Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Begbies hikes dividend after solid year

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

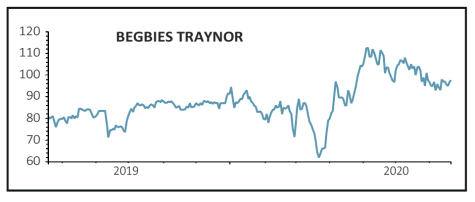

Begbies Traynor (BEG:AIM) 99p

Gain to date: 12.5%

Original entry point: Buy at 88p, 19 December 2019

Insolvency and business recovery firm Begbies Traynor (BEG:AIM) pleased the market on 21 July with an 8% increase in the dividend after posting in-line results for the year to 30 April.

Revenues for the period were £70.5 million, an increase of 17%, of which 5% was due to organic growth and 12% came from acquisitions.

Adjusted pre-tax profits were up 31% to £9.2 million, exactly in line with guidance despite a minor hit from the pandemic.

Its business recovery and financial advisory operations continued to win and progress new cases, and work has increased this quarter although the firm expects its current year results to be weighted towards the second half as the Government removes its support measures and companies begin to struggle.

While lockdown put the brakes on commercial property activity and the sale of businesses, transaction volumes have picked up this quarter but as with recovery and advisory the firm expects insolvency-focused areas to see more work in the second half.

Financially the firm is in good shape thanks to improved cash generation, and following the July 2019 capital raise the firm has almost zero net debt.

SHARES SAYS: Keep buying. Results will improve as the economy slows making Begbies a good portfolio hedge.

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine