Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

How to analyse property-focused investment trusts, aka REITs

Real estate investment trusts, or REITs for short, launched in the UK in 2007 and there are now more than 50 of these vehicles listed on the London Stock Exchange.

In effect a REIT looks to replicate the experience of holding property directly for an investor.

The average person can only afford to own their home, and some might also have a buy-to-let property as well. For most, the idea of having a portfolio of properties including commercial real estate is out of the question, which is why REITs can be an advantageous and simple way of getting exposure to this asset class in an investment portfolio.

WIDE VARIETY OF REITS

REITs come in lots of different shapes and sizes, ranging from multi-billion-pound market valuations to being worth less than £10 million, and encompassing everything from office blocks and supermarkets to care homes and theme parks.

Another top-level distinction made by Numis investment companies research associate Andrew Rees is between investment company and equity REITs.

He notes the lines between the two can be blurred but says:

‘Investment company REITs tend to be externally managed, with a “property adviser” or manager paid an annual management fee and sometimes a performance fee to undertake all investment decisions regarding the property portfolio, although still overseen by an independent board who ensure that the fund is fulfilling its investment objectives:

‘Conversely management of equity REITs is generally internalised and so more akin to other operating companies.’

REITs – the fine print

To qualify as a REIT, a company needs to be listed on a recognised stock exchange and must distribute 90% or more of its tax-exempt income (principally the rent paid by tenants) to investors.

These distributions are normally paid after deduction of withholding tax at the basic rate of income tax (20%), which the REIT pays to HMRC on behalf of the shareholder.

A REIT pays corporation tax on any profit it makes apart from through rental income, such as trading property or asset management fees, and any dividends paid out of this income are paid as normal company dividends, so without a withholding tax.

FTSE 100 REITS

Two high profile equity REITs are British Land (BLND) and Land Securities (LAND). Both are constituents of the FTSE 100 and they take a diversified approach to investing in property, with their portfolios including shopping centres and offices.

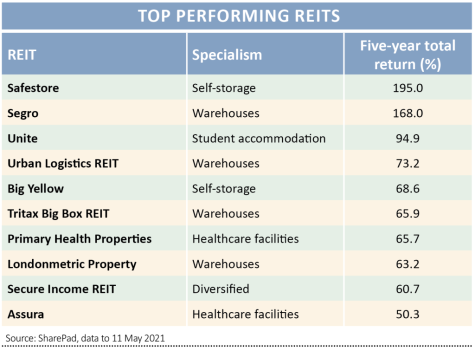

Another FTSE 100 REIT is Segro (SGRO). It is more specialist and focuses on warehouses – a seemingly dull area which has been rendered ‘hot’ by the growth of e-commerce and the need for businesses to store, manage and distribute products sold over the internet.

WHAT TO LOOK FOR

While different types of REIT will have different risk profiles and sensitivities to the wider property market there are three main metrics to judge them on. These are: NAV which stands for net asset value; dividend yield; and the total return encompassing dividends and either the growth in NAV or the share price.

REITs can and do trade at discounts and premiums to their NAV which is total assets minus total liabilities.

For example, Segro trades at a 30% premium to its NAV, while Town Centre Securities (TOWN) which is exposed to a structurally challenged high street and trades at a 50% discount.

If a REIT trades at a premium to NAV it would typically suggest that the market thinks the value of its properties is set too low or is poised to increase, whereas if it trades at a discount to NAV then the opposite is true, investors clearly believe valuations have further to fall.

THE IMPORTANCE OF YIELD

The other key thing to look at is the dividend yield. Within this it is also useful to look at the net initial yield on the property portfolio – which is the ratio of rental income to the valuation at which the property was acquired.

In 2019 giant warehouse investor Tritax Big Box REIT (BBOX) moved into developing assets because the yields from buying operational assets fell to levels that would struggle to have supported the level of dividends it had paid historically.

‘A high yield has the potential to boost the NAV total returns, but it is crucial to understand how sustainable this dividend yield is and so you need to examine dividend cover too - calculated by dividing EPRA earnings per share by dividend per share,’ says Rees at Numis.

‘If the REIT is paying an uncovered dividend then this will have to be partly funded from capital and so is actually eroding the NAV. This might not be a problem for a short period but could become an issue if the company is consistently paying an uncovered dividend.’

ASSET DIVERSIFICATION

It is worth considering how diversified a REIT is in terms of number of tenants and number of properties. For example, if it is reliant on one or two large tenants which run into financial trouble, or a single asset which fell in value, this would have significant implications for performance.

Also, you could look to see if its rental agreements include a link to inflation and the source of the rental income. Some REITs, such as health care facilities landlord Assura (AGR) and social care specialist Civitas Social Housing (CSH), receive government-backed income streams either directly or through local authorities and housing associations which should be more reliable than commercial rents.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Case study

Feature

Great Ideas

- Hill & Smith set to cash in on US infrastructure boom

- Improving backdrop for still cheap TT Electronics

- Buy Shield Therapeutics as it stands on cusp of US breakthrough

- Bank a tidy profit on UDG as private equity swoops

- Investors toast Diageo’s £4.5 billion capital return

- Coca-Cola HBC should fizz higher on reopening

magazine

magazine