Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

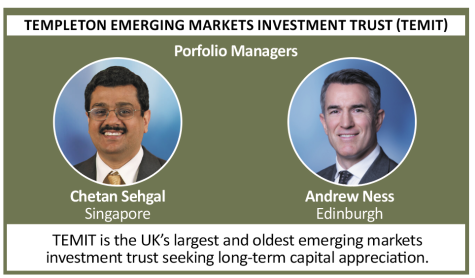

Emerging markets: Views from the experts

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

1. South Korean automotive manufacturer signalled that it expected the global automotive chip shortage to ease by the second quarter of 2022. The spread of the Covid-19 Omicron variant has impacted the supply of automotive semiconductors, particularly from Southeast Asia, where Malaysia is the dominant supplier accounting for 10% of basic semiconductors used in cars, smartphones and home devices. An easing of the supply shortages would be positive for the South Korean market as reflected in consensus expectations of 11% earnings growth in 2023. We are positive on the outlook for the South Korean market, in particular the technology sector.

2. Higher commodity prices and stronger domestic currencies drove returns in Latin America. Undemanding valuations coupled with growth in Brazil’s economic activity index after four consecutive months of decline, and expectations that inflation may have peaked drove equity prices in Brazil. In Chile, investors welcomed president Gabriel Boric’s new cabinet that reinforced his moderated stance and promoted economic stability. Similarly, market confidence in Peru was driven by indications that president Pedro Castillo was taking a more moderate approach than widely expected. However, Mexican equities declined on peso weakness and disappointing gross domestic product data, which indicated that the economy entered a technical recession in the final quarter of 2021.

3. Europe, Middle East and Africa region rose in January. Markets in the Middle East gained on the back of higher oil prices. The South African market gained on higher metal prices and a stronger rand. Sentiment was further driven by the end of the country’s fourth COVID-19 wave and relaxation of mobility measures. In Hungary, strength in the financials sector drove market returns. Russia was among the worst.

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine