Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Full speed ahead: Stocks and funds to play the electric vehicle revolution

Very little in the investment world has captured the imagination quite like the exponential growth potential of electric vehicles.

From car makers and battery firms to chemicals companies and miners, and even energy storage firms, seemingly everyone in the financial world is trying to find a way to make some serious profit as we all start to bin our petrol and diesel cars and buy electric ones that we charge at home in the evening.

The growth potential is clearly there. From now until 2030, Deloitte predicts the electric car market will grow at an annual compound growth rate of 29%, meaning that in 10 years’ time almost one in every three new car sales will be electric.

There’s also a school of thought – one that has excited many investors – that all these projections could turn out to be a massive underestimate.

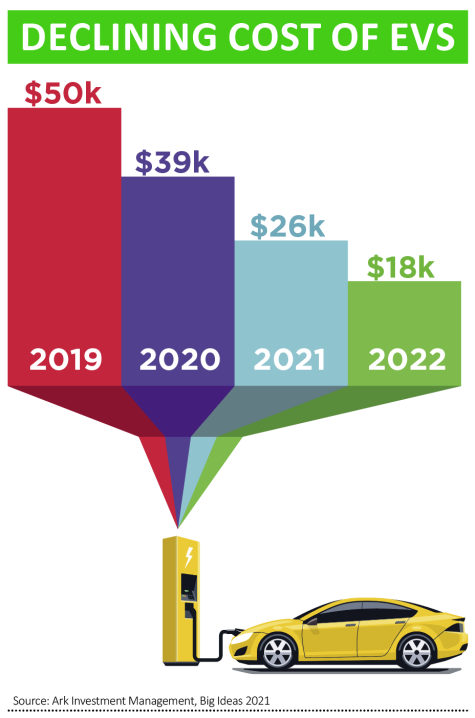

This theory is backed by the need of all developed nations to meet tough carbon targets, the growing awareness among us all that we need to do more to protect our planet, and the rapidly falling costs of EVs (as well as sleek new designs and longer battery lives to reduce range anxiety). These factors are making them ever more attractive to consumers, particularly as the big carmakers advertise their new EVs with more advertising campaigns.

In this article, we lay out where investors can find the opportunities to profit from this promised electric vehicle revolution and suggest five stocks and funds to buy.

GROWTH SET TO ACCELERATE

First of all, to be clear EVs haven’t ‘arrived’ yet. They only accounted for around 3.2% of global car sales in 2020. But this is a figure that is set to grow substantially, possibly exponentially, in the coming decade, largely due to falling EV battery costs.

There are various forecasts used in this article, but two examples of the past show how hard it can be to accurately predict trends when demand growth turned out to be exponential compared to what was projected.

In the 1980s, American telecoms giant AT&T asked consultant McKinsey to predict how many mobile phone users there would be by 2000. Noting all the problems with portable handheld phones at the time – too heavy, batteries that kept running out, patchy coverage and exorbitant costs per minute – they confidently predicted there would be 900,000 mobile phone users by the turn of millennium. As it turned out, there were 109 million.

That same year, when there was talk of a way to harvest energy from the sun, i.e. solar power. The International Energy Association tempered the excitement of solar enthusiasts by asserting that by 2020 there would be just 18GW of electricity – enough to power around 5.4 million homes – generated by solar power in a grand total of 20 years, again noting the costs and limits of the technology at the time.

In fact, 142GW of solar capacity was added just last year alone, enough for 42.6 million homes.

UNKNOWN UNKNOWNS

These examples show that while we can make predictions on the future based on what we know today, as well as ‘known unknowns’, there are still many ‘unknown unknowns’ (a global pandemic, for example) which limit the degree to which we can accurately predict the future.

But in the here and now for investors looking to take advantage of the opportunity EVs provide, however big it may turn out to be, there are many questions and aspects to consider when assessing the opportunity.

Do you buy shares in car manufacturers who are transitioning to EVs, or are companies making the components better investment opportunities?

Another big question regards the carmakers themselves – should you buy Tesla, or another manufacturer such as Volkswagen for example?

While Tesla would seem the obvious beneficiary from a rapid rise in the use of electric vehicles, in March Volkswagen unveiled grand plans for an EV push.

Compared to the other incumbent carmakers, VW is arguably the most advanced with its EV plans and though its lags behind the joint venture of Renault, Nissan and Mitsubishi in terms of EV sales at the moment given the popularity of the Nissan Leaf and Renault Zoe models, the amount it plans to invest in EVs and the number of electric models it plans to produce far outweigh its peers.

‘VOLTS’WAGEN A THREAT TO TESLA

One investor that has plumped for Volkswagen is Polar Capital Technology (PCT) manager Ben Rogoff, who added the German giant to get more EV exposure – ‘not something even we envisaged a year ago,’ he says.

Rogoff views VW as a ‘key potential threat’ to Tesla due to its innovations around electric vehicles, batteries and due to an ‘R&D budget that dwarfs Tesla’s’, as well as most other carmakers.

In his monthly fund commentary for March Rogoff says: ‘What changed for us is that VW has materially accelerated its push into EV, announcing its intention to invest $86 billion over the next five years (it was already one of the most credible competitors with the launch of the ID.3).’

According to Credit Suisse, VW has already comfortably surpassed Tesla in Europe with 24% of the EV market in 2020, compared to 13% the previous year while Tesla’s market share has fallen to 13% from 29%.

Now, VW and various partners are investing more aggressively in software and batteries to drive down the cost and improve efficiency, with six plants expected in Europe alone.

Rogoff adds that VW is ‘coming from behind’ but is currently ‘outspending Tesla almost 10 to one on R&D’, though says a large portion of this is not currently spent on EV and the gap is narrower when capex is considered.

He says: ‘This is not so much a negative call on Tesla, which remains the clear leader in EV today (albeit a lot is clearly priced in with a market cap of $645 billion); rather, we feel that if VW succeeds and ends up being a substantially bigger player than Tesla, there is substantial potential for a re-rating of the business over time (market cap $165 billion).’

Despite the potential of carmakers like VW, there’s also a view that the component makers for electric vehicles could in fact be better investment opportunities than the carmakers themselves.

PICKS AND SHOVELS

Zehrid Osmani, head of global long-term unconstrained equities at fund manager Martin Currie, thinks the ‘attractive returns’ from EVs won’t come from the carmakers themselves, but rather ‘mission critical’ companies further up the value chain that have high barriers to entry, strong pricing power, attractive return on invested capital and ‘good upside potential’.

He explains: ‘In the 1840s gold rush, it was the sellers of picks and shovels, not the miners that made the best returns. Similarly, for investors seeking the best returns from this monumental shift to EV, we think most OEMs could be no more than an unnecessary distraction, and at worst could be at risk of sucking in vast amounts of capital that will not generate the required returns to cover their cost of capital.

‘The real value is more likely to be found further up the value chain, in niche sub-segments where competitive pressures are lesser, barriers to entry are higher, and therefore pricing power is stronger, leading to higher return profiles.’

Such a scenario has already played out in the past year in the renewable energy space, where the solar panel and wind turbine makers rather than the operators saw their share prices soar, particularly after Joe Biden was elected US President and vowed to spend trillions on renewable energy.

The Invesco Solar ETF in the US for example become a five-bagger in less than a year, bouncing back from its March 2020 lows as investors looked to profit from the panel and battery makers that made up the ETF.

Osmani cites as examples of component makers big tech firms like L&G, Samsung and Panasonic, which have the battery technology and knowhow to profit most from the growth in EV batteries in his view. He says they, along with Chinese firm CATL, are forming an ‘oligopolistic structure’.

PEDAL TO THE METAL

The other main aspect to consider with electric vehicles is the metals which go into making them and their batteries.

At the moment, the main metals which seem irreplaceable are copper and lithium. Copper as it is a current conductor for the electricity, and lithium as the main component because of its lightness and durability.

Cobalt was considered key to manufacturing EVs, but the view on this has advanced as technology has changed, highlighting the importance not to get swept up in the hype that can accompany certain commodities.

Adam Davidson, who runs mining royalty company Trident Royalties (TRR:AIM), is keen on lithium but steers clear of metals in EV batteries that can potentially be designed out because they’re too expensive, such as cobalt.

He says: ‘We don’t pretend to know where this is all going to go, but we’re confident on lithium. There’s been no material push to remove lithium [from EV batteries], but cobalt we’re more nervous about. When the cobalt price spiked there was a move to design out cobalt, and in the next generation of EVs the amount used has been cut in half. In solid state batteries they’ve managed to completely remove cobalt.’

Another important metal highlighted by Davidson, and one which has been proven as key for EVs is nickel, so much so that Tesla founder and chief executive Elon Musk last year told Vale, the world’s largest nickel miner, to ‘give us all the nickel you have’.

Many industry watchers have long shared the view that nickel prices should be significantly higher in the medium term, and according to Shore Capital ‘the billion-dollar question being exactly how much higher’.

TWO-SPEED MARKET

Shore Capital has long been of the belief that electric vehicle battery demand will result in the nickel market diverging into a two-speed one, with premiums for ‘battery nickel’.

That said, it adds steelmaking nickel prices should also benefit, as it expects undersupply to stainless steel manufacturers as a result of Class I nickel (which accounts for just under half of overall nickel production) being diverted to the battery sector. The broker’s expectation is that average nickel prices will trend towards $25,000 per tonne (excluding any battery premiums) by the mid-2020s. It currently trades at $17,265 per tonne.

EV STOCKS TO BUY

THE CAR MANUFACTURER

VOLKSWAGEN €219.30

In August 2020, we flagged Volkswagen as a value/recovery story rather than a growth story, and the share price has since gone up by 62%.

Following its Tesla-like ‘Power Day’ where it unveiled grand plans to push into the EV market, we now think VW has a lot of growth ahead of it.

The firm aims to generate close to half of its sales from electric vehicles within 10 years, and on top of the billions it has already spent developing the e-Golf, e-Up and the yet-to-be-released ID.3 full electric car, it is spending €60 billion over the next four years on 75 new models using electric and hybrid technologies, as well as spending on ‘digitising’ vehicles, betting on its scale as the world’s second-largest carmaker as well as its reputation for quality and reliability.

Given the disparity in valuation compared to Tesla, the stock could see a re-rating as it delivers on its EV plans.

In VW’s favour is that it is also a play on the rising Chinese middle class, as it manufactures vehicles in the country both under its own brand and through joint ventures.

THE COMPONENTS PLAY

INFINEON €34.08

Ask a fund manager what EV stock they would pick apart from Tesla and the chances are they would say Infineon.

The German giant is a top 10 holding in many European, tech and green-focused funds and for good reason given its products – semiconductors – have been hailed as the ‘building blocks of modern society’.

The firm makes power semiconductors with four broad uses – automotive, industrial, consumer and security – and is a notable beneficiary of the transition towards EV, hybrid and self-driving cars, given their increased use of semiconductors.

Over 40% of Infineon’s sales come from the auto industry, and the company estimates that on average there’s $834 worth of semiconductors in each EV, versus $434 per carbon-powered vehicle. If we get fully self-driving cars, the company thinks a fully autonomous vehicle could require as much as $1,250-worth of semiconductor material.

The world’s top automotive semiconductor maker with a 13% market share, if anyone’s going to benefit from the rise in EVs it will be Infineon, which is why the firm is so coveted.

Admittedly the shares aren’t cheap on a 2022 price-to-earnings ratio of 33, but among other things this only takes into account the current estimates for the growth in EVs, and could turn out to be much fairer value if the growth rate for EVs turns out to be larger than expected.

EV FUNDS TO BUY

BLACKROCK WORLD MINING TRUST (BRWM) 639.1p

A range of metals are expected to be in demand as more electric vehicles and their batteries are manufactured, chief among them the likes of nickel, aluminum, iron, copper and manganese to varying extents.

The best way to get exposure to what could be significantly rising metal prices is through the miners that dig the metals out of the ground, rather than for example an ETF which tracks the commodities’ price, given that miners are leveraged plays on the commodities they produce.

Not all London-listed miners have exposure to all areas that could benefit from the growth in electric vehicles, so while stocks like Anglo American (AAL) and BHP (BHP) are well-positioned to benefit from the growth in EVs, holding a basket of such stocks which also includes overseas giants like Vale and Freeport could be the better option to capture more of the upside.

That’s where BlackRock World Mining Trust (BRWM) comes in. It holds the aforementioned miners and others, thereby providing diversified, leveraged exposure to all the commodities expected to do well in the coming years as a result of the growth in EVs.

L&G BATTERY VALUE CHAIN ETF (BATG) £13.20

Designed to track stocks that provide electro-chemical energy storage technologies, and mining companies that produce metals used to manufacture batteries, L&G Battery Value-Chain (BATG) is arguably one of the best ways to get diversified exposure to the rise of EV batteries.

The index it tracks uses a screening approach that picks battery providers mapped according to their technology type (lead-based, lithium-based, nickel-based and sodium-based), as well as lithium miners that currently produce the metal. Lithium is the one metal that’s deemed too critical to really be designed out of EV batteries by engineers.

The ETF has already gone up a lot, it must be said, with a 75% gain in 2020 and another 12.6% gain year-to-date. Investors shouldn’t expect such outsized returns every year, but the scope for strong future growth is still certainly there and at a total expense ratio of 0.49% a year, the ETF provides good value access to a sector that’s only really just getting started.

ISHARES ELECTRIC VEHICLES AND DRIVING TECHNOLOGY (ECAR) $7.78

For the most direct exposure to EVs, iShares Electric Vehicles & Driving Technology ETF (ECAR) does exactly what it says on the tin.

Containing the likes of Tesla, Kia, General Motors and Ford, the ETF provides investors with exposure to all the carmakers either transitioning to EVs or already selling EVs, and also contains stocks involved in the technology behind the scenes like South Korean tech giant Samsung and Infineon.

Given it contains a number of tech and growth names, as well as previously beaten down carmakers which have jumped thanks to the value rally, the ETF looks like it could provide steady, rather than stellar, returns over time with its mix of value and growth stocks as the world shifts to EVs, meaning it perhaps might not capture all of the upside, but could well provide a layer of downside protection for a more cautious investor who still wants exposure to the EV theme. It is also decent value with a 0.4% annual charge.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

- Convatec shares start moving up after it hits half a billion of sales in first quarter

- Google parent Alphabet is a class investment right under your nose

- Stick with Yamana Gold despite share price weakness

- Multi-bagger potential for digital star Panoply

- Jupiter Green: small caps are the best place to make money with the ‘E’ of ESG

- This small cap pick has delivered an eye-popping early return

magazine

magazine