Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Why Ocado’s latest deal is more important than you might think

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

First-half results from online groceries business Ocado (OCDO) on 6 July are arguably less relevant than the company’s latest deal – a partnership with Spanish supermarket chain Auchan Retail for its Alcampo brand.

One reason why Ocado shares had stalled in 2021 after a strong run in 2020 was the lack of international deals to act as a catalyst for the share price, which has now been addressed.

Ocado has benefited from increased demand and focus on web-based food sales in the wake of the pandemic but travel restrictions had prevented management from traversing the globe to sign up new international customers for its technology system.

It licences the technology to global supermarkets to power massive warehouse fulfilment centres with the majority of the picking for shoppers carried out by robots.

A typical agreement sees Ocado incur up to £30 million of cost for the technology hardware and software for each warehouse with the partner paying for site construction. Ocado then books a cut of the sales from each of these fulfilment centres.

Now that the Auchan Retail deal has been struck and with global economies beginning to be unlocked, sentiment towards Ocado may improve as investors get increasingly confident in its ability to sign up more customers for its systems.

Importantly, Auchan operates across 13 different countries and the statement announcing the transaction confirms the partnership may be expanded into other geographies, creating scope for significant growth in the future.

Existing Ocado partners span territories as diverse as Japan, the US and France and include Aeon, Kroger, Sobeys, Morrisons (MRW), Groupe Casino, Coles Supermarkets, ICA Group, Bon Preu Group, and a joint venture with Marks & Spencer (MKS).

This latter venture is the most visible part of Ocado’s business to the average UK consumer and in addition to providing a revenue stream, it acts as a shop window for the benefits of the technology system.

Bank of America notes that the robust profit performance of the Marks & Spencer joint venture in the six months to 30 May is ‘evidence for Ocado’s partners and potential future partners that the grocery online model is profitable when run at full capacity’.

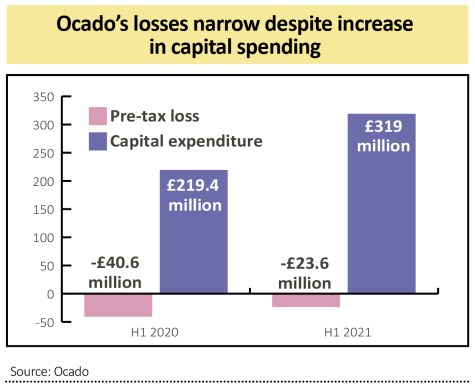

One of Shares’ top picks for 2021, Ocada remains an investment for patient investors with the company still loss making as it sinks the upfront cost required to get fulfilment centres up and running.

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine