Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Questions raised by return of share buyback craze

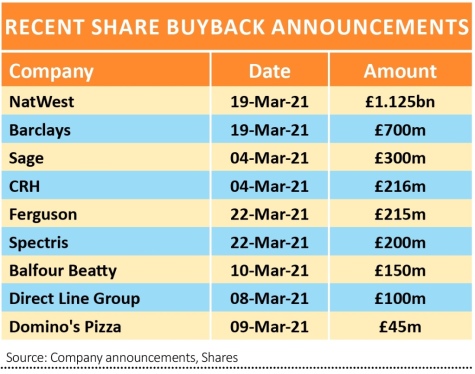

A year after the UK locked down for the first time and companies went into ‘survival mode’, cutting all non-essential spending and hoarding cash, share repurchases are making a comeback.

Investors should be asking why firms are buying back stock and not reinvesting their capital to generate higher returns.

Barclays (BARC) and NatWest (NWG) have both announced major share buybacks, the former for up to £700 million worth of shares in the market and the latter to buy £1.125 billion worth of shares directly from the Government.

For Barclays, the buyback amounts to roughly 2.2% of its market value. Once purchased, the shares will be cancelled, adding a small amount to tangible net asset value.

For NatWest, the purchase of Government-owned shares amounting to 4.9% of its capital also raises its net asset value, although it is only cancelling 60% of the acquired shares and retaining 40% for its employee share scheme.

Industrial firms Ferguson (FERG) and Spectris (SXS) have laid out plans to repurchase a combined £415 million of shares.

Despite differing fortunes – with Ferguson enjoying rising sales and Spectris experiencing falling sales over the past year – both firms have found themselves with excess capital and no obvious use for it.

Typically, firms have a list of options for surplus capital starting with paying down debt, then making growth investments – either to boost organic growth or adding sales via acquisitions – before they consider handing cash back to shareholders via buybacks or dividends.

Ferguson had spent $224 million on acquisitions in the six months prior to its buyback announcement so it had already made growth investments, but Spectris was a net seller of assets and clearly hadn’t found a useful way to deploy the proceeds.

Earlier this month insurer Direct Line (DLG) announced a £100 million buyback saying it was ‘confident’ in the outlook and saw itself as a ‘tech and data driven insurance company of the future’.

Insurers are historically income plays so Direct Line’s buyback may have been to top up the miserly increase in the final dividend. But given the historic hardening of rates across the insurance industry it’s surprising the firm should choose to hand cash back to shareholders when it could be earning supranormal returns on invested capital for the next couple of years.

Domino’s Pizza (DOM), which aims to increase sales by 30% in the next few years through new store openings, also chose to buy back shares, which seems to raise questions both over its capital allocation policy and confidence in its own growth plan.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine