Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Is inflation already below target in the US?

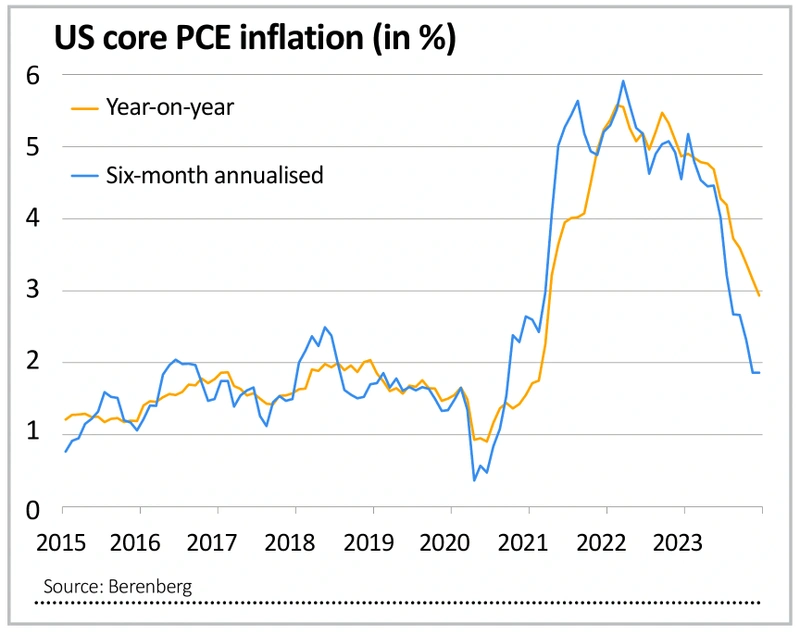

Ever since the inflation genie was let out of the bottle in 2021, the market has been obsessed with how quickly it can be brought back under control and back within central bank targets. On at least one measure, US inflation may already be within the 2% limit targeted by the Federal Reserve.

The Fed’s preferred measure of inflation is core PCE (personal consumptionexpenditure) – which strips out the impact of more volatile food and energy prices. As the chart shows, Berenberg calculates that on a six-month annualised basis this dipped below 2%, hitting 1.9% in November and December.

Berenberg chief economist Holger Schmieding says: ‘To understand the pattern, consider the three major causes of the preceding surge in US inflation. It started with the excessive fiscal boost during the pandemic. While lockdowns and social distancing curtailed access to services, US households tried to spend their stimulus cheques by ordering more goods online than China and others could produce and the global shipping industry could deliver at the time. This drove up prices.

‘Thereafter, the post-pandemic rebound in the economy met a constrained supply of labour as some workers had withdrawn from the labour force, causing a spike in labour costs. Finally, the surge in energy prices in 2021 and early 2022 worked its way through the production chain into prices for non-energy goods and services. As a result, the core PCE settled at a year-on-year rate above 5% from November 2021 to November 2022.’

Schmieding affords some credit to the Fed for ‘belatedly’ switching to a restrictive stance but says the major reason for the changed inflation picture is a return to normality with the three factors he discusses ‘largely one-offs which have run their course’. On this basis there seems little case for the Fed maintaining rates at current levels for too much longer – even if the US economy has proved more resilient than feared.

This is encouraging for equity investors, given rate cuts should be supportive to stocks. However, there are other risks to consider. One is whether Schmieding (and others) are right that the three major drivers of inflation over the last few years are truly one-offs or if they are more structural in nature.

There is also the near-term risk associated with another spike in energy prices and shipping costs thanks to escalating tensions in the Middle East. This could add to inflationary pressures once more. Evidence of this and the knock-on effect for consumers may not be apparent for some time – which could be weighing on the minds of monetary policy makers.

Finally, the fortunes of the world’s largest and most liquid market – the US – are heavily concentrated on a small collection of big tech stocks where valuations and expectations are both elevated. Even beyond these influential names, plenty of Wall Street shares are trading at or in sight of record highs. The question we now face is whether the landing can be soft enough to justify such exuberance.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Daniel Coatsworth

Editor's View

Education

Feature

Great Ideas

Investment Trusts

News

- Pfizer beats earnings expectations but still has a lot to do to recapture former glories

- Chinese stock market rocked by $330 billion Evergrande liquidation

- Why shares in fashion victim Superdry have slumped 50% year-to-date

- InterContinental Hotels continues to benefit from strong travel demand

- Luxury goliath LVMH shows resilience but Diageo serves up sobering results

magazine

magazine