•

•

•

•

•

•

•

•

Tnotmarket,whynotsimplymirrorwhatitdoesand worryaboutafundmanagermakinggoodor trackerbaddecisions.Exchange-tradedfundsorETFsareaformof fund.Theirchargesaretypicallyalot lowerthananactivelymanagedfundbecause thereisnofundmanagertopay.Instead,theETFs rulestrackaspecificindexwhosemake-upisbasedon thatacomputercanmanageatlittlecost. inThismightbeabasketoflargesharestrading generousacertainpartoftheworldoroneswhichpay dividends. product.TheappealofETFscanbeillustratedbyasingle comparedForanongoingchargeofjust0.05%, witharoughaverageofaround1%foractivelymanagedfunds,investorscanuseAmundi

PrimeGlobalETF(PRIW)togainexposuretomore than1,500stocksacrossdevelopedmarkets.This exampleofdiversificationatsuchalowcostis what’sdrivengrowthintheETFmarketsincethe firstsuchinstrument,trackingtheFTSE100index ofUKshares,waslistedinLondonin2000. expandedIntheintervening20-plusyearsthemarkethas hugely,andinvestorscannowinvestina widevarietyofmarketsusingETFsincludingbonds, property,commoditiesandevenspecificthemes andinvestmentstyles. Inthisarticlewelookatthedifferentoptions andhighlightsomeofthecheapestproducts.Ina separatearticle,weselectsomeETFstocreatea diversifiedportfoliofromscratch.

This week’s main feature looks at the cheapest ways to invest in markets, themes and more via ETFs. There’s something for everyone and it’s easy to build a diversified portfolio with just a handful of products.

heseveretighteninginfinancial conditionsinthesecondhalfof2022 atcausedcommercialpropertyvaluestofall thefastestsix-monthrateonrecord. areAsaresultofmuchcheapervaluations,investors timeaskingthemselveswhethernowisagood companiestostarttakingpositionsinlistedproperty andrealestateinvestmenttrusts,alsoknownasREITs. couldWelookatwherevaluationsare,wherethey go,andwhichstockslookthemostattractive.WHATHASHAPPENEDTOVALUATIONS? Onekeythingretailinvestorsneedtoappreciate aboutpropertycompaniesistheimportanceof interestratesindeterminingvaluations. changesPropertyisanincome-generatingasset,and investorsininterestratesaffecttherateofreturn requireontheirinvestment. bankBeforeMarch2020,theBankofEngland’sofficial 0.75%,rate(alsoknownasthe‘baserate’)was butwithinweeksoftheCovidcrisisthe bankcutitsratefirstto0.25%andthento0.1%,a 325-yearlow.Asaresult,theyieldonUKgovernmentbonds orgilts–consideredthe‘risk-free’rate–slumped, allowingrentalyieldsonpropertytofalland valuationstosoar. retailThebest-performingpropertyassetswere householdswarehousesandprimelogisticscentresas shiftedtoshoppingonline. BankWiththepandemicintherear-viewmirror,the 2021,ofEnglandbeganraisingratesinDecember sincewhenithashikedthebaseratenine timesto3.5%,meaninghigheryieldsongiltsand propertystocks. Justaslowerratessparkedajumpinvaluations,

withsohigherrateshaveseenvaluationsfallsharply, theworst-affectedsectorsbeinglogistics and‘big-box’retailwhichpreviouslygainedthe most. expertAccordingtocommercialpropertyvaluation CBRE,whichcompilesanindexbasedon andthevalueofover1,000commercialproperties 31monthly-valuedfundsworthintotalover 2022.£16billion,overallcapitalvaluesfellby13.3%in bounce-backThatcompareswitha13.8%post-pandemic in2021. declineIndustrialassetsfell21%invalue,followedbya of12.1%inofficesand8.1%inretail. strongestOnapositivenote,rentalvaluesrose4.7%,the sincethemillennium,withindustrial forrentsup10.3%,officesup2%anda0.5%increase Asretail. -18.1%aresult,thetotalreturnforeachsectorwas forindustrialassets,-8.2%foroffices,and for-2.1%forretail,withtheoveralltotalreturn-9.1% theyear. ISTHEREMOREDOWNSIDETOCOME? Theconsensusviewisthatcommercialproperty morevaluationswillkeepfallingthisyeardueto interestraterises,aUKeconomywhich isweakeningifnotalreadyinrecessionand continuingmacro-economicuncertaintyduetothe ongoingconflictinUkraine. theTherearestillvaluationconcernsoverpartsof retailsectorexposedtothecost-of-livingcrisis

Discover the reasons why experts are turning more bullish on the space and the stocks that look attractive.

Werevealthenameswiththemost amountof‘buy’or‘sell’ratings

Everyyearthiscolumntrackstheratings FTSEputonstocksacrosstheFTSE100and provide350bytheinvestmentbankswhich researchontheUKequitymarket.bullishThistime,theanalystcommunityisthemost ithaseverbeensinceourfirstsurvey backin2015,basedonstock-specific,public recommendations. ‘buys’Asweenter2023,57%ofallstockratingsare andjust9%are‘sells’forconstituentsofthe FTSE100,thejoint-highestandjoint-lowestscores

AnalystsaremorebullishthaneveronFTSE100andFTSE250stocksasweenter2023

overthepastnineyearsrespectivelyandmatching thoseof2022.FortheFTSE350index63%ofall recommendationsarepositiveratingsandjust8% wenegativeones,thehighestandjoint-lowestsince beganthissurveyin2015.Sharesisnotendorsingtheseviews,butinvestorsacouldbeforgivenforwonderingwhetherthisis warningsignaltobuymoreLondon-tradedstocksora MomentumtocutexposuretoUKequities.playersmayfeelinclinedtogo withthepositiveflow.Contrariansmaytakethe

Source:Refinitivdata,analystsconsensus,Marketscreener.Dataasof6January2023

Source:Refinitivdata,analystsconsensus,Marketscreener.Dataasof6January2023

Take more notice of broker ‘sell’ ratings than ones that say ‘buy’.

Table:Sharesmagazine•Source:Refinitivdata,analystsconsensus, Marketscreener.Dataasof6January2023

Going against the crowd takes more conviction and therefore ‘sell’ ratings are worth analysing, particularly when most brokers are bullish on a stock.

Sosandar shares strut 10% higher as Sainsbury’s clothing tie-up excites

More to go in airlines’ recovery says Liberum, EasyJet shares most attractiveMarston’s shares gain 8% as investors cheer strong Christmas trading Why 13% dividend hike puts spotlight on Greencoat UK Wind’s dividend appeal

You can save a lot of money on charges by investing in tracker funds.

Now might be a good time to look for opportunities in the commercial property space.

Asset Value Investors (AVI) has managed the c.£1.1bn* AVI Global Trust (the “Trust”) since 1985. The strategy over that period has been to buy quality companies held through unconventional structures and trading at a discount to estimated underlying net asset value; the strategy is global in scope, and we believe that attractive risk-adjusted returns can be earned through detailed research with a long-term mind-set.

The companies we invest in include family-controlled holding companies, closed-end funds, other asset-backed special situations and, most recently, cash-rich Japanese companies. The approach is benchmark-agnostic, with no preference for a particular geography or sector.

AVI has a well-defined, robust investment philosophy in place to guide investment decisions. An emphasis is placed on three key factors: (1) companies with attractive assets, where there is potential for growth in value over

time; (2) a sum-of-the-parts discount to a fair net asset value (“NAV”); and (3) an identifiable catalyst for value realisation. A concentrated core portfolio, with the current top 10 holdings accounting for nearly 60% of NAV, allows for detailed, in-depth research which forms the cornerstone of our active approach.

Once an investment has been made, we seek to establish a good relationship and actively engage with the managers, board directors and, often, families behind the company. Our aim is to be a constructive, stable partner and to bring our expertise – garnered over three decades of investing in asset-backed companies–for the benefit of all.

AGT’s long-term track record bears witness to the success of this approach, with a NAV total return well in excess of its benchmark. We believe that this strategy remains as appealing as ever and we continue to find plenty of exciting opportunities in which to deploy the Trust’s capital. Past performance should not be seen as an indication of future performance. The value of your investment may go down as well as up and you may not get back the full amount invested. Issued by Asset Value Investors Ltd who are authorised and regulated by the Financial Conduct Authority.

It’s been a rough period for shareholders of software provider Salesforce (CRM:NASDAQ) with the shares halving since November 2021.

Some relief came on 23 January after the Wall Street Journal reported activist investor Elliott Management had taken a multi-billion-dollar stake. The shares gained more than 2% adding to the 14% gains already notched-up in 2023.

Managing partner Jesse Cohn told Reuters ‘We look forward to working constructively with Salesforce to realise the value befitting a company of its stature.’

an investor presentation the investor said it was pleased with the $50 billion 2026 sales target but was disappointed by the 42% operating margin target, considering a peer group average of 50%.

Like many technology companies which overexpanded during the pandemic Salesforce announced this month it was laying off around 10% of its workforce and closing some offices.

Elsewhere, hedge fund and activist investor Oasis Management has taken a 5% stake in Wagamama and Frankie & Benny chain owner Restaurant Group (RTN) according to a Financial Times report (20 January). The stake was purchased in November 2022.

The Hong Kong-based investor last hit the headlines in the UK after building a near 20% stake in Mr. Kipling cake maker Premier Foods (PFD) and campaigning to oust its CEO.

Elliott targets companies it believes have good fundamentals and prospects but where management have ‘dropped the ball’ causing the company to fall short on delivering its full potential.

The activist took a stake in pharmaceutical firm GSK (GSK) in April 2021. It pushed for management change and supported the demerger of consumer healthcare division Haleon (HLN) which was listed on the stock market in July 2022.

In the case of Salesforce Cohn said the company was ‘one of the preeminent software companies in the world’.

Elliott is the second activist investor to target Salesforce in the past year. In October 2022 Starboard Value announced a ‘significant’ stake. In

Hospitality was one of the worst-hit sectors during the pandemic while the cost-of-living crisis has hampered Restaurant Group’s recovery. Rising interest rates have also provided a challenge.

Restaurant Group extended its borrowing facilities in December by two additional years out to April 2028 and has agreed extra headroom with lenders to operate with a higher debt to EBITDA (earnings before interest, tax, depreciation, and amortisation) ratio.

In addition, the company has capped its interest costs to reduce the risk of interest changes over the next four years. The revised debt package means the firm had upwards of £140 million of cash headroom as at 21 December. [MG]

A ray of hope for anyone holding underperforming shares is the arrival of a shareholder who will shake things up

There is an important read-across to Unilever and Reckitt which will soon update the market

USconsumer health and hygiene giant Procter & Gamble (PG:NYSE) delivered what initially looked like a positive set of second quarter results, beating revenue estimates and increasing its full year organic growth forecast.

However, P&G shares fell to two-month lows as investors were spooked by falling sales volumes and a continued rise in input costs.

Despite meeting Wall Street estimates with earnings per share of $1.59 and slightly beating sales forecasts, the firm revealed a 6% drop in second-quarter volumes driven by falling consumption and a big hit to margins from increased raw material costs and a negative product mix.

The firm also said given ‘continued significant cost headwinds from commodity and materials costs’ and foreign exchange impacts, it expected earnings per share to be towards the lower end of its guidance range for the current year.

The question investors will be asking is whether UK firms such as Unilever (ULVR) and Reckitt (RKT) can avoid the same pitfalls when they report in a couple of weeks’ time, and even if their results are good will the shares respond positively?

In October, Unilever posted a forecast-beating 10.3% increase in third-quarter sales due to record price increases and raised its full-year revenue growth guidance to ‘above 8%’, so that is the first figure investors will scrutinise when the firm reports its annual results on 9 February.

Price hikes came at the expense of unit sales, which declined 1.6% in the quarter, and the company braced the market to expect ‘more negative underlying volume growth’ in the final three months of the year.

Chief executive Alan Jope also maintained his target of a 16% operating margin and guided investors to expect the return on sales to rise further this year due to strong pricing, an improved product mix and cost savings, so the margin outlook will be just as important as the results.

Reckitt also delivered better than expected third quarter sales and predicted full year revenue growth would be at the top end of its 6% to 8% range of guidance.

Price and product mix improvements of 12% came at the expense of a 4.7% decline in volumes and meant overall revenue growth slowed sharply from the second quarter, although the continuing strength of the US dollar provided a further tailwind to sales when reported in sterling.

When Reckitt reports on 17 February, as well as the top line investors will be looking to see how much further costs have risen as the firm has repeatedly cautioned higher input prices will affect its profit margins. [IC]

Shares in Scottish Mortgage Investment Trust (SMT) are down by one third in value over the past 12 months at 746.6p, having sold off due to the impact of high inflation and rising interest rates on long duration assets including the ‘world’s most exceptional growth companies’ it invests in.

Scottish Mortgage became an investor favourite after delivering a staggering net asset value (NAV) total return of 2,921% between November 2008 and November 2021. But the Baillie Gifford-run trust is now the second worst one-year share price total return performer in the Association of Investment Companies’ Global sector with souring sentiment reflected in a near-12% share price discount to NAV.

at the highest level for a decade. It points out private investment exposure is at full capacity, with the trust currently unable to make follow-on or new investments in this part of the market.

Investec is also concerned the reduction in private company valuations ‘may gather momentum as audited year-end numbers begin to feed through for those funds where there is a valuation lag’, a major risk given that private companies speak for 35.9% of portfolio NAV.

And with central banks struggling to control inflation, the global economy is at risk of tipping into recession with an acceleration in quantitative tightening set to further drain liquidity.

Scottish Mortgage 500

1,500 Chart: Shares magazine • Source: Refinitiv

‘Over the next few months, this environment could bring further strong headwinds for Scottish Mortgage’s “growth at unreasonable prices” philosophy, with the manager favouring stocks with growth of an explosive nature,’ says Investec.

1,000

Investec Securities has urged clients to ‘sell’ Scottish Mortgage in a research note (19 January 2023), warning the next few months may bring ‘the second leg’ of the sell-off in riskier growth assets. That would be bad news for Scottish Mortgage, whose holdings include gene-sequencer Illumina (ILMN:NASDAQ) and Elon Musk-led Tesla (TSLA:NASDAQ) and SpaceX, the latter privately owned.

Investec worries Scottish Mortgage’s balance sheet is overstretched, with gearing of 17%

Despite such headwinds, Scottish Mortgage’s optimistic managers Tom Slater and Lawrence Burns remain focused on the long-term and are sticking to the trust’s key interests – digitisation of society, the intersection of biology and technology, and the energy transition.

Meanwhile, investment bank Stifel argues the ‘cliff-edge’ in NAVs implied by wide discounts among private equity trusts may be avoided. When the market sees beyond the peak in interest rates, it believes there could be increased buying interest and a sharp rebound in the valuations of funds investing in private equity and mid/small caps.

There are reasons to expect further pain in the coming months

Over-50s travel and insurance group Saga (SAGA) has rebounded strongly of late, gaining 120% in just three months.

This increase in the share price is from all-time lows below 100p and the shares are still, once you adjust for a 2020 share consolidation, down more than 90% on the price at which they listed in 2014. This isn’t really a recovery of Saga’s own making and has been

led by wider positivity towards the travel space. The company, often the author of its own misfortune, did post a relatively reassuring update on 24 January, though a 10-fold increase in revenue for its travel and cruises business is still expected to translate into a small loss in the 12 months to 31 January. The insurance underwriting division is also set to be loss-making.

Having been one of the best performing shares in 2022, South African coal miner Thungela Resources (TGA) has now lost momentum.

The stock has fallen by nearly 40% in value over the past four months as coal prices have weakened as weather conditions in parts of Europe have been milder than expected, thus hurting demand.

Analysts at Liberum say the stock is ‘cheap’ under all likely scenarios, despite weaker coal prices and problems with South Africa’s

rail network which is impacting deliveries to a major port. Its base case is 15 million tonnes of coal sales in 2023 at the $170 per tonne price at which you can buy coal in the market today.

If achieved, it expects Thungela to pay out dividends equal to a 28% yield. Should the miner only sell 10 million tonnes of coal – Liberum’s bear case – at $120 per tonne, the analysts still believe shareholders would get an 8% yield.

Clearly the risk of a further decline in the coal price could pull down the shares even more, so

Saga is considering a sale of the underwriting business with the proceeds used to pay down borrowings. While this could boost sentiment, it might not make too much of an impression in its £721.3 million net debt pile given a large portion of the underwriting function for its insurance business had been outsourced. [TS]

Saga (p)

investors must consider capital gains and losses in addition to the potential income. [DC]

Thungela Resources (p)

Over-50s travel and insurance firm has recovered from record lows

The miner has gone from stock market winner to loser

FULL-YEAR RESULTS

30 January: SThree 1 February: Glencore, GSK 2 February: Shell

HALF-YEAR RESULTS

31 January: ITM Power, NWF 2 February: Renishaw

TRADING UPDATES

27 January: Industrials REIT, Paragon Banking 30 January: DP Eurasia, Computacenter 31 January: Hochschild Mining, Pets at Home 1 February: Entain, Gem Diamonds, Vodafone

2 February: Airtel Africa, BT, Cranswick, JTC

Telecoms group BT (BT.A) has a mountain to climb if it is going to keep shareholders satisfied with its third quarter update on 2 February and its promised price hike.

The firm’s Q2 results raised more questions than they answered,

Energy giant Shell (SHEL) has already published a raft of forecasts for production and costs across its business ahead of its fourth quarter results on 2 February, which suggest a decent lift to earnings from its LNG (liquefied natural gas)

according to analysts at Berenberg, such as whether the growth in average revenue per consumer customer is sustainable, has weakness in the Enterprise business bottomed and does the decline in Openreach’s broadband base represent ‘a new normal’?

As well as providers answers to these questions, the company needs to assure the market it will stick with a plan to raise prices in March by 14% or CPI plus 3.9%, as permitted by the regulator, in the face of an all-too-likely political storm. [IC]

division while lower oil prices will impact refined products.

It has indicated windfall taxes in the UK and Europe could be as much

as $2 billion, which will no doubt feature in any commentary on its previously communicated plan to invest £25 billion in the UK. [IC]

FOURTH QUARTER EARNINGS EXPECTATIONS WERE SIGNIFICANTLY DOWNGRADED LAST OCTOBER

Investors will be keen to see if e-commerce giant Amazon (AMZN:NASDAQ) lowered expectations enough after significantly downgrading its fourth quarter earnings outlook in October. The results will be published on 2 February.

Revenues are expected to be between $140 billion to $148 billion with operating income ranging from zero to $4 billion.

Consensus full year earnings

estimates have tumbled from a profit of $1.34 billion to a loss of around $1.2 billion according to Refinitiv data. Earnings for 2023 are forecast to bounce back to almost $17 billion. Amazon has been forced to retrench following overexpansion during the pandemic which saw its workforce more than double to 1.6 million. In January the company announced 18,000 job cuts and a hiring freeze as it prioritises cost control and profitability. [MG]

27 January: American Express, Chevron 30 January: NXP

31 January: Exxon Mobil, Pfizer, McDonald’s, United Parcel Service, Caterpillar, AMD, Stryker, Mondelez, Marathon Petroleum, General Motors, Phillips 66, MSCI, Spotify 1 February: Meta Platforms, Novo Nordisk, Alibaba, Novartis, Altria, Vertex, Boston Scientific 2 February: Apple, Alphabet, Amazon, Eli Lilly, Merck & Co, Roche, Bristol-Myers Squibb, Conoco Phillips, Starbucks

WHY MARK ZUCKERBERG’S UNLOVED META MUST START TO DELIVER

Meta Platforms’ (META:NASDAQ) fourth quarter results update on 1 February will be scrutinised by investors to see if the company achieved guidance for quarterly revenue in the $30 billion to $32.5 billion range. That will depend on whether weaker advertising spend has impacted its Facebook and Instagram social

media platform earnings.

Revenue softened 4% year-on-year to $27.2 billion in the third quarter of 2022 and Meta is coming under increased investor scepticism surrounding its metaverse strategy, as well as concerns over governance and privacy regulation. [JC]

Arecent rising market tide has lifted all boats, with shares in many cyclicals and lower-quality businesses moving higher. But given the difficult year shaping up for the global economy, high-quality, cash-generative companies with defensive characteristics are the best stocks to own for the duration of 2023 and beyond.

A perfect example of this is soft drinks-tosnacks giant PepsiCo (PEP:NASDAQ). This US multinational boasts brand strength, pricing power and a track record of beating earnings forecasts then raising guidance.

Despite an impressive long-run share price chart moving up and to the right over many years, PepsiCo has recently dipped to create a good entry point. It is a terrific total return stock, having raised the dividend for 50 consecutive years and with the company now buying back up to $10 billion worth of stock over the next three years.

Guided by CEO Ramon Laguarta, PepsiCo’s portfolio of super-resilient brands spans everything from eponymous soft drink Pepsi to Gatorade, Mountain Dew, Frito-Lay, Quaker Oats, Walkers and Tropicana. Copious cash generation enables PepsiCo to sustain investment in brand innovation and marketing to extend market share gains.

High inflation continues to squeeze consumer spending around the globe, yet PepsiCo has been able to flex its pricing power muscles and pass elevated raw material costs onto shoppers without denting demand. Treats such as fizzy drinks or crisps are affordable repeat purchases which can get consumers through the stresses of everyday life.

And brand loyalty is strong in this area; even if prices go up, people are less likely to turn to supermarket own-brand products or other cheaper alternatives when the craving for a PepsiCo product strikes.

PepsiCo has protected profitability by raising prices successfully and there is now scope for margins to expand as commodity input costs go down.

Following strong third quarter results (12 October 2022) showing organic sales growth of 16%, PepsiCo raised its year-to-December 2022 organic revenue growth guidance from 10% to 12% and its constant currency earnings per share growth forecast from 8% to 10%. Fourth quarter and full year results will be published on 9 February.

According to Stockopedia, you’ll have to pay up for PepsiCo’s defensive earnings and cash flows as the stock trades on a 12-month forecast rolling price to earnings ratio of 23.3. However, this rating is a discount to a high of 31.9 times scaled in 2021 and PepsiCo also offers a 2.8% dividend yield. It is also worth noting that investors who’ve previously bought PepsiCo ‘on the dip’ over the years have been richly rewarded as the stock has subsequently continued on its upwards trajectory. [JC]

for the rest of the world over the past five years, meaning there is ‘plenty of wiggle-room to grow’ says Kerley.

Investors looking to build a diversified portfolio with an emphasis on income ought to look at Henderson Far East Income (HFEL), an investment trust which is currently yielding more than 8% and has raised its dividend annually for the last 15 years.

While Asia may not occur straight away as a predictable source of cash flows and income, profits and dividends have been growing strongly and the region is expected to grow faster than the rest of the world this year.

In the past few months, the trust has reduced its exposure to Taiwanese technology stocks, after weak results in the sector pointed to an oversupply of chips and falling margins. It has added a Chinese consumer goods company and a copper miner, which was neatly timed given the strong run in the copper price of late.

The trust currently has close to a one-third weighting in financial stocks, which pay good dividends and are benefiting from rising interest rates, followed by a 14% weighting in telecoms, a 13% weighting in real estate and an 11% weighting in energy.

Asia is hugely diverse with hundreds of strong dividendpaying companies to choose from”

Structural reforms put in place since the crisis in the late 1990s mean Asian economies and companies are on a much better footing than in the past with stronger balance sheets and low levels of unhedged foreign debt.

Combined with high margins and positive economic growth, the dividend growth story has become an intriguing one for investors, according to manager Mike Kerley.

‘Asia is hugely diverse with hundreds of strong dividend-paying companies to choose from. Given they tend to be under-researched relative to other stock markets, it presents hidden gems for actively managed trusts such as Henderson Far East Income to find,’ he says.

Dividends in Asia are expected to rise by 8% to a record £333 billion in 2023, yet companies are still quite conservative in their financial management with pay-out ratios (the percentage of net income paid in dividends) averaging just 39% versus 47%

Unusually for a Far East-focused trust, China isn’t the key focus: on a country basis, just over one-fifth of the portfolio is invested in South Korea and a similar amount in Australia, with China accounting for less than one-fifth of assets.

The trust has a 1.01% ongoing charge, trades at a small premium to net asset value and has recently broken out of a multi-year downward trend which suggests investors should look sooner rather than later. [IC] Henderson Far East Income (p)

We flagged the appeal of telecoms testing firm Spirent (SPT) at 275p on 12 January, seeing it as a smart way to play the rollout of 5G mobile network infrastructure. Sadly, a 20 January trading update materially undermined this hypothesis.

WHAT’S HAPPENED SINCE WE SAID TO BUY?

Spirent provides testing, analytics and security services to the telecommunications space and it was a warning of hesitancy on the part of this customer base which really rocked sentiment towards the company and saw the shares drop more than 20% at one point, falling way below our entry point.

The Crawley-based business at least confirmed guidance for 2022 – with profit slightly ahead of the market consensus of $127 million – a 7.2% year-on-year increase. The order book was also up 7% in the year. However, delays are now expected to see a ‘heavier than usual’ second-half

weighting for 2023. Broker Canaccord Genuity painted a bleaker picture noting that the 9% organic growth in the first three quarters of 2022 creates a demanding comparison for the next nine months.

It adds: ‘Our analysis further indicates capex spend by Spirent’s largest customer group, the US service providers (20%-plus of sales), has peaked and will likely decline by a double-digit percentage over the next couple of years. Factoring in likely further operating/capital expenditure budget tightening among Spirent’s other customers, in our view, makes meaningful outperformance of 4% consensus revenue growth expectations less likely this year.’

If spending by Spirent’s largest customers on 5G has peaked for the time being, then a central part of our reason for recommending the shares has gone. In these circumstances it seems sensible to take our medicine (painful as it is) and walk away with 17.6% loss. Particularly as there appear limited catalysts in the short term which could get the share price moving again. [TS]

meaningful outperformance of 4% consensus revenue growth expectations less likely this year”

Infrastructure as an asset class holds considerable appeal for investors against a volatile backdrop for broader markets…

Infrastructure is an asset class which can provide a high level of security to investors and trusts investing in ‘availabilitystyle’ infrastructure assets are an attractive and defensive variant within this theme.

‘Availability-style’ infrastructure assets are typically a type of public-private -partnership (PPP), where private investment is used to develop and manage public social infrastructure assets, like roads, hospitals or schools. Once a project is complete and meets a set of pre-defined standards (meaning the infrastructure is ‘available’ for use), the investors in the assets keep receiving what are known as ‘availability payments’ as long as the asset remains available for use.

These contractual payments vary in duration, but it’s common for them to last for between 25–35 years and to have high quality inflation linkage. Perhaps the most appealing facet of investment in these infrastructure assets is the fact that payments are government backed.

Availability-style infrastructure assets contrast with demand-based infrastructure assets, where the investor takes on the risk of how much the infrastructure will be used and thus how much revenue it generates. For example, an investor may fund public transport systems or toll roads that end up being used more or less than anticipated, and so will generate more or less cash for investors than originally expected. This problem can become especially acute when an asset experiences a big shock to demand, such as during the pandemic lockdowns or during a recession.

This is a big part of the reason the team at BBGI Global Infrastructure (BBGI) only invest in availabilitystyle critical social infrastructure assets with high-quality inflation linkage. The trust, which is internally managed and led by co-CEOs Duncan Ball and Frank Schramm, has been operating for over a decade and invests in these types of high quality availability-style infrastructure assets that are backed by government contracts in highly rated investment grade countries.

The portfolio, valued at £1.1bn, is currently diversified globally and across 56 critical social infrastructure investments, with exposure to several different asset classes. Approximately half of the portfolio is in transportation, with the remainder in infrastructure assets in healthcare, correctional facilities, education, clean energy and affordable housing.

Having exposure to these assets would likely appeal to the more safety-conscious investor under most circumstances. However, as we seem very likely to be heading into a recession, investing in assets that can produce a regular stream of revenue, backed by government contracts, can start to look a lot more attractive and secure.

Compounding this is the fact that the contracts which BBGI has with its counterparties have revenues with highquality inflation-linkage. This means income from the trust’s investments are protected in real terms even in inflationary environments. Moreover, the income streams won’t be subject to any changes in demand that may result from the economic impact of inflation or a recession.

This is not to say that availability-style assets are riskfree. Failing to keep infrastructure projects available for use, for example, means availability-style payments are not guaranteed. These risks can largely be mitigated through facilities management and insurance agreements. It is also worth noting that BBGI continues to have a high level of asset availability of 99.9%.

Another risk is interest rate hikes which, like government bonds, are putting pressure on valuations across the board. A couple of factors are helping mitigate the impact of interest rate rises for BBGI now and moving forward. One is that BBGI has only a marginal exposure to refinancing risk as the projects themselves are typically either financed on a long term basis with the debt term closely matching the concession term.

Also the individual portfolio companies tend to have substantial cash holdings, which generate an increased income as banks increase the rates of interest they pay. BBGI at a corporate level has mostly remained ungeared over the past decade, but periodically draws upon its £230 million revolving credit facility (maturing in 2026) to acquire assets, which it then repays through equity issuance, avoiding the issue of cash drag. Lastly, the high quality inflation linkage across BBGI’s revenues also works as a partial hedge against rising inflation.

Taking all these factors into account, BBGI’s holdings could be capable of riding out a recession well. The trust is in a position to continue delivering attractive income, even if interest rates rise, inflation continues and the general economy remains soft. Whether or not this will actually happen in practice remains to be seen. But as we enter a period of economic uncertainty, it seems fair to suggest that highly-rated governments will honour their contractual obligations and make availability payments to the suppliers of critical infrastructure like BBGI, even as other business and funds may end up struggling.

BBGI Global Infrastructure is a client of Kepler Trust Intelligence. Material produced by Kepler Trust Intelligence should be considered as factual information only and not an indication as to the desirability or appropriateness of investing in the security discussed. Kepler Partners LLP is a limited liability partnership registered in England and Wales at 70 Conduit Street, London W1S 2GF with registered number OC334771. Full terms and conditions can be found on www.trustintelligence.co.uk/investor

The fact only a quarter (27%) of fund managers beat the market in 2022 has led many investors to look at low-cost tracker funds. Instead of trying to outperform the market, why not simply mirror what it does and not worry about a fund manager making good or bad decisions.

Exchange-traded funds or ETFs are a form of tracker fund. Their charges are typically a lot lower than an actively managed fund because there is no fund manager to pay. Instead, the ETFs track a specific index whose make-up is based on rules that a computer can manage at little cost. This might be a basket of large shares trading in a certain part of the world or ones which pay generous dividends.

The appeal of ETFs can be illustrated by a single product. For an ongoing charge of just 0.05%, compared with a rough average of around 1% for actively managed funds, investors can use Amundi

Prime Global ETF (PRIW) to gain exposure to more than 1,500 stocks across developed markets. This example of diversification at such a low cost is what’s driven growth in the ETF market since the first such instrument, tracking the FTSE 100 index of UK shares, was listed in London in 2000.

In the intervening 20-plus years the market has expanded hugely, and investors can now invest in a wide variety of markets using ETFs including bonds, property, commodities and even specific themes and investment styles.

In this article we look at the different options and highlight some of the cheapest products. In a separate article, we select some ETFs to create a diversified portfolio from scratch.

For many people ETFs are a useful way of tracking the big domestic and overseas indices. A starting point for lots of UK investors will be the FTSE 100 and the iShares Core FTSE 100 (ISF) is both the longest standing UK ETF and one of the most widely held. It charges just 0.07%.

Competition in this area of the market means there isn’t a huge amount to choose between the different ETFs when it comes to cost. Though because of the big fees ETF providers must pay the index providers like FTSE and MSCI, products not tracking mainstream indices can be cheaper.

