Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

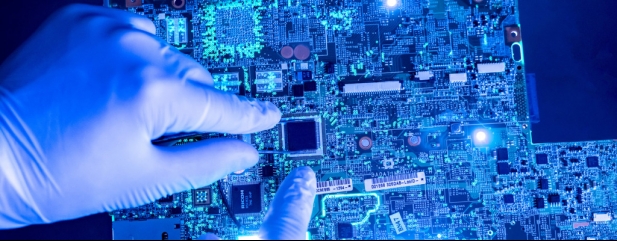

Chip shortages set to continue into 2022

Semiconductor designers and manufacturers have warned that the global semiconductor shortage could run into 2022 or even 2023 despite billions being spent on new fabrication capacity.

TSMC, or Taiwan Semiconductor Manufacturing Company, Intel and Nvidia have all said they expected the crisis to drag on for a couple of years, as new plants take time to come online. This is after TSMC, the world’s largest microchip manufacturer, upped its fabrication spend from $28 billion to $30 billion this year and plans to invest $100 billion over the next three years.

The industry has been plagued by a series of exceptional supply shocks in recent months that have added to capacity constraints created by the Covid outbreak. These have included the particularly bad past winter in Texas, one of the world’s semiconductor manufacturing capacity centres, water shortages in Taiwan and a fire at a key installation in Japan.

‘These issues in the first quarter of 2021 came at a time when semiconductor supply chains were already under pressure,’ note Peel Hunt’s technology analysts. Importantly, the Peel Hunt team believe that the industry was caught out by how rapidly the initial pandemic pause would turn into a ‘demand explosion’ fuelled by home working and other changes to people’s day to day lives.

Technology adoption has not seen this sort of device demand boom for several years. For example, analysts at market researcher Canalys calculate that in the first quarter of 2021, worldwide smartphone shipments reached 347 million units, up 27% year-on-year.

The semiconductor supply issues are affecting everything from car manufacturing to smartphone production.

These factors have lit a fire under leading industry stocks as investors look towards a massive ramp-up in fabrication investment and equipment spend to boost capacity in the months ahead. The sector benchmark Sox, or the Philadelphia SE Semiconductor index, has rallied 15% in 2021 to date, and has soared around 125% since stock markets bottomed as the pandemic broke.

Semiconductor equipment designers ASML and Lam Research have seen their share prices more than double over the past year or so, while analogue chip maker Texas Instruments is up 65%.

Taiwan Semiconductor continues to forecast ‘multiple years of growth opportunities’ as the digital economy increasingly becomes ‘the’ economy. We expect chip demand to remain high, if somewhat cyclical, with the need for faster, smaller, more powerful and more complex semiconductors driving strong returns for the right companies and their investors.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

- Continental is a great play on electric vehicles

- Activist pressure to give fresh impetus to Aviva shares

- Latest evidence of reading boom and special dividend lift Bloomsbury

- Belvoir is a great way to invest in the booming property market

- DiscoverIE delivers on raised forecasts and sees return to growth

magazine

magazine