Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Why companies which can lower the cost of doing business are well positioned

Few companies have escaped the impact of higher inflation, whether in the form of higher raw material and energy costs or increased labour and transportation expenses.

Even if central banks manage to eventually cool inflation, it seems more likely than not to remain elevated for some time.

This shift in the macro environment will encourage companies to accelerate investments in automation and productivity-enhancing technologies, according to research from US investment bank Morgan Stanley.

The idea is that companies which enable cost reduction and/or increase productivity will become more valuable. Historically technological advances have been associated with deflation or falling prices.

REVIVING THE PRODUCTIVITY SLUMP

Decades of declining productivity growth in the US and an ageing capital base combined with the potential for structurally higher wage costs could threaten corporate profitability over the medium term.

According to Morgan Stanley the average age of private fixed assets in the US is the highest since the 1950s.

One solution to the toxic mix of ageing assets and high costs is for companies to pivot from financial engineering tactics such as share buybacks towards productivity-enhancing investment.

This could create new technologies which potentially lower the cost of doing business and increase shareholder returns.

Morgan Stanley singles out clean energy and battery storage as industries which are on the cusp of seeing significant gains from deflation enablers.

Rapidly declining costs of alternative energy and batteries would allow companies to scale-up manufacturing which will drive faster adoption.

INFLECTION POINT FOR AI-BASED TECHNOLOGIES

Every new technology requires time to get into its stride and although artificial intelligence (AI) has been around for decades only recently has it seen accelerated growth and adoption.

In part this has been driven by increased computing power, but it has also been influenced by security fears at government level and by a need to find an AI ‘edge’ at the corporate level.

The acceleration in the rate of growth is exemplified by the amount of time it takes to train an AI system to recognise certain images. Training time fell significantly from 6.2 minutes in 2018 to 47 seconds in 2020 according to research at Stanford University.

At the same time the hardware cost of the same process has dropped from around $1,100 to $7.43, making it roughly 150 times cheaper. These advances make it quicker and cheaper to deploy AI in certain industries.

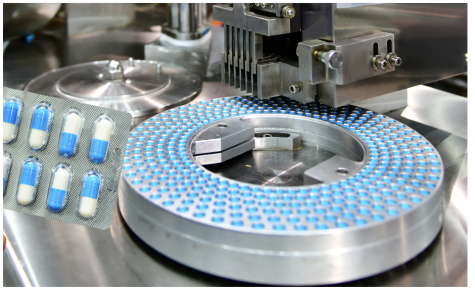

FASTER AND CHEAPER DRUG DEVELOPMENT

One area of great excitement is the potential to increase the speed of drug development while reducing costs. Computers are much better than humans at shifting through millions of combinations of potential drug candidates.

According to Morgan Stanley the initial data suggests the potential to reduce the time spent in key stages of pre-clinical drug development by around 75% and development costs by around 50%.

Some AI-drug developers have said they are able to reduce the number of molecule candidates by 90% compared to the industry average.

In addition, they can ‘fast-fail’ improbable candidates early to prioritise the opportunities with the best chance of success.

Morgan Stanley estimates these advancements could result in up to 50 new drug therapies over a 10-year period and represent a $50 billion-plus opportunity for the pharma industry.

The investment bank highlights US biotech AI firms Schrodinger (SDGR:NASDAQ) and Exscentia (EXAI:NASDAQ) as ones to watch for the future.

In the UK, teleradiology company Medica (MGP) has developed AI solutions to assist radiologists in identifying hard to detect haemorrhages.

Another interesting company to keep on the radar is Spectral MD (SMD:AIM) which develops technology using predictive analytics and AI algorithms to help clinicians make more accurate and faster treatment decisions.

The objective is to make an immediate assessment of a wound’s healing potential, saving valuable time, not to mention pain relief for patients.

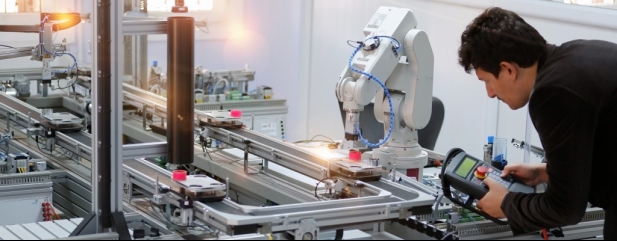

RISE OF THE ROBOTS

Separate to the debate around whether robots are good or bad for society the robotics industry has seen strong growth Morgan Stanley highlights.

The investment bank points out this is consistent with Wright’s law which states that costs decline at a constant rate for every doubling of cumulative units made.

The cost savings work out at around 30% and suggests robot pricing could fall substantially if the industry continues to grow at the current rate. This would create a virtuous circle where lower costs allow new industries to adopt robots and expand the total addressable market.

Global robot penetration, defined as the number of robots per 10,000 manufacturing workers, has tripled since 2009. While there are multiple drivers of demand, demographics appear to play an important role.

Outside China, countries with the highest installations also happen to have a high proportion of over 60s, suggesting this is a structural growth driver.

Robots are a small segment of the overall industrial automation market. Swiss engineering giant ABB (ABB:SWX) estimates the industrial automation market is worth around $75 billion and growing around 6% a year.

Leading players in the industrial robot manufacturing space include Japanese company Fanuc (6954:TYO) and US company Teradyne (TER:NASDAQ).

Automation within the office environment is becoming more widespread as companies look to make efficiency gains outside of manufacturing.

Rising wage costs in the current environment increase the incentive for firms to go further down the automation route.

It shouldn’t be surprising therefore that Britain’s leading robotic process automation specialist Blue Prism attracted the attention of private equity firm Vista Equity which ended up buying the business for £1.22 billion in November 2021.

Retraining employees will likely become a priority as companies streamline operations through automation to mitigate higher inflation. Companies such as Learning Technologies (LTG:AIM) may have a role to play in that digital transformation.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

- FTSE 250: Can UK mid caps shine again and which stocks should you buy?

- Why Chipotle’s red-hot pricing power has positive read-across for Tortilla

- Why companies who cross-sell have happy customers and investors

- Explaining economic moats and why investors are so keen to own businesses which have them

- Why companies which can lower the cost of doing business are well positioned

magazine

magazine