Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

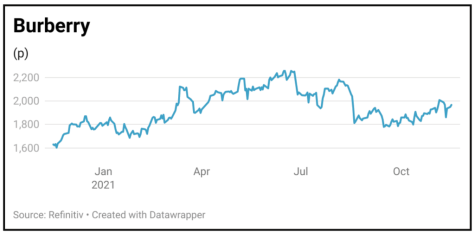

Burberry still looks good despite recent tumble

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

BURBERRY (BRBY) £19.65

Gain to date: 20.3%

Original entry point: Buy at £16.34, 19 Nov 2020

Our buy call on Burberry (BRBY) is 20.3% in the money, although shares in the British luxury brand took a tumble on first half results (11 Nov).

The leather goods, jackets and shoes seller reinstated the interim dividend at 11.6p after reporting a jump in pre-tax profits as sales returned to pre-pandemic levels. Burberry said full-price sales are growing at a double-digit percentage rate, driving margin expansion and strong free cash generation.

Yet while the Americas, China and South Korea delivered strong double-digit growth versus the comparable pre-Covid period, reduced tourist levels are weighing on the EMEIA (Europe, Middle East, India and Africa) region. Ongoing travel restrictions are limiting tourist flows, although this headwind could pass as restrictions are relaxed and assuming well-heeled Asian tourists return to Europe in numbers.

Encouragingly, Burberry is seeing an acceleration in performance in countries less impacted by travel restrictions and remains comfortable with current year market expectations. Medium-term guidance for high single-digit top line growth and ‘meaningful margin accretion’ remains intact too.

The pricing power conferred by its strong brand means the company can contend with inflationary pressures.

SHARES SAYS: Burberry is still a buy.

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine