Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Reasons why stock markets moved higher on latest Fed news

There was no question who was centre of attention at the Jackson Hole summit of central bankers, held virtually rather than in its usual Wyoming location on 27 August. All eyes were on US Federal Reserve chair Jerome Powell and whether he would give the market any clues on the future direction of monetary policy. Fortunately, the news for investors was positive.

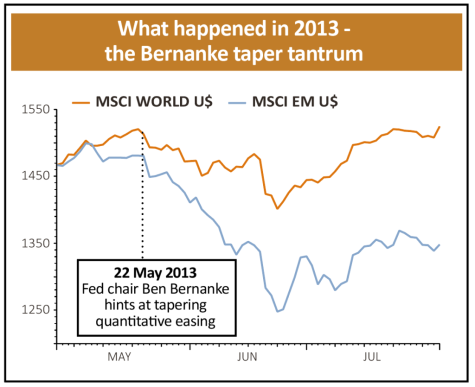

Investors had recently started to fret about a tapering or scaling back of support for the economy, with fears there could be a repeat of the taper tantrum in 2013 when Powell’s then predecessor Ben Bernanke suggested he would slow the pace of quantitative easing. That action prompted the yield on US treasury bonds to surge and prices to fall, leading to global markets seeing significant volatility.

Powell will naturally be aware of this history and he seemed to use his appearance at Jackson Hole to calm any fears over a withdrawal of support for the economy.

He did this in three ways. First, he suggested that while the test of seeing ‘substantial further progress’ on inflation had been met, the same was not true of the jobs market. Powell specifically referenced the Delta variant as a consideration despite the strong employment figures reported in July.

Second, he made it clear that any decision on tapering financial stimulus should not be taken as a signal that an interest rate hike is imminent. Something which will not be countenanced until the ‘economy reaches conditions consistent with maximum employment’.

He also reiterated his view that the current escalation in prices would prove transitory as they were based on a narrow collection of goods and services which have been directly hit by the pandemic and subsequent reopening of the economy. He spent a lot of time on this topic too, seemingly to drive home the point.

His words had the desired effect as US stocks moved to new record highs, European stocks moved higher and yields on US government debt fell as prices rose.

HSBC chief investment officer Willem Sels pointed out that Powell effectively covered off concerns about inflationary pressures by setting the starting gun on tapering asset purchases, but by confirming the process as gradual he also addressed fears the recovery could be undone by a withdrawal of the Fed’s support.

Sels adds: ‘It is clear the timing and triggers for tapering are not the same as for rate hikes, which will provide comfort to bond and equity markets.’

Whether Powell’s words continue to resonate will be tested when the Fed does begin scaling back stimulus with its meeting on 21-22 September seen as a possible candidate for the start of this process.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine