Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Feed the world: How to invest in the future of food

The world is on the cusp of the most consequential disruption in food and agricultural production since domestication of plants and animals began thousands of years ago.

As highlighted in Baillie Gifford’s 2020 ‘Positive Change Impact Report’, in 2050, the global population is expected to reach 10 billion, up from around 8 billion today.

This explosive population growth will require global food production to increase by somewhere between 24% and 70%, heaping pressure on a complex global system encompassing farmers, traders, food manufacturers and food retailers.

While this global food system feeds the majority of the world’s population today and food supply per capita has increased more than 30% since 1961, it is alarming to find out that 821 million people remain undernourished.

Besides food security, one of the other great challenges facing the food system is climate change, with agriculture being particularly vulnerable to climatic shifts. Up to 37% of total greenhouse gas emissions are attributable to the food system, with significant contributions arising from crop and livestock activities.

And as the latest investor presentation from cellular agriculture company Agronomics (ANIC:AIM) illustrates, the environmental and health implications of animal husbandry are severe, with 18% of all anthropogenic greenhouse gas emissions coming from animal agriculture. That’s more than all forms of transport combined.

Furthermore, 80 billion animals are slaughtered each year for meat, with 2 trillion fish killed annually for human consumption. And a staggering 80% of all antibiotics are used in agriculture, while 75% of all new human pathogens originate from animals, a risk that will resonate with all of us as we emerge from the Covid pandemic.

FOOD REVOLUTION UNDERWAY

Population growth twinned with rising incomes for billions of consumers is driving an expansion in the value of the world food economy.

As household incomes increase, consumers are diversifying diets away from staple foods into higher value products such as meat, dairy and fresh fruit, which has an impact across the length of the food and agriculture value chain.

2020 was the year in which demand for sustainable food products accelerated, as the pandemic prompted people to pay more attention to their diet and heightened concerns over the ways in which food production impacts ecosystems, biodiversity and deforestation.

In short, a food revolution is on its way and investors hungry for exposure to the theme should position portfolios for the profound shift that is taking in place in what we eat and how it is grown.

Could vertical farming be the next big thing?

Indoor or vertical farming is among the latest green technology trends, with US-listed Village Farms and AppHarvest capturing investors’ interest, although both have had a few share price stumbles in 2021.

Canadian firm Village Farms grows agricultural produce, but it also owns cannabis maker Pure Sunfarms, which makes it a fairly speculative investment. US firm AppHarvest, on the other hand, sticks to growing tomatoes and vegetables.

AppHarvest claims its high-tech indoor farms, which are lit by LEDs and controlled by sensors and cameras using the Internet of Things, use 90% less water than traditional farms and yield up to 30 times the amount that could be produced from a similar sized plot of agricultural land. It plans to have a dozen sites across the southern US by 2025.

The latest vertical farming company to list its shares on the stock market is AeroFarms, also based in the US, which claims it can achieve nearly 400 times greater productivity per square foot than traditional agriculture, while also using 95% less water. It mainly grows greens, and its biggest customer is Amazon-owned Whole Foods.

While there are no pureplay vertical farming companies on the UK stock market, online grocery delivery firm Ocado (OCDO) has invested in several indoor farms in recent years and plans to locate new sites close to or within its customer fulfilment centres to reduce time to market.

INVESTMENT OPTIONS

Agriculture has an enormous environmental impact, yet innovation can help make agriculture more sustainable while meeting growing food demand.

One great example is precision agriculture; by combining technologies such as sensors, satellite communication and software, the likes of US-listed agricultural equipment leader Deere & Co are helping farmers to increase yield while using less fertilisers and pesticides.

High in meat and dairy products, the western diet is also contributing to greenhouse gas emissions, which is where disruptors such as Beyond Meat with its plant-based burgers, sausages, ground beef and chicken comes in.

Founded in 2009, Beyond Meat aims to replicate the taste and texture of meat products using vegetable proteins and transition ravenous consumers to a more plant-based diet as it sells its products through retailers and fast-food outlets.

Rebalancing diets in favour of plant-based products will reduce the emissions associated with the livestock industry as well as the flow of antibiotics into people and the environment. We discuss Deere & Co and Beyond Meat in more detail later in this article.

RECENT STOCK MARKET DEBUT

Another company whose shares trade on the US stock market and which offers healthier eating and drinking options is Sweden-based oatmilk maker Oatly.

Investor excitement saw the stock soar on its NASDAQ debut in May. However, the share price has since come back a lot after a negative report from short-seller Spruce Point, which attacked Oatly’s sustainability claims and believes the company will never achieve profitability. This weighed on sentiment towards the stock.

Backed by celebrities including Oprah Winfrey, Oatly is seeing robust consumer demand for its oat-based products, which now include ice cream and yoghurt, although the business remains loss-making as it invests in expanding production, building brand awareness and entering new markets.

A LESSER-KNOWN STOCK

Relevant stocks to the future of food theme on the UK market include Agronomics, the cellular agriculture investor focused on cultivated meat and alternative proteins.

Cultivated meat is meat grown in a laboratory using bioreactors, without the need to raise animals for slaughter, which has the same appearance, taste and texture of meat but with purely non-meat media as inputs.

Agronomics has established a portfolio of early-stage companies in this rapidly advancing sector. Its cultivated meat sector holdings include BlueNalu, producing seafood products directly from fish cells, Dutch cultivated meat company Meatable and Shiok Meats, the world’s first cell-based crustacean meat company.

Funding in the cultivated meat sector is growing, with roughly $170 million invested worldwide between 2016 and 2019 and over $270 million raised in 2020 alone. Global consultancy AT Kearney predicts that cultivated meat’s market share of meat consumption will reach 35% by 2040.

VARIOUS FUND OPTIONS

Investors looking to take a taste of the theme without single stock exposure could explore exchange-traded fund Rize Sustainable Future of Food (FOGB). It tracks an index of shares in compares that are ‘innovating across the food value chain to build a more sustainable, secure and fair food system for our planet’.

This index follows a purity-based weighting scheme where companies with higher revenue exposure to the theme achieve a bigger weight in the index.

The biggest holdings in the ETF are in the packaging sector including SIG Combibloc which is an innovator in food and drink containers, O-I Glass which makes glass bottles, and pulp and paper manufacturer BillerudKorsnäs.

Pictet-Nutrition Fund (B54YLC1) invests in businesses contributing to, or profiting from, the agriculture value chain, including tractor maker Deere and US-listed agriculture machinery specialist AGCO, as well as food and drink groups Nestle and Danone.

SHARES’ TOP TWO PICKS

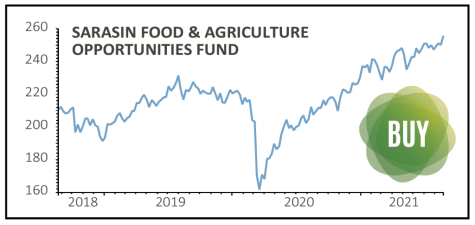

Sarasin Food & Agriculture Opportunities Fund (B77DTQ9)

One savvy way to play the powerful long-term themes impacting the global food economy is Sarasin Food & Agriculture Opportunities Fund (B77DTQ9).

Manager Jeneiv Shah invests across the entire food and agriculture value chain and uses a thematic process to identify robust and enduring growth trends and the companies benefiting from them.

The fund offers exposure to four sub-themes: diet change, nutrition and dietary health – ‘everything to do with this shift in our diets towards being less animal protein heavy and being a bit more balanced, so is not completely removing animal protein but moving towards plant-based proteins and cell-based agriculture’, as well as food away from home, agricultural and farming technology and the online digitilisation of food.

In recent years, drivers of portfolio performance have included the likes of Deere and kitchen equipment maker Middleby, while the fund also has positions in online food delivery plays such as Ocado and Just Eat Takeaway (JET).

Sarasin Food & Agriculture also invests in four names that provide ingredients or taste and texture capabilities – Kerry (KYGA), Givaudan, International Flavors & Fragrances and Koninklijke DSM – which all have ‘a growing share of their business that is providing expertise and capability to the likes of Beyond Meat, Impossible Foods, Monde Nissin (owner of Quorn) and others,’ says Shah.

The fund has a 0.99% ongoing charge and has achieved 10.16% annualised returns over the past five years, according to Morningstar.

Deere & Co (DE:NYSE) $373.70

A high-quality name offering a play on the theme is New York-listed Deere & Co, the world’s leading manufacturer of agricultural equipment famed for its iconic tractors.

Producing some of the most recognisable machines in the heavy machinery industry, the agricultural equipment giant plays a key role in the global food chain and helps farmers to increase yield while using less fertilisers and pesticides.

Morningstar says Deere has a wide economic moat and ‘will continue to be a leader in the agriculture industry and one of the top players in construction’.

For over a century, the company has been the pre-eminent manufacturer of mission-critical agricultural equipment and its strong brand is underpinned by quality, extremely durable and efficient products. Customers in the farming sector value Deere’s ability to reduce the total cost of ownership.

Alongside strong third quarter earnings (20 Aug), Deere raised its full year earnings forecast to a $5.7 billion to $5.9 billion range with management expecting demand for farm and construction equipment to continue benefiting from favourable fundamentals.

Based on Refinitiv Eikon data, Deere trades on prospective price to earnings multiples of 16.9 and 15.7 for the years to October 2022 and 2023 respectively, ratios which look undemanding to our minds.

Benchmark Holdings (BMK:AIM) 60.44p

An investment idea for individuals with a higher appetite for risk

Global demand for salmon continues to grow at a healthy clip, and even increased during the pandemic with almost 2.7 million metric tons of Atlantic salmon produced last year. Aquaculture, or farmed fish, represents around three quarters of overall salmon production worldwide.

As well as being a good source of protein, which is important for building bones and preventing muscle loss, salmon contains omega-3 fatty acids which the body doesn’t produce but are beneficial for our heart, joints and potentially our brains, with studies suggesting regular consumption reduces age-related memory loss.

However, there are few places in the world which have the right geographic conditions to support aquaculture. Salmon thrive in cold, deep water on sheltered coastlines, which is why production has historically centred on Scotland and Norway, and more recently Chile, which has become a major producer thanks to the fjords along its southern coast.

What was once a luxury food is now among the most popular fish with consumers in Europe, the US, Japan and increasingly China, meaning producers can’t keep up with global demand.

Geographic and regulatory constraints on traditional open net-pen farming limit producers’ ability to keep pace.

Another factor limiting sustainable production is the threat of disease. Salmon producers must manage the health of the fish, combatting parasites such as sea lice – which are more prevalent in farmed than wild salmon – and natural phenomena such as mass algal bloom, which sucks oxygen out of the water, killing the fish.

Another factor limiting sustainable production is the threat of disease. Salmon producers must manage the health of the fish, combatting parasites such as sea lice – which are more prevalent in farmed than wild salmon – and natural phenomena such as mass algal bloom, which sucks oxygen out of the water, killing the fish.

One UK company with solutions to many of these problems is Benchmark Holdings (BMK:AIM), which operates through three divisions: genetics, advanced nutrition and health.

Using the latest genomic tools, the genetics business breeds salmon eggs for fish farmers, allowing them to produce better, healthier fish. It also breeds tilapia and shrimp broodstock, and accounts for just under 40% of group revenues.

The advanced nutrition business, which accounts for close to 60% of sales, produces early-stage nutrition, preventative health products and environmental solutions for the early stages of shrimp and fish production.

The health business, which accounts for 5% of sales, produces cutting-edge sea lice treatments which kill the pests without harming the environment and allow farmers to continue operating as normal.

Demand for the firm’s products is growing fast with sales in the most recent quarter up 17%, led by the genetics business as capacity in Norway and Iceland sold out for the year.

Group gross margins are over 50%, which appeals, while earnings are growing faster than sales thanks to operational improvements and tight cost control.

Numis, which is the company’s broker, has a ‘buy’ rating and believes the share price could hit 80p in the next year, calling it a structural growth story with strong sustainability credentials. It believes Benchmark will move into profit in the year to September 2022.

Why now isn’t the right time to invest in Beyond Meat

Much as the pandemic failed to slow the flow of funds into ‘responsible’ investments, so it did little to impact sales of vegan products.

The global vegan market was worth around $15.4 billion last year, 20% more than in 2018, and is forecast to grow by just under 10% per year over the next five years.

However, the real target for vegan food producers is to turn more of the world’s meat eaters on to plant-based products. The global animal meat industry is worth $1.2 trillion per year and converting just a fraction of those sales would supercharge growth.

One of the first plant-based protein producers to come to market was Beyond Meat, which has made strong gains since listing in New York in 2019 at $25 and now trades around $125 per share.

However, it has been a patchy last 12 months for investors. In November, the share price collapsed nearly 30% after the firm posted a third quarter loss of $19 million on weaker than expected revenues.

Gross margins shrivelled to 27% compared with 36% in the previous year as the company was forced to offer higher trade discounts to fight off growing competition, while inventories ballooned more than 50% due to weak demand.

In contrast, the shares soared 30% in January after the firm announced it had formed a joint venture with US soft drinks maker Pepsico, giving it access to the latter’s distribution channels.

It also signed a three-year strategic global agreement with fast-food giant McDonald’s to supply the co-developed McPlant product range and inked a multi-year partnership with Yum! Brands to co-create and offer plant-based protein menu items for Yum’s KFC, Pizza Hut and Taco Bell chains.

Yet Beyond Meat’s financial performance continues to disappoint. In February, it blamed ‘continued challenges’ in the foodservice industry for missing fourth quarter sales forecasts and posting a loss of $25 million.

This was followed in May by first quarter losses of $27 million, which it blamed on higher marketing costs and lower selling prices, and last month it posted a second quarter loss of almost $20 million which it topped off with a disappointing sales outlook for the third quarter.

Bulls of Beyond Meat believe the firm can grow its market share thanks to its superior innovation capabilities and broad product portfolio, while its global partnerships give it a strategic moat which underpins its long-term growth potential.

However, with no sign of an end to losses, and with increasing competition, supply chain issues and concerns over the Delta variant raising uncertainty over sales, we see no rush to own the shares.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine