Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

FTSE 250 hits new record high: why mid caps are winners

The FTSE 250 index of medium-sized UK-listed companies hit a record high in early April, after a strong bounce back from the pandemic crash, a recovery which started as far back as March of last year.

The strong performance has been credited to a resurgence in the UK economy thanks to a successful vaccine rollout, and that’s certainly part of the story, when you consider that FTSE 250 companies like JD Wetherspoon (JDW), Greggs (GRG) and EasyJet (EZJ) will heartily benefit from the UK reopening once again.

However, there are plenty of international businesses on the FTSE 250 that have done their share of the heavy lifting too. The likes of the cruise operator Carnival (CCL), and the travel firm TUI (TUI), which report their earnings in dollars and euros respectively, have also enjoyed a strong rebound. This demonstrates that the reopening trade is not just restricted to these shores, it’s a global phenomenon.

The strong performance of the FTSE 250 isn’t just a flash in the pan though, and the long-term performance figures suggest there’s something more going on here than simply animal spirits.

Over the past 20 years, a £10,000 investment in the FTSE 250 would be worth £62,859 today. That compares with £25,181 from the FTSE 100, and £49,389 from the S&P 500 index of US-listed companies.

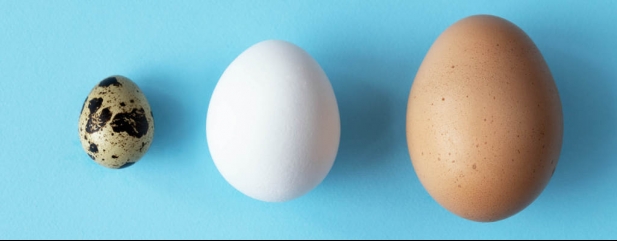

So why have medium sized companies been such a successful place to be invested? The answer probably lies in the fact that these companies are large enough to be established businesses, but small enough to still have significant growth left in the tank. The numbers strongly suggest the mid cap market is the sweet spot for share price performance.

The FTSE Small Cap index has also performed well of late, marking new record highs since December 2020.

Small caps have significantly outperformed the big blue chips over the long term too, but not by as much as the FTSE 250.

While these smaller companies have growth potential, as a group they are perhaps let down by those which never reach critical mass, or indeed, those which simply fail.

Successful smaller companies grow, and then themselves often make it into the FTSE 250, and perhaps even beyond into the FTSE 100. The numbers would suggest this is where the journey slows down somewhat, as revenue growth becomes harder to come by, and cost bases harder to control.

Mid and small cap stocks can exhibit higher levels of volatility, reflecting lower levels of liquidity and the potential for business performance to surprise the market, both on the upside and the downside.

But long-term investors should take notice of the strong performance of mid-caps, and small caps too, and considering how to gain exposure in their portfolios.

These can be areas where active managers really earn their crust by delivering outperformance too, because these companies are less widely analysed, and that gives fund managers a greater chance of unearthing hidden gems.

There aren’t too many funds which offer exposure dedicated to medium sized companies, but two funds which do are Franklin UK Mid Cap (B7BXT54) and the Vanguard FTSE 250 ETF (VMID).

The latter is a fund which very much does what it says on the tin. With an annual charge of just 0.1%, this exchange-traded fund offers investors a cheap and cheerful way to gain exposure to the UK-listed medium-sized companies, though it is a tracker so won’t ever outperform the market.

The Franklin fund is managed by the experienced mid cap investor Richard Bullas, who runs a concentrated portfolio of 30 to 40 medium-sized companies he’s identified as having good qualities, but which are trading at attractive valuations, with a particular emphasis on cash flows. The fund has outperformed the benchmark mid cap index by 6% over the last five years.

Smaller company funds are more plentiful, meriting their own fund and investment trust sectors. One example is the TB Amati UK Smaller Companies Fund (B2NG4R3).

Paul Jourdan has been running this fund for over 20 years, and the whole team is steeped in experience when it comes to small cap investing. They look for high quality companies with competitive advantages. They have an emphasis on the AIM market, but they can invest in stocks all the way up to the FTSE 250.

It’s worth maintaining some balance in your portfolio, so that you have exposure to companies at all stages of the stock market journey, from minnow to behemoth. For many investors naturally lured towards the glitzy lights of the FTSE 100, this may well mean topping up on some small and mid-cap opportunities.

DISCLAIMER: Editor Daniel Coatsworth owns shares in Vanguard FTSE 250 ETF.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine