Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

China exposure is a key risk for Lindsell Train Equity Fund

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Lindsell Train UK Equity FUND

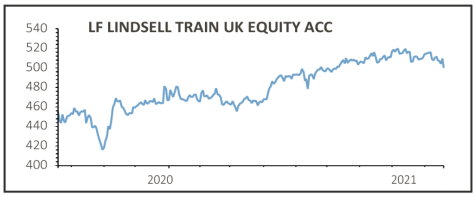

(B18B9X7) 507.7p

Gain to date: 9.6%

Original entry point: Buy at 463.1p, 4 March 2021

A tilt back towards quality stocks earlier this year as the vaccine-led value rally ran out of steam has supported a recovery for Lindsell Train UK Equity (B18B9X7). However, exposure to a brewing Chinese crisis could make life more difficult for the fund in the coming months.

Longer term we believe the Nick Train-steered collective’s emphasis on quality will pay off for holders of the fund. However, in the short term, big positions in luxury brand Burberry (BRBY) and French spirits group Remy Cointreau could come under pressure given their exposure to China, where sentiment is weakening.

In his latest commentary on the fund Nick Train observed: ‘An important reason for our holdings in Burberry and Remy is that the premium/luxury nature of their products not only allows them to participate in global growth (as they have all this century), but also protects shareholders against the effects of inflation.

‘The brands confer pricing power. Certainly, both companies, particularly Remy, have been able to increase prices in 2021.’

SHARES SAYS: Investors should note the risks associated with China-related exposure and growing market concerns that Chinese consumer spending could disappoint in the near-term. That said, the fund is still a long-term buy for patient individuals.

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine