Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

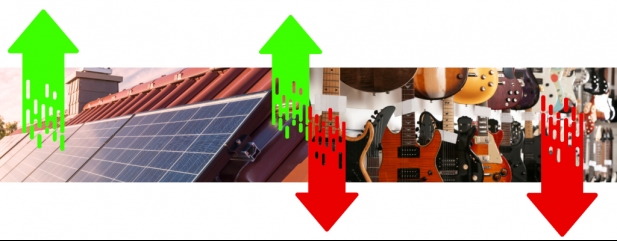

Growth stocks continue to struggle as we reveal stocks at 52-week highs and lows

It is one thing for analysts to forecast which stocks and sectors will do well in a rising-rate or inflationary environment, but when it actually comes to pass it’s always fascinating to see what works in practice.

Judging by the list of stocks making 12-month highs over the past week, those who favoured real assets were on the money.

Standing tall are 3i Infrastructure (3IN), AEW UK REIT (AEWU), GCP Infrastructure (GCP), JLEN Environmental Assets (JLEN), JPMorgan Core Real Assets (JARA) and Taylor Maritime Investments (TMI).

Also looking down on the rest of the market are a couple of solar trusts, Foresight Solar (FSFL) and NextEnergy Solar (NESF), which had consistently lagged until the invasion of Ukraine sent energy prices skyward, along with a basket of oil exploration and production firms.

Other winners include telecoms testing equipment maker Calnex Solutions (CLX:AIM), payments group Equals (EQLS:AIM), insurance group Helios Underwriting (HUW:AIM), industrial conglomerate MS International (MSI:AIM) and people-screen technology firm Thruvision (THRU:AIM).

Honourable mentions go to distributor Bunzl (BNZL), outsourcer Serco (SRP) and warehouse investor Tritax Big Box (BBOX) which are just a few percent away from making 12-month highs.

On the losing side over the last week have been a handful of overseas funds, mostly in Japan, along with several former growth darlings.

Baillie Gifford Japan (BGFD), Baillie Gifford Shin Nippon (BGS) and JPMorgan Japan Small Cap Growth & Income (JSGI) are all in the dog house, as are Abrdn China Investment Company (ACIC) and Infrastructure India (IIP).

Previous high-flyers now making year-lows include telecoms infrastructure investor Helios Towers (HTWS), legal services firm Knights Group (KGH:AIM), building accessories supplier Tyman (TYMN) and logistics group Xpediator (XPD:AIM).

Several life sciences firms have also struggled this year, such as diagnostics companies EKF Diagnostics (EKF:AIM) and Renalytix (RENX:AIM), biotech MaxCyte (MXCT:AIM), gene therapy firm Oxford Biomedica (OXB) and medical device maker Rua Life Sciences (RUA:AIM).

Other notable losers include former lockdown winners musical instrument seller Gear4Music (G4M:AIM), online card and gift seller Moonpig (MOON), nearly-new car dealer Motorpoint (MOTR), online grocery delivery platform Ocado (OCDO) and pet health provider Pets At Home (PETS).

Finally, following a warning over its medium-term future and a fall of more than 65% in its shares this week, convenience retailer McColls (MCL) has seen its shares slump to a new 12-month low. McColls’ market cap is now just £11 million from £220 million a year ago.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

- Great buying opportunities from the big tech rout

- The companies able to charge more without hurting demand

- Explaining the poison pill defence which could have derailed Musk’s Twitter bid

- How big property funds have performed and the different ways to invest

- Emerging markets: Views from the experts

- The best and worst first quarter performers in emerging markets

- Why Unilever has a 10.5% stake in this small cap drug developer

Great Ideas

- Strong reasons to buy Strix, a global leader in niche market

- Loungers maintains fast growth despite facing consumer headwinds

- Brookfield and Homeserve in talks as broker says shares could be worth £15

- Asia Dragon Trust goes shopping for stocks amid market sell-off

- Smartly-timed sale and share buyback reveal Spectris’ hidden value

- Why B&M remains a great way to beat the squeeze

News

- Novacyt faces £134.6 million NHS legal claim

- Can consumer-facing firms beat the big squeeze?

- Growth stocks continue to struggle as we reveal stocks at 52-week highs and lows

- Shares in mining companies hurt by Chinese lockdowns and operational issues

- Why language services group RWS could be the latest private equity victim

magazine

magazine