Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Don’t miss the chance to buy tech giant ASML at 2017 prices

Dutch firm ASML may not be a familiar name to most investors, yet it probably should be. The monopoly microchip business is exposed to the most resilient parts of massive semiconductor industry capital investment.

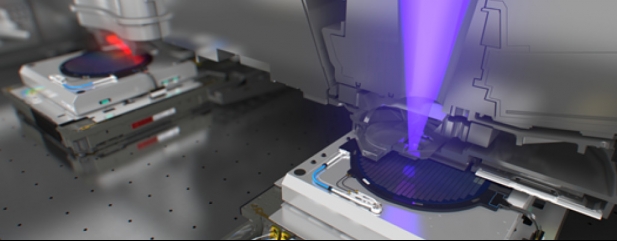

It’s the only company in the world capable of manufacturing the extreme ultraviolet (EUV) tools needed for printing bleeding edge, complex semiconductor chips, according to investment bank Berenberg.

What’s more, even after a pandemic bounce, the stock is still trading on a 2021 price-to-earnings (PE) multiple of 23.2. The stock has not been this cheap since mid-2017, meaning now is a superb buying opportunity.

ASML doesn’t design or manufacture semiconductors. Instead it makes clever lithography technology kit which uses light to print tiny patterns on silicon, a fundamental part of microchip mass production.

The biggest chip makers in the world, such as Intel, Samsung, Apple, Nvidia and AMD, use the tools to make chips cheaper, smaller and increase their complexity.

Against the current backcloth order delays cannot be ruled out but first quarter results last week offered huge encouragement and no material impact from Covid-19.

Net bookings were strong at €3.1bn, up from €2.4bn year-on-year, resulting in €2.4bn net sales at 45.1% gross margins. Eleven EUV tool sales put the company in a great position to meet its 32 full year target.

UBS predicts €3.6bn to €3.7bn bookings in the second quarter, and there are good reasons why.

The semiconductor industry is dedicating more of its capex to a ‘shrinkage roadmap’, with an estimated 70% of future spending earmarked, says Berenberg.

This should underpin ASML orders beyond any near-term volatility, and ASML says customers are asking for EUV shipments to be brought forward to avoid any impact from future logistical disruption.

Typical of tech businesses, ASML has net cash worth more than €4.7bn on its books, providing plenty of funding flexibility in the future.

UK investors should be able to buy shares in ASML via most investment platforms. The stock is listed on the Amsterdam Euronext and New York stock exchanges, and is a member of the Stoxx 600 and Stoxx Europe 50 indices.

For anyone not comfortable investing directly in overseas company shares, ASML is a key holding in Baillie Gifford Positive Change Fund (BYVGKV5) and BlackRock Greater Europe Investment Trust (BRGE).

‘Prior to the market sell-off, the shares traded in excess of 30-times, a deserved premium to peers given ASML’s less volatile end-markets and monopolist status,’ says Berenberg. A return to those PE multiples would imply a €340 share price, nearly 30% higher than now.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine