Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

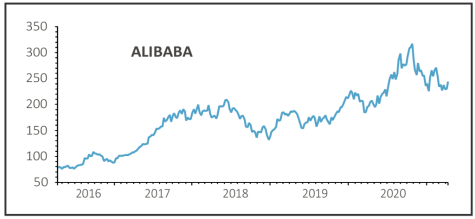

End of Alibaba antitrust probe is positive news for the stock

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

A $2.8 billion antitrust fine by the Chinese authorities may look punishing for Alibaba (BABA:NYSE) but it effectively draws a line under an issue that has been dogging the shares for month. It represents barely 10% of the company’s annual free cash flow so is unlikely to hurt the company in the long run.

This point was reflected by the stock’s 9% rally earlier in the week. With the probe now closed, it was interesting that the regulator made a point of flagging how Alibaba as a business has largely been very positive for China and its people, nipping in the bud fears that the e-commerce platform was the target of a regulatory witch hunt.

Longer-term policy objectives designed to seed greater digital competition creates some debate about any impact on Alibaba’s future earnings, but the underlying growth story seems largely unchanged. We have seen no recent cuts to forecasts that imply 20%-plus earnings growth this year to March 2022.

On a 12-month forward price to earnings multiple of 21 versus 25 for its industry, Alibaba still trades at a near 20% discount to its peer group.

SHARES SAYS: Removing uncertainty around Alibaba is great news for investors and we expect the stock to kick on higher through the rest of 2021. Still a ‘buy’.

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine