Paying for university

The investment plan to help your children graduate without big debts

best ways

VOL 25 / ISSUE 09 / 09 MARCH 2023 / £4.49

xxxxxxxxxx The hot topics and the

to invest SOFTWARE SECTOR REPORT

• China’s new 5% growth target underwhelms as its focus shifts to boosting consumption

• Aston Martin shares jump the gun in rush for profitable growth

• Shaftesbury focused on income growth and cost cutting as it completes Capco merger

• ASOS shares gain 80% year-to-date on growing turnaround hopes

• Fresnillo suffers as costs surge and precious metals lose some shine

12 GREAT IDEAS New: Harmony Energy Income Trust / Medica Updates: Cheniere Energy

16 FEATURE Find out which companies are planning double-digit dividend increases

20 FEATURE Paying for university: The investment plan so your children graduate without big debts

28 SECTOR REPORT Investing in the software industry

33 UNDER THE BONNET How new boss Tufan Erginbilgic can transform the fortunes of Rolls-Royce

37 EDITOR’S VIEW The UK stock market indices have a crisis on their hands

38 RUSS MOULD Should investors seek exposure to the FTSE 100? Here are the pros and cons

42 FEATURE What is ‘the 4% rule’ and is it still relevant to investors today?

45 ASK TOM What are the rules around adding cash to a SIPP in capped drawdown?

47 PERSONAL FINANCE Building a £1 million tax-efficient portfolio for your children

50 INDEX Shares, funds, ETFs and investment trusts in this issue

Contents 06 NEWS

42 47 09 March 2023 | SHARES | 03

28 06 20

SectorReport:Thesoftwareindustry

inHowyoucaninvest

21stcompaniesstate-of-the-artpoweringthe Centuryeconomy

whyShareslooksatthesoftwareindustry, itissoimportantandwhoarethemajorplayers Isensethasbeendifficulttoignoretherenewed marketsofoptimismcreepingintostockthisyear.Miseryhasbeenreplaced byawatchfulbrightness,andnowherehas thissheenreflectedbetterthanamongsoftware growthstocks. US-listedAftertumblingmorethanathirdin2022,the iSharesExpandedTech-SoftwareSectorETF(IGV:BATS) comprisedofmanyofthemajor asenterprisesoftwareplayers,wasup16%thisyear writeof2February.Itremainsabout11%aheadaswe Thatthisfeature(2March).comparestotheNasdaqComposite’s10.4%FTSEgainandthe4.1%advanceoftheS&P500.The The100isabout5%ahead.macroeconomicandgeopoliticalanxietiesof rates,thepastfewyears–soaringinflation,risinginterest war,recession,etc.–arestillrampantand feedinvestorworriesaboutweakeningbusiness spendingthataredampeningforwardexpectations. SOFTWAREISINLOCKSTEPWITHINFLATION, RATESANDEARNINGS whatSoftwareisasectorthatwalksinlockstepwith happenswithinflation,ratehikes(particularlybytheUSFederalReserve)and2023earnings andguidance.‘Investorsremainfocusedonmacrocommentary report.ITspendingpatterns,’saidanRBCCapitalMarketresearchfirmGartnerinJanuarycut itsforecastforgrowthin2023globalinformation technologyspendingbymorethanhalfto2.4%, addingupto$4.49trillion.

compared‘InJanuary,wesawhigherscrutinyonbudgets toDecember,resultinginadditional anddelaysinlargedeals,’saidJayChaudhry,chairman chiefexecutiveofcloudsecuritybusinessZscaler(ZS:NASDAQ) atthebeginningof March2023. WoodButthereisoptimismtoo.CowenanalystDerrick enterpriserecentlysurveyedtechdepartmentsonsoftwarespendingpriorities.‘Oursurveyprojects7.3%budgetgrowthin2023,amodest decelerationfrom8.3%in2022,’hesaid. vendorsAshasbeenthecasewithmanysoftware businessesduringthelatestearningsseason,aretakingmoretimetoscrutinisedeal arelengthsorsubscriptions,andsoftwarecompanies streamliningtheirownoperations,aworryforthepaceofgrowththrough2023. Yetsoftwarepenetratesvirtuallyeveryaspect bothofourlivesinthedigitalinformationageand systemsindividualsandbusinessesrelyonoperating andapplicationsthatmakessoftwareascrucialasoil,glassandsteel. industryForexample,virtuallyeverycompanyinevery isnowlookingtousesoftwaretoget andclosertoitscustomers,innovatemorequickly, embarkingoperatemoreefficiently.Manyfirmsare onmulti-yeardigitaltransformation, clouddistribution,e-commerceanddataanalytics ofprojects,areatleastinvestigatingthepotential andartificialintelligenceandmachinelearning, thisseemslikelytoaccelerateascompanies andgovernmentorganisationsadapttohybrid workenvironments.

Shares in the software sector have bounced back this year as investors focus more on the long-term opportunities

Read our sector report to learn more about the investment opportunities and our two favourite stocks

areFindoutwhichcompanies dividendplanningdouble-digit increases

Three important things in this week’s magazine 2 3

Someareplayingcatch-upafterthe thepandemicbutforothersitcouldbe signofthingstocomeT herehavebeensomenotabledividend knownincreasesinrecentweeksfromwellcompaniesonthestockmarket includinga31%hikefromadvertising groupWPP(WPP)whilebankinggiantHSBC (HSBA)raiseditsordinarydividendby28%on topofcommentsthatitmightpayaspecial hasdividendoncethesaleofitsCanadianbusiness Evencompleted. companymoreimpressively,miningservices WeirGroup(WEIR)liftedits2022 57%dividendby38%withthefinalpayoutincreasing Thisyear-on-yearafterpre-taxprofitjumped40%. articleexaminesrecenttrendsindividend Wepayoutstouncoverwhatmightbehappening. revealhowmanyoftheincreasedpayouts arerelatedtoapost-pandemiccatch-upand thereforeaone-off,andhowmanyaregenuine step-upincreases. promisingFinally,weidentifycompanieswhichare bigincreasesbutattheexpenseof reducingdividendcover(theratioofearningsto dividendspaid)andthereforemaybelessreliable. ODDTIMINGTOLIFTDIVIDENDS Risingdividendsareagoodindicatoroffinancial

Payingfor university

healthandgiveinvestorsapositivesignalabout prospects.Managementsarereluctanttoraise dividendsoneyearonlytocutthemthenextwhich dentsshareholderconfidence. However,therecentsplurgeindividendscomes atacurioustimegiventheuncertaineconomic arebackdrop.Risinginflationandhigherinterestrates geopoliticsputtingastrainonconsumerspendingwhile Therefore,addsfurtherrisktothegrowthoutlook. itfeelslegitimatetoaskwhysome thecompanieswouldcommittolargeincreaseswhen futureissouncertain.Eitherbusinessisgood, andtheeconomyisstrongerthanmanybelieve,or dividendincreasesarenotsustainable. WHICHCOMPANIESHAVEGENEROUS DIVIDENDGROWTHFORECASTS? UsingSharepad,SharesscreenedtheFTSE350 indexexcludinginvestmenttrustsforcompanies

Double-digit dividend growth has become a common theme this year among large cap stocks

We explore the announcements to see if this is the new normal or whether companies are simply playing catch-up from the pandemic

The planinvestment childrensoyourgraduate withoutbigdebts

WithtuitionfeesinEnglandcurrently yearstandingat£27,500forathreechildrencourse,or£9,250ayear,your mightneedafinancial weleg-upwhentheygotouniversity.Fearnot,as It’shaveaplan. significanteasytoseewhystudentsgraduatewith debts,particularlyastherearerent fees.andgrocerycoststoconsiderontopoftuition However,withsomesensibleplanningand areasonableamountoftime,itispossiblefor parentstosaveandinvestmoneysotheirchildren graduatedebt-freeorwithaslittledebtaspossible. Here’showyoumightdoit.

BySabuhiGard DanielCoatsworthandTomSieber

Visit our website for more articles

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

8.8% 2022 total return

CURRENT TUITION COSTS UKTuitionfeesvarydependingonwhichregionofthe youlivein.InEngland,annualfeesarecapped at£9,250forUKandIrishstudentsuntil2025. country,Scottishstudentscanstudyforfreeintheirhome butoutsidersmustpay£9,250.InWales

yearlytuitionfeesare£9,000ayear.Ifyouarefrom NorthernIrelandandyourchildrenarestudying there,tuitionfeesare£4,395peryear. subjectTuitionfeescanalsovary,dependingonwhat example,yourchildrenstudyatuniversity.For medicineandveterinarymedicine coursesarelonger–betweenfiveorsixyears.CURRENT ACCOMMODATION COSTS Whensavingforyourchildrenitisimportantto factorinstudentaccommodationcosts.Thesevary dependingonthelocationandthetypeofhousing. UnionAccordingtoaUnipolandtheNational weeklyofStudentssurvey,theaveragecostfor accommodationrentintheUKinpurpose-builtstudent for2021-2022was£166. forPrivateaccommodationaveraged£155aweek London,anen-suiteroomand£228forastudio.In universitytheaveragewas£212perweekforaccommodationand£259forprivately-ownedproperty.

Saving just over £500 a month over 10 years could help your child graduate from university with minimal debt

We look at the costs of higher education and ways in which you can invest money to pay for tuition and accommodation

Greggs outlines ambitious growth plans as sales soar in early part of 2023

Contents 1 09March2023 SHARES 29

09March2023 SHARES 17

20 | SHARES 09March2023

Global income star Murray International proposes 5-for-1 share split after

Rightmove shares dip as in-line results leave investors unmoved

Where the market is placing bets if TikTok receives US ban

04 | SHARES | 09 March 2023

WE’LL FOCUS ON THE DIVIDENDS, YOU ENJOY THE COMMUTE

The Merchants Trust PLC

The Merchants Trust aims to provide an above average level of income that rises over time. So whilst we focus on investing in large UK companies with the potential to pay attractive dividends, you can focus on travel, family, home, retirement – whatever really matters to you. Although past performance does not predict future returns, we’ve paid a rising dividend to our shareholders for 40 consecutive years, earning us the Association of Investment Companies’ coveted Dividend Hero status. Beyond a focus on dividends, Merchants offers longevity too. Founded in 1889, we are one of the oldest investment trusts in the UK equity income sector. To see the current Merchants dividend yield, register for regular updates and insights, or just to find out more about us, please visit us online.

www.merchantstrust.co.uk

INVESTING INVOLVES RISK. THE VALUE OF AN INVESTMENT AND THE INCOME FROM IT MAY FALL AS WELL AS RISE AND INVESTORS MAY NOT GET BACK THE FULL AMOUNT INVESTED.

A ranking, a rating or an award provides no indicator of future performance and is not constant over time. You should contact your financial adviser before making any investment decision. This is a marketing communication issued by Allianz Global Investors GmbH, an investment company with limited liability, incorporated in Germany, with its registered office at Bockenheimer Landstrasse 42-44, D-60323 Frankfurt/M, registered with the local court Frankfurt/M under HRB 9340, authorised by Bundesanstalt für Finanzdienstleistungsaufsicht (www.bafin.de). The summary of Investor Rights is available at https://regulatory.allianzgi.com/en/investors-rights. Allianz Global Investors GmbH has established a branch in the United Kingdom deemed authorised and regulated by the Financial Conduct Authority. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website (www.fca.org.uk).

THIS IS A MARKETING COMMUNICATION. PLEASE REFER TO THE KEY INFORMATION DOCUMENT (KID) BEFORE MAKING ANY FINAL INVESTMENT DECISIONS.

China’s new 5% growth target underwhelms as its focus shifts to boosting consumption

Mining stocks fall back on implications for commodities demand

New Chinese guidance for GDP (gross domestic product) growth has checked some of the optimism over any boost from the country’s reopening and hit shares in resources stocks given the implications for commodities demand.

China’s GDP growth of 3% for 2022 was the lowest since 1976 as it struggled with lockdowns and weakening demand for exports.

Many economists were expecting a strong rebound in 2023 as the economy emerges from its restrictive zero-Covid policy.

It therefore comes as quite a shock to see the new growth target announced at the National People’s Congress set at just 5% which is at the bottom end of market expectations according to a Reuters report.

While the initial stages of China’s growth in the late 20th and early 21st centuries were focused on building infrastructure and new cities to pull people out of rural areas the hope is that future growth will be driven by increased consumption.

China’s latest efforts to spur consumption are intended to bring its economy in line with most western economies where consumer spending makes up around two thirds of GDP.

Outgoing Chinese premier Li Keqiang said: ‘The incomes of urban and rural residents should be boosted through multiple channels. We should stabilise spending on big-ticket items and promote recovery in consumption of consumer services.’

The budget deficit as a percentage of GDP was increased from 2.8% in 2022 to 3%. Former Shanghai party chief Li Qiang, an ally of president Xi Jinping, is expected to be confirmed as the new premier imminently.

Other reform-oriented policy officials are set to retire, allowing more Xi loyalists to take the reins and strengthening his grip on power after winning a third term at October’s Communist Party Congress.

Long-time emerging markets investor Mark Mobius, previously bullish on China, told Fox Business on 2 March the Chinese government has restricted the flow of money out of the country, leaving him unable to get his own cash out, and warned investors of barriers being imposed. Claims which have been denied by Beijing.

In a worrying sign of increasing geopolitical tensions, in particular over Taiwan, the military budget was increased from 7.1% to 7.2% of GDP with the armed forces urged to devote more energy towards combat preparedness.

One of the many challenges facing the economy is demographics with the population shrinking for the first time in 2022 since the 1960s. Chinese officials said it plans to tackle falling fertility by reducing the costs of childbirth and education. [MG]

News 06 | SHARES | 09 March 2023

China

(%) 199520002005201020152020 0 10 Chart: Shares magazine • Source: Refinitiv

GDP (% change year-onyear)

Aston Martin shares jump the gun in rush for profitable growth

Investors have got ahead of themselves as debt and cash flow worries could still stall volume and pricing progress

Share prices often move up or down but the rally in those of Aston Martin Lagonda (AML) in recent months has left investors and analysts dumbfounded. Since early November 2022, the stock has soared 235%, a run that has added nearly £1.5 billion to the luxury car maker’s market valuation.

There’s clearly more going on than retail investors getting excited about Fernando Alonso’s podium finish at the Bahrain Grand Prix on 5 March, as had been suggested.

Analysts at investment bank Jefferies believe the stock has jumped the gun, cautioning that paying off debt and sustaining growth while funding a shift to electric will be a tough task to pull off.

‘The path to organic deleveraging is unclear with more capital likely needed to fund electrification investments,’ the analysts said. ‘Given market and execution risks we would look for more attractive entry points (for the shares).’

Jefferies has cut 2023 volume estimates for the sports car maker by 5% to just above 7,000 units, still up 9% on last year’s 6,412, citing an expected rise in debt to £900 million by the end of this year.

On 1 March, Aston Martin reported fullyear revenues of £1.38 billion for 2022, a 26% rise

Aston Martin Lagonda

versus 2021. That is partly down to the mix of models but also points to the pricing power the luxury brand enjoys. It can push up prices for its deep-pocketed customers and still grow sales volumes.

In the fourth quarter of 2022, Aston Martin sold 2,352 cars, a 22% year-on-year increase on 2021’s 1,928 vehicles, that helped sales surge 46% to £524 million. This is good news for the company and investors, as is confidence in its target of around 10,000 wholesale car sales volumes in time, although it did quietly drop the 2024/25 date previously attached to that ambition.

Aston Martin still hopes to hit around £2 billion of revenue and £500 million of adjusted EBITDA (earnings before interest, tax, depreciation and amortisation) by then.

In the context of past share price performance, there are reasons to be less sceptical, if not entirely cheerful. ‘The company is at least trying to get things moving in the right direction, investing in new vehicles to help capitalise on what is still a brand with wide appeal among motorheads,’ said Russ Mould, investment director at AJ Bell.

Jefferies dubbed the results ‘a treat’, but pointed to ‘mixed details’ and is forecasting free cash flow to remain negative in 2023. Aston Martin burned through nearly £300 million of free cash in 2022. Jefferies also doesn’t see pre-tax earnings break even until 2024. [SF]

DISCLAIMER: AJ Bell owns Shares magazine. The author (Steven Frazer) and article editor (Daniel Coatsworth) owns shares in AJ Bell.

News 09 March 2023 | SHARES | 07

(p) Apr 2022 JulOctJan 2023 100 200 300 Chart: Shares magazine • Source: Refinitiv

Shaftesbury

focused on income growth and cost cutting as it completes Capco merger

This week marks the start of a new chapter for the UK property sector with the completed merger of London’s West End landlord Shaftesbury and rival Capco.

Shaftesbury, which first listed in 1987, was formed by the Levy family as a vehicle to invest in areas such as Carnaby Street, Chinatown and Seven Dials, and brings to the marriage two million square feet of lettable space including over 600 cafes, pubs, bars and restaurants as well as offices and posh apartments.

Capco – previously known as Capital & Counties – is much older, having been established with a portfolio of properties in London and the Home Counties in 1933, but it only hit the headlines in 2006 when it acquired the iconic Covent Garden market and piazza along with several neighbouring properties.

The newly merged group, which is now known as Shaftesbury Capital (SHC), is a mixed-use real estate investment trust with a portfolio of 2.9 million square feet of prime rental space in some of London’s most vibrant areas, including Soho and Fitzrovia.

Its asset base, valued at £4.9 billion, is split roughly one-third retail, one-third hospitality and one-third office and residential.

The old Shaftesbury shares have been delisted and Capco has issued new equity, with Shaftesbury investors receiving new shares in Capco (albeit now under the name of Shaftesbury Capital) into their account on or after 6 March, but in any event no later than 20 March.

In order to deliver value to shareholders, the managers of the merged company have two major tasks ahead of them, cutting costs while at the same time growing revenues.

Integrating the two businesses to create a ‘stronger operational platform of scale and efficiency’ is set to deliver £12 million of recurring pre-tax cost savings from the end of the secondyear post-completion. Meanwhile, the managers claim the portfolio has ‘significant revenue growth potential, to be delivered through incremental asset management opportunities, dynamic leasing and strategic consumer marketing strategies, enhanced connectivity of adjacencies, leveraging insights from its improved access to valuable data and cross-location marketing opportunities’.

At the start of this month, Capco reported an increase in net rental income of 17% to £57.2 million for 2022 but a loss for the year of £212 million against a profit of £34.8 million in 2021.

Also, group net debt and gearing rose last year –especially for assets in Covent Garden – while cash on hand and undrawn facilities shrank, so there is a lot riding on management’s ability to continue growing its income while cutting costs. [IC]

News 08 | SHARES | 09 March 2023

The management team has a full in-tray and a lot to prove to investors

ASOS shares gain 80% year-todate on growing turnaround hopes

The website for fashion-loving 20-somethings has rallied hard on hopes of better news flow ahead

While shares in ASOS (ASC) are down almost 90% on a five-year view, the once-mighty online fast fashion retailer has rallied 80% so far this year amid a broader retail sector bounce-back driven by the lessening risk of an economic hard landing.

ASOS reported a ‘significant improvement in profitability’ with its Christmas trading statement on 12 January, which helped to reignite investor interest following a disastrous period for the website for fashion-loving 20-somethings, whose shares cratered as competition, slowing sales growth, warehouse issues and supply

chain problems conspired to drive earnings downgrades.

Now, investors are hoping ASOS’ ‘Driving Change’ commercial and turnaround strategy under a new management team led by CEO José Antonio Ramos Calamonte, which includes a £300 million cost savings plan, combined with fading margin headwinds,

Fresnillo suffers as costs surge and precious metals lose some shine

Mexican miner’s operational performance has also disappointed the market

Mixed precious metals prices and disappointing operational news mean Fresnillo (FRES) shares have had a very poor start to 2023, down more than 17%.

Focused on Mexico, the miner is the world’s largest producer of silver

from ore and has significant gold output. Prices for both metals have been volatile amid an uptick in bond yields on expectations interest rates might be higher for longer.

can drive improved profitability and cash generation in the year ahead and beyond.

The Topshop and Miss Selfridge brands owner’s first-half results on 10 May will include an update about March and April trading as well as further details about the progress made against the Driving Change agenda. [JC]

DOWN in the dumps

Fresnillo has been the author of its own misfortune too. An operational update on 25 January revealed silver production for the final three months of 2022 of 12.5 million ounces, short of Berenberg’s 13.7-million-ounce forecast. The amount of metal contained within the ore at its flagship Fresnillo mine

has also been below expectations.

At the same time the company is being hit by higher costs with adjusted production costs up as much as 20% as more ore was processed, it faced wider inflationary pressures, increased waste material was charged to costs and maintenance spend went up.

Full year results on 7 March showed profit more than halved to $248.6 million in 2022, thanks to these pressures. [TS]

News 09 March 2023 | SHARES | 09

Fresnillo (p) Jan 2023 Feb Mar 750 800 850 900 950 Chart: Shares magazine • Source: Refinitiv

ASOS (p) Jan 2023 Feb Mar 500 600 700 800 900 Chart: Shares magazine • Source: Refinitiv HIGHER Moving

UK UPDATES OVER THE NEXT 7 DAYS

FULL-YEAR RESULTS

13 March: Direct Line Insurance, HGCapital Trust, Phoenix, MTI Wireless

14 March: Gresham Technologies, Midwich, Genuit, Yu Group

15 March:

Prudential, Keywords Studios, 4Imprint Group, Ferrexpo, Advanced Medical Solutions, Foresight Solar, Balfour Beatty, Marshalls.

16 March: Empiric Student Property, OSB, Bridgepoint, TI Fluid Systems, Rentokil Initial, Deliveroo, Gem Diamonds, Savills, Centamin, Restore, The Gym Group.

HALF-YEAR RESULTS

13 March: Nightcap

14 March:

Litigation Capital Management, Eagle Eye Solutions, Close Brothers, Virgin Wines UK

16 March: Gelion

TRADING UPDATES

16 March: Investec, Halma

Can the insurer win back the market’s support after dividend fiasco?

Having paid out over £1.5 billion to shareholders in the last decade, including during the pandemic, Direct Line (DLG) was a well-liked and widely-owned stock. However, after dropping a bombshell in January with the news it was pulling its dividend in order to rebuild its balance sheet, Direct Line has a mountain to climb to win back the market’s confidence this month.

Deliveroo

Expectations for the takeaways platform turn to profitable growth, not at any price

Investors have had their fill of growth at any price talk, now it’s time for food delivery platform Deliveroo (ROO) show that this is not halfbaked optimism. Core profit margin is expected to be higher than previous guidance, something to lift the spirits, yet there is a long way to go before the company is making anything like the big profits which have long been promised. Details will come alongside full year results on 16 March, but with the stock down 75% since summer 2021, the jury remains out. [SF]

With the shares nearly 25% below their early January level of 230p, investors will be hoping the worst is priced in when the company reports its full-year results on 13 March. January’s warning was precipitated by a ‘perfect storm’ of higher weather-related property claims, more frequent and more costly motor-related claims and a sharp drop in the value of the firm’s property investment portfolio in the final quarter of 2022 after the disastrous ‘mini-Budget’. [IC]

News: Week Ahead 10 | SHARES | 09 March 2023

FedEx

The deliveries and logistics firm is a good bellwether for the wider economy

Often seen as a good indicator of the health of the wider economy thanks to the breadth of its exposure across areas like transportation, logistics

Adobe

and e-commerce, delivery firm FedEx (FDX:NYSE) will be watched closely when it reports on 16 March.

The last two quarterly updates were Jekyll and Hyde with the company warning on profit and removing guidance in September before announcing better-than-expected second quarter numbers in December

and restoring annual earnings guidance.

FedEx has steered for earnings per share between $13 to $14 for the 12 months to 31 May 2023. Based on the $6.40 reported in the first half this means earnings will have to accelerate in the second half to hit even the lower end of that total. [TS]

US UPDATES OVER THE NEXT 7 DAYS

QUARTERLY RESULTS

Guidance and Figma news will drive the shares

It could be a tough day on 16 March for creative software giant Adobe Systems (ADBE:NASDAQ) as investors nervously eye first-quarter 2023 earnings, but it won’t be the reported figures moving the share price. Guidance for the rest of the year will power the market’s mood, that and any update on proposed acquisition Figma. The stock has been depressed for several weeks as doubts creep in that the US Department of Justice could block Adobe’s £20 billion purchase of the start-up. [SF]

10 March:

AIA, DocuSign

13 March:

Getty Images

16 March:

Adobe, Dollar General, FedEx

EUROPEAN UPDATES OVER THE NEXT 7 DAYS QUARTERLY RESULTS

14 March:

Volkswagen

15 March:

BMW, EON, Inditex

News: Week Ahead 09 March 2023 | SHARES | 11

Harmony Energy Income Trust is a battery play with real dividend appeal

The trust yields 6.5% and has several assets coming on stream in the next two years

If the world is going to make the transition from fossil fuels to renewables, then batteries and battery technology are going to play an important part.

Harmony Energy Income Trust (HEIT) is an attractive way to play this long-term theme while also offering a generous income in the here and now.

At present just one of the firm’s battery assets is operational, the 98 MW (megawatt) Pillswood project in Yorkshire, the largest of its kind in Europe.

However, its Broadditch asset in Kent is set to become operational in the next few weeks, and as more come on stream over the next 18 months to two years, we would expect the trust’s valuation to grow. Harmony currently trades at a 1.2% discount to net asset value and offers a prospective yield of 6.5%. Dividends are paid quarterly. The ongoing charge is 1.28%.

Some people may be under the illusion batteries are located on site at a wind or solar farm and store energy from the relevant panels or turbines. There are what are called ‘co-located assets’, and some are in the trust’s own pipeline, but most batteries are just connected directly to the grid and are used to help balance supply and demand for the network operator, National Grid (NG.)

It is these connections, of which Harmony has several, which are its real competitive advantage and a genuine barrier to entry given, as manager Paul Slade observes, if you were applying for grid connections with National Grid now ‘you’re not going to get anything this side of 2030’.

This mitigates any concern about developments in battery technology rendering any of Harmony’s assets obsolete as the connections to the grid will always be valuable. And, in any case, as it stands Harmony has a technological advantage given all of

HARMONY ENERGY INCOME TRUST

(HEIT) Price: 122.8p Market cap: £278 million

its batteries have two-hour duration, where many others have just one.

Harmony makes money in three ways. Ancillary services (selling energy from batteries through short-term contracts), capacity market (an insurance policy on the part of the grid to protect against blackouts) and arbitrage. It is in the latter where the extra duration of its batteries really pays off. Buying power cheaply overnight to store and selling it at peak times in the evening, Harmony’s two-hour duration means it has twice as much power to trade with.

Slade adds the development of batteries is running behind that of renewables which should result in attractive market dynamics for the trust. It also benefits from access to an extended pipeline of assets being progressed by its parent Harmony Energy, a battery, solar and wind farm developer. [TS]

Harmony Energy Income Trust

Great Ideas: Investments to make today 12 | SHARES | 09 March 2023

(p) Oct 2021 Jan 2022 AprJulOctJan 2023 100 110 120 Chart: Shares magazine • Source: Refinitiv

Medica: the small cap with underappreciated opportunities

The company has successfully diversified and increased the quality of its earnings growth

Over the past five years teleradiology services company Medica (MGP:AIM) has more than doubled sales and profit yet the shares are trading roughly where they were in March 2018.

The shares have derated from over 30 times earnings per share to the current 18.5-times. It might be tempting to conclude that growth potential has diminished, but that isn’t the case.

Numis analysts estimate sales and operating profit could grow by a compound annual growth rate of 16% and 17% respectively between 2021 and 2024.

The shares trade on a 2023 estimated free cash flow yield of 5.8% according to Numis’ estimates and the company remains in a net cash position.

Shares believes there is good potential for double digit shareholder returns over the next few years driven by the fundamentals of the business.

In addition, if the shares continue to languish, they may attract takeover interest. Strategic Equity Capital (SEC) fund manager Ken Wotton told Shares that Medica trades at a big discount to the takeover valuations of previous deals in the sector.

Fundamentally there continues to be a big gap between the demand and supply of qualified radiologists which creates an opportunity for Medica.

In a full year trading update (17 January) the company said it had seen a strong recovery in radiologist reporting capacity from September 2022 onwards.

The UK business (70% of revenues) experienced a robust recovery in elective procedures and notched-up net new contract wins and extensions of service agreements as the NHS deals with exceptional patient demand.

The company’s after-hours Nighthawk services business achieved double digit sales growth in 2022 and is well placed to deliver future growth.

Over the last year 65% of contracts have been

MEDICA (MGP:AIM)

Price: 164p

Market cap: £199 million

renewed and with an average contract length of three to five years coupled with new contract wins, momentum remains positive.

Businesses outside the UK which include Medica Ireland and US company RadMD both experienced strong growth in 2022 driven by increased contract wins. Medica Ireland saw a significant increase in the number of new out-of-hours teleradiology hospital clients.

Numis continues to see opportunity for Medica to leverage its brand and network to increase its range of telemedicine services as well as expanding into new geographies.

Medica acquired RadMD in early 2021 and it has since demonstrated significant sales growth and developed a more diversified order book including new pharmaceutical and biotechnology companies. Furthermore, it continues to evaluate strategic acquisition opportunities to expand the scale and therapeutic focus of its clinical trials imaging business. [MG]

Great Ideas: Investments to make today 09 March 2023 | SHARES | 13 Medica (p) 201820192020202120222023 100 150 200 250 Chart: Shares magazine • Source: Refinitiv

Cheniere Energy outlines big expansion plans for the future as LNG profit surges

Exporting plentiful US natural gas is proving highly lucrative for the company

Cheniere

We flagged Cheniere Energy (LNG:AMEX) on 3 March 2022 as a potential beneficiary of Europe’s need to wean itself off Russian gas as the LNG (liquefied natural gas) specialist increased its volume of exports. Cheniere buys natural gas in the North American market and transports it to two hubs on the country’s Gulf Coast where it is processed into LNG and loaded onto vessels.

WHAT HAS HAPPENED SINCE WE SAID TO BUY?

Our reasoning has proved sound even if the shares have retreated from the highs seen in the autumn as a mild winter in Europe meant gas demand was lower than expected. There is still a big differential between US gas prices and the rest of the world and this has positive implications for

Cheniere’s profitability.

This was reflected in better-than-anticipated fourth quarter results with earnings per share of $1.87 compared with the $1.72 pencilled in by analysts. Revenue for the period was also higher than the forecast $4.38 billion at $4.72 billion.

The company signalled its own expectations for lasting demand with plans for a 74% increase in capacity at its Sabine Pass plant by the end of 2030.

Jefferies analyst Sam Burwell says Cheniere’s first mover advantage ‘gives it a leg up in contracting and self-funding growth projects’.

He adds that this ‘should help sustain its position as the largest US liquefication player generating strong returns on capital and consistent cash flows’.

‘Helped by this virtuous circle, we believe Cheniere will be well positioned to return cash to shareholders through growth spending and commodity cycles,’ he concludes.

WHAT SHOULD INVESTORS DO NEXT?

Cheniere shares do not look overly expensive, trading on 10.6 times Jefferies 2023 forecast earnings per share of $14.70 and we think the longterm potential for the stock remains significant so keep buying.

While countries are looking to transition away from fossil fuels, natural gas and LNG will continue to play an important role. [TS]

Great Ideas Updates 14 | SHARES | 09 March 2023

Gain to Date: 18% Cheniere Energy ($) 2022 2023 60 80 100 120 140 160 Chart: Shares magazine • Source: Refinitiv

Energy (LNG:AMEX) $156.55

Finding Compelling Opportunities in Japan

Asset Value Investors (AVI) has been finding compelling opportunities in Japan for over three decades. Despite a year filled with challenges and volatility, Japanese equities fared relatively well.

Many investors may be surprised to hear of Japan’s resilience during what was a difficult year for global equity markets. After all, Japan has suffered from stagnant growth and an ageing population for a prolonged period of time. However, Japan has a relatively stable economy and the attitude towards corporate governance has improved significantly since the onset of ‘Abenomics’. Japan is now the world’s second largest activist market. Activist events have risen 110%* over five years, as pressure from shareholders continued to intensify. This was accompanied by a surge in corporate buybacks as cash was returned to investors.

Excess cash is one of the things that the investment team at Asset Value Investors (AVI) look for in Japan. AVI’s portfolio of 20-25 stocks are all companies that have been thoroughly examined by the investment team to find value, quality, and an event to realise the upside. Key to the strategy is to build relationships with company management, actively working together to improve shareholder value. While AVI can launch public campaigns, it aims to work behind closed doors with management to find mu-

tually beneficial solutions. The depth of the investment team provides AVI the resources to undertake detailed and targeted research.

In 2022, our engagement was mostly behind the scenes. Over 120 meetings were held with 26 portfolio companies and 24 detailed letters or presentations were sent to these companies. This engagement is well supported by the broader changes in the attitudes of Japanese management as they are encouraged by the Japanese Corporate Governance Code to better allocate capital. The result is long term sustainable improvements in returns for investors.

As anyone who has invested in Japan will know, change takes time. Discovering

overlooked and under researched investment opportunities requires a long-term approach. A long-term time horizon aligns AVI with the interests of the management to work together on creating shareholder value.

The companies AVI invests in have cash on their balance sheets and attractive business models with either stable earnings or structural growth trends to ensure corporate value is growing.

In 2018, AVI launched the now c. £149m* AVI Japan Opportunity Trust (AJOT). The strategy’s first four years bears witness to the success of this approach, with a strong NAV total return and outperformance of its Japan small-cap benchmark. AVI’s aim is to be a constructive,

stable partner and to bring our expertise – garnered over three decades of investing in Japan. We are optimistic about the macro environment in Japan. The weak Yen makes Japan highly cost-competitive, both for tourism and manufacturing. Our portfolio includes a variety of sectors, with strong exposure to the domestic Japanese economy. Inflation has returned after a 40-year absence and with wage growth and increased spending, we expect to see better allocation of capital and improved productivity, which would support returns for investors. AVI is well positioned to capture this long-term opportunity with a unique investment approach and established track record.

*Source CLSA and AVI, as at 31 December 2022. Past performance should not be seen as an indication of future performance. The value of your investment may go down as well as up and you may not get back the full

by Asset Value Investors Ltd who are authorised and regulated by the Financial Conduct Authority. Discover AJOT at www.ajot.co.uk

amount invested. Issued

Find out which companies are planning double-digit dividend increases

Some are playing catch-up after the pandemic but for others it could be the sign of things to come

There have been some notable dividend increases in recent weeks from wellknown companies on the stock market including a 31% hike from advertising group WPP (WPP) while banking giant HSBC (HSBA) raised its ordinary dividend by 28% on top of comments that it might pay a special dividend once the sale of its Canadian business has completed.

Even more impressively, mining services company Weir Group (WEIR) lifted its 2022 dividend by 38% with the final payout increasing 57% year-on-year after pre-tax profit jumped 40%.

This article examines recent trends in dividend payouts to uncover what might be happening. We reveal how many of the increased payouts are related to a post-pandemic catch-up and therefore a one-off, and how many are genuine step-up increases.

Finally, we identify companies which are promising big increases but at the expense of reducing dividend cover (the ratio of earnings to dividends paid) and therefore may be less reliable.

ODD TIMING TO LIFT DIVIDENDS

Rising dividends are a good indicator of financial

health and give investors a positive signal about prospects. Managements are reluctant to raise dividends one year only to cut them the next which dents shareholder confidence.

However, the recent splurge in dividends comes at a curious time given the uncertain economic backdrop. Rising inflation and higher interest rates are putting a strain on consumer spending while geopolitics adds further risk to the growth outlook.

Therefore, it feels legitimate to ask why some companies would commit to large increases when the future is so uncertain. Either business is good, and the economy is stronger than many believe, or dividend increases are not sustainable.

WHICH COMPANIES HAVE GENEROUS DIVIDEND GROWTH FORECASTS?

Using Sharepad, Shares screened the FTSE 350 index excluding investment trusts for companies

16 | SHARES | 09 March 2023 Feature: Dividend growth

forecast to increase their dividend by more than 10%.

This group was then sorted by the growth rate in dividends since 2019 to see which companies had reached pre-pandemic payout levels and those which fell short.

The next step was to compare current dividend cover for each firm to separate companies which have reduced dividend cover from those where cover has been maintained or increased. These steps created three groups of companies.

DIVIDENDS HIGHER THAN PRE-PANDEMIC

This grouping had the largest number of companies and the table shows a selection of those with the biggest expected dividend increases this financial year.

The fact that some of the big banking groups feature on the table shouldn’t be a surprise given they are benefiting from rising interest rates which bolster their interest margin and cash generation. The Bank of England has increased its base rate from a 0.25% to 4% in less than a year.

According to Credit Suisse analyst Omar Keenan, UK banks are expected to return 17% of their market value to shareholders over the next 12 months and this rises to 25% in 2024.

Continued dividend hikes are more likely than not in the next couple of years from the banking sector, although the risk of higher bad debt provisions if the economy falters should also be noted.

Software and technology firms are usually owned for their growth potential so it is noteworthy that digital transformation specialist Kainos (KNOS) is on the list of substantial dividend growers.

Kainos’ dividend is expected to increase 13% in the year to 31 March 2023 and 11% in 2024 which puts the dividend 170% above pre-Covid levels.

The same comments can be made for IT reseller Softcat (SCT) where its dividend is expected to be hiked 62% in the year to 31 July 2023 which takes it 160% above pre-pandemic levels.

Looking at Softcat’s recent dividend history, a casual observer may conclude the business was unaffected by the pandemic as the company delivered an uninterrupted increase throughout the whole period. In fact, Softcat has notched up 68 consecutive quarters of organic sales and profit growth.

Examples of companies with dividends higher than prepandemic

CATCH-UP HIKES

The firms on this table are all expected to hike their dividends strongly, but investors should not read too much into the trend as it is related to rebuilding the payout back to levels seen before the pandemic.

Weir sits in this group; despite recently saying it would pay 32.8p in dividends for the 2022 financial year, this remains below the 46.2p per share paid for 2018.

Likewise, high street and travel retailer WH Smith (SMWH) is seeing a strong post-pandemic recovery as global travel returns to normality, but there is more work to do to rebuild the dividend which remains half the level paid in 2019.

Like many of the names on the tables in this article, it is worth remembering that WH Smith issued new equity during the pandemic to shore

09 March 2023 | SHARES | 17 Feature: Dividend growth

NatWest 26% 691% Glencore 33% 501% Kainos 13% 170% Softcat 62% 160% Lloyds Banking 17% 155% 4imprint 287% 146% Centrica 20% 140% Dunelm 52% 118% YouGov 20% 110% Savills 72% 108% HSBC 82% 107% JD Sports Fashion 50% 100% Name Forecast dividend growth for next year to be reported Difference in dividend versus 3 years ago

Table: Shares magazine • Source: Sharepad, Shares magazine, Company websites

Catch-up dividend hikes

earnings which has increased the dividend cover.

Shell has moved from a wafer-slim one times coverage in 2019 to nearly four-times. Similarly, BP has gone from an uncovered dividend to around fourtimes. It suggests both companies believe current elevated profitability is likely to be short-lived.

HIKES DIVIDEND BUT COVER IS FALLING

The smallest group comprises companies which have rebuilt their dividends to higher levels than pre-pandemic but reduced their dividend cover.

Cover is generally healthy across the group above three times earnings, suggesting these firms have historically paid out less of their earnings as dividends and are now increasing the ratio.

For example, Asian bank Standard Chartered (STAN) is expected to increase its dividend by 25% this year to a level which is 220% above 2019, but the cover falls from 10.7-times to 5.5-times.

It is the same story for Barclays (BARC) which has seen its dividend cover fall from 4.6-times to 3.6-times and dividends increase 207% in the last three years.

Dividend growth and lower cover

up its balance sheet. By having more shares in issue, the dividend money needs to be spread across a larger pool of shares so investors might want to look at the overall monetary amount paid in dividends rather than just the per share amount when doing year-on-year comparisons. Increased share count will reduce the amount paid in dividends per share unless the overall dividend pot is bigger.

Oil majors BP (BP.) and Shell (SHEL) have seen a huge increase in profit related to the surge in oil and gas prices following the war in Ukraine. Both firms have used share buybacks to reward shareholders and increased dividends less than

By Martin Gamble Education Editor

18 | SHARES | 09 March 2023 Feature: Dividend

growth

Standard Chartered 25% 221% JTC 25% 220% Barclays 28% 207% Learning Technologies 30% 160% Balfour Beatty 11% 108% OSB 17% 108% Name Forecast dividend growth for next year to be reported Difference in dividend versus 3 years ago

Table: Shares magazine • Source: Sharepad, Shares magazine, Company websites

WH Smith 220% −50% Mediclinic 107% −22% Whitbread 65% −33% ITV 52% −38% Weir 31% −33% TP ICAP 19% −25% Morgan Advanced Materials 19% −2% Melrose Industries 17% −59% IMI 16% −32% Prudential 14% −69% Hiscox 13% −9% Shell 12% −34% SSE 11% −2% Pennon 10% −31% BP 10% −32% Name Forecast dividend growth for next year to be reported Difference in dividend versus 3 years ago

Table: Shares magazine • Source: Sharepad, Shares magazine, Company websites

Think Beyond Ordinary Tech Funds

As the world becomes digitised, protecting valuable and sensitive data is increasingly essential.

Cybersecurity UCITS ETF

Cybersecurity UCITS ETF BUGG-LN

Beyond Ordinary ETFs™

GLOBALXETFS.EU @GLOBALXETF sEU

Issued by Global X Management Company (UK) Limited, 123 Buckingham Palace Road, London, SW1W 9SH, which is authorised and regulated in the UK by the Financial Conduct Authority. Information about us can be found on the Financial Services Register (register number 965081). This communication has been approved as a financial promotion, for the purposes of section 21 of the Financial Services Market Act 2000 (FSMA), by Resolution Compliance Limited which is authorised and regulated by the Financial Conduct Authority (FRN:574048).

Capital at risk: The value of an investment in ETFs may go down as well as up and past performance is not a reliable indicator of future performance. Prospectuses and Key Investor Information Documents (KIIDs) for these ETFs are available in English at www.globalxetfs.eu.

Paying for university

With tuition fees in England currently standing at £27,500 for a threeyear course, or £9,250 a year, your children might need a financial leg-up when they go to university. Fear not, as we have a plan.

It’s easy to see why students graduate with significant debts, particularly as there are rent and grocery costs to consider on top of tuition fees. However, with some sensible planning and a reasonable amount of time, it is possible for parents to save and invest money so their children graduate debt-free or with as little debt as possible. Here’s how you might do it.

CURRENT TUITION COSTS

Tuition fees vary depending on which region of the UK you live in. In England, annual fees are capped at £9,250 for UK and Irish students until 2025.

Scottish students can study for free in their home country, but outsiders must pay £9,250. In Wales

By Sabuhi Gard, Daniel Coatsworth and Tom Sieber

yearly tuition fees are £9,000 a year. If you are from Northern Ireland and your children are studying there, tuition fees are £4,395 per year.

Tuition fees can also vary, depending on what subject your children study at university. For example, medicine and veterinary medicine courses are longer – between five or six years.

CURRENT ACCOMMODATION COSTS

When saving for your children it is important to factor in student accommodation costs. These vary depending on the location and the type of housing.

According to a Unipol and the National Union of Students survey, the average cost for weekly rent in the UK in purpose-built student accommodation for 2021-2022 was £166. Private accommodation averaged £155 a week for an en-suite room and £228 for a studio. In London, the average was £212 per week for university accommodation and £259 for privatelyowned property.

20 | SHARES | 09 March 2023

The investment plan so your children graduate without big debts

WHAT ABOUT STUDENT LOANS?

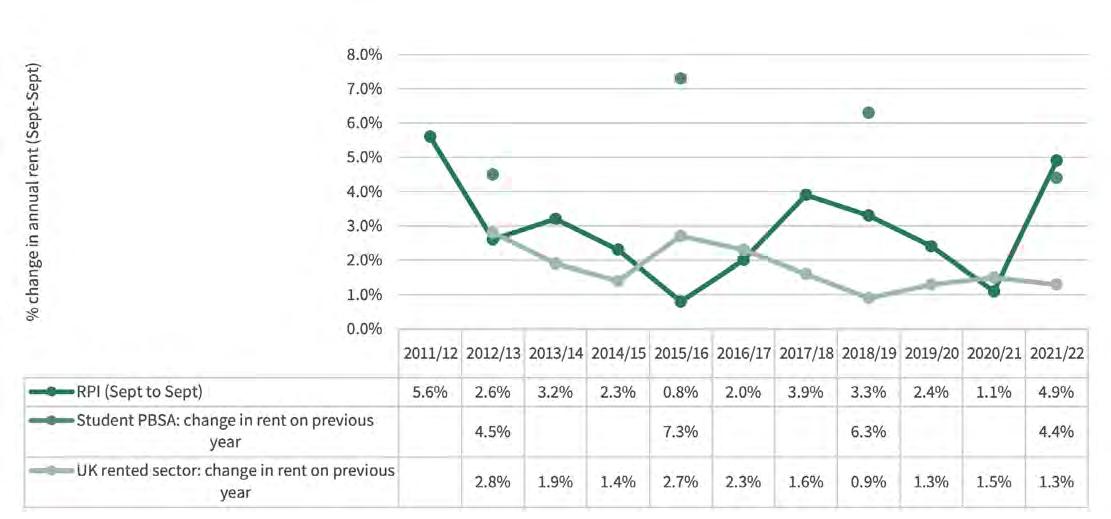

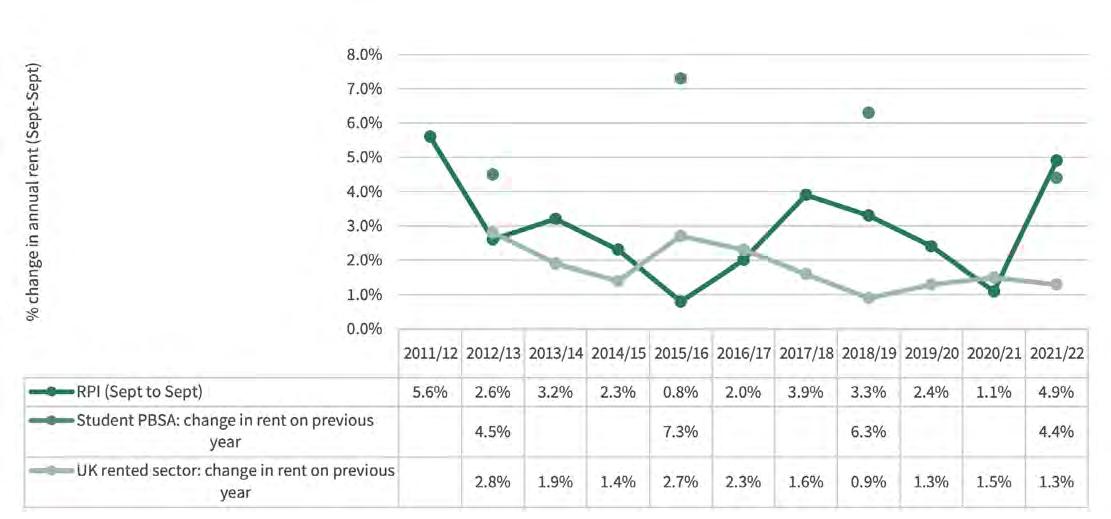

A lot has been said by critics about the rising costs of student and maintenance loans. Interest is linked to the retail price index rate of inflation, which currently stands at more than 10%. The Government has capped this rate at 6.5% as of 1 December 2022.

All students can apply for a student loan to cover tuition fees and a maintenance loan to cover living costs.

While studying and until the following April after graduation, the interest rate is set at RPI plus three percentage points. Once someone graduates, they pay the RPI rate if on a salary below £27,295. Earn more than £49,130 and they will pay RPI plus three percentage points. Someone earning between the two bands has an interest rate based on a sliding scale.

If your children are low earners during their working life, they might never have to repay the full student loan, as it wiped out after 30 years.

WHEN SHOULD I START SAVING?

If you want to help it is best to start early, albeit be realistic about when you will have spare cash. Many people won’t be able to afford to contribute into a university investment pot when their child is young as they face large childcare costs (unless they are lucky enough to have grandparents nearby).

Between five and 10 years before the child starts university is more realistic to start investing to cover the tuition and accommodation costs.

FACTORING IN INFLATION

The big question for parents and children is how inflation will impact the cost of studying in the future. While the Government has frozen tuition fees in England until the start of the 2025 academic year, there are growing calls from those in the university sector that funding needs to improve, particularly as inflation has been so high.

Therefore, it is worth factoring in a rise in tuition

09 March 2023 | SHARES | 21

OVERALL ANNUAL RENT INCREASES VS RETAIL PRICES INDEX VS PRIVATE HOUSING RENTAL PRICES, 2011/12 - 2021/22

Source: Accomodation costs survey – NUS & Unipol. PBSA = Purpose-built student accommodation.

Potential cost of university tuition over the coming years

Potential cost of university accommodation over the coming years

fees from 2025 as it is better to tuck away more than you need than have a shortfall and be forced to load up your children with student debt.

Although the Bank of England has a 2% inflation target, many market commentators believe it will be some time before we get back to that level. Therefore, it might be worth factoring in a higher rate of inflation, such as 4%.

Let’s put some of these figures into practice. We will use the example of a married couple called Roy and Lucy who hope their daughter Christine goes to university in September 2033.

Starting point is the average cost as per Unipol and the National Union of Students’ 2021 survey. We have assumed 4% annual inflation each year thereafter.

Chart: Shares magazine • Source: Shares / Unipol

They’ve got 10 and a half years to save up.

According to our calculations using 4% inflation, the potential cost of university tuition for a threeyear course starting in 2033 is £41,097.

The average accommodation cost for a student in the 2021/2022 term was £7,374 according to a Unipol and the National Union of Students survey. If we apply 4% annual inflation to that figure,

22 | SHARES | 09 March 2023

Start date (Sept) 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 £9,250 £9,250 £9,620 £10,005 £10,405 £10,821 £11,254 £11,704 £12,172 £12,659 £13,165 £13,692 £14,240 Assumes 4% inflation from 2025. Source: Shares magazine

Start date (Sept) 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 £7,374 £7,669 £7,976 £8,295 £8,627 £8,972 £9,331 £9,704 £10,092 £10,496 £10,916 £11,353 £11,807 £12,279 £12,770

If sending your children to university is a bit of a financial stretch, there are other options to explore:

• Degree apprenticeships. Training and tuition fees will be paid for by the employer and the government, and a salary will be paid for by the employer

• Foundation degrees. Like an apprenticeship, it is a qualification designed to prepare someone for a specific area of work by combining academic study and work experience.

• Higher apprenticeships. The government and the employer fully fund the costs.

the accommodation cost would be £11,807 for Christine’s first year at university. Across three years, lodging would add up to £36,856.

The total cost to Roy and Lucy for Christine’s tuition and lodging at university could be £77,953. That sounds a lot but some judicious monthly saving could help them hit the goal without breaking the bank. To hit a goal in 10 and a half years, they would need to invest £507 a month and achieve 4.5% annual return. The calculations assume 0.75% a year charges.

WHAT IF I ONLY HAD FIVE YEARS TO SAVE?

Let’s use a second example of Ram and Kim whose son Mikey hopes to start university in September 2028. They will be looking at a potential £30,292 accommodation cost and £33,779 for tuition, or £64,071 in total.

• Traineeships. Unlike apprenticeships no salary is offered, but a reimbursement of travel and food expenses is likely.

• Entry-level jobs. Designed for school leavers, your children can apply for a job directly with any employer and be paid a salary without the need for higher education qualifications.

• Work experience or internships. These tend to only last a couple of weeks and are normally unpaid. Some internships have a more formal structure.

Source: Shares magazine, Savethestudent.org

The monthly investment (assuming 0.75% annual charges and 4.5% annual investment growth) to hit this goal would be £875. That’s manageable for Ram and Kim as they are both working and can share the cost, but it does highlight the challenge for a couple where only one person is working, or a single parent who must foot the entire bill.

While some people will want the full amount on day one of university enrolment for peace of mind, remember the bills will be spread across the three-year course so you don’t need everything at the start.

WHICH ACCOUNT SHOULD I USE?

One way to save for your children’s university fees is through a Junior ISA. The allowance for the 202223 tax year is £9,000 and investment growth and income will be free from tax.

09 March 2023 | SHARES | 23 ALTERNATIVES TO UNIVERSITY

Just remember that the money would legally belong to the child once they turn 18 so there needs to be an element of trust. Otherwise, you might wake up one morning and see that they have blown all your hard-earned savings on something other than university-related costs.

In Ram and Kim’s case, their £875 monthly contribution (or £10,500 annual) takes them over the £9,000 annual limit for a Junior ISA. They would need to put the remainder in one of their own ISAs.

WHICH INVESTMENTS SHOULD I MAKE?

A decade is a long enough period to take bigger risks with investments as you would have time to ride out any dips in the market.

However, given that university is an important life event for parents, it’s important to strike a balance between having exposure to equities and not chasing the craziest thing in the hope of winning big.

You don’t want to ruin all the hard effort of saving money by being too aggressive with your investment choices, should they not pay off.

THE 10-YEAR PLAN

A sensible approach for someone with 10 years to save up for university bills is to seek diversification and not pay too high a price for investments. One strategy is to spread money across a US equity fund that has a value tilt, a UK equity fund that has both a value style and exposure to companies known as ‘compounders’, and a multi-asset fund that has its fingers in lots of pies.

For the US equity component, you might want to put money into JPM US Equity Income (B3FJQ48) which is a fund full of companies in the oil, healthcare and banking sectors rather than being dominated by tech stocks.

The investment process focuses on company fundamentals like profit and valuation. On a fiveyear basis, the fund has returned 70.4% versus 67.7% from the IA North America sector. Pick the ‘Acc’ version of the fund so dividends are automatically reinvested.

Liontrust UK Growth (B56BDS0) is also a good

24 | SHARES | 09 March 2023

Invest each month £875 Invest each month £507 Goal by September 2028 £64,071* Goal by September 2033 £77,953*

Capital

in:

Put equal amounts in:

Gearing Trust Put equal amounts

JPM US Equity Income Fund

F&C Investment Trust

Liontrust UK Growth Fund

Royal London Sustainable World Trust

5-YEAR PLAN

Royal London Sustainable World Trust

10-YEAR PLAN

Table: Shares magazine. *Assumes 4.5% annual investment growth and 0.75% annual charges.

option. Don’t be misled by the name as this is not a fund stuffed with fast-growth stocks. Instead, it is more balanced in style and holds positions in companies with a history of good long-term returns. Managers Anthony Cross and Julian Fosh are highly respected and they look for companies with a durable competitive advantage.

The portfolio includes a mixture of defensive stocks in sectors like tobacco, pharmaceuticals and consumer goods, while also having exposure to industrials, energy, financials and a small bit of real estate. Many of these sectors typically fall into value investing territory. The split of assets is roughly two thirds large caps, one third mid-caps. The annual charge is 0.83% and on a five-year basis, the fund has returned 35.7% versus 21.5% from the IA UK All Companies sector.

To complement these two funds, we would add Royal London Sustainable World Trust (B882H24) which is an effective way to get exposure to different parts of the world and various asset classes all through one investment product.

At the end of January, it had approximately 83% of its assets in stocks and shares – roughly half of which is held in US companies and the rest spread across companies listed on UK, European and emerging markets. A further 15% of assets are held in bonds and the remaining 2% in cash.

There is an ethical flavour to its approach as it only invests in companies expected to make a positive contribution to society.

The fund is the top performer in the Unit Trust Mixed Investment 40%-85% Shares sector over five years, according to FE Fundinfo, returning 58.9% versus 27.3% from the sector. The ongoing charge is 0.77% and buying the Acc version of the fund means any dividends are automatically reinvested.

THE FIVE-YEAR PLAN

If you only have five years until money is needed to fund university fees then it is important to be cautious about taking on too much risk as a bad period could leave you without the necessary funds when you need them.

Two investments to consider are Capital Gearing Trust (CGT) which has a bias towards capital preservation – or making sure it doesn’t lose money – and F&C Investment Trust (FCIT) which is highly diversified and therefore should be good at smoothing out any volatility in the market.

Managed by Peter Spiller for more than four decades, Capital Gearing has delivered absolute returns in 39 out of 40 years. Spiller has said ‘don’t fight the Fed’ is ‘excellent advice’ and argues investors should take notice of what he believes is the US Federal Reserve’s message that asset prices should be lower.

Mindful of interest rate volatility and the risk of recession, Spiller has positioned the portfolio defensively with an emphasis on inflation protection and is holding back some cash to invest as and when opportunities arise. The trust trades at a 0.8% discount to NAV (net asset value) and has competitive ongoing charges of 0.52%.

F&C Investment Trust offers exposure to a broad spread of holdings diversified by both geography and sector. The consistency of performance was underlined by a 51st dividend increase in a row in 2022 with a further rise planned for this year.

Steered by Paul Niven since 2014, the portfolio is selected by internal managers at Columbia Threadneedle and a range of external managers. The trust has more than 400 holdings from 35 countries, spanning both quoted and unquoted investments. F&C trades at a 2.6% discount to net asset value and offers a modest yield of 1.4%. Its ongoing charge is 0.54%.

We would also put one third of the university savings into Royal London Sustainable World Trust for the same reasons discussed earlier in this article – asset, geographic and sector diversification. It is suitable for someone with either a five-year or a 10-year horizon.

09 March 2023 | SHARES | 25

THE YEAR AHEAD IN NATURAL RESOURCES

BLACKROCK ENERGY AND RESOURCES INCOME INVESTMENT TRUST

2022 saw an acceleration of the energy transition, as the war in Ukraine prompted a wholesale reevaluation from governments of the way they source and use energy, says Mark Hume, manager of the BlackRock Energy and Resources Income Investment trust.

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Russia’s invasion of Ukraine has had a profoundly disruptive impact on energy markets in 2022: it has highlighted the world’s ongoing reliance on fossil fuels, but also galvanised investment into alternative energy sources as countries confronted the necessity of energy independence. This ‘replumbing’ of energy markets is likely to be a major feature of energy markets in 2023.

The immediate vacuum left by Russian sanctions has forced European governments to find new, short-term sources of supply. Liquified natural gas (LNG) has proved a temporary fix, with countries also switching coal plants back on. The pressure in key energy markets has eased, with natural gas and crude oil prices dropping in the latter half of the year.

Nevertheless, in our view, prices are unlikely to drop significantly even as recession bites. This is particularly evident in the oil market. OPEC’s announcement of reduced production targets in October demonstrates a willingness to be more reactive to manage oil prices. This should support prices amid economic uncertainty. For energy companies, this should make them more defensive in the year ahead. The US administration’s announcement that it will buy oil at prices below $721 also puts a floor under oil prices.

Higher oil prices have not yet resulted in notably lower global demand. Demand remained relatively high and may rise further as China shifts its zero Covid policy. Nevertheless, higher interest rates and recession across most major economies could weaken demand, as could high prices.

The supply of oil remains tight. The past decade has seen relatively little investment in new oil production, with the exception of US shale oil. Energy company balance sheets are much stronger today than in the past downturns, once notorious for profligate spending.2 Investors have encouraged capital discipline on the sector, which should bring an end to unchecked US shale growth. Many energy companies have committed to return free cash flow to shareholders rather than

return to maximising production. This means supply is likely to remain tight, while demand continues to increase.

SUSTAINABLE ENERGY

New commitments from governments on sustainable energy production has been a key feature of 2022.

Governments across the world have committed significant capital to bringing green energy sources on stream via the EU Green Deal and recent REPowerEU in Europe; in China for wind, solar and EV adoption and in the US via the Inflation Reduction Act.

This is unlikely to diminish in 2023, with three powerful factors in play: supportive regulation and policies; a new drive for energy security and independence; and cost. On the latter, there is now an expectation that traditional energy prices will remain higher for longer, making sustainable energy sources more cost competitive.

Renewable energy costs for onshore wind and solar panels now represent the most economic technology choice for power generation in many markets, which is driving rapid adoption. Other areas of alternative energy distribution and storage are also becoming more competitive as economies of scale develop. This is evident in areas such as energy storage solutions in automotive electrification, where the transition to electric is driving an increase in EV adoption.

The transition to a lower carbon economy is a multi-decade phenomenon and will prove disruptive for many industries and business models, while also creating significant opportunities for those businesses on the right side of change. The sums involved are eye-watering, the International Energy Agency estimates that annual clean energy investment will need to more than double to US $4 trillion by 2030.3 This puts significant money in motion.

INVESTMENT CONSEQUENCES?

The BlackRock Energy and Resources Investment trust is positioned to capture the opportunities from an energy market in flux. We believe that the scale of the growth opportunity for the sustainable energy sector as a whole over the coming years has been under-appreciated both as a play on capital allocation and attractive long-term investment exposure.

However, the transition will also affect the traditional energy providers. In the year ahead, the trust has a bias towards higher-quality oil producers which we expect to benefit the most from a stronger for longer oil and gas price environment, a potentially resurgent oilfield services sector and the need

THIS IS AN ADVERTISING PROMOTION

1 Bloomberg – 12 December 2022 2 FT – 13 February 2022 3 Bloomberg – 27 October 2022

for increased Liquified Natural Gas (or LNG) output to replace Russian gas exports into Europe.

We retain the flexibility to shift the portfolio between sustainable and legacy energy production as the environment dictates. This has been a vital year for energy producers and 2023 promises to be every bit as exciting.

RISK WARNINGS

Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

TRUST-SPECIFIC RISKS

Counterparty Risk: The insolvency of any institutions providing services such as safekeeping of assets or acting as counterparty to derivatives or other instruments, may expose the Fund to financial loss.

Currency Risk: The Fund invests in other currencies. Changes in exchange rates will therefore affect the value of the investment.

Emerging Markets: Emerging markets are generally more sensitive to economic and political conditions than developed markets. Other factors include greater ‘Liquidity Risk’, restrictions on investment or transfer of assets and failed/delayed delivery of securities or payments to the Fund.

Gearing Risk: Investment strategies, such as borrowing, used by the Trust can result in even larger losses suffered when the value of the underlying investments fall.

Investments in Mining Securities: Investments in mining securities are subject to sector-specific risks which include environmental concerns, government policy, supply concerns and taxation. The variation in returns from mining securities is typically above average compared to other equity securities.

IMPORTANT INFORMATION

In the UK and Non-European Economic Area (EEA) countries: this is issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock.

For more information on this trust and how to access the potential opportunities presented by smaller companies, please visit www.blackrock.com/uk/beri

TO INVEST IN THIS TRUST

This document is marketing material. The Company is managed by BlackRock Fund Managers Limited (BFM) as the AIFM. BFM has delegated certain investment management and other ancillary services to BlackRock Investment Management (UK) Limited. The Company’s shares are traded on the London Stock Exchange and dealing may only be through a member of the Exchange. The Company will not invest more than 15% of its gross assets in other listed investment trusts. SEDOL™ is a trademark of the London Stock Exchange plc and is used under licence.

Net Asset Value (NAV) performance is not the same as share price performance, and shareholders may realise returns that are lower or higher than NAV performance.

The investment trusts [listed below/above/in this document] currently conduct their affairs so that their securities can be recommended by IFAs to ordinary retail investors in accordance with the Financial Conduct Authority’s rules in relation to nonmainstream investment products and intend to continue to do so for the foreseeable future. The securities are excluded from the Financial Conduct Authority’s restrictions which apply to non-mainstream investment products because they are securities issued by investment trusts. Investors should understand all characteristics of the funds objective before investing. For information on investor rights and how to raise complaints please go to https://www.blackrock.com/corporate/ compliance/investor-right available in local language in registered jurisdictions.

Any research in this document has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof and no assurances are made as to their accuracy.

This document is for information purposes only and does not constitute an offer or invitation to anyone to invest in any BlackRock funds and has not been prepared in connection with any such offer.

© 2023 BlackRock, Inc. All Rights reserved. BLACKROCK, BLACKROCK SOLUTIONS and iSHARES are trademarks of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners.

MKTGH0223E/S-2703143

THIS IS AN ADVERTISING PROMOTION

CLICK HERE

Shares looks at the software industry, why it is so important and who are the major players

It has been difficult to ignore the renewed sense of optimism creeping into stock markets this year. Misery has been replaced by a watchful brightness, and nowhere has this sheen reflected better than among software growth stocks.

After tumbling more than a third in 2022, the US-listed iShares Expanded Tech-Software Sector ETF (IGV:BATS), comprised of many of the major enterprise software players, was up 16% this year as of 2 February. It remains about 11% ahead as we write this feature (2 March).

That compares to the Nasdaq Composite’s 10.4% gain and the 4.1% advance of the S&P 500. The FTSE 100 is about 5% ahead.

The macroeconomic and geopolitical anxieties of the past few years – soaring inflation, rising interest rates, war, recession, etc. – are still rampant and feed investor worries about weakening business spending that are dampening forward expectations.

SOFTWARE IS IN LOCKSTEP WITH INFLATION, RATES AND EARNINGS

Software is a sector that walks in lockstep with what happens with inflation, rate hikes (particularly by the US Federal Reserve) and 2023 earnings guidance.

‘Investors remain focused on macro commentary and IT spending patterns,’ said an RBC Capital report. Market research firm Gartner in January cut its forecast for growth in 2023 global information technology spending by more than half to 2.4%, adding up to $4.49 trillion.

‘In January, we saw higher scrutiny on budgets compared to December, resulting in additional delays in large deals,’ said Jay Chaudhry, chairman and chief executive of cloud security business Zscaler (ZS:NASDAQ), at the beginning of March 2023.

But there is optimism too. Cowen analyst Derrick Wood recently surveyed tech departments on enterprise software spending priorities. ‘Our survey projects 7.3% budget growth in 2023, a modest deceleration from 8.3% in 2022,’ he said.

As has been the case with many software vendors during the latest earnings season, businesses are taking more time to scrutinise deal lengths or subscriptions, and software companies are streamlining their own operations, a worry for the pace of growth through 2023.

Yet software penetrates virtually every aspect of our lives in the digital information age and both individuals and businesses rely on operating systems and applications that makes software as crucial as oil, glass and steel.

For example, virtually every company in every industry is now looking to use software to get closer to its customers, innovate more quickly, and operate more efficiently. Many firms are embarking on multi-year digital transformation, cloud distribution, e-commerce and data analytics projects, are at least investigating the potential of artificial intelligence and machine learning, and this seems likely to accelerate as companies and government organisations adapt to hybrid work environments.

28 | SHARES | 09 March 2023

How you can invest in state-of-the-art companies powering the 21st Century economy

Companies that provide vital applications to power these transitions could be potential beneficiaries of these trends. Examples include Microsoft (MSFT:NASDAQ), Salesforce (CRM:NYSE), Workday (WDAY:NASDAQ), Oracle (ORCL:NYSE) and SAP (SAP:ETR)

SOFTWARE’S KEY METRICS

Recurring or subscription-based revenues is a major financial data point for studying the merits of software stocks. Industry businesses are increasingly trying to tie customers into a software ecosystem, offering better value through tools and applications that become mission critical, creating a network effect from which it becomes prohibitively complex and expensive to switch away.

Think about how Microsoft uses Windows and its Office 365 package of tools to clients, with Teams, PowerPoint, Excel and Word providing a gateway into its Azure Cloud applications suite of data storage, distribution and analytics.

‘Should we switch away from Microsoft?’ is a boardroom conversation starter as rare as hen’s teeth.

Highest gross margins

software companies progress from start-up to maturity, providing enormous financial firepower to invest in new markets, make acquisitions and, eventually, pay dividends to shareholders.

Microsoft handed nearly $19 billion (£15.8 billion) back to shareholders in 2022.

It is this cash flow quality and faster-than-average growth that tends to see software companies trade on higher-than-average valuations than many other types of stock.

WHICH COMPANIES CAN I INVEST IN?

The UK software sector has been decimated over the years by overseas buyers and private equity investors. In the past year or so we have lost £9 billion engineering software firm Aveva (at the time the UK’s largest listed software company), consumer cybersecurity firm Avast, infrastructure IT business Micro Focus and EMIS, a software provider to the NHS.

That’s about £21 billion of software market value that generated roughly £5.5 billion of annual software revenues.