonder why they have been spending more time on the social media networks recently. That might be down to actions by the company which owns these platforms.

Meta has been using AI to suggest what it hopes are more relevant short-form videos for users. Increased engagement should equate to more exposure to advertising. Forty percent of Instagram content is now AI-recommended.

The company has also built custom computer chips to help with AI and videoprocessing tasks.

25 May 2023 | SHARES | 29

META PLATFORMS (META:NASDAQ)

Pearson (p) 20192020202120222023 0 500 1,000 Chart: Shares magazine • Source: Refinitiv RELX (p) 20192020202120222023 0 1,000 2,000 Chart: Shares magazine • Source: Refinitiv Meta Platforms ($) 20192020202120222023 0 100 200 300 Chart: Shares magazine • Source: Refinitiv

but are

up to the job?

The recent tightness in the UK’s labour market has impacted the country’s economic growth and the resulting spike in wage costs has also contributed to the core inflation number that keeps central bankers awake at night.

There has been much discussion about potential solutions to labour issues, from increased migration to more technological methods: automation, robotics and AI (artificial intelligence).

Recent advances in the latter have fuelled the imagination and sparked investor interest with tech players enjoying something of a renaissance as search engines become more intuitive and chips and processors become more responsive.

BT (BT.) recently announced it was looking to replace about a fifth of its customer service workers with AI and there have been warnings that ‘Tomorrow’s World’ could see more than 300 million jobs at risk.

UK prime minister Rishi Sunak has promised the country will take a leadership position when it comes to these sweeping technological advancements, and it was hot topic at the recent G7 summit. But it led me to ponder exactly what roles can’t be filled by tech.

ROBOTS IN REAL LIFE

On a recent trip to Belfast my pre-flight airport

burger was delivered to me by a very polite, very speedy robot. Only the accompanying glass of wine couldn’t be handed over, a real person had to check I was legally of age to imbibe.

But how long before that robot is kitted out with facial recognition software that can scan my all too visible crow’s feet and decide I am ‘of age’ – perhaps a better question is how long will it be before the law allows it?

Robotics and automation have a huge initial outlay so there has to be a real monetary gain in order for businesses to make this investment. At Belfast there are times the airport is almost empty and other times when every seat seems to be taken.

Paying for workers to stand around for hours makes little sense and few people are willing to turn up for a shift that’s just an hour or two long.

But robots don’t always provide the solution that business needs. The first incarnation of ‘Flippy’ the burger cook was turned off after just one day at the stove because it was too slow and required too much human assistance.

And a bakery in Barnsley made headlines back in 2009 when it turned on its robotic helper, which it hoped would decrease energy use and increase capacity in its ovens by 80%. The only problem was it just couldn’t stand the heat and when I returned to film at the bakery a few months later I found it had been quietly retired.

Danni Hewson: Insightful commentary on market issues 30 | SHARES | 25 May 2023

More companies are experimenting with robots in the workforce,

they

How robotics and AI might shake up the labour market

THE INVESTMENT PERSPECTIVE

There will be many examples of failures and no investor wants to end up wearing the emperor’s new clothes or finding themselves in the next dotcom bubble when it bursts.

Sector-specific ETFs (exchange-traded funds) are one way to get exposure while remaining diversified and increased headlines haven’t hurt the share price performance of three options since the start of the year (see table).

Like those EV start-up companies, robotics and AI operations can burn through capital to take an idea from the drawing board and into mainstream production. The aforementioned Flippy has since been reborn and Flippy 2 started service in the US in 2021 just as the post-Covid labour crisis was at its peak.

Retail investors cannot currently invest in Miso Robotics, the company behind Flippy 2 but the ETFs mentioned in the table have a wide variety of global players in their portfolios including Keyence (6861:TYO) and ABB (ABB:NYSE).

REPLACING HUMANS

The potential for the robotics and automation space is huge, especially at a time when migration is such a political hot potato.

Food growing, picking and production is an obvious area for investment and a new funding

Robotic ETFs: share price performance this year

round has just gone live to allow businesses to invest in new technologies that could fill skills and staffing gaps and ultimately help bring prices down for the consumer.

AI has further changed the game and there are now super-smart robots (named Tom, Dick and Harry) that can identify and zap weeds among crops which means the need for fewer herbicides, and prototypes have been created that could ultimately solve the crop-picking crisis.

Right now, like Flippy’s first incarnation, those prototypes can’t match the speed of human hands and a review last year into automation in farming found that it’s likely to take at least another five to seven years before the prototypes move to commercially-available options.

Productivity investment in robotics, AI and automation seems like a total no-brainer, but there are questions about the ultimate impact this shift will have on the global labour force. What jobs will be safe, what jobs will be created and what jobs will disappear from our vacancy lists?

Governments will have to step in to regulate this space and that’s something companies and investors will have to watch closely. But it seems ‘Tomorrow’s World’ is really upon us and rather like the internet before it, I doubt anything is likely to slow it down.

Danni Hewson: Insightful commentary on market issues 25 May 2023 | SHARES | 31

Global X Robotics & Artificial Intelligence UCITS ETF 29.1% iShares Automation & Robotics UCITS ETF 19.2% L&G ROBO Global Robotics and Automation UCITS ETF 14.3% As of 22nd May 2023 Table: Shares magazine • Source: Sharepad

Investing in gold miners: the stocks and funds that matter

We look at the key drivers for the gold price and the various ways to get exposure

In an environment of political, economic and market turmoil, the gold price is within touching distance of record highs and US precious metals miner Newmont (NEM:NYSE) recently sealed a blockbuster $19 billion takeover of Australian rival Newcrest Mining (NCM:ASX), bringing extra pizzazz to the sector.

Gold and its miners are clearly in the spotlight and encouragingly for investors who fear they may have missed the boat, valuations among small and medium-sized gold mining stocks have not kept pace with the surging price of the metal.