Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

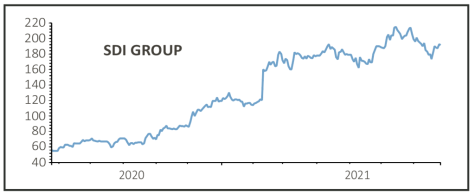

SDI continues to reward loyal retail investor fans

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

SDI (SDI:AIM) 194p

Gain to date: 11.2%

Original entry point: Buy at 174.5p, 27 May 2021

In the context of the global pandemic SDI’s (SDI:AIM) full year to 30 April 2021 results were impressive. In line with May’s trading update, revenue growth of 43.2% to £35.1 million (19% pre-acquisitions) and fully adjusted pre-tax profit soaring 70% to £7.4 million effectively beat market expectations in real terms.

Yes, there were some significant one-off Covid-19 related boosts which helped offset weakened demand elsewhere, but as the world gradually returns to normality analyst anticipate a return to steady and reliable progress.

As a reminder, SDI is a collection of multiple subsidiaries that design and manufacture digital imaging, sensing and control equipment used in life sciences, healthcare, astronomy, manufacturing, precision optics and art conservation applications.

Acquisitions are a major part of the story so it is pleasing to see growth opportunities enhanced by its latest, Monmouth Scientific. Strong cash generation (it cleared its £4 million net debt last year) and balance sheet strength underpin this acquisition strategy, with one analyst highlighting the benefit from the company’s increasingly diverse catalogue products and end markets.

‘With a good order book and good trading in May and June, as laboratories re-open post-pandemic, we leave revenues unchanged implying strong growth of 20%,’ FinnCap analysts said of their full year April 2022 forecasts.

SHARES SAYS: Still a great buy for the long-term.

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine