Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Our stock picks for 2021 are outpacing the market

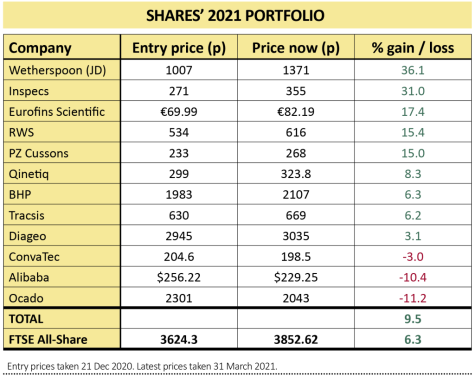

At the end of a tumultuous first quarter for global markets our top picks for 2021 have handily outperformed the market, chalking up a 9.5% gain versus 6.3% from UK shares in general, as measured by the FTSE All-Share.

Four of the 12 stocks have underperformed, having been victims of shifting market sentiment as much as any individual failings at a company-level.

BUMPER PERFORMANCE FROM WETHERSPOONS

The standout performer is pubs group JD Wetherspoon (JDW), up 36.1%. The stock is benefiting as the market reacts to the looming reopening of the UK economy. The shares have also benefited from a shift in investor preference in favour of value-orientated stocks offering the prospect of earnings recovery today rather than the promise of growth at some point in the future at an elevated valuation.

Numis analyst Tim Barnett recently made the comment that Wetherspoon seems ‘moderately upbeat on reopening’. While the 12 April reopening date is a bit later than the company had expected, there are slightly fewer restrictions than feared.

He says Wetherspoon previously hoped customers would be able to order from the bar from the end of June, but this is not a given. Barnett adds: ‘It sounds like they plan to reach average weekly turnover close to 2019 levels by the end of the year.’

EYES ON THE PRIZE

The second best performer from our portfolio is eyewear frames specialist Inspecs (SPEC:AIM). The company delivered an in-line update for 2020 with sales of $46.2 million, less than 2019 because of the pandemic but modestly better than the $45 million forecast by broker Peel Hunt.

Perhaps more importantly the company revealed strong progress with the integration of the recently acquired German business Eschenbach, leading Peel Hunt to observe that the company was ‘well placed to make strong progress when restrictions ease and the synergies start to come through, and now has a platform to build a materially larger business’.

Other big winners in our portfolio include Eurofins Scientific. As we’d hoped the French biopharmaceutical and cosmetics testing specialist has benefited from pandemic-linked work, with the company recently launching an at-home, prescription-free Covid test.

In March the company confirmed guidance for 2021 but said results could be materially better if Covid-19 testing continued at the current levels.

NOT ALL TECH FIRMS ARE OUT OF FAVOUR

Another value play which has done well year-to-date is language services and technology firm RWS (RWS:AIM), which already this year has pointed to good progress with integrating the SDL acquisition and, armed with a debt-free balance sheet, has signalled it is looking at further deals.

The only negative has been relative strength in sterling which is acting as a bit of a headwind to earnings.

PZ CUSSONS MAKEOVER CONTINUES

PZ Cussons (PZC) has outperformed other names in its consumer goods sector like Unilever (ULVR) and Reckitt (RB.). The market seems to be warming to the stock as it outlines plans for a turnaround of the business.

Numis says: ‘The application of a more rigorous approach to brand management and reduced complexity should allow the business deliver low to mid-single digit sustainable, profitable revenue growth.

‘We believe (a recent investor day) provided a clear, credible road map towards unlocking the potential of PZ Cussons’ brands and markets.’

TRACKING THE MARKET

There is a collection of names whose gains are roughly in line with the wider market. These include tech-focused defence firm QinetiQ (QQ.) which at its own investor event on 4 March detailed plans to deliver enhanced returns over the next five years.

Perhaps more notable is mining firm BHP (BHP) which enjoyed an extremely strong start to the year amid talk of a commodities super-cycle and was briefly minted as the largest company in the FTSE 100.

However, a recent reversal in iron ore prices after a crackdown by Chinese authorities on excess capacity in the country’s steelmaking industry as well as measures to tackle pollution in the sector have seen a large chunk of those early gains erased.

PLAYING CATCH-UP

The three biggest disappointments where we are sitting on losses of varying degrees of severity have largely been victims of the same rotation out of ‘jam tomorrow’ into ‘jam today’ value stocks which benefited Wetherspoon.

Medical products firm Convatec (CTEC) also hasn’t been helped by continuing delays to elective procedures thanks to Covid. Though the company did offer some encouragement after revealing a better-than-expected outlook in a 5 March trading update.

China’s Alibaba has been at the centre of potential regulatory issues in the US and China and increased scepticism over Chinese internet stocks in general.

Bottom of the leader board is online groceries firm Ocado (OCDO) which has been shunned by investors who have developed an aversion to highly rated growth stocks.

In addition, the pandemic is proving an obstacle to signing up more international supermarkets for its robotics and automation-based solutions.

Berenberg commented: ‘There has been increased interest in Ocado’s solutions, but the main barrier to signing deals is international travel restrictions and partner executive teams not being able to physically see the facilities in operation… travel restrictions will likely continue to impact the ability to sign new partnerships over the coming months.’

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine