Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

True tech growth stocks

When Moonpig (MOON) listed on the London stock market earlier this month it used a plethora of buzzwords to describe itself. It called itself a ‘platform’, talked about its ‘proprietary technology and apps’ and said it leaned heavily on ‘data science’.

This may seem curious for a business that basically sells an extensive range of greeting cards. As one analyst told Shares, it’s a consumer of tech rather than a creator of tech.

This feature is not about Moonpig, we looked in depth at it last week and readers are free to come to their own conclusions on that business, but it does raise a question that has become increasingly relevant during the Covid pandemic; just what is a technology stock these days?

Tech stocks, in the broader sense, are widely perceived as the real stock market winners during the pandemic notwithstanding the recent wobble on inflation concerns. Lockdowns have forced many organisations to think online for the first time, or speed-up existing digital transformation plans to keep up with changing demands of consumers and businesses.

In this article we’ll talk to top fund managers about why growth prospects not labels matter and identify three of our top relevant investment ideas.

TECH IS IN DEMAND

Eight of the S&P 500’s top stock performers in 2020 were ‘tech’ companies of one stripe or another, including PayPal, Nvidia and ServiceNow.

In the UK, Ocado (OCDO), Flutter Entertainment (FLTR), ASOS (ASC:AIM), ITM Power (ITM:AIM) and AO World (AO.), which might make claim for a tech badge, all featured in the top 10 of their respective market cap groups.

The gravitational shift of investors embracing the technology space means businesses across every sector, from fashion to finance, are now claiming the tech label. It has become cooler to be about the internet of things than just things, but the recasting is seductive in more tangible ways.

It implies faster growth, easy and cheap scalability and better returns. That opens the door to pools of investment capital that might not otherwise be available and can push stock valuations to extraordinary levels.

One 1999 study called ‘A Rose.com by any other name’ illustrated how, during the dotcom bubble of 1997 to 2000, companies adding the dotcom suffix to the end of their name experienced a temporary surge in their stock price.

The company did not have to be particularly affiliated with the internet, showing there was real financial gain by aligning your company with tech. The landscape has changed since the dotcom bubble but parallels between dotcom then and tech today are there to see.

WHY THE HUT WAS A HIT

The Hut Group, or THG (THG) as it is officially called, is an apt example. The £7 billion company has seen its share price rally more than 40% since its initial public offering (IPO) in September last year despite making most of its sales and, as far as we can tell, all profit from simply selling stuff online.

THG has two main parts to its business, selling beauty products through Lookfantastic and other websites, and Myprotein in sports nutrition. These together generate about 80% of revenue.

An emerging third leg is its retailer tech platform Ingenuity, worth 11% of annual sales. It is effectively a ready-made online sales platform for businesses and brands eager to go digital. It’s a full service that covers everything from designing websites, payments and goods delivery. Product manufacturing can even be managed if a client wants it. It’s a mini-Shopify, if you like.

Whether THG deserves its rough 32-times EV/EBITDA valuation (enterprise value/earnings before interest, tax, depreciation and amortisation) will depend on whether you see THG as a run-of-the-mill online retailer, or a more exciting tech platform that can deliver on 40% growth forecasts.

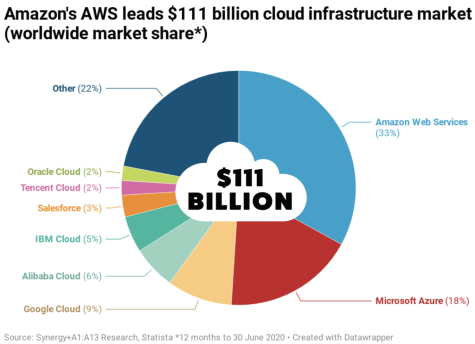

Canny readers might well say the same is true of Amazon. It too makes most of its revenue from selling stuff online, but it can also say that its real tech bit – cloud platform AWS – generates roughly 55% to 60% of the firm’s profit on 30%-plus operating margins, something that THG cannot.

Puffing up tech credentials can be a way of implying that a company is at the forefront of innovation without necessarily having to innovate. Exciting IPOs like DoorDash, Airbnb, Peloton and Lemonade, have been huge hits with investors and have set stock price pulses racing in the US.

How tech these businesses, and many others like them, really are is open to debate as the definitions of what a technology company is blur.

What is a tech stock?

‘It’s generally a company whose primary business is selling tech or tech services. A more nuanced definition is a company with tech or tech services as a key part of its business. It’s a hard question.’

Todd Berkowitz, vice president of research, Gartner

TECH CREATORS NOT CONSUMERS

‘At Blue Whale, we make a distinction between the users of tech and the creators of tech’, said Stephen Yiu, lead manager of the £700 million LF Blue Whale Growth Fund (BD6PG78).

‘We see lower barriers to entry for users of tech which decelerates growth as competition catch up. Creators of tech are better able to maintain their competitive edge and therefore enjoy sustainable growth for longer’, Yiu believes.

‘As much as retail analysts want to think of Amazon as a retailer, it is really a technology and cloud company that monetises through sales of products and services’, said Baird analyst Colin Sebastian.

‘As much as traditional media investors want to think of Google (officially called Alphabet) as a media company, they are a hardcore engineering company that monetises its advanced computing platform through search and advertising.’

‘Are companies that are embracing technology now considered technology companies? Probably not’, said Sebastian.

