Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

20 small caps where analysts are upgrading earnings forecasts

Small caps may have fallen further than large caps in March, with the FTSE Small Cap index losing 40% in value from the highs compared with 35% for the FTSE 350. But contrary to popular perception they have recouped more of the losses and are down 15% year-to-date compared with 18% for the FTSE 350.

Some small caps are operating well in the current environment prompting analysts to increase their earnings estimates while most of the market is seeing downgrades. Shares reveals a range of stocks with recent upgrades.

EARNINGS ESTIMATES

Analysts’ estimates are collected by Refinitiv to produce a consensus estimate, based on an equal weighted average of all the forecasts.

Economist Burton Fabricand is thought to be first person to write about the link between earnings estimates and subsequent share performance. He showed that portfolios of stocks based on the largest estimate revisions went on to significantly beat the average market return over a three-month period.

GOOD NEWS TRAVELS SLOWLY

The root cause is linked to how investors perceive risk, with the typical investor being risk averse. They feel roughly twice as disappointed by negative news as they feel excited by positive news. Consequently, bad news travels quickly and good news travels slowly.

This bias means downward revisions are quickly priced in by investors while they tend to underreact and take a wait-and-see attitude to upward revisions based on good news.

In effect when analysts downgrade earnings investors assume the worst without waiting for further evidence to appear, but in the case of upgrades they tend to question the sustainability of the improvement. This leaves scope for the share price to catch up with the news.

Shares analysed small cap stocks with the biggest upgrades in the UK market over the last month and we now look at what’s behind the upgrades for a selection of these names.

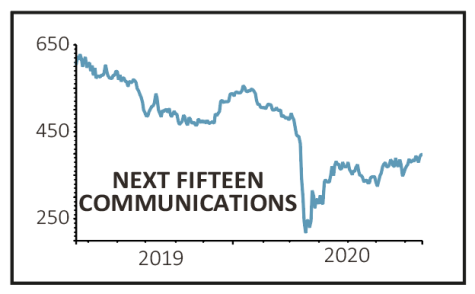

Next Fifteen Communications (NFC:AIM)

Price: 398p

Market Cap: £354 million

A marketing company focused on the technology space, Next Fifteen Communications (NFC:AIM) is well positioned longer term given growth trends in the sector have been accelerated by the pandemic.

The company is demonstrating resilience in the short term, with a trading update on 25 June materially better than most analysts had feared. The company guided for modest sales growth in the six months to 31 July – causing Berenberg to upgrade its earnings forecasts for the January 2021 and January 2022 financial years by 11% and 3% respectively.

Based on these increased forecasts and a share price of 400p, Next Fifteen trades on a price-to-earnings ratio of 10.5.

The group’s services span digital content, public relations, marketing software, market research, public affairs and policy communications. As well as serving the tech industry it has significant technological capability itself. The company also has a strong balance sheet – net debt is forecast by Numis to total £5.8m at the end of the current financial year.

Anglo Asian Mining (AAZ:AIM)

Price: 133.5p

Market Cap: £147 million

Anglo Asian Mining (AAZ:AIM) produces gold, silver and copper from four mines in Azerbaijan. It has invested in processing facilities so it can produce gold doré bars and copper concentrate.

It pays dividends, has a net cash position and some of the lowest operating costs in the gold mining industry globally. In recent years the highly cash generative business has made a bigger push with exploration in the hope of finding more resources on its licence area and extending the life of its mines.

A recent quarterly update slightly disappointed the market because year-on-year gold production rates were lower, and it has suffered some operational inefficiencies linked to coronavirus-related disruption.

However, broker SP Angel increased its earnings forecasts for the company after lifting its gold and copper price forecasts. Forthcoming news to watch includes an exploration update this month and a new mineral resources and reserves statement later in the quarter.

It has also proposed a joint venture in Ireland to explore for gold.

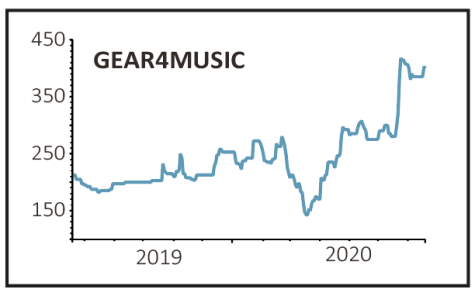

Gear4music (G4M:AIM)

Price: 402.5p

Market cap: £83 million

Shares in online musical instruments retailer Gear4music (G4M:AIM) have rocketed from 142.5p in mid-March to 402.5p, with analysts upgrading estimates off the back of positive trading updates.

Cooped up indoors due to the Covid-19 lockdown, consumers have looked to occupy their time by playing pianos and jamming on guitars, while Gear4music has also seen a boom in sales of specialist podcast microphones, as chief executive Andrew Wass relayed to the Financial Times.

Following positive updates in April, York-headquartered Gear4music reported on 23 June a ‘strong return to profitability’ for the year to March 2020, with revenues rising 9% to £120 million. The online specialist posted record profits thanks to strong gross margin gains and cost efficiencies.

N+1 Singer analyst Matthew McEachran also highlighted a welcome pivot from cash burn to cash generation and upgraded his March 2021 earnings estimates given the positive momentum in the business, with Wass witnessing an ‘exceptional and sustained increase in demand’ for Gear4music’s products in the first quarter.

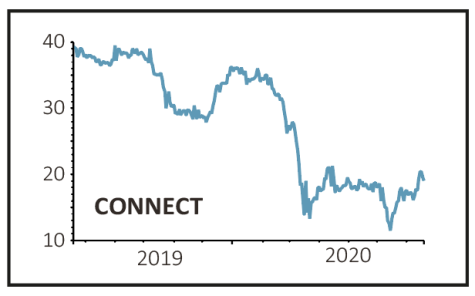

Connect (CNCT)

Price: 19.6p

Market Cap: £51 million

Connect Group (CNCT) operates Smiths News, one of the UK’s largest newspaper and magazine distribution businesses with around 55% market share. The stock responded positively to its latest trading update (14 Jul), rising by 9.4%, taking the shares up 15% over the last three months and prompting analysts to upgrade their profit estimates.

Releasing data for the 44 weeks to 4 July, the group said it had seen a marked increase in retail store outlets reopening since lockdown rules were relaxed such that only 5% of its customers’ stores, predominantly in travel and leisure locations, remained closed.

As a result of better than anticipated trading and operational cost reductions in excess of £5 million, Connect expects full year continuing adjusted pre-tax profit of between £26 million and £28 million for the period to 29 August. The middle of the range is 16% higher than current consensus analysts’ expectations implying more upgrades to come.

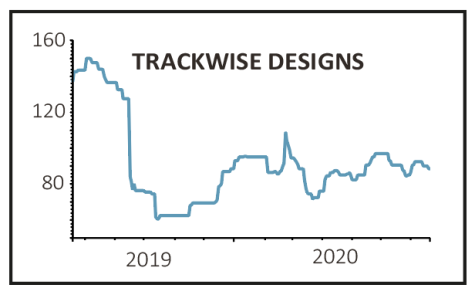

Trackwise designs (TWD:AIM)

Price: 90p

Market cap: £20 million

Trackwise Designs’ (TWD:AIM) printed circuit technology-based products are used globally in RF/antenna and lightweight interconnect products across different sectors and applications.

Full-year results for 2019 published on 23 June 2020 were in line with market forecasts and trading this year has remained resilient despite some short-term impact on the timing of revenue and order intake.

It has been shifting the sales mix with a reduction in low-margin Chinese RF sales and a greater level of Improved Harness Technology (IHT) sales, thereby boosting gross margins. Progress had been made in widening its IHT customer base beyond aerospace to electric vehicles and medical appliances.

Broker FinnCap pushed through a small upgrade to 2020 pre-tax profit forecasts following the 2019 results, which together with a £0.2 million tax credit resulted in a 27% boost to its earnings per share estimates. Stockbroker Arden, which also publishes forecasts on the stock, didn’t change its 2020 estimate.

For 2021, FinnCap says a higher depreciation charge marginally lowered its adjusted pre-tax profit forecast, but a review of the R&D tax credit situation prompted a switch from a tax charge to a £0.3m tax credit, resulting in a boost to adjusted EPS of 22% to 7.2p. Arden pushed through a near-20% upgrade for its 2021 estimate to 7.3p.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine