Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Many stocks now offer yields above 10%

Investors whose main aim is to generate a steady income from their portfolio in order to cover regular outgoings will be less than pleased at the Bank of England’s decision to cut base rates to 0.25% last week.

While the cut is intended to help businesses manage the expected economic slowdown caused by the spread of coronavirus, it also means that savers have to search even harder for reliable, income-generating assets, with the emphasis on reliable.

As Warren Buffett is fond of saying, when the tide goes out you see get to see who’s been swimming naked. For the tide going out we can substitute coronavirus, and for those swimming naked we can substitute companies who are forecast to pay dividends they may now not be able to afford.

THE 12% CLUB

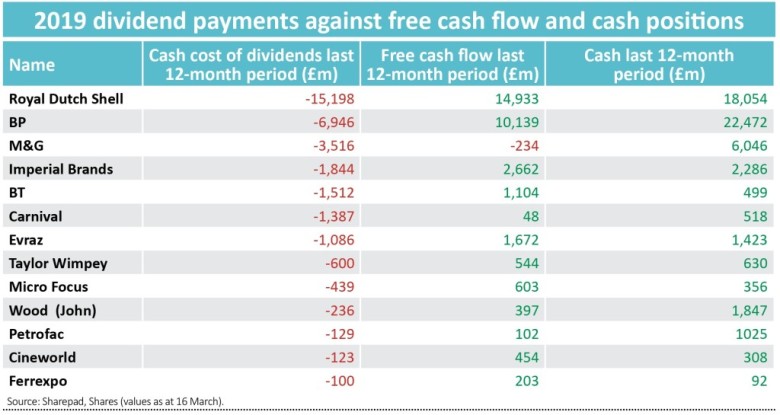

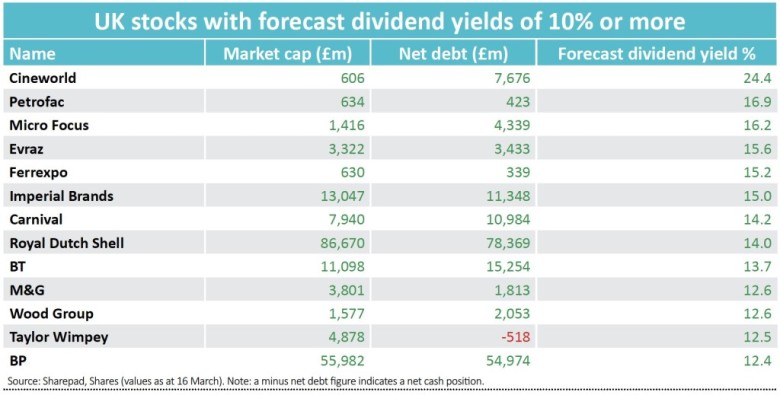

Using SharePad we screened the UK market looking at dividend yields based on forecast payments, free cash flow yields, the size of each firm’s dividends compared to its cash flows, together with their net debt or net cash position. We restricted ourselves to companies worth more than £500m.

Thanks to the collapse in commodity prices, which preceded selling in equities, a significant proportion of the highest-yielding stocks in our screen are resources firms.

Of the 13 stocks with a theoretical dividend yield of 12% or more, no fewer than six fall into this category including oil giants BP (BP.) and Royal Dutch Shell (RDSB).

The highest yielding stock by some distance is cinema operator Cineworld (CINE). Its net debt is several multiples of its current market cap.

Coronavirus will have a big impact on the business, which has taken on significant amounts of debt to fund acquisitions in the US. People should not be even considering the 24.4% yield as a realistic prospect right now. The key question is how it gets borrowings under control and deals with likely breaches to debt covenants.

Even if a company apparently has the cash flow to cover dividend payments, or even cash on the balance sheet to fund them, events could force its hand and lead it to reduce or scrap payments altogether.

Housebuilder Taylor Wimpey (TW.) in theory has quite a comfortable balance sheet position but on 12 March its well-financed peer Berkeley (BKG) put on hold recently announced plans to double investor returns to £1bn. The decision reflects the current uncertainty around the UK economy.

CASH IN THE BANK

Of the two heavyweights, BP in 2019 had enough cash to cover the dividend comfortably and Royal Dutch didn’t, but the latter does has a significant cash pile (note not net cash, it still has very significant borrowings) which it can use to make up the shortfall.

It could also resort to ‘scrip dividends’, which means paying dividends in new shares, as it did during the period of weak oil prices from 2014 to 2016, if needed.

Of the other FTSE 100 high-yielding stocks, Imperial Brands (IMB) generated more cash than it pays out in dividends and like Royal Dutch it also has a reserve of cash which it could dip into if needs be. Though historic and future cash flows could look very different.

Even before the coronavirus struck, BT (BT.) wasn’t generating enough cash to cover its dividends nor did it have a significant cash position. Therefore to maintain its dividends it will likely need to issue debt which is less than ideal when its borrowings are already bigger than its market value.

Chief executive Philip Jansen recently maintained that despite a poor third quarter the firm is ‘on track’ to meet its full year targets, but concerns linger over the dividend.

Other companies with yields of 12% or more and which paid dividends which exceeded their free cash flows over the last 12 months according to SharePad are Carnival (CCL) and Petrofac (PFC). Both of these companies’ payouts are highly likely to be at risk.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine