Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Governments near agreement on global corporate tax ‘alignment’

One hundred and thirty countries and jurisdictions have joined together to ratify a two-stage plan to reform international tax rules, curtailing tax avoidance by large multinational companies and giving smaller countries more tax revenues from overseas firms.

According to the OECD, the current international tax system, which dates back several decades, ‘is no longer fit for purpose in a globalised and digitalized 21st century economy’.

The new regime, which applies to all companies with profit margins of 10% or more, aims to be fairer and to ensure that large companies pay tax where they operate and earn profits.

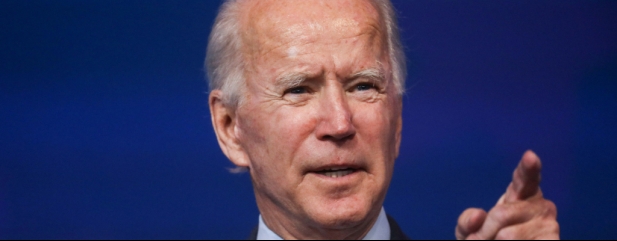

US President Joe Biden, who needs Congress to pass the proposal, said the new system ‘will level the playing field and make America more competitive’.

He also warned large multinational companies they would ‘no longer be able to avoid paying their fair share by hiding profits generated in the United States, or any other country, in lower-tax jurisdictions’.

Illustrating the challenge facing his administration, however, Republican Congressman Kevin Brady of Texas, who sits on the Ways and Means Committee, called the tax deal ‘a dangerous economic surrender’.

Meanwhile, three European countries are holding out against the agreement, which would see multinational companies pay a minimum of 15% corporate income tax and generate around $150 billion in increased tax receipts globally.

Opposition from any of the three countries – Estonia, Hungary and Ireland – could prevent the 27-member European Union from implementing the plan as to become law it needs unanimous support.

Ireland’s finance minister called the agreement ‘an important signpost’ but argued the country was not ready to lose up to a fifth of its overall annual tax revenue (around €2.3 billion).

Ireland’s corporate tax rate of 12.5% is among the lowest in the world and has been instrumental in attracting investment from large, mainly US, multinational corporations.

Other countries, including China, India and Turkey, expressed reservations about the deal but came on board late in the day in the hope that their issues could be ironed out through talks in the next few months before the G20 meeting in October.

The new policy is likely to impact US tech giants such as Amazon, Alphabet which owns Google, and Microsoft more than UK companies.

While Amazon’s group profit margin is below 10% due to the low returns on its retail business, under segregation rules proposed as part of the new tax agreement by the OECD the firm’s highly profitable cloud services business AWS would likely be included as a special case.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

- Why Tesla is a bad investment

- Why Tesla is a good investment

- Stiff competition stymies Liontrust ESG investment trust launch

- Stocks making highs and lows and how investors can use this information

- Tesla: Great investment or waste of time?

- Governments near agreement on global corporate tax ‘alignment’

- The winning and losing investments so far in 2021

magazine

magazine