Lyxor Core UK Equity All Cap (LCUK) follows the Morningstar UK NR index – targeting the top 97% of stocks on the UK market by size – and its charges

An

Because

are even lower than the iShares FTSE 100 product at 0.04%. L&G UK Equity UCITS ETF (LGUK) has ongoing charges of 0.05% and tracks the Solactive Core United Kingdom Large & Mid Cap index. It is excluded from our table due to only having £69 million in assets.

For the most part the underlying holdings and performance of these alternative indices will be broadly like their more established counterparts.

Some investors may prefer to play UK stocks through an ETF which tracks the FTSE 250. This mid-cap index has a more domestic focus than the FTSE 100 and has performed better over the long run. There is a clear difference in cost, with Vanguard FTSE 250 (VMID) the cheapest.

type of

market

value. The

It’s

limited assets (such as less than £100 million) that the product is at risk of being closed if it cannot attract more interest.

These sub-scale ETFs may also have more limited liquidity which leads to a larger spread between the price at which you can buy and sell.

If you are holding an ETF for the long term this might not make a huge difference, however you may well want to rebalance your portfolio if the proportion of stocks to other asset classes has moved above or below your targeted level and here small differences in the cost of trading can add up over time.

than £100 million, there runs the risk of it being shut down by the provider.

by the time a trend has entered the mainstream to the extent that ETF providers have launched products to tap into it, many of the obvious stocks positioned to harness it may have already rallied.

There are lots of ETFs with an ESG (environmental, social and governance) focus. Some are deliberately geared towards themes in this area while others track versions of existing indices which have been screened using sustainability criteria.

iShares’ range of thematic ETFs are some of the largest, addressing some of the risks around fund size, and include iShares Automation & Robotics

The performance of thematic ETFs has been mixed and there is an argument that a more nuanced, active approach can be a better way of capturing returns from long-term trends. Also,

ETFs are normally set up for either income or accumulation. The ‘inc’ or income version of ETFs pay out distributions to holders as cash. ‘Acc’ or accumulation ETFs effectively reinvest the dividends for you. So, you need to make sure you buy the right version of the ETF if you want to receive the income as cash.

Some ETFs won’t offer a choice of income or accumulation versions of their fund. If there is no choice, it typically means any dividends will be paid out in cash.

(RBOT), iShares Digital Security (LOCK) and iShares Global Clean Energy (INRG).

iShares Automation & Robotics is, for example, considerably cheaper than L&G ROBO Global Robotics and Automation (ROBG) with an ongoing charge of 0.4% compared with 0.8% for the latter product. The five-year return for the iShares product is also better at 40.7% compared with 31.7% for the L&G ETF.

Sector-based ETFs often track broad industry categories and typically they don’t follow UK stock market groupings but are more likely to be global, US or regional sectors.

ETFs have been a useful way for ordinary investors to access the bond market, something it is difficult to do directly. Most of the products in this space provide exposure to baskets of government bonds or investmentgrade corporate bonds.

There is also a range of exchange-traded products which track the price of individual commodities and sometimes a basket of them. Instruments offering exposure to gold are particularly popular. Real estate ETFs track stocks with exposure to this sector rather than investing directly in the properties themselves.

It is possible to use ETFs to capture different investment styles or factors. Arguably these products blur the line between active and passive management.

Dividend ETFs which would appeal to income investors are more established. There are ETFs which track baskets of high-yielding stocks such as iShares UK Dividend (IUKD) and others that focus on dividend growth like SPDR S&P Global Dividend Aristocrats (SPDR).

Increasingly there are ETFs which are growth or value-focused and some which include stocks with share price momentum, or businesses with attributes which make them higher quality.

There are also several multi-factor products which select investments based on a range of different factors. iShares Edge MSCI World Multifactor (FSWD), for example, tracks firms in developed markets selected according to value, momentum, quality and size.

emerging markets stocks, to gain exposure to long-term growth drivers linked to positive demographics – i.e., a large working age population – and an emergent middle class.

One of the most compelling attributes of exchange-traded funds, also known as ETFs, is they allow investors to create a diversified investment portfolio from scratch rapidly, easily and inexpensively.

If you bought a product tracking the MSCI World index you could arguably do this at the click of a single button – and by doing so you would gain exposure to more than 1,500 stocks. But that index is not enough for a diversified portfolio.

The unpredictability of markets and the fact the large US market dominates global indices means there is a case for having money in a broader spread of geographies and asset classes.

Let’s build a portfolio using ETFs which might appeal to someone in their 30s and 40s and who doesn’t need the money for at least 10 years.

For purposes of illustration, let’s say you start with a £10,000 pot and choose to put half of that money into developed market shares. You might want to split it £4,000 into an ETF tracking the MSCI World and £1,000 into a FTSE 250 ETF.

While the FTSE 100 is the London’s market’s flagship index, the mid-cap FTSE 250 has more of a domestic focus and has also performed better than its large-cap counterpart over the long term.

This reflects some of the key qualities of mid-cap investments. They typically have more significant growth potential than FTSE 100 firms and are not as widely followed by analysts so there is a greater possibility of them surprising on the upside with earnings, but they are also not as volatile as small caps and are more likely to pay dividends.

You could put £2,000 or 20% of the sum into

That would leave £3,000 to split evenly between other asset classes including bonds, to help cushion some of the volatility of the stock market, commodities and property.

To create our portfolio, we have focused on ETFs which offer low charges (with an average ongoing charge of just 0.15%) and sufficient scale (at least £100 million in assets).

Where possible we have included an accumulation class of ETF, which automatically

We select six ETFs providing exposure to stocks, bonds, commodities and property

reinvests any income from underlying investments. This assumes the portfolio is for someone with a long investment horizon who may not need income from their investments in the short term.

There are six constituents in our ETF portfolio –someone looking for a slimmed down, simplified version could consider halving that number by allocating 70% to the MSCI World ETF alone, 20% in the bond product and 10% in the property vehicle.

(LCWL) £11.29

Ongoing charge: 0.12%

This ETF tracks the performance of more than 1,500 large and mid-cap stocks across 23 developed market countries including Microsoft (MSFT:NASDAQ) and Johnson & Johnson (JNJ:NYSE). On a 10-year view the annualised return from the underlying index is more than 8%.

(LEMA) £38.48

Ongoing charge: 0.14%

This is among the cheapest ETFs offering exposure to the emerging markets space. It tracks the MSCI Emerging Markets index which includes the world’s leading chip manufacturer Taiwan Semiconductor (2330:TPE), Chinese e-commerce group Alibaba (BABA:NYSE) and Indian tech firm Infosys (INFY:NSE). In the 22 years up to the end of 2022 the annualised return from the MSCI Emerging Markets index has outpaced the developed market MSCI World at 7.5% versus 5.4%.

(VMIG) £33.25

Ongoing charge: 0.1%

This tracks the FTSE 250 index – in effect the 250 next largest companies after the FTSE 100 on London’s Main Market. Its largest allocation is to financials, but it is more diversified than the FTSE 100 with a large exposure to industrials too. Top constituents include mining services specialist Weir (WEIR), renewable energy trust Greencoat UK Wind (UKW) and engineering firm IMI (IMI).

iShares Core Global Aggregate Bond ETF

(AGGU) £4.16

Ongoing charge: 0.1%

Looking to match the performance of the Bloomberg Barclays Global Aggregate Bond index, this ETF offers exposure to both government and corporate bonds. This includes the debt of pharmaceutical giant AbbVie (ABBV:NYSE) and US bank Morgan Stanley (MS:NYSE).

commodities, industrial metals and gold –benefiting from growing demand linked to population growth as well exposure to the metals and other commodities required to help deliver a transition away from fossil fuels.

(TREG) £32.27

Ongoing charge: 0.2%

Like all property-based ETFs this invests in listed property companies – conveying the advantage that the underlying investments are easy to buy and sell and enabling it to keep costs low. It follows the GPR Global 100 index – which tracks 100 developed market real estate firms. Members of the index include US real estate investment trust Prologis (PLD:NYSE). Property offers income as well as diversification and, as a so-called real asset, often performs well during inflationary periods.

iShares Diversified Commodities Swap ETF

(COMM) £5.76

Ongoing charge: 0.19%

At a stroke this product provides access to commodities like oil and gas, agricultural

Holidaymakers will be familiar with exchanging pounds for euros and dollars when making trips abroad.

A weak pound can make that trip more expensive, or a strong pound can result in extra cash to spend.

Exchange rates also impact investing in overseas markets, but unlike the holidays example a weak pound has a positive benefit for investors as we explain in this article.

Exchange-traded funds or ETFs often have different currency classes available which gives investors greater choice but deciding which one is best can seem daunting.

Don’t be put off, because the listing currency doesn’t make much difference to the return investors receive. It’s the currency of the underlying investments in the ETF that matters.

Before getting into the details, it is worth emphasising currencies are notoriously difficult to predict. So much so that analysts don’t bother trying to forecast future exchange rates when drawing up their company earnings estimates.

Historically currencies have been more volatile (annual price variability or fluctuation) than bonds or fixed interest securities and less volatile than shares.

Currencies can help performance and be a source of return as well as a risk. Let’s start with a single company example.

If Jim purchased 100 shares of Tesla (TSLA:NASDAQ) at $130 for $13,000 his investment platform provider should convert the US price into pounds and deduct exchange rate fees and commissions.

Let’s say Jim received an exchange rate of

$1.23 dollars to the pound. The cost before charges is £10,569.

If the pound weakens (buys fewer dollars) from $1.23 to say $1.05 in a year’s time Jim will earn a bigger return due to the increased value of the dollar. Let’s say Tesla shares rise 20%.

The sale price of Tesla would be $156 a share giving US proceeds of $15,600 and a dollar profit of $2,600 (20%). But when converted back into sterling Jim would receive $15,600/$1.05 which is £14,857.

So, in pounds Jim’s profit would be £14,857 minus £10,569 which is £4,287, or 40%, doubling his dollar return.

These dynamics apply to all overseas investments which need to be converted back into pounds including ETFs that hold foreign stocks.

But ETFs offer investors the choice of buying foreign currency classes such as a US dollar class or sterling class.

In the former, investors incur exchange rate costs to convert pounds into dollars. In the latter, they don’t. But ultimately the pounds need to be converted by the fund to be invested into US shares.

Buying the GBP class saves exchange rate fees when converting the purchase and sales from dollars back into sterling.

Investing outside the UK creates foreign currency exposure which can both help and hinder returns

For example, the Vanguard S&P 500 ETF (VUSA) priced in pounds has returned 51.2% over the last five years. The same ETF priced in US dollars (VUAA) has returned 48.9%.

When considering global funds there are more currencies impacting performance, but the principles are the same. A weak pound will enhance returns and a strong one will detract. Another thing to consider is that because global

funds are exposed to several currencies, they tend to naturally hedge each other as rising currencies are offset by falling ones.

It is possible to buy GBP hedged ETFs which aim to remove underlying currency effects. But they do not eliminate all the risk and they can cost more because hedging can be expensive. ETFs which are hedged will have ‘GBP Hedged’ in the description.

Investors do not buy bonds for capital growth but rather for their stable income and portfolio stabilisation qualities. Bond prices tend to move up when equities move down, but this isn’t always the case as 2022 showed.

Global bond ETF providers usually hedge foreign currency exposure to minimise the risk of wiping out the relatively low fixed return and reduce volatility.

By Editor

UK equities were more resilient than many other world markets in 2022. Within the market, investors displayed a clear preference for larger, more international FTSE 100 companies. The extent of the underperformance of small and mid-caps (“smids” for short) is rare and, in the past, such periods have usually been followed by longer spells of outperformance.

The UK smids market encompasses more than 1,000 companies. They may be less well-known than companies in the FTSE 100, but that doesn’t mean they’re not world-leading companies capable of generating superior returns. There are plenty of well-run, innovative and disruptive UK smids, with market-leading positions in new and emerging industries.

The acute underperformance of UK smids in 2022 is piquing the interest of a variety of investors as they look to 2023. Historically, it is unusual for UK smids to underperform to the extent that they did last year. When it has occurred, a period of strong outperformance versus the FTSE 100 has usually followed.

In part, this is because underperformance often leads to more attractive valuations. Meanwhile, with a longer runway of growth ahead of them, investing in small and mid-sized businesses should ultimately deliver superior performance. Many academic studies have evidenced the premium returns on offer from smaller companies.

It can be argued that UK stocks are cheap for a reason, and economic and political events clearly undermined confidence in 2022. Nevertheless, it is always worth remembering that it’s during challenging periods that opportunities can be most plentiful.

Sue Noffke, Head of UK Equities at Schroders, sees a diverse range of attractive opportunities across

both domestic and global-facing UK smids:

“We see opportunities in both the ‘domestics’ serving the UK consumer and business end user, and the many internationally-focused smids. There is no silver bullet to the issues facing the UK economy, where more than 20% of the working age population is economically inactive. Valuations, however, are very beaten up and the market does not seem to be discerning between the good and less good companies.”

Ultimately, some of the higher quality businesses in this part of the market may prove vulnerable to bids. Mid cap companies may be in the sweet spot here, as Andy Brough, Head of the Schroders PanEuropean Small and Mid Cap Team explains:

“Should we see a resumption of bids for cheap UK assets, mid cap companies can be the target of choice – not too big, but sufficiently large to make a difference for the acquirer. As companies are taken out it helps make room for the next tranche of exciting FTSE 250 entrants (only around 20 of the original constituents from 1999 are still in the index today) helping to create a dynamism perhaps not there in other areas of the market.”

As the name suggests, the Schroder UK Mid Cap Fund plc may be viewed as an attractive way of accessing the opportunity in UK smids. The highly experienced team, led by Jean Roche, views the UK mid cap investment universe as the source of the UK’s star businesses of tomorrow and has an impressive track record.

Jean Roche looks to build a high conviction portfolio of 40-50 resilient companies that are capable of delivering dependable long-term growth. She is not complacent about the economic challenges but is confident that the disciplined investment approach continues to deliver a portfolio capable of capturing the attractive opportunity that lies ahead.

The current attractive opportunity in UK smids can also be embraced by portfolios with a broader mandate. Take the Schroder Income Growth Fund plc, for example. The Company has raised its dividend every year since its launch in 1995*, making it an attractive proposition for income-seeking investors.

It may invest anywhere across the UK market cap spectrum and the portfolio has a bias towards larger companies. Nevertheless, the investment opportunity in UK smids is well represented within the current strategy, with more exposure to this part of the market now than ever before.

There is clearly an exciting opportunity among UK small and mid-sized companies currently, but as is always the case, it is not without risk. The war against inflation is far from over. Even the best companies are struggling to pass on higher costs in a cost of living crisis of historic proportions.

Higher interest rates could be a major issue for companies with high levels of borrowings, especially if that debt needs to be refinanced soon.

However, many of the best UK smids have made it through the pandemic and, with the support of strong balance sheets and attractive starting valuations, they are well prepared to weather whatever storms lie ahead.

* Source: AIC/Morningstar, July 2022.

The company may borrow money to make further investments, this is known as gearing. Gearing will increase returns if the value of the investments purchased increase by more than the cost of borrowing, or reduce returns if they fail to do so. In falling markets, the whole of the value in that investment could be lost, which would result in losses to the fund.

As a result of fees being charged to capital, the distributable income of the company may be higher but there is the potential that performance or capital value may be eroded.

The company may be concentrated in a limited number of geographical regions, industry sectors, markets and/or individual positions. This may result in large changes in the value of the company, both up or down, which may adversely impact the performance of the company.

This information is a marketing communication.

Past Performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of investments to fall as well as rise.

The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations.

Reliance should not be placed on any views or information in the material when taking individual investment and/or strategic decisions.

Schroders has expressed its own views and opinions in this document and these may change.

We recommend you seek financial advice from an Independent Adviser before making an investment decision. If you don’t already have an Adviser, you can find one at www.unbiased.co.uk or www.vouchedfor.co.uk

Before investing in an Investment Trust, refer to the prospectus, the latest Key Information Document (KID) and Key Features Document (KFD) at www.schroders.co.uk/investor or on request.

Issued in January 2023 by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registration No 4191730 England. Authorised and regulated by the Financial Conduct Authority

Find out more at www.schroders.com/investmenttrusts

The severe tightening in financial conditions in the second half of 2022 caused commercial property values to fall at the fastest six-month rate on record.

As a result of much cheaper valuations, investors are asking themselves whether now is a good time to start taking positions in listed property companies and real estate investment trusts, also known as REITs.

We look at where valuations are, where they could go, and which stocks look the most attractive.

One key thing retail investors need to appreciate about property companies is the importance of interest rates in determining valuations.

Property is an income-generating asset, and changes in interest rates affect the rate of return investors require on their investment.

Before March 2020, the Bank of England’s official bank rate (also known as the ‘base rate’) was 0.75%, but within weeks of the Covid crisis the bank cut its rate first to 0.25% and then to 0.1%, a 325-year low.

As a result, the yield on UK government bonds or gilts – considered the ‘risk-free’ rate – slumped, allowing rental yields on property to fall and valuations to soar.

The best-performing property assets were retail warehouses and prime logistics centres as households shifted to shopping online.

With the pandemic in the rear-view mirror, the Bank of England began raising rates in December 2021, since when it has hiked the base rate nine times to 3.5%, meaning higher yields on gilts and property stocks.

Just as lower rates sparked a jump in valuations,

so higher rates have seen valuations fall sharply, with the worst-affected sectors being logistics and ‘big-box’ retail which previously gained the most.

According to commercial property valuation expert CBRE, which compiles an index based on the value of over 1,000 commercial properties and 31 monthly-valued funds worth in total over £16 billion, overall capital values fell by 13.3% in 2022. That compares with a 13.8% post-pandemic bounce-back in 2021.

Industrial assets fell 21% in value, followed by a decline of 12.1% in offices and 8.1% in retail.

On a positive note, rental values rose 4.7%, the strongest since the millennium, with industrial rents up 10.3%, offices up 2% and a 0.5% increase for retail.

As a result, the total return for each sector was -18.1% for industrial assets, -8.2% for offices, and -2.1% for retail, with the overall total return -9.1% for the year.

The consensus view is that commercial property valuations will keep falling this year due to more interest rate rises, a UK economy which is weakening if not already in recession and continuing macro-economic uncertainty due to the ongoing conflict in Ukraine.

There are still valuation concerns over parts of the retail sector exposed to the cost-of-living crisis

Capital values are falling faster this timeThe rebound in capital values post trough

May 93

Jul 09

Nov 89

Jun 07Jun 22

0% -5% -10% -15% -20% -25% -30% -35% -40% -45% -50%

0 4 12 16 20 24 28 32 36 40

Months from peak

Source: MSCI, CBRE, Peel Hunt

and parts of the office sector which need upgrading to meet new environmental standards, but most parts of the market are not overbuilt and there are supply shortages in some areas.

Therefore, the jury is out over how much further valuations will fall this year before confidence returns, but CBRE notes there is still an abundance of debt and equity capital available and towards the end of last year prices were beginning to firm, attracting buyers into the market.

Analysts Matthew Saperia and James Carswell at Peel Hunt are optimistic the bottom is near given the speed with which values have already fallen.

‘The quicker we reach the bottom the quicker investment activity will restart and the quicker we will find clarity on valuations and NAVs (net asset values). It feels to us like we could be close, and the sector is typically quick to rerate in such circumstances,’ they argue.

‘The sector-wide share price implied property yield sits at 6.3% on an equivalent basis, offering a significant spread over the risk-free rate,’ they add, while the quality and exposure of the listed sector is ‘far superior to the broader benchmark’.

Richard Shepherd-Cross, managing director of Custodian Property Income REIT (CREI), which invests in smaller commercial properties across the country, believes valuations have overshot to the downside in many cases.

‘There is an expectation that commercial property yields should show a premium over gilts,

18% 16% 14% 12% 10% 8% 6% 4% 2% 0%

0 1 2 3 4 5 6 7 8 9 10 11 12

Months from trough

Source: MSCI, CBRE, Peel Hunt

the risk-free rate, but don’t overlook rental growth. ‘Certain sectors could be oversold if growth isn’t factored in, and there is a very strong case for rental growth in smaller lot-size industrial and logistics assets, regional offices where clients are offered a high level of service and amenity, and in some retail locations where values have fallen too far.’

Michael Nicholson, Peel Hunt’s head of mergers and acquisitions, believes higher operating costs combined with higher interest rates highlight ‘the merits of scale’ for many UK companies.

Historically, the main acquirers of UK firms over the past five years have been North American, but in the property sector most deals have been domestic such as last year’s merger proposal between Shaftesbury (SHB) and Capital & Counties Properties (CAPC)

While deals have been few and far between since Covid, share-price premiums for transactions have been healthy at around 25% reflecting the big discounts to net asset value in the sector and a tendency by sellers to leave the door open to attract competing bids.

The Peel Hunt team believe private equity firms are likely to be looking at UK property, and we note that US investment giant Blackstone (BX:NYSE) has been active raising capital and deploying it in property assets in the past year.

The painful adjustment to an environment of higher inflation and interest rates was the financial market story of 2022. A tough combination of the war in Ukraine, the legacy of the exceptional policy response to the pandemic and disrupted supply chains pushed prices higher for energy, agricultural commodities and, increasingly, labour. Central banks were forced to raise interest rates to curb these pressures.

These stresses were mostly felt in short-term inflation expectations, while longer-term expectations moved only slightly. Nevertheless, the short-term moves were severe. In the UK, inflation hit levels of 13-14%, the highest levels seen since the early 1980s. The Bank of England raised rates nine times from December 2021, pushing up gilt yields, peaking at the time of the shambolic Truss/Kwarteng mini-budget.

Whilst this created an extremely difficult backdrop for stock markets, 2022 was not without its success stories: the UK’s larger companies were flattered by a weaker sterling (a significant share of their revenues comes from overseas) and by the strong performance of commodity-related sectors. However, the domesticallyfocused FTSE 250 saw double-digit falls for the year.

Sector performance was significantly influenced by the interest rate cycle. Companies with high debt, or little pricing power struggled as the economic environment weakened and borrowing costs soared. Energy was the year’s stand-out performer, but there were other pockets of resilience, including healthcare, utilities

and consumer staples. The worstperforming sectors were domestic cyclicals such as real estate, consumer discretionary and technology. There was a significant rotation away from growth and towards ‘value’ sectors. Sentiment towards UK assets was volatile. There can be little doubt that the mini-budget left the UK on the naughty step for many investors. The subsequent Autumn statement stabilised the situation, but the UK is still viewed carefully for any signs fiscal discipline may be lapsing.

It was a year of two halves for Dunedin Income Growth Investment Trust (DIGIT). Amid the uncertainty during the first six months of 2022, our main focus was to test the thesis for all the companies in the portfolio against the new economic environment, and make any adjustments. Selectively, we added to existing holdings when share prices fell back and made a few selective sales. We exited GSK (formerly GlaxoSmithKline) and Haleon, for example and added to Unilever, Aveva and the London Stock Exchange. These are all good quality businesses with long-term growth prospects that had been sold down.

In the second half of the year, as more clarity emerged and markets adjusted to higher inflation and interest rates, we started to look more closely for new opportunities. This included switching out of Persimmon and adding Taylor Wimpey, adding insurance group Hiscox, while also introducing Oxford Instruments, a specialist industrial manufacturer of high tech industrial equipment. At the moment, we are finding the most significant opportunities among domestic cyclical companies, where share prices have

been hit hard. That includes companies such as Morgan Sindall and Marshalls.

The trust is well-balanced for defensiveness and recovery. It should be resilient if the economic environment worsens – the earnings and balance sheets for companies in the portfolio are likely to be more robust. However, if investors become more confident and enthused, we have been increasing our exposure to UK mid cap, domestically-focused businesses, so would hope to participate in that recovery. We are minutely focused on getting company selection right – if we do, share prices will follow.

At the start of 2023, the market remains focused on inflation and interest rates: where will inflation level out? How quickly will it subside? Will it become embedded in wages? In all scenarios, markets will be watching central banks’ next move. It is likely that, barring a significant shock, we are closer to the end than the beginning of the tightening cycle.

Perhaps this may even mean that investors will have a less intensive focus on interest rates and inflation this year. The market had a significant adjustment to make in 2022, but expectations now appear more settled. This may finally allow a greater focus on the specific characteristics of individual

Ben Ritchie and Rebecca Maclean, Investment Managers, Dunedin Income Growth Investment Trust PLC

Ben Ritchie and Rebecca Maclean, Investment Managers, Dunedin Income Growth Investment Trust PLC

companies, after a year when inflation data and the latest guidance from the US Federal Reserve occupied investor attention.

We would certainly welcome more focus on individual businesses. This is where we spend our time, looking at how a business is performing from a revenue, profit, cash flow and dividend point of view. Broader market sentiment and macroeconomic data are important, but these factors tend to be unpredictable. In the year ahead, we hope to spend less time talking about inflation and more time talking about profitability.

There are a wide range of outcomes for 2023 and we believe share price performance may vary considerably depending on the company and individual subsector. There are

plenty of reasons for caution with UK consumers facing the rising cost of living, higher mortgage rates and interest costs. Similarly, forwardlooking global economic indicators are negative, and some of the more economically sensitive sectors may have to lower their forecasts. The key questions though are how much of this is priced in and do companies have the strength of balance sheet and cash generation to trade through what may be difficult times ahead. In that regard we are optimistic that for those able to take a medium-term view that there are attractive opportunities emerging.

There also remain pockets of strength. For example, The US Inflation Reduction Act and the need to drive energy security will support sectors such as renewables across the world. Likewise there remains strong structural growth drivers in areas such

Risk factors you should consider prior to investing:

• The value of investments, and the income from them, can go down as well as up and investors may get back less than the amount invested.

• Past performance is not a guide to future results.

• Investment in the Company may not be appropriate for investors who plan to withdraw their money within 5 years.

• The Company may borrow to finance further investment (gearing). The use of gearing is likely to lead to volatility in the Net Asset Value (NAV) meaning that any movement in the value of the company’s assets will result in a magnified movement in the NAV.

• The Company may accumulate investment positions which represent more than normal trading volumes which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

• The Company may charge expenses to capital which may erode the capital value of the investment.

• Derivatives may be used, subject to restrictions set out for the Company, in order to manage risk and generate income. The market in derivatives can be volatile and there is a higher than average risk of loss.

• There is no guarantee that the market price of the Company’s shares will fully reflect their underlying Net Asset Value.

as healthcare, speciality chemicals and financial services. We are also more optimistic on the prospects for consumers in emerging markets, particularly in Asia. Companies providing essential products and services to these end markets, with strong competitive positions and resilient financials should be wellplaced to navigate an uncertain period ahead. Looking to balance the portfolio between exposure to both structural growth and selective cyclical opportunities is where we see the best combination of risk adjusted returns in 2023.

Companies selected for illustrative purposes only to demonstrate the investment management style described herein, and not as an investment recommendation or indication of performance.

• A s with all stock exchange investments the value of the Company’s shares purchased will immediately fall by the difference between the buying and selling prices, the bid-offer spread. If trading volumes fall, the bid-offer spread can widen.

• Certain trusts may seek to invest in higher yielding securities such as bonds, which are subject to credit risk, market price risk and interest rate risk. Unlike income from a single bond, the level of income from an investment trust is not fixed and may fluctuate.

• Yields are estimated figures and may fluctuate, there are no guarantees that future dividends will match or exceed historic dividends and certain investors may be subject to further tax on dividends.

Issued by abrdn Fund Managers Limited, registered in England and Wales (740118) at 280 Bishopsgate, London EC2M 4AG. abrdn Investments Limited, registered in Scotland (No. 108419), 10 Queen’s Terrace, Aberdeen AB10 1XL. Both companies are authorised and regulated by the Financial Conduct Authority in the UK.

Find out more by registering for updates. You can also follow us on social media: Twitter and LinkedIn

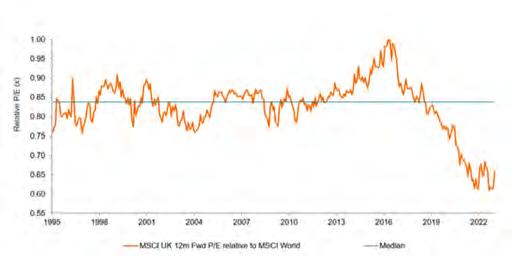

You could make ‘very good money’ from UK stocks, according to a well-respected fund manager

The FTSE 100 approaching a new record high puts the spotlight on UK stocks again. The index is full of shares which should thrive in the current environment – value stocks, energy producers, defensive sectors like tobacco and healthcare, and banks which benefit from higher interest rates. Valuations are cheap and dividends are generous. Key to pushing the UK market higher is luring back foreign investors.

Predictions of a big slowdown in economic growth this year due to recession don’t help, neither does the recent turmoil within the UK Government. However, markets are forward looking, and so much bad news is already in the price.

Getting a good entry point is crucial in investing and one could argue that UK equities are incredibly cheap now. Just imagine if we started to see foreign investors load up on FTSE 100 stocks. That could provide the tailwind to take the index well above its May 2018 record high.

‘The UK is incredibly unpopular in global terms, and I think there is only upside,’ says Mark Slater, manager of Slater Growth Fund (B7T0G90). ‘It would take very little to really move the market if international investors switched on to the UK.

‘Anyone who wants to be out of the UK is out so there is an awful lot of scope for upside surprise in the UK market. The precise timing is not something I think is worth agonising about. If you are looking three to five years ahead, I think people will make very good money.’

If interest rates stay elevated, then the growth stocks that populate the upper echelons of the US market could continue to find life hard. Value stocks

should do better, and the UK has them in spades.

The UK became less attractive to international investors after the UK voted seven years ago to leave the EU. ‘International investor aversion to the region intensified amid trading and regulatory uncertainty,’ says Jo Rands, portfolio manager and research analyst at asset manager Martin Currie. ‘Today, the UK valuation discount versus the rest of the world remains over 30% lower than it was in June 2016.’

The negativity has lingered, exacerbated by institutional investment decisions becoming more centralised. ‘There has been an increasing preference for global allocations,’ Rands explains. ‘The US makes up circa 50% of the global benchmarks versus just 4% for the UK. This is evident when we consider actively managed asset flows over the past 36 months – UK equity asset classes have endured outflows of $79 billion versus inflows of over $300 billion for global equity asset classes over the same period.’

These UK outflows have resulted in bargains galore, so what would it take for foreign investors to reappraise the FTSE 100’s constituents? Another bad year with US stocks might do it.

It seems increasingly likely the impact of an economic slowdown will cause many large US companies to miss earnings expectations, particularly if their margins are being squeezed by demand weakness and high staff costs.

There remains a compelling argument to own UK stocks and you want to already have a position before overseas investors flock back. As Mark Slater says, it’s hard to say when that will happen, but the reasons for them doing so are growing day by day.

very year this column tracks the ratings put on stocks across the FTSE 100 and FTSE 350 by the investment banks which provide research on the UK equity market. This time, the analyst community is the most bullish it has ever been since our first survey back in 2015, based on stock-specific, public recommendations.

Russ Mould Bell Investment Director

Table:

over the past nine years respectively and matching those of 2022. For the FTSE 350 index 63% of all recommendations are positive ratings and just 8% negative ones, the highest and joint-lowest since we began this survey in 2015.

Shares is not endorsing these views, but investors could be forgiven for wondering whether this is a signal to buy more London-traded stocks or a warning to cut exposure to UK equities.

Momentum players may feel inclined to go with the positive flow. Contrarians may take the

Table: Shares magazine • Source: Refinitiv data, analysts consensus, Marketscreener. Data as of 6 January 2023

opposite view as they bear in mind legendary investor Sir John Templeton’s maxim that ‘bull markets are founded on pessimism, grow on scepticism, mature on optimism and die on euphoria.’

One way to research which path may be the best one to follow is the assess the efficacy of individual analyst recommendations.

This column has backtested the performance on the most and least popular stocks at the start of a year, as measured by the percentages of ‘buy’ and ‘sell’ ratings attributed to them by analysts.