But Baillie Gifford’s Tom Slater believes labels like tech are unhelpful.

‘Anytime you frame something like that you draw false comparisons’, said the co-manager of Scottish Mortgage (SMT) investment trust. Far more important is ‘the business model - can you take advantage of the opportunities.’

In Slater’s view, Amazon’s success in retail wasn’t because the business was underpinned by technology, but by the way it changed the way goods were sold.

For example, in the past a consumer branded goods company could only sell into the retail channel and give 50% to a retailer, but now those products can be sold direct to consumers. There are options to sell on their own website or do they use Facebook, Instagram, Pinterest, all these different channels.

‘It’s no longer about being the most efficient or the most dominant in a fixed mode of operating, it’s about competing in completely different environments with a completely different set of competitors. Sure, that’s happened because of technology but it is the business model and whether it is adaptable enough to succeed in that environment that matters’, Slater said.

‘I think the only reason people talk about technology is because index makers classify stocks as technology.’

Tancredi Cordero of investment advisory Kuros Associates agrees that asking if a company is tech or not is far too simplistic. ‘From an investors standpoint technology is a global, multidimensional phenomenon, which is no longer segregated within the boundaries of a single industry’, he said.

What is a tech stock?

‘A tech company uses technology to create an unfair advantage in terms of product uniqueness or scale or improved margins. Ask the question: Could this company exist without technology? If the answer is no, it has to be a tech company.’

Greg Bettinelli, partner, Upfront Ventures

TECHNOLOGY IS MISSION CRITICAL

Cordero believes that every industry and business must have the highest possible application of technology in the 21st Century because it is critical for survival as a business, not a strategic option.

‘In the next 10 years we will experience the most dramatic shifts (and concentration) in market shares across industries, which is going to be determined by technological applications and younger consumers preferences that are also geared towards digital experiences and user interfaces (UIs)’, said Cordero.

‘People asking you is such and such company a technology stock are missing the point’, states William De Gale, who runs the Bluebox Global Technology Fund, currently an institutions-only fund that is hoping to get the UCITs retail investor green light down the line.

De Gale sees the distinction between disruptors and enablers as crucial to long-run returns success, and ‘everybody is focusing on the disruptors.’

He recalls the first company to talk to him about using big data was an engineering company about 12 to 15 years ago, during his days as a fund manager at BlackRock. Applying big data analytics would allow the engineers to spot potential aero engines problems before they had happened, so they could be pulled out of operation and serviced in a planned way that would save a lot of money.

‘But it didn’t benefit because all the other aero engineering companies did exactly the same’, said De Gale.

SEMICONDUCTOR FOCUS

De Gale spent years analysing the semiconductor space and he remains a big fan of the space. Semiconductor companies ‘have real value because everything depends on them so their stock valuations will inflate at the same speed, if not faster than everything else.’

US-listed Ukrainian software services company EPAM is a great example of De Gale’s direct connection investment theme, where computing increasingly becomes embedded into all parts of life.

Over recently months EPAM has built parcels delivery notification systems, oil refinery software that allows inspections without shutting down, a wealth management system, developing new drug discovery processes and helped computer games designer Epic to get 350 million people playing Fortnite in the cloud.

‘These are completely different industries, potentially disrupting the disruptors’ he said.

‘That’s why it’s gone from $12 to $360 (now $381) in the nine years since IPO outperforming Tesla. But no one talks about it because it’s not seen as a disruptor so must be boring. No one ever pays for boring.’

THREE WAYS TO INVEST IN TECH GROWTH

Scottish Mortgage (SMT) £12.14

Carved a gold-plated reputation with investors as an elite picker of growth stocks, controlling almost £20 billion of assets. This investment trust prides itself on identifying exciting growth companies capable of producing superior returns for investors over the medium to long term, or at least five years. One of the ways Scottish Mortgage can continue to diverge from more mainstream funds will be to unearth opportunities among privately-owned companies not listed on stock markets. It has done this successfully in the past, backing the likes of music streaming service provider Spotify, ride hailer Lyft and workplace collaboration platform Slack before they floated in the US.

Key stocks: Tesla, Amazon, Tencent, Illumina, Nio

First Trust Cloud Computing UCITS ETF Class A GBP (FSKY) £30.76

There are few growth themes more talked about than cloud computing and while it may feel old hat, cloud adoption remains in its very early days. Estimates predict $199 billion opportunity in 2019 will reach $760 billion by 2027. The First Trust Cloud Computing ETF is a great way to get in on this growth. It tracks 50 of the world’s leading cloud stocks providing wider cloud growth opportunities while still handing investors stock diversification.

Key stocks: Amazon, Alphabet, Microsoft, Alibaba. Kingsoft Cloud

ASML €470

It’s a tough ask to pick a single stock but given how crucial semiconductors are to resilient and structural growth themes going forward, Euronext-listed Dutch firm ASML is a super option. It’s the only company in the world capable of manufacturing the extreme ultraviolet (EUV) tools needed for printing bleeding edge, complex semiconductor chips. This is clever multi-million dollar lithography technology kit which uses light to print tiny patterns on silicon, a fundamental part of microchip mass production. All of the major chips designers and manufacturers, including Intel, Samsung, Apple, Nvidia and AMD, use the tools to make chips cheaper, smaller and increase their complexity.

DISCLAIMER: The author Steven Frazer owns shares in Scottish Mortgage and Blue Whale Growth Fund

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine