Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Blue Prism takeover not done deal yet

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

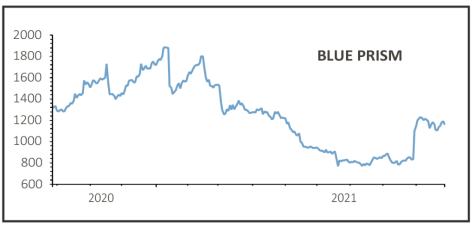

Blue Prism (PRSM:AIM) £11.70

Gain to date: 50.3%

Original entry point: Buy at 778.5p, 15 July 2021

Investors may be disappointed by the takeover terms for robotic process automation firm Blue Prism (PRSM:AIM).

The £1.1 billion deal agreed with Vista Equity Partners fell short hoped for levels and saw the shares dip on the news.

While the £11.25 per share offer was pitched at a 35% premium to the price before Blue Prism revealed it had entered into talks with Vista and its rival bidder TPG Capital in August, the market was clearly expecting in a higher offer.

The company appears to be trying to win investors over to the merits of the deal by painting a reasonably bleak picture of its immediate prospects.

Blue Prism cited several operational and organisational headwinds and the difficulty in searching for a new chief executive as it responds to shareholder pressure to split the combined chairman and CEO hat currently worn by Jason Kingdon.

Based on the pattern of other recent takeover situations it would not be a surprise to see a higher bid surface, as the business has attractive growth prospects despite some near-term challenges.

SHARES SAYS: Anyone owning the shares should sit tight for now and see how the situation plays out.

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine