Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Buy top quality small cap Somero

There is an awful lot to like about Somero Enterprises (SOM:AIM) and it has unsurprisingly built up a loyal, if small, following among retail investors. We believe this audience will grow in time because it stands out as top quality company at a very attractive price.

Those unfamiliar with the story may be surprised that this is the world number one when it comes to concrete levelling kit. Its success was to develop laser-guided technology over the last couple of decades that is accurate to within fractions of millimetres.

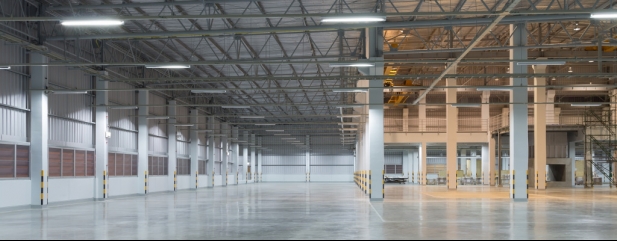

This is becoming increasingly important for major construction projects like building skyscrapers, but Somero has a digital economy slant too. Huge modern warehousing and fulfilment centres are increasingly embracing robotics and automation in a similar way that the car industry did years ago. For these robots to work they need to move swiftly and smoothly around the property, and that means level flooring to the nth degree.

Somero has developed something like 16 or 17 different levelling machines all based on its intellectual property-based laser technology, including three new models launched in the first half of this year despite lockdown restrictions. Demonstrations will likely become easier over the coming months which should underpin expressions of interest.

But importantly, it is not just the kit that makes Somero the best, it is the training, fast turnaround servicing and general advice to buyers about how the get the best performance both operationally and from a capex prospective that really sets the company apart.

HIGH MARGINS PROTECTED

This is what protects its high margins in an industry where cheaper, reverse engineered copycat machines are an accepted irritation.

This has always been a cyclical business so periods where new business is harder to come by needs to be accepted by potential investors, such as the last couple of years, not helped by the pandemic shutdown.

That will mean revenue and profit this year will be down by about 17% and 34% respectively to around £75 million and £17.6 million pre-tax profit. But management are definitely becoming more upbeat, reintroducing guidance and reinstating shareholder dividends earlier this month.

This is positive as it indicates the company has excess funds even when accounting for the $15 million of cash it always keeps in reserve. Plus there’s no debt to worry about.

Even in the face of a trying environment quality metrics are set to stay impressively strong. Pre-tax profit margins of around 23% to 24% are forecast this year – they typically run at circa 30% - while return on capital employed is expected to be comfortably over 20% this year. It has been as high as 40% in the past.

The shares trade on 10.9 times earnings, despite a solid growth record and high returns on equity, and they are on track to yield 6.6% this year.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine