Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

What investors should do after Prudential’s Jackson Life split

Insurance giant Prudential (PRU) is poised for a major change as it plots the imminent demerger of its US Jackson Life business.

In October 2019 Prudential spun off its fund management arm M&G (MNG), crystallising a £5.6 billion valuation with investors receiving shares in both companies.

Prudential is now close to demerging Jackson Life, with the process set to take place later in September. Investors will receive one share in Jackson for every 40 shares held in Prudential.

In our view investors should sell the shares they receive in Jackson Life which will be listed on the New York Stock Exchange, and retain their holdings in UK-listed Prudential.

WHY INVESTORS SHOULD SELL THEIR SHARES IN JACKSON LIFE

Low interest rates coupled with high market volatility have combined to create extremely difficult conditions for Jackson Life’s core variable rate annuity business. This has resulted in higher reserve requirements and hedging costs which have consumed a huge portion of the cash flows generated by the business.

Moreover the American business is distinctly mature and the market is sceptical about the sector’s ability to generate consistently high returns. This is reflected in the market ratings ascribed to Jackson’s peer group. Brighthouse trades at 0.13 times its net asset value and just 2.5 times forward earnings and Lincoln National trades at an almost as unloved rating of 0.3 times NAV and 3.4 times forward earnings.

Prudential has consistently struggled to generate consistent returns from what is a mature but well regarded annuity business. Exiting Jackson provides management with the opportunity to generate capital that it can invest more lucratively in its Asian operations.

It also raises the prospect of closing a material valuation discount to its closest Asian peer, AIA.

WEIGHING UP THE ASIAN OPPORTUNITY

The demerger of Jackson Life will transform Prudential from being an incongruous growth/value hybrid into a pure growth play driven by a growing Asian middle class, and the associated demand for savings and insurance products.

Prudential has a unique and leading position in fast-growing and increasingly affluent Asian markets, where it focuses on savings and health and protection products, supported by a leading agency and bancassurance (the term for when banks sell insurance products) distribution network.

A FOOTPRINT FROM CHINA TO INDIA

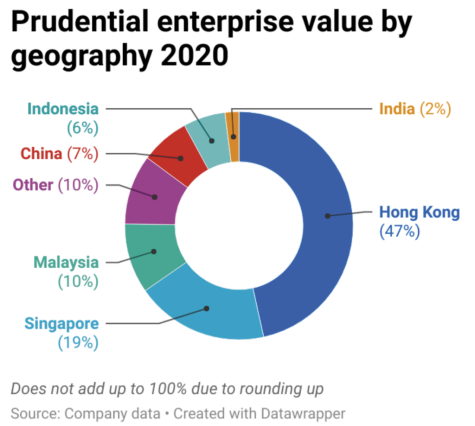

Prudential has a strong business franchise that extends across China to India. Hong Kong is the largest market with respect to APE (annual premium equivalent), with the region constituting 39% of pre-pandemic APE, and 25% of pre-pandemic operating profit.

Prudential has a number three market share position among foreign players in Hong Kong, and number five position overall.

Asian life insurance continues to grow strongly and Prudential’s agency distribution network seems well placed to capitalise on strong medium-term trends to higher insurance penetration. Margins are high and seeing little pressure, while volumes are shrugging off recent volatility in emerging markets.

Indonesia is a disproportionately lucrative market for Prudential, accounting for approximately 8% of APE and 20% of operating profits.

In addition to both population and income growth, market growth in the region is being driven by new product development including sharia-compliant offerings. Prudential enjoys strong market share positions in the lucrative markets of Thailand, Singapore and Malaysia.

Prudential is also focusing on growth markets in India, Vietnam and the Philippines. It is interesting to note that in none of these markets is insurance penetration beyond the mid-single digits. In most instances the rates are in the low single digits.

RESULTS VINDICATE THE STRENGTH OF THE ASIAN FRANCHISE

Prudential’s recent first-half results revealed an unexpected strength in the recovery of Asian sales. Overall, sales and margins both significantly exceeded consensus expectations, with APE beating by 6.9%, and NBP (new business profit) by 8.8%.

The group continued to see good momentum in China with new business profit up by 65%, and in its growth markets where NBP increased by 44%.

Equally impressive was the recovery in the more mature markets of Singapore and Malaysia where NBP increased by 65% and 59% respectively.

Indonesia was an area of disappointment with NBP declining by 17% in response to the surge in Covid cases, and the associated lockdown measures. Hong Kong was also an area of weakness with NBP declining 13% in the wake of border restrictions.

CLOSING THE VALUATION GAP

In a recent research note UBS Insurance analyst Colm Kelly argued that ‘Prudential’s Asia business is intrinsically undervalued to the tune of 40%’.

The UBS analysis suggests that Prudential Asia is currently valued at 1.1 times its embedded value (the present value of future profits plus adjusted net asset value), versus 1.7 times for it closest peer AIA.

UBS comments: ‘A lack of comparability impairs investors’ ability to price this with conviction, creating a complexity overhang on the stock.

‘However, once the US business is demerged, price discovery from Prudential Asia can begin, resulting in a progressive unlocking of the full value through multiple expansion over time.’

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine