Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Budget 2021: the key takeaways for investors and the markets

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

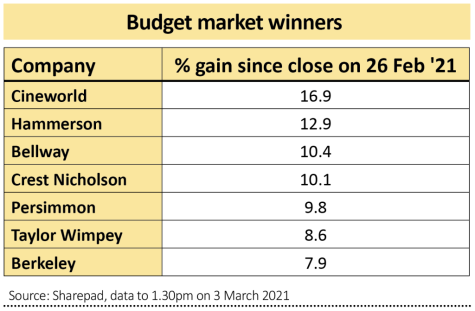

Housebuilders and hospitality firms were among the big winners from chancellor Rishi Sunak’s 2021 budget (3 Mar).

Most of the major announcements had been revealed in advance and stocks in the housebuilding and travel and leisure sectors rose ahead of the budget and consolidated those gains as generous support was confirmed. The lack of major surprises saw the domestic-focused FTSE 250 broadly unchanged from the gains it enjoyed intra-day ahead of Sunak’s speech.

The stamp duty holiday on property transactions below £500,000 was extended until the end of June and the threshold will be double the normal level at £250,000 until the end of September.

The mortgage guarantee scheme will support products which require a 5% deposit with several major lenders primed to offer these from April onwards.

What the budget means for private investors

• Lifetime allowance on pension tax relief, annual exemption on capital gains tax and inheritance tax threshold frozen for five years.

• Annual ISA and Junior ISA limit frozen at £20,000 and £9,000 respectively for the coming tax year.

“Sunak has started a fiscal ice age by freezing the tax rate thresholds.”

Rachael Griffin, tax and financial planning expert at Quilter.

There were replacements for the current government loan schemes and extensions to the business rates and VAT relief offered to the leisure and hospitality sectors. While a plan to offer companies 130% of the cost of business investment in tax relief was eye-catching.

In order to restore the public finances there was also a widely trailed increase in corporation tax, though not until 2023.

According to Vivek Paul, UK chief investment strategist, BlackRock Investment Institute, the attempt to balance the books ‘doesn’t herald a return of the austerity seen after the global financial crisis, in our view’.

He added: ‘The extended furlough program, continuation of the Universal Credit uplift and other extensions of Covid relief packages are essential to minimizing long-term damage.

‘Rapid vaccine roll-out has enabled the government to plan a route out of lockdown which we think will enable economic activity to return to pre-Covid levels by the end of this year – strengthening our conviction to be overweight UK equities on a six-to-12-month horizon.’

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine