Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Market health check: Why have global stocks stalled and should you worry about inflation

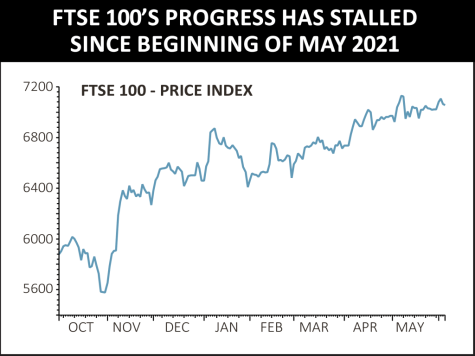

Despite healthy double-digit gains in 2021, driven by successful vaccination rollouts and recovering economies, major stock markets around the world appear to have stalled since early May.

London’s FTSE 100, the Standard and Poors 500, Japan’s Nikkei 225 the Nasdaq 100 indices have failed so far to push on from recent highs.

The exception is emerging markets with Brazil’s Bovespa index up 6%, while China’s Shanghai Composite and India’s BSE 100 are up around 5%, arguably beneficiaries of recent weakness in the dollar.

Investors are now wondering if stalling momentum is part of the natural ebb and flow of markets or if perhaps there are fundamental reasons behind the market’s hesitation.

There are a lot of factors to consider, not least the lofty valuations which many stocks currently trade on.

WHAT THE CAPE RATIO IS AND ISN'T TELLING US

Nobel Prize winning economist Robert Shiller reckons the best way of assessing value in forward looking markets is to look to the past.

In 1988 he popularised the cyclically-adjusted price to earnings (CAPE) ratio, also known as the Shiller PE, to help investors decide if a stock, sector or market is trading at a premium or discount to its historical value.

Whereas a price to earnings (PE) ratio is calculated with one year’s earnings, CAPE uses the average over 10 years to avoid factoring short-term fluctuations in earnings into the assessment.

To calculate the CAPE, you divide the latest share price by the average earnings over the previous 10 years, which are adjusted for inflation.

US stocks on this metric are trading at their highest levels since the dotcom bubble at 37 times.

While this is a warning signal for some, others believe the fact bonds are offering such low returns in a rock-bottom rates scenario and the outsized returns achieved by global technology companies makes the CAPE ratio less relevant.

TAXES AND TAPERING

The stronger than expected recovery in the economy has seen the Bank of England raise its expectations for growth to 7.5% this year, up from 5% in February.

Meanwhile the OBR (office for budget responsibility) has said it now expects the economy to return to its pre-pandemic level by the middle of 2022, sooner than originally forecast.

The rosier outlook has given chancellor Rishi Sunak the chance to increase corporate tax rates to 23% in April 2023 from the current 19% as he attempts to get government finances back under control.

The Government has borrowed a peacetime record £355 billion since the start of the pandemic and expects to borrow a further £234 billion next year, around 10.3% of GDP, according to the OBR.

US president Joe Biden has also signalled that taxes will rise from 21% to 28% to pay for pandemic fuelled expenditures. Investment bank UBS estimated that the effect could impact S&P earnings by 7.4%.

That might be good news for governments but it will also act as a drag on post pandemic earnings growth and valuations.

Meanwhile bond investors, whom collectively own government debts, haven’t been asleep at the wheel. Since the start of the year US 10-year bond yields have risen sharply from 0.9% to 1.6%, reflecting increasing bond price volatility and a higher risk of inflation.

Because bonds generally pay a fixed rate of interest, the value of the income is diminished by rising prices.

There has also been speculation that the US Federal Reserve, which sets monetary policy, may be close to slowing its monthly asset purchases, known as tapering.

Historically, reducing asset purchase has had a big impact on financial markets, creating heightened volatility in so-called ‘taper tantrums’.

In 2013 when Fed chairman Ben Bernanke attempted to taper asset purchases, markets panicked, and bond yields spiked higher.

This matters to investors because risk free government rates are used to discount company earnings and everything else being equal, higher rates reduce the theoretical value of shares.

THE ELEPHANT IN THE ROOM

Perhaps the biggest risk factor threatening a continuation of the rally in equities is increasing inflation expectations. In recent trading updates more companies have mentioned inflation as a key risk.

As a reminder, a key gauge of US inflation, the PCE (personal consumption expenditure) rose 3.1% year-on-year in April, higher than expected and above the 2% that the Fed considers healthy to promote full employment.

Economists at UBS argues that the current factors affecting rising inflation are likely to prove transitory and that conditions for a longer-term regime shift in inflation aren’t in place.

The investment bank notes that inflation expectations as represented by surveys remain at very low levels (despite the recent tick-up) compared with earlier periods where inflation was generally below central bank targets.

Economists at wealth manager BlackRock are less sanguine and see higher medium-term inflation, due to rising production costs, the Fed’s new policy framework which allows inflation overshoots, and rising debt levels that they say will make it harder for central banks to lean against inflation.

However, for now, both investment banks remain constructive on equities despite their diverging views on inflation. BlackRock is of the view that a taper tantrum, ‘would ultimately reduce the attractiveness of fixed income but reinforce that of equities’.

IF INFLATION STICKS AND THE ECONOMY OVERHEATS

There has been a growing chorus of economists and policymakers sounding the alarm about inflation for most of 2021. They warn that a combination of government stimulus and the impending economic snapback will cause prices to overheat. The more excitable among them hark back to the 1970s as an example of inflation spinning out of control, warning that a similar scenario might be on the horizon.

By the mid-1970s average inflation in the UK was running at 16%, compared to this year’s 1.5% forecast, based on the consumer prices index, or CPI. You can see what that did to interest rates and the performance of UK stocks in the chart.

The inflation hawks have remained in the minority so far yet in June 2021 BlackRock chief executive Larry Fink warned that investors might be underestimating the potential for a spike in inflation.

‘Most people haven’t had a 40-plus year career, and they’ve only seen declining inflation over the last 30-plus years,’ Fink said at a virtual event hosted by Deutsche Bank on 2 June. ‘So this is going to be a pretty big shock.’ As the boss of the world’s largest fund manager, Fink’s voice echoes loudly around investment markets.

Inflation has been low for a while, but it could quickly turn around, the arguments go. This could force the hand of central banks to heave their interest rate levers that would launch the UK and other major economies on a potentially painful rate hike spiral.

When central banks increase interest rates it cools things down, making borrowing more expensive and in turn triggering a slowdown in spending.

The Bank of England and US Federal Reserve have talked about inflationary pressures easing as the global economy gradually returns to some sort of normality, and the Fed has also changed tack to allow more leeway with its inflation measurement. But what if inflationary pressures prove stubbornly resistant, it could feasibly force the Fed into a dramatic policy u-turn. If so, what should investors do?

Avoiding heavily indebted companies is a good start, where borrowing cost rises could push firms into breaking banking covenants which would hammer their share prices. Stocks like utilities and housebuilders could benefit if energy prices are rising and new homes can sell for more. While banks traditionally do better when rates are rising as it boosts the profitability of their traditional lending activities. SPDR MSCI World Financials (WFIN) would be a low-cost way of securing exposure to this theme.

PICKS FOR INFLATION AND RATES PROTECTION

Ruffer Investment Company (RICA)

– 296.7p –

Investors seeking an all-weather investment vehicle to help guard against inflation should buy Ruffer (RICA), an investment trust with a long track record of making money in up and down markets.

Managed by Hamish Baillie and Duncan MacInnes, Ruffer focuses on preserving and growing real, that is inflation adjusted, capital, regardless of financial market conditions. Ruffer invests in multiple asset classes including shares, index-linked government bonds and gold.

And this wide mandate also includes scope to invest in unconventional asset classes, leaving Ruffer well-equipped to deal with the increasing inflation and economic and market volatility that Baillie and MacInnes see ahead.

Ruffer also incorporates hedging strategies not typically seen in many products readily available to the retail investor, including exposure to credit default swaps, which offer asymmetrically high upside in adverse economic scenarios with limited downside, and more recently bitcoin, though the position has now been exited at a substantial profit. (JC)

Unilever (ULVR)

– £42.63 –

Consumer goods giant Unilever (ULVR) should be prized for the pricing power conveyed by its strong portfolio of brands in an inflationary environment.

And if prices don’t run out of control but the economy still recovers its products are likely to be in demand, while equally its defensive qualities should come to the fore if we see another Covid-inspired downturn.

The company, maker of everything from Magnums to Marmite, targets solid growth of 3% to 5% over the longer term and a first quarter trading update on 29 April saw the company guide for first-half growth to be at the top end of this range as it showed signs of being able to pass through increased raw material costs to consumers.

Unilever also signalled some confidence in the outlook by commencing a €3 billion share buyback in May. The shares are some way off 2019 highs and based on consensus forecasts trade at an undemanding 17 times 2021 earnings. (TS)

GOLDEN 20S COULD SEE REVENGE OF THE GROWTH STOCK

Readers with a head for history may have already drawn parallels with the past with the decade ahead evoking the ‘Roaring 20s’ of a century ago. The post-war growth of the 1920s also followed a health pandemic, after 1918’s Spanish Flu outbreak, but it was also a time of great change galvanised by new technology, such as the motor car, radio and much else.

‘We see a great chance of a strong recovery from the Covid-19 pandemic followed by a long period of solid economic growth thereafter,’ analysts at investment bank Berenberg wrote in a note to client last month. They claim that policymakers have learned how to cope with occasional crises that do not necessarily need to end in a big bust, as the Roaring 20s did with the Great Depression.

‘If economic policy does not make major mistakes, large parts of the western world could indeed enjoy a Golden Twenties this time.’

‘When new business models, underpinned by technology, are driving forward industries that have hitherto seen little progress, it’s more important than ever to focus on what the world might look like over the decades ahead, rather than concentrating on the past,’ said Baillie Gifford.

The current inflation pressures are transitory, believes Stephen Yiu, manager of the Blue Whale Growth Fund (BD6PG78). Yiu sees the digital transformation and changing habits brought about by the pandemic, including online shopping, less business travel and homeworking, will act as a headwind to inflationary pressure and a catalyst that whipsaws investors’ new-found love of value stocks back towards stock strategies that embrace sustainable growth.

BlackRock’s Nigel Bolton, chief investment officer of fundamental equities, suggest that investors seek out sticky spending and companies that can display strong earnings into 2022 and 2023. ‘This means identifying the areas where Covid hasn’t simply pulled forward demand, but has where consumer behaviour has changed permanently.’

Two examples, Bolton offers, are pandemic pets and food from your phone. ‘Dog ownership soared during the pandemic, and people are spending more on their pets. This means premium pet-food companies could be well placed to profit,’ he says.

Similarly, thousands of us have ordered takeaways via online apps for the first time during lockdown and many of us will continue to do so. ‘There is some evidence that consumers enjoyed the experience so much that they may use takeout apps more often in a post-pandemic world,’ says Bolton. ‘Sales for food delivery apps in some parts of the US have actually strengthened as these areas open up.’

GOLDEN 20S PLAYS

Watches of Switzerland (WOSG)

– 821p –

Shares in luxury goods group Watches of Switzerland (WOSG) have enjoyed a spectacular run, bid up on a series of earnings upgrades.

Yet the high-end watches and jewellery purveyor has real momentum and offers inflation protection, as the luxury watches it sells are durable assets with outsized demand compared to supply, giving retailers like Watches of Switzerland significant pricing power.

Selling coveted watch brands including Rolex, OMEGA, TAG Heuer and Breitling, Watches of Switzerland recently reported a strong finish to the financial year with adjusted earnings expected at the upper end of guidance thanks to robust UK trading, outstanding growth in the US and a step-up in online sales.

Group revenue for the fourth quarter grew 82% at constant currency to £218.2 million, with UK stores generating strong growth upon re-opening. According to Refinitiv Eikon, Watches of Switzerland trades on 26.2 times forecast earnings for the year to April 2022, although a price-to-earnings growth (PEG) ratio of 0.69 suggests investors aren’t overpaying in comparison to the growth the timepiece specialist is delivering. (JC)

BlackRock Smaller Companies (BRSC)

– £19.82 –

As the world enters what could be a new ‘Golden 20s’ decade with fortunate individuals still in jobs liberated from their homes and splashing cash saved during Covid lockdowns, a good way to capture this upside could be through BlackRock Smaller Companies (BRSC).

A favourite of wealth managers and investment professionals, the investment trust offers exposure to wide range of exactly the type of stocks that would benefit from a boom in both consumer spending and the economy in general.

Among its top holdings are well-positioned consumer-focused stocks such as Stock Spirits (STCK) and Pets at Home (PETS), and others that would do well with a jump in economic activity such as food products manufacturer Treatt (TET), building materials group Breedon (BREE:AIM) and highly regarded fund manager Impax Asset Management (IPX:AIM).

The trust has performed well since the value rally began with a 35% gain, with its shares now sitting above pre-pandemic levels. But it still sits at a 4.2% discount to net asset value. (YF)

RWS (RWS:AIM)

– 634.5p –

If Berenberg’s 2020’s version of the roaring 1920’s proves correct, growth in productivity will be a key driver of performance because of the drag from declining population growth, accompanied by rapid innovation.

We believe that RWS (RWS:AIM) is well positioned to thrive in such an environment due to its strong position providing translation services to half of the top 20 patent filers in the world.

The company is also the world’s leading provider of language services and technology, serving 90 of the top 100 brands by value and the top 10 pharmaceutical firms.

The greater role likely to be played by technology should be a key driver of demand for RWS, providing good growth opportunities for its machine learning translation technology.

In the shorter term, the company is benefiting from better than expected cost synergies from the merger with language company SDL. (MG)

DISCLAIMER: Author Steven Frazer has a holding in Blue Whale Growth Fund referenced in this article

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

- Continental is a great play on electric vehicles

- Activist pressure to give fresh impetus to Aviva shares

- Latest evidence of reading boom and special dividend lift Bloomsbury

- Belvoir is a great way to invest in the booming property market

- DiscoverIE delivers on raised forecasts and sees return to growth

magazine

magazine