Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Buy Lindsell Train UK Equity for strong short and long-term returns

For investors who are concerned about the soaring valuations of technology and healthcare stocks, but who don’t want to go fishing in the world of value stocks, there could be a perfect middle ground.

A retail investor favourite, Lindsell Train UK Equity (B18B9X7) could be just the ticket – ideal for a long-term investor, but also an investment that should perform well this year with its collection of quality defensive growth names which have been overlooked by the market, initially in favour of racier technology companies and then value stocks in the banking, mining and oil and gas sectors.

Manager Nick Train is a well-known long-term buy and hold investor looking for quality companies that have strong free cash flow and returns on capital invested. These qualities helped the fund weather the Covid collapse, but also mean the fund has underperformed in the ‘vaccine bounce’.

FOCUS ON QUALITY

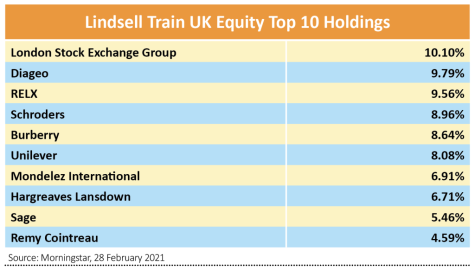

But the open-ended fund includes a number of high quality companies in its top 10 holdings whose business performance could benefit strongly from the reopening of society and the economy, including consumer discretionary stocks like Smirnoff and Johnnie Walker maker Diageo (DGE) and luxury fashion brand Burberry (BRBY), publishing and events firm RELX (REL) and financials like fund manager Schroders (SDR).

Admittedly, the fund’s performance has gone nowhere in the past nine months and has returned a grand total of -0.64% so far this year following on from -2.47% return last year. Its five-year annualised return is 9.29%.

But with the coronavirus vaccine rollout ahead of schedule UK stocks, having lagged global peers, are primed for a rebound this year – with the collection of stocks in Lindsell Train’s most popular open-ended fund better positioned than most for a recovery in earnings.

The fund is also good value for the collection of stocks it contains with an ongoing cost of 0.65% a year, while in terms of risk metrics it also appears to be one of the least risky funds on the market with a max drawdown – the maximum observed loss from a peak to a trough of a portfolio – of just -18% over five years according to Citywire, placing it well inside the top quintile of over 200 funds in the UK equity sector.

DRINKS FIRMS DOMINATE

Top holding Diageo, making up 9.95% of the fund, is still marginally below its pre-pandemic level with analysts not forecasting any sales growth in its financial year to June 2021, particularly as a large chunk of its earnings come from pubs, bars, restaurants, etc.

But the company has been performing well in its stronger markets, particularly the US where performance has been ahead of expectations and helped offset losses elsewhere, meaning that when the hospitality sector reopens and most people receive a vaccine, the company should start seeing significant sales momentum in the second half of this year, i.e. the first half of its 2022 financial year.

Other related holdings in the fund include premium mixer brand Fevertree Drinks (FEVR:AIM), the former stock market darling which is back above pre-pandemic levels but still well below its peak in September 2018, and Irn-Bru maker AG Barr (BAG).

BOOM IN LUXURY GOODS

This decade is being predicted as a boom time for luxury goods, the start of which we’re likely to see later this year with the release of pent-up demand, both from the well-heeled among the population as well as more affluent mass market consumers who have higher discretionary spending power thanks to money saved during lockdown.

Trench coats-to-cashmere scarves seller Burberry, which accounts for 7.93% of the portfolio, naturally has struggled over the past year with declining sales but now appears to be over the worst of the pandemic.

Famed for its iconic Equestrian Knight Device and the Burberry Check, the London-headquartered fashion house is blessed with a strong and enduring brand, and while third quarter sales dropped 9% on a like-for-like basis, efforts to reel back markdowns have helped shore up profit.

Other holdings which could see their operational performance benefit from reopening include RELX (REL), which has remained resilient despite a collapse in its events business thanks to its three main divisions, Scientific, Technical & Medical (STM), Risk and Legal, which together posted a decent 4% growth in adjusted operating profit to £2.25 billion.

The outlook for events is still unclear, but RELX’s acquisitions last year did include exhibitions assets implying its underlying optimism on the sector, which combined with the resilient performance in its other divisions should help position the company for an earnings recovery when restrictions are lifted and the sector recovers.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

First-time Investor

Great Ideas

- Buy Dotdigital, among the UK’s few, true software growth businesses

- Panoply seeds growth opportunity with biggest ever acquisition

- Buy Lindsell Train UK Equity for strong short and long-term returns

- Supermarket Income REIT appeals as a steady investment purely for dividends

- Eurofins beats forecasts and raises guidance again

magazine

magazine