Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Big upgrade for FTSE 100 group Croda as new strategy pays off

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

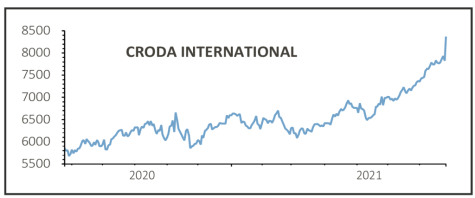

Croda (CRDA) 338.9p

Gain to date: 30%

Original entry point: Buy at £63.84, 1 April 2021

Our confidence in chemicals firm Croda’s (CRDA) new strategy is already being rewarded in spades with its first half results (27 Jul) revealing strong trading and prompting a material upgrade to full year guidance.

Pre-tax profit increased by 41% to £204.1 million, driven by a 39% jump in sales to £934 million. It has proposed to increase the dividend by 43.5p.

There have been several key factors behind the company’s strong showing. The company’s existing operations are benefiting from restocking and a rebound in consumer demand as well as spending on innovation.

A series of recent acquisitions are also contributing nicely, in particular lipid-based drug delivery specialist Avanti. Croda now expects to generate $200 million in sales from lipid systems this year up from the $125 million expected in March. This new-found expertise in lipid nanoparticles was a key reason we liked the Croda story.

Flavour and fragrance firm Iberchem has also made a strong contribution after being acquired in November 2020.

Finally the Life Science division has performed well, driven by its Crop Care and Healthcare arms.

SHARES SAYS: We remain bullish. Keep buying.

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine