Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Renishaw is one of the best UK businesses on the market

Despite a strong recovery for the share price since the big correction in March, the market is still underestimating the long-term potential at precision engineering firm Renishaw (RSW).

In this article we will explore how the company is investing for future growth and why investors with a five to 10-year timeframe should buy the stock and hold it through good and bad times.

A CROWN JEWEL

The company is one of the UK stock market’s crown jewels.

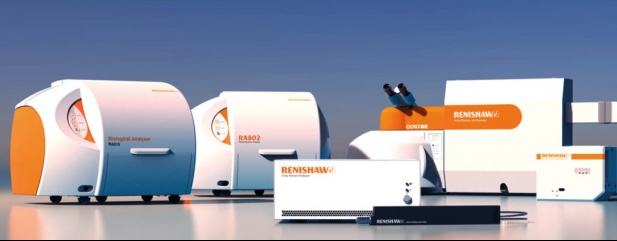

It is a genuinely outstanding business and a global leader in the development and manufacture of high-end precision measurement kit.

Founders still heavily involved

More than 50% of Renishaw’s shares are owned by founders David McMurtry and John Deer who occupy the executive chairman and non-executive chairman roles, having set up the business in 1973.

Renishaw’s products are used across a range of sectors including healthcare and automotive. Its products run from 3D printed customised medical implants to the hardware and software used in improving the calibration and performance of machine tools.

The company’s deep reserves of skill and expertise have helped to erect significant barriers to entry to its areas of business and reduce the competitive threat it faces. To maintain this position, it consistently allocates around 15% of sales to research and development.

In the words of investment bank Berenberg: ‘We find a lot to like about the business: market leadership, founder-led, high insider ownership (c50%), net cash balance sheet and exceptional margins (c30%) and returns (c40%) in good markets.’

At present upwards of 90% of revenue and profit comes from metrology – essentially the precision measurement bit – but it is investing heavily in its neurology and additive manufacturing (3D printing) solutions which Berenberg believes could add £500 million in earnings and add billions of pounds worth of value to the group over time.

GROWTH OPPORTUNITY

Renishaw designs and makes 3D printing systems which employ the complex laser power bed fusion process, specialising in areas which require high volumes and high levels of precision.

The company believes its RenAM 500Q machine can help reduce the cost of this production method and open up new markets which are currently dominated by conventional manufacturing.

This equipment could also be employed in conjunction with other Renishaw products and offered to its existing customer base.

The group is developing machines and equipment for the treatment of neurological disorders like Parkinsons and epilepsy. These encompass four main areas: its Neuroinspire surgical planning software, its Neuromate robot which enables reliable and accurate placement of electrodes within a patient’s brain, Neuroguide tubes and implants used to support this process, and its Neuroinfuse drug delivery system.

The differences between this part of the business and the remainder of Renishaw were acknowledged by the creation of a new entity – Renishaw Neuro Solutions.

The company is currently engaged in clinical trials with Finnish healthcare firm Herantis Pharma, whereby Herantis provides the drug and Renishaw takes care of the delivery system.

In early September 2020 the partners announced positive results from the latest stage in this process.

Renishaw's recipe for success

The company continuously invests in R&D and has masses of in-house intellectual property. It is also a vertically integrated business – with high quality manufacturing facilities in the UK, Ireland, Germany, India, the US and France. This enables it to keep close control of its supply chain and ensure the highest levels of quality control on its products.

The company has a highly embedded position with its customers and looks at how its products can best benefit individual businesses with well-resourced and skilled sales and technical support teams. The idea being to work in partnership with clients to understand and solve their problems.

COVID HIT

The company was not immune from a Covid-19 impact, particularly given it has exposure to the aerospace sector, with adjusted pre-tax profit down 50% to £48.6 million in the 12 months to 30 June.

Dividends have also been paused to preserve the balance sheet, which showed a net cash position of £120.4 million as at 30 June, and the pressures on demand brought about by the pandemic will likely be reflected in an upcoming trading update on 22 October.

However, it was notable that Renishaw was able to maintain supply to its customer base throughout lockdown. The company has also taken costs out of the business which should make it more profitable as demand recovers.

The shares are richly priced – at £57.85 and based on Berenberg forecasts they trade on 59 times 2021 earnings per share (EPS) and 38.5 times 2022 EPS. However, Renishaw is rarely cheap and this story is not about the next two or three years of earnings but the long-term potential driven by investments in new products and technology. A solid buy.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

First-time Investor

Great Ideas

- Novacyt still looks really cheap despite share price rally

- Panoply busy signing new contracts and buying businesses

- Premier Foods poised for Hovis windfall

- Don’t miss out on this high-quality European growth company

- Take profits on gold miner Centamin

- Shares in AG Barr start to pick up after reassuring results

Investment Trusts

Money Matters

News

- How Trump’s Covid-19 diagnosis has impacted stock markets

- The options for Rolls-Royce shareholders as £2 billion rights issue looms

- What Asda’s sale means for supermarket rivals

- Cineworld faces liquidity crunch as cinemas close again

- Housebuilders rally on Boris Johnson’s bid to help first-time buyers

magazine

magazine