Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Give your portfolio a spring clean

This time last year, the UK had just entered what turned out to be the first of a series of lockdowns, and the nation was digesting a very restrictive new normal.

Today, vaccines have provided hope that soon the worst of the pandemic will be in the rear-view mirror, and expectation that the global economy will open up and record some decent growth.

It’s therefore an opportune time to take a good look under the bonnet of your portfolio to make sure it’s fit for current market conditions.

AN ANNUAL EXERCISE

Indeed, it’s good practice to have an annual spring clean of your finances every year, to make sure they’re in tip top shape. Regular maintenance can keep your investment portfolio from falling into disrepair, but it can be difficult to know where to start. The task can be made a lot more approachable by going about it in a methodical fashion.

The first thing to assess is whether there have been any significant changes in your personal situation. If you have got married, had a child, or bought a bigger house, this can have an impact on your finances, most notably your life insurance requirements, and the need to update your will.

But your personal circumstances can also affect how much risk you should be taking with your investment portfolio, for instance if you are approaching your retirement and looking to start drawing on your pension.

So consider, what, if anything, has changed personally, and consider how this affects your appetite for taking risks with your investments.

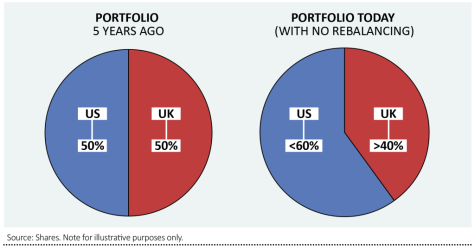

Regular rebalancing is an important way to keep your portfolio from becoming out of kilter. That’s because even if you start off with a balanced portfolio, over time market performance can warp its shape.

As a simple example, consider a portfolio that was 50% invested in UK equities and 50% invested in US equities five years ago. Today, that portfolio would be over 60% invested in the US and less than 40% invested in the UK. This is due to the value of US stocks growing faster than UK stocks.

STAYING DIVERSIFIED

To be diversified you should have more global exposure than just two markets, but this example illustrates how the relative performance of two areas can affect the make-up of your portfolio. In this scenario, you might well choose to continue with a higher US allocation, in which case you need take no action, but you have at least made a considered decision rather than letting the balance in your portfolio be dictated by market movements.

As well as the regional split of your portfolio, you should give some consideration to the allocation across asset classes; equities, bonds, property, gold, cash, and so on. You should also consider whether any sectors have performed particularly well, and now make up an outsized part of your portfolio.

Given its strong recent run, it wouldn’t be surprising to find technology shares making up a significant portion of investors’ portfolios if left unchecked.

Finally, see if any specific funds have done a lot better than others and now constitute a large part of your portfolio. That’s clearly a good sign, but it’s worth making sure that your portfolio returns are not too heavily reliant on just one fund manager, no matter how good they are, because even the very best can go off the boil.

MONITOR THE BAD PERFORMERS

At the other end of the spectrum, you should check your portfolio for any serially poor performers. These are not funds which have had a bad year, or even three years, simply because their investment style is out of favour, but rather funds which have lagged behind competitors for a long period, and show little sign of change for the better.

You should consider replacing fund duds with more promising active funds, or cheaper tracker funds, which won’t outperform, but aren’t charging the higher fees associated with active management for the privilege of underperforming.

As well as inspecting performance, it’s worth checking that the fundamental reasons you bought an investment are still in place. For funds and investment trusts, make sure there hasn’t been a change in fund manager or strategy, and if there has, consider switching out if it doesn’t fit your goals anymore. For shares, consider if the reason you bought an investment has now run its course, or has still got some legs.

For example, can Whitbread (WTB), the owner of Premier Inn, still prosper in a world when business travel looks likely to be lower thanks to widescale adoption of teleconferencing? Perhaps so, but it’s certainly worth asking the question.

LOOKING FOR NEW IDEAS

A portfolio review is also a decent time to scout around for new investment ideas, which might replace funds or stocks you’re selling. Are there any emerging trends you might want to buy into? Or any fund managers who have finally clocked up a long enough performance record to merit inclusion in a portfolio.

The final piece of the jigsaw is to make sure your portfolio is invested as tax efficiently as possible. A new tax year means fresh pension and ISA allowances, which will only start to protect your investments from capital gains tax and income tax once they’re wrapped inside the tax shelter.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine