Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Oil surge helps revive Shell after strategy concerns

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

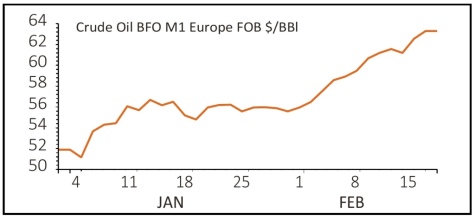

New threats to supply and recovery hopes pegged on vaccine roll-outs and US stimulus are helping oil prices extend their stunning start to 2021.

As we write this is contributing to big gains for the FTSE 100 thanks to the heavyweight status of BP (BP.) and Royal Dutch Shell (RDSB) on the index.

While the demand recovery story is a medium-term one, the problems on the supply side, other than the planned quotas imposed by producers’ cartel OPEC and Russia, appear to be more short term in nature.

The freezing temperatures in Texas which have disrupted oil production are starting to ease and tensions in the Middle East seem to have simmered down for now.

Though there are apparent signs of speculators moving into the oil market, following in the wake of the recent GameStop phenomenon, which could provide another leg to the oil price rally.

This rally has helped Shell to recover its losses after investors gave the thumbs down to its 11 February strategy update with Berenberg noting that for all the talk on the energy transition the renewables arm ‘remains the division with the lowest return target for the company’.

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine