Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Keep faith in CentralNic, there could be big upside to come

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

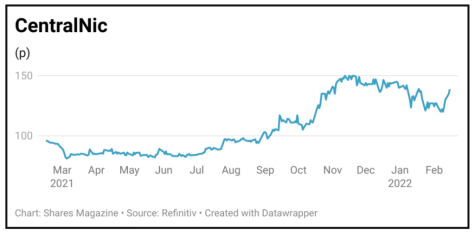

CENTRALNIC (CNIC:AIM) 137.7p

Loss to date: 3.7%

Original entry point: Buy at 143p, 25 November 2021

Internet expert CentralNic (CNIC:AIM) has started 2022 much the same way that it ended 2021, putting up strong growth numbers and continuing its acquisitions push.

That just weeks into its new 2022 financial year CentralNic believes it will beat current forecasts shows just how rampant demand is for online marketing expertise.

Those estimates range between $48 million and $51 million of earnings before interest, tax, depreciation and amortisation on $410 million to $468 million revenue, although Zeus Capital has raised its own estimates by 4% and 15% respectively.

Which makes the shares’ relatively slow progress puzzling and frustrating, for investors and management. CentralNic has been using debt funding for acquisitions rather than risk diluting shareholders at what it believes is a discounted valuation.

The small but strategic purchases of Germany domain name .ruhr and Fireball will bolster its domains business and increase its portfolio of privacy-focused solutions for its growing online marketing customer base and generate extra internet traffic revenue.

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine