Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Tech stocks fight back after big earnings season

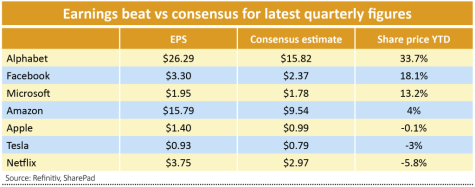

Tech stocks have been catching investors’ attention again with Amazon, Apple and Facebook the latest US tech titans to report earnings that have been going through the roof.

The share prices of all three have risen markedly after their latest quarterly figures to the end of March, which round out a blowout quarter for the US tech titans after superb figures from Microsoft and Google-owner Alphabet.

Amazon smashed expectations with profit of $8.1 billion for the three months to the end of March, compared to $2.5 billion a year ago. Earnings per share came in at $15.79 compared to the $9.54 expected.

Fears business could slow for Amazon as lockdowns are eased have been quelled with the company expecting revenue between $110 billion and $116 billion in the quarter to the end of June, surpassing Wall Street’s projection of $108.6 billion.

Apple also significantly beat expectations with quarterly revenue up 53.7% year-on-year to $89.58 billion, compared to $77.36 billion estimated. EPS came in at $1.40 compared to $0.99 expected.

The iPhone maker defied expectations across most metrics with its smartphone, iPad, Mac, services and other product sales all beating forecasts.

Concerns this is temporarily accelerated growth due to the pandemic have been tempered by a strong showing in China, which hasn’t been in lockdown for months and where Apple reported almost 100% growth in sales.

Mac sales in particular, up 70% year-on-year at $9.1 billion compared to $6.86 billion expected, could continue to provide strong growth for Apple.

RETURN OF THE MAC

Chief executive Tim Cook told broadcaster CNBC: ‘We’re seeing strong first-time buyers on the Mac… it continues to run just south of 50%. In China it’s even higher than that… it’s more around two-thirds. And that speaks to people preferring to work on the Mac.’

Meanwhile Facebook beat on both earnings and revenue in its first quarter as it attributed its 48% year-on-year growth in revenue to $26.17 billion – ahead of $23.67 billion expected – to a big jump in advertising spend following a 30% increase in the average price per advertisement and a 12% rise in the number of advertisements shown. EPS came in at $3.30 compared to $2.37 forecast.

Unlike Amazon and Apple, Facebook’s sales are almost entirely reliant on advertising. The time consumers have spent at home and online contributed to the revenue surge, though despite the ongoing shift to digital advertising it remains to be seen how much more growth Facebook can achieve in the coming months as it expects revenue to remain stable next quarter.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

- Convatec shares start moving up after it hits half a billion of sales in first quarter

- Google parent Alphabet is a class investment right under your nose

- Stick with Yamana Gold despite share price weakness

- Multi-bagger potential for digital star Panoply

- Jupiter Green: small caps are the best place to make money with the ‘E’ of ESG

- This small cap pick has delivered an eye-popping early return

magazine

magazine