Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

What a bombshell climate report and global wildfires mean for markets

Wildfires are raging across Europe and North America, while the latest report from the IPCC (International Panel on Climate Change) warns temperatures are likely to rise 1.5 centigrade above pre-industrial levels in the next two decades, prompting extreme weather and environmental devastation.

And yet it looks like the recent boom in sustainable and ESG (environmental, social and governance) investing is starting to wane a touch, while claims of greenwashing – overstating environmental credentials or claiming something is green when it isn’t – continue to abound.

Data from Morningstar shows inflows into ESG funds in Europe dropped 25% quarter-on-quarter in the three months to 30 June, while globally inflows were down 24% to $139.2 billion.

Liberum notes that since 2002 the 20% of stocks in the UK with the lowest greenhouse gas emissions have outperformed the 20% with the highest greenhouse gas emissions by 2.4% per year.

But in 2021, this position has reversed with the highest emitters outperforming the lowest by 2.2% as at 1 August 2021. This likely reflects a rebound for oil and gas stocks as crude oil prices hit multi-year highs.

And in turn it could explain why investors’ commitment to investing sustainably has wavered a touch, with oil stocks benefiting from higher prices and looking cheap on earnings and dividend metrics.

The Morningstar data should be treated with a measure of perspective given total assets in ESG funds still increased 12%.

Not all funds live up to their ESG billing.

Liberum investment strategist Joachim Klement commented: ‘With the introduction of the Sustainable Finance Disclosure Regulation in the EU in March, fund managers saw their ESG asset base shrink as they had to reclassify sustainable assets as non-sustainable.

‘More recently, individual firms were publicly embarrassed by internal emails showing that almost none of their sustainable assets were subject to the company’s ESG integration process. In short, fund managers need to “put up or shut up” when it comes to ESG integration as transparency and regulatory requirements increase.’

These new EU rules have not been without criticism, and the inconsistent application of regulations around the globe pose a challenge for both investors and asset managers.

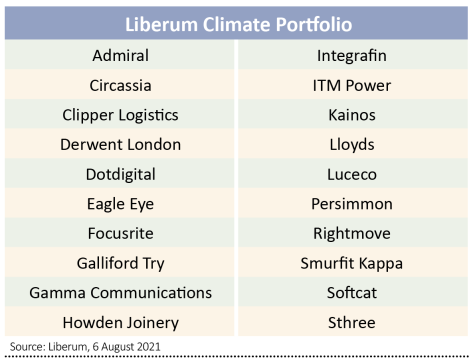

Liberum has come up with its own index of the best low emitting UK stocks which it says has beaten the FTSE All-Share by 5.5% in the last seven months. The full list of constituents can be seen in the table.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine