Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Disney shares hit new record high on plans for major TV and film push

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Launching a new streaming service just ahead of a global pandemic proved fortuitous for entertainment giant Disney as it has benefited from a literal captive audience in lockdown.

The company is way ahead of its initial plans for subscriber numbers, helping its shares reach an all-time high as it unveiled (10 Dec) ambitious content pipeline plans.

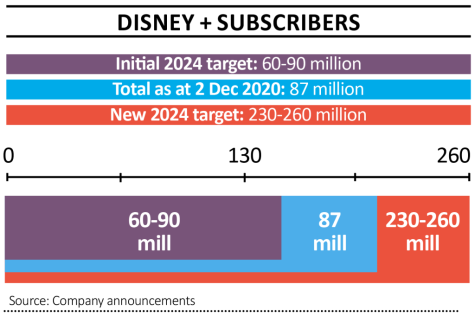

Initially Disney was targeting 60 million to 90 million global subscribers for Disney+ by the end of its September 2024 financial year. As of 2 December 2020, it had already hit 87 million and those 2024 targets have now been increased to between 230 million and 260 million.

The company is also raising the price for Disney+, a move which is underpinned by the wealth of content both new and historic, on or coming to the platform.

This roster of fresh content is set to increase significantly in the coming years with 105 new films and TV series announced at its investor day, of which 80% will appear on Disney+. Some will even debut on the streaming service rather than appear in cinemas first.

Among the projects planned are a prequel to the Lion King, a new version of the Little Mermaid plus a whole roster of new Marvel titles and a new entry in the Indiana Jones series.

The Star+ platform, which will be included within Disney+ in Europe, will add more shows pitched at adult audiences, helping to broaden the streaming service’s appeal.

Creating all these new series and films will involve a significant amount of spending. This will impact earnings with Disney guiding for maximum dilution in 2021. However, the pay-off in the longer term could be significant as it positions itself to dominate the streaming space.

The coronavirus crisis has led to a rapid reshaping of the business with streaming becoming the main contributor to revenue.

In doing so this part of the group has overtaken the theme parks, many of which have been closed for at least some of 2020 due to Covid.

The parks division should benefit as the world emerges from the pandemic, even if the timing is uncertain, particularly when it comes to travel restrictions.

As we discussed in this in-depth piece from March these resorts are highly profitable and generate lots of cash. They also play a critical role in making its creations resonate with consumers.

